Passing The Tax Cuts And Jobs Act

On Dec. 22, 2017, former President Donald Trump signed a massive tax bill known as the Tax Cuts and Jobs Act . As its name implies, it cut individual, corporate, and estate tax rates.

The lower corporate tax rate is one of the key components of the Act. This cut is said to be a major factor for corporate profits and job creation. The act went in the record books as An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for the fiscal year 2018.”

The final bill is approximately 200 pages, and the title gives you just a whiff of how the text reads. Even tax and public policy experts probably need megadoses of caffeine to slog through it. The ultimate effects on Americans and the economy continue to play out and will be enforced until 2025. Meanwhile, a number of its effects were clear immediately.

Family Credits And Deductions

The law temporarily raises the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The child credit can only be claimed if the taxpayer provides the child’s Social Security number. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income exceeds $400,000 . These changes expire in 2025.

Fannie Mae And Freddie Mac

Congress created Fannie Mae and Freddie Mac to provide liquidity, stability, and affordability in the mortgage market. The organizations provide liquidity for thousands of banks, savings and loans, and mortgage companies, making loans for financing homes.

Fannie Mae and Freddie Mac purchase mortgages from lenders and hold the mortgages in their portfolios or package the loans into mortgage-backed securities that may later be sold. Lenders use the cash raised by selling mortgages for engaging in additional lending. The organizations purchases help ensure that people buying homes and investors purchasing apartment buildings or other multifamily dwellings have a continuous supply of mortgage money.

Don’t Miss: Did Trump Donate His Salary To Military Cemeteries

Theres A Reason For This

When a country sees its debt increase, it diminishes economic growth in the long-term. Its why many opponents of the bill say that letting the debt increase is effectively taxing future generations, as they will one day have to deal with increases in the tax rates.

The World Bank believes that the tipping point for debt to GDP is 77%. Right now, the debt to GDP ratio for the US is 104% before the tax cuts. And every percentage point above 77% costs a country 1.7% in growth. So, do the math, and youll see how much the US is losing out on in growth terms.

The Trump Tax Bill is using the theory of supply-side economics. Thats the belief that tax cuts spur economic growth. And it has worked in the past. It worked throughout the Bush tax cuts, and it worked under Reagan when he made major cuts.

The problem is that taxes under Reagan were as high as 70%, which was prohibitively high from an objective economists standpoint. This is the essence of trickle-down economics in a nutshell. But it has been debunked many times, and tax cuts from an already low tax rate will make little difference in growth terms.

Unsurprisingly, few corporations have said theyre going to create jobs with the money theyll gain from these tax cuts. Estimates state that corporations could be sitting on a huge $2.3 trillion vault in cash reserves, which is up 100% from the rate in 2001.

So, where should the tax cuts really fall if the government wants to boost growth?

Its Bidens Turn To Repeal And Replacethe Trump Tax Plan

One of former President Trumps unfulfilled campaign promises from 2016 was to repeal and replace the Affordable Care Act. Trump tried, but a Congressional vote failed in 2017, in part because Trump and his fellow Republicans never had a coherent plan to replace the ACA with.

President Biden is now trying to repeal and replace a signature Trump achievementthe 2017 Tax Cuts and Jobs Act. Biden isnt using Trumps language, but a series of tax changes he and his fellow Democrats want to make would essentially dismantle the 2017 tax law, which Republicans passed with no Democratic votes. And unlike Trump, Biden has detailed alternatives plus a solid rationale for overturning a law that has never enjoyed majority support.

The first part of Bidens tax overhaul is a higher corporate tax rate and other changes meant to bring revenue from business taxesback to historical levels. Those higher taxes would finance some of the infrastructure programs in Biden’s American Jobs Plan. In a few weeks, Biden is likely to call for higher taxes on wealthy individuals to help finance social programs in the forthcoming American Family Plan.

Also Check: Where Can I Buy A Donald Trump Hat

How The Tcja Tax Law Affects Your Personal Finances

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

What follows is a view of the Tax Cuts and Jobs Act and some of the changes you can expect to affect your taxes in the near term. There is also an overview of some much-discussed provisions that didn’t happen. While this guide is not an exhaustive list of every change to the tax code, it does cover the key elements that will affect the most people.

How the tax bill affects you depends on your personal situation how many children you have, how much you pay in mortgage interest and state/local taxes, how much you earn from work, and more.

What May Be Ahead For Income Taxes

Three years ago, the president signed off on the Tax Cuts and Jobs Act, an overhaul of the tax code.

