Idaho Offers A Return

While federal lawmakers deliberate the parameters of a nationwide bonus, can Idahos return-to-work bonus act as a template? How does their program work?

Its quite simple.

Idahoans returning to a full-time job can earn a one-time $1,500 bonus and $750 for part-time workers. You must have lost your job after March 1st and return to work between May 1st and July 1st to claim this payment.

The money for this program comes from the CARES Act. While some states have turned the funds into state and local stimulus checks, Idaho has opted to use it to incentivize people to return to work. This bonus will be distributed on a first-come, first-serve basis.

Eligibility: Who Qualifies For The Extra $300 Unemployment Benefit

To be eligible for the $300 a week benefit, you need to be receiving unemployment benefits from any of these programs:

- Unemployment compensation, including regular State Unemployment Compensation, Unemployment Compensation for Federal Employees , and Unemployment Compensation for Ex-Service members

- Pandemic Emergency Unemployment Compensation

- Pandemic Unemployment Assistance

- Mixed Earner Unemployment Compensation

- Payments under the Self-Employment Assistance program.

Low-wage, part-time or seasonal workers may fail to qualify for the extra $300.

Can You Trust Trump Profit Promise

There has been several success stories mentioned on the Trump Promise Promise website and after hearing success stories the creators of the website decided to research what was going on.

They looked at literally everything to figure out the truth behind Trump Profit Promise.

What they found was extremely interesting and gave them exactly what they needed.

The video mentions specifically about a loophole that any American can take advantage of today.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

These checks are apparently extremely easy to collect.

The website reminded me of a scheme called American Superpower Checks although it has nothing to do with this it does sound very similar.

Some people have waited as long as 14 years to get hold of what Trump has been able to do.

They waited through the whole Bush administration and even longer but never saw what Trump has put in place.

That is why people are so excited about Trumps Profit Promise and what it really means.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Also Check: How To Email President Trump Directly

Should You Invest Or Spend

If you’re near retirement, you definitely want to keep the extra cash on hand. But if you’re in your 20s or 30s, you may want to invest the money toward your retirement by putting it in a Roth individual retirement account, Sun suggested.

“If you went and bought XYZ mutual fund or put it into your IRA, I’m sure that in 20 years that would turn out to be a great thing,” said certified financial planner Jude Boudreaux, senior financial planner at The Planning Center in New Orleans.

One thing to remember about a universal plan to pay all Americans is that it is not based on financial need.

“It’s going to be too much for some of them and not enough for others,” Burman said.

If you don’t need the money, you may want to consider donating to a charity that’s directly involved in relief efforts or to your local food bank, Boudreaux suggested.

It’s the difference between just being constantly in a fear and reactive state to the ability to shift and start to move forward again.Jude Boudreauxsenior financial planner at The Planning Center

“If you wanted to really make a difference in a bunch of families’ lives right now, and you absolutely didn’t need those dollars, I would really consider passing that along to an organization that does a lot of good for a lot of people,” Boudreaux said.

In the aftermath of Hurricane Katrina, Boudreaux saw firsthand how payments from organizations like the Federal Emergency Management Agency and the Red Cross helped prop up the local economy.

I Am About To Exhaust My Regular Unemployment Compensation Benefits What Kinds Of Relief Does The Cares Act Provide For Me

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation program. PEUC benefits are available for weeks of unemployment beginning after your state implements the new program and ending with weeks of unemployment ending on or before December 31, 2020. The program covers most individuals who have exhausted all rights to regular unemployment compensation under state or federal law and who are able to work, available for work, and actively seeking work as defined by state law. Importantly, the CARES Act gives states flexibility in determining whether you are actively seeking work if you are unable to search for work because of COVID-19, including because of illness, quarantine, or movement restrictions.

In addition, if you have exhausted the 13 weeks of additional benefits available under the PEUC program, you may be eligible to continue receiving benefits under the PUA program. PUA benefits are available for a period of unemployment of up to 39 weeks, meaning that if you have exhausted regular UC and PEUC benefits in fewer than 39 weeks, you may be eligible to receive assistance under PUA for the remaining weeks within PUAs 39 week period.