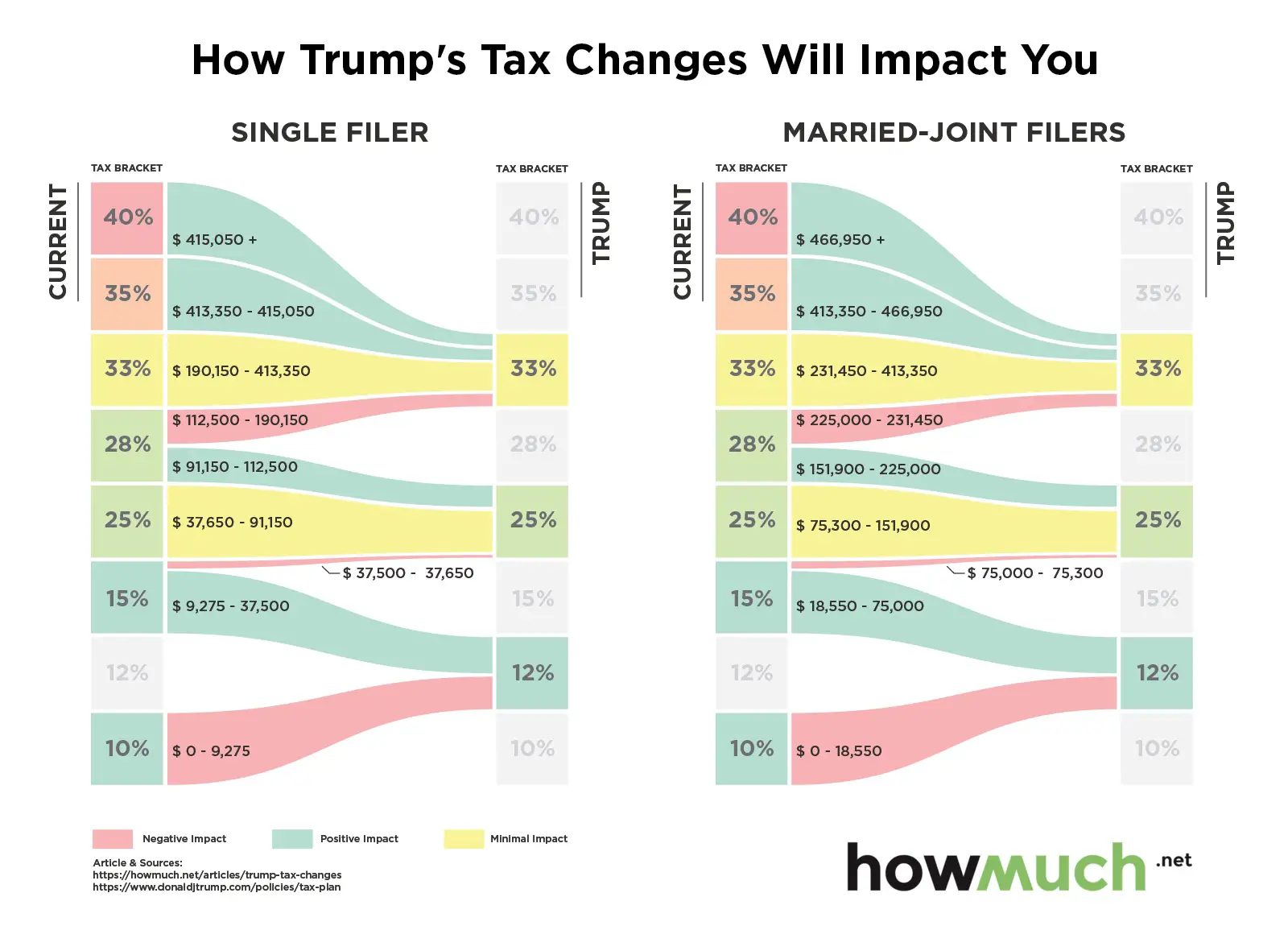

This legislation reduced individual income tax rates, nearly doubled the standard deduction and limited certain itemized deductions, including a new $10,000 cap on the state and local taxes.

“President Trump has made incredible strides to lower taxes on families and help Americans keep more of their hard-earned paychecks in their pockets,” said Courtney Parella, deputy national press secretary for the Trump campaign.

Extending the tax cuts from the overhaul would reduce taxes by $1.1 trillion from 2021 through 2030, according to a recent analysis from the Tax Policy Center

The president has also called for expanding opportunity zones.

The Tax Cuts and Jobs Act created qualified opportunity funds investments that direct money to low-income or distressed areas and reward investors with a tax break in return.