Don’t Miss: Where Is The Next Trump Rally Going To Be

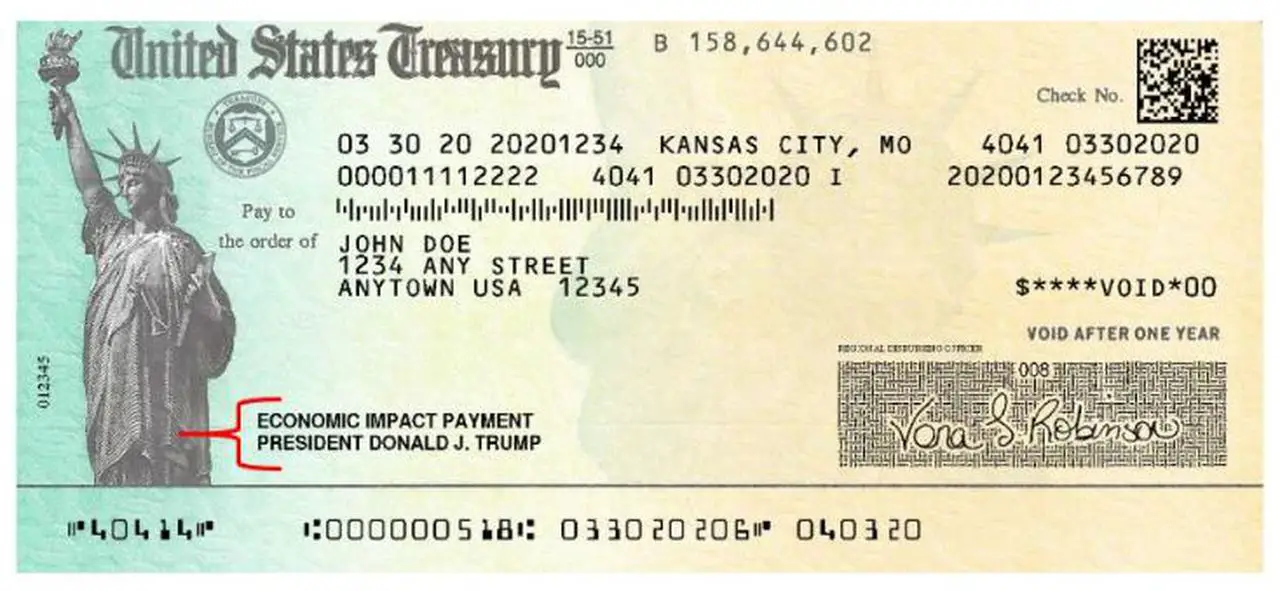

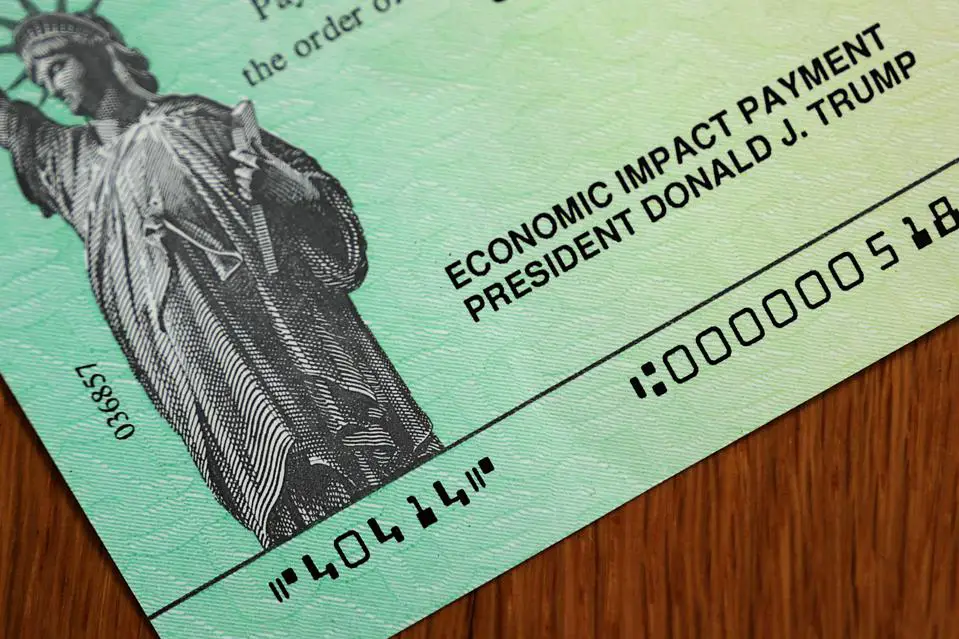

Coronavirus: Trumps Name To Appear On Us Relief Cheques

President Donald Trumpâs name will be printed on paper cheques being sent to millions of Americans struggling financially because of coronavirus.

It is the first time a US president’s name will appear on a federal government handout.

Treasury officials have denied claims that the decision could delay delivery of the aid.

The assistance is part of a $2 trillion financial relief package approved by the US Congress in March.

Some 16m lost their jobs in the past month alone.

Asked at the White House coronavirus task force briefing on Wednesday why his name was on relief cheques, Mr Trump said he “didn’t know too much about it”.

But he said people will be “very happy” to get a “big, fat, beautiful cheque and my name is on it”.

Trump said adding his name to the cheque was not “delaying anything”.

More than 80 million Americans have begun receiving payments of up to $1,200 in their bank accounts, according to the Treasury Department

But for those who did not provide banking details, they will receive a cheque with “President Donald J. Trump” printed on the left-hand side.

âItâs absolutely unprecedented,â Nina Olson, a former senior official in the Internal Revenue Service, told the Washington Post.

“Taxes are supposed to be nonpolitical, and it’s that simple.”

Two senior IRS officials told the Washington Post the move would probably lead to a delay in issuing the first batch of cheques. The Treasury Department denied this.

How Much Money Can You Make

How much do you want to invest? Your potential returns are completed based on how much you invest. Then there is how the companies you have invested in perform during the year.

Company distributions are purely based on profits, which are then shared among investors. One of the biggest companies that in the past have stored their money offshore is Apple.

The 2018 dividend return for Apple was 1.5% meaning for every $100 worth of apple you own, you will get $1.50 back over the year. So if Trump Bonus Checks suggested apple as a company to invest, to make $4,000 a month you would need to invest $3.2 million.

There are better dividend yields, and as I mentioned MFPs and REITs can also get you 5-10%, even with these numbers, you would need hundreds of thousands. If not millions to make the returns marketed.

Read Also: Where Are Trumps Maga Hats Made

One Of My Workers Quit Because He Said He Would Prefer To Receive The Unemployment Compensation Benefits Under The Cares Act Is He Eligible For Unemployment If Not What Can I Do

No, typically that employee would not be eligible for regular unemployment compensation or PUA. Eligibility for regular unemployment compensation varies by state but generally does not include those who voluntarily leave employment. Similarly, to receive PUA, an individual must be ineligible for regular unemployment compensation or extended benefits under state or federal law, or pandemic emergency unemployment compensation, and satisfy one of the eligibility criteria enumerated in the CARES Act, as explained in Unemployment Insurance Program Letter 16-20. There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them. Individuals who quit their jobs to access higher benefits, and are untruthful in their UI application about their reason for quitting, will be considered to have committed fraud.

If desired, employers can contest unemployment insurance claims through their state unemployment insurance agencys process.

Is Federal Rent Checks A Scam

Federal Rent Checks isnt a scam because it doesnt exist. Its a marketing gimmick. One that was created to sell a yearly subscription to The 10-Minute Millionaire Insider.

And I personally dont believe that The 10-Minute Millionaire Insider is a scam either. This is a product that was created by someone who is an expert in the field of investing and does contain useful information.

With that being said

I wouldnt expect to buy it and become a millionaire overnight. Success with anything takes time, effort and persistence. And investing is generally just risky, so theres even a chance you could join this and end up losing money.

And if Im being honest, I didnt like the Federal Rent Checks sales pitch. I found the whole thing to be nothing more than a clever marketing gimmick. Its that sort of marketing that is why people are literally searching for how they can get on the distribution list and start receiving government checks.

And if youve read this far, youll know that this is simply not the reality.

Recommended:Go here to see my #1 recommended stock advisory service

Also Check: How To Pray For President Trump

Use The Irs’ Free Online Tool To Speed Up Payment

If you don’t have a tax-filing obligation and don’t receive federal benefits, the IRS urges you to use its new tool for non-filers so you can provide payment information and receive your money quickly.