Recommended Reading: How Many Times Did Trump Lie

Irs Data Proves Trump Tax Cuts Benefited Middle Working

Joe BidenJosé Andrés to travel to Kentucky following devastating tornadoesSunday shows preview: Officials, experts respond to omicron Biden administration raises alarms about Russia, ChinaBiden says he will visit area impacted by storms: ‘We’re going to get through this together’MORE and congressional Democrats Build Back Better Act is now in the hands of the Senate. That legislative bodys 50-50 partisan split will undoubtedly make the bills passage difficult.

In order for BBB to become law, Democratic Senate leadership will need to convince moderates such as Sens. Kyrsten SinemaJoe ManchinMatt Taibbi: Mainstream media ‘in sync’ with Democratic PartyThe problem with our employment statsManchin faces pressure from Gillibrand, other colleagues on paid family leaveMORE that the legislations $2.4 trillion price tag can be offset by expanding the IRS and its enforcement efforts while imposing substantial tax reform measures.

Income data published by the IRS clearly show that on average all income brackets benefited substantially from the Republicans tax reform law, with the biggest beneficiaries being working and middle-income filers, not the top 1 percent, as so many Democrats have argued.

Filers who earned $50,000 to $100,000 received a tax break of about 15 percent to 17 percent, and those earning $100,000 to $500,000 in adjusted gross income saw their personal income taxes cut by around 11 percent to 13 percent.

Impact Of Tcja Cuts Becoming Permanent

Congress could choose to make the individual cuts permanent before they expire. If that happens, the cost of the tax cuts would rise to $2.3 trillion instead of $1.5 trillion over the next 10 years.

A separate analysis found that while the TCJA would result in increased economic growth, all of the revenue from this growth would go toward paying for the cuts. The cost is too high for the tax cuts to pay for themselves. Instead, the deficit and debt would continue to grow.

Recommended Reading: Superpowerchecks.com Review

Automatic Spending Cuts Averted/paygo

Under the Statutory Pay-as-You-Go Act of 2010 , laws that increase the federal deficit will trigger automatic spending cuts unless Congress votes to waive them. Because the Act adds $1.5 trillion to the deficit, automatic cuts of $150 billion per year over ten years would have applied, including a $25 billion annual cut to Medicare. Because the PAYGO waiver is not allowed in a reconciliation bill, it requires separate legislation which requires 60 votes in the Senate to end a filibuster. If Congress had not passed the waiver, it would have been the first time that statutory PAYGO sequestration would have occurred. However, the PAYGO waiver was included in the continuing resolution passed by Congress on December 22 and signed by President Trump.

Eliminate Numerous Tax Deductions For Individuals

As mentioned earlier, Trump plans to increase the standard deduction amount. Well, surprise! On top of that, he also wants to limit the tax deductions that taxpayers can claim on their return, so limited that youll really only be able to claim any that relate to mortgage or charitable donations. This brings me back to our original prediction. Claiming the standard deduction will be the simpler option for many taxpayers if the plan passes.

Read Also: How To Contact President Trump

Republican Leadership Tax Plans Pass

A key reason why the tax plan that the Trump Administration and congressional Republican leaders released in September is costly and heavily tilted to the wealthiest households is its special, much lower top rate for pass-through business income. This is income from businesses such as partnerships, S corporations, and sole proprietorships claimed on individual tax returns that is, it passes through to the business owners and is taxed at the owners individual tax rates . These businesses already have the advantage of being exempt from the corporate tax on profits and taxes on dividends. Under the September Republican tax plan, pass-through income would be taxed at no more than 25 percent far below the 39.6 percent top individual income tax rate that now applies to pass-through income, or the 35 percent top rate that would apply to individual income under the GOP plan. This would provide a massive windfall to the very wealthy and has sometimes been referred to as the Trump loophole because Donald Trump exemplifies the type of business owner whom it would most benefit.

The GOP tax plan as a whole would cost well over $2.4 trillion over a decade and would cut millionaires taxes by $200,000 in 2018, on average. The pass-through provision is a prime driver of that cost and regressive tilt. Tax Policy Center analyses of plans to reduce the pass-through rate to 25 percent show:

Repeal The Alternative Minimum Tax

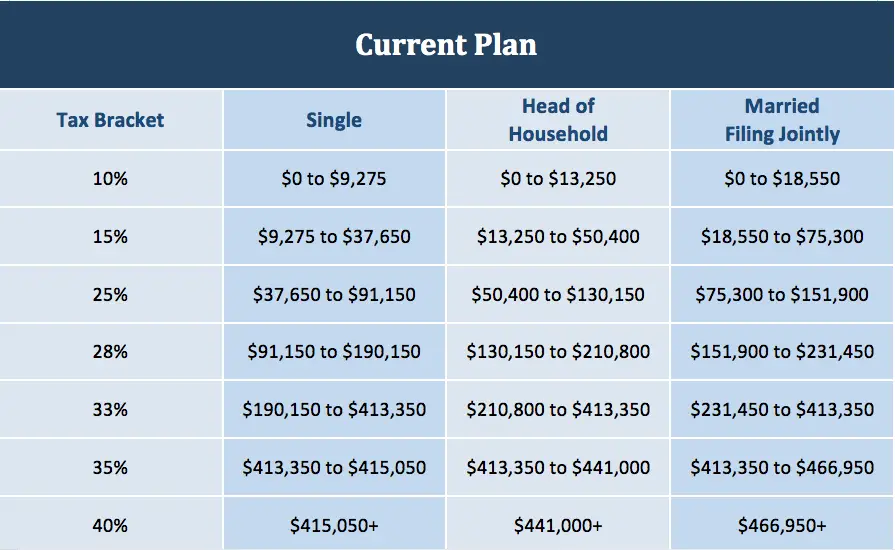

The AMT was originally designed to prevent the higher-income earning Americans from using deductions and a variety of other loopholes to pay less tax. It is basically a set of rates that make wealthier taxpayers pay more than lower-income earners. Heres a basic chart for 2016 to get a better understanding:

Long story short, Trumps new tax plan states that it will be eliminating this tax altogether. Although the low-income taxpayers label this as controversial, many others are beginning to see the benefits. Over the years, the purpose of the alternative minimum tax has altered now affected middle-income earners as well as the high-income earners. That wasnt the original goal so many dont see the harm in eliminating the tax completely.

Don’t Miss: Does Trump Donate To Charity

Trump Tax Cuts Results: Full Review

The Tax Cuts and Jobs Act, championed by President Trump and congressional Republicans, spurred a boom in economic growth that took Americans off the sidelines and got them back to work. Thanks to these reforms, our economy doesnt have to strain under a tax code from 1986, but will recover with a modern, dynamic tax code that promotes growth.

To download this factsheet as a PDF, .

MORE JOBS AND INVESTMENT

- Lowered tax rates for job creators of all sizes.

- Made it easier for companies to bring jobs and investments back to the U.S.

How the Economy Responded:

FAIRER TAXES

- Simplified that tax filing process for millions of workers.

- Eliminated the Alternative Minimum Tax for most taxpayers.

- Expanded popular savings tools, like 529 accounts.

How the Economy Responded:

- Millions of Hours Saved. Nearly nine out of 10 Americans took the standard deduction in 2019, no longer needing to go through the complicated process of itemizing.

- Revenues Soared. Breaking dire predictions from experts, federal revenues reached an all-time high, due to more Americans working, bigger paychecks, and businesses expanding.

BIGGER PAYCHECKS

- Cut income tax rates across the board.

- Nearly doubled the standard deduction.

- Doubled the Child Tax Credit.

How the Economy Responded:

Want to read more on the fight against Coronavirus? Read our Coronavirus Bulletin here which contains our extensive FAQ about recent federal actions.

Was this message forwarded to you? to subscribe to our emails.

Arctic National Wildlife Refuge Drilling

The Act contains provisions that would open 1.5 million acres in the Arctic National Wildlife Refuge to oil and gas drilling. This major push to include this provision in the tax bill came from Republican Senator Lisa Murkowski. The move is part of the long-running Arctic Refuge drilling controversy Republicans had attempted to allow drilling in ANWR almost 50 times. Opening the Arctic Refuge to drilling “unleashed a torrent of opposition from conservationists and scientists.” Democrats and environmentalist groups such as the Wilderness Society criticized the Republican effort.

Recommended Reading: Was Melania Trump A Prostitute

Differences Between The House And Senate Bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. For example:

In final changes prior to approval of the Senate bill on December 2, additional changes were made that were reconciled with the House bill in a conference committee, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

In the Senate, Republicans “eager for a major legislative achievement after the Affordable Care Act debacle … have generally been enthusiastic about the tax overhaul.”

A number of Republican senators who initially expressed trepidation over the bill, including Ron Johnson of Wisconsin, Susan Collins of Maine, and Steve Daines of Montana, ultimately voted for the Senate bill.