The tool, which can be found here, asks for direct-deposit details , Social Security number, mailing address, date of birth, and number of qualifying children in order to create and submit a simple tax return .

TurboTax has a free portal of its own for those who are not required to file a full tax return this year and want to submit direct-deposit details to the IRS. It has the same requirements as the IRS tool.

Explore America Tax Credit

One idea to stimulate consumer spending is the Explore America Tax Credit. This credit can be worth up to $4,000 and encourages Americans to spend money on restaurants, travel and tourism. The pandemic is greatly affecting businesses in these three industries.

This idea still needs to gain traction in Congress, but its a possibility. If this credit passes in its Americans can claim up to 50% of their household spending on most dining and travel purchases.

Americans will need to feel comfortable with traveling and dining again for this credit to have optimal results. Both political parties want the fourth stimulus package to provide focused aid to the hardest-hit industries. This tax credit is one way to funnel aid to those who need it most while rebuilding consumer confidence.

Also Check: Who Can Beat Trump Poll

Start Your Day With Laist

President Trump is pushing a plan to send money directly to Americans in response to the coronavirus, saying it’s time to “go big” to boost the now stalled economy. How much the checks will be for is still under consideration, but they’re considering $1,000 each.

Trump said he wants to push through a major comprehensive package to help businesses and workers facing hardships.

“That’s the way I want to go. I just want to get it done and have a big infusion, as opposed to going through little meetings every couple of days,” Trump said. “We want to go big.”

Treasury Secretary Steven Mnuchin is meeting with lawmakers Tuesday to discuss details of the administration’s proposal.

Mnuchin said Trump wants to start sending out checks within the next two weeks.

It’s not clear what income restrictions might be put on the stimulus payments, but Mnuchin said they don’t want to be sending checks to millionaires.

Trump and Mnuchin did not say how much the proposal would cost, but a person familiar said earlier on Tuesday that the White House is asking Congress for $850 billion in aid.

The administration is also planning to allow Americans to defer tax payments up to $1 million for 90 days.

The impact of the outbreak has ground the U.S. economy to a near standstill.

Can New Variants Of The Coronavirus Keep Emerging

The feds have delivered stimulus checks to millions of Americans, but millions more who are still waiting can follow some simple steps to get their money faster.

The Trump administration expects more than 80 million people to get direct deposits by Wednesday with their share of the $2.2 trillion stimulus package Congress passed last month to blunt the economic impact of the coronavirus pandemic.

The earliest recipients of the payments which total $1,200 for individuals earning up to $75,000 had bank account information on file with the Internal Revenue Service because they got refunds from their 2018 or 2019 tax returns, according to officials. The government plans to mail checks to people who havent submitted bank info, which is likely to take several weeks.

But the feds have created tools to speed up the process for those individuals, including low-income people who dont usually have to file tax returns. Theres also a way to track the status of your payment if you submit tax filings but havent gotten the money yet.

Also Check: How Do You Send A Message To Donald Trump

How Does Federal Rent Checks Work

Essentially what theyve done here, is taken a legitimate method of investing, and created a marketing hook that is loosely based on this, to sell a subscription service.

Of course there is testimonial after testimonial from regular people who are cashing in. Which makes it seem like its a real way to sign up to a real distribution list. Heres some screenshots I took from the video of people who are apparently making money:

But these people are really just stock photos as you can see:

I guess their stories could be real, but Im not convinced.

Anyways, by the time you get to the end of the video, Barton pitches a yearly subscription to The 10-Minute Millionaire Insider. Which costs either $39 for one year or $79 for two years. And after that 1-2 year period is up, you are automatically billed again.

Now dont get me wrong, D.R. Barton seems like a very knowledgeable investor. And someone who probably shares a lot of valuable information with people.

Im just not a fan of how this is marketed to people. In my opinion, its a bit misleading and absolutely doesnt paint a realistic picture of what to expect if you do buy.

Anyway, The 10-Minute Millionaire Insider itself is an ebook that contains lots of information about investing and trading the market, beyond just REITs.

Its something Barton developed that he says can help you become a millionaire.

Read:6 Hidden Truths About Stock Advisories Every Investor Must Know