Trump Tax Reform And Americans Abroad

Americans Overseas was curious how the Trump tax reform might change the situation for Americans living abroad. Sadly, we regret to conclude that the proposed Trump tax reform does not mention anything on the adjustment of the tax obligations for Americans abroad

The Trump tax reform will still impact individual taxpayers living and working abroad: US citizens will still be taxed on their worldwide income. The U.S. is the only developed country in the world that enforces a tax duty on citizenship rather than whether the American citizen lives or works in the country. This implies that every US citizen wherever they are born or where they are currently based or work, has to file US taxes yearly. This includes US nationals with and without passport, green card holders and others.

Distribution Of Benefits And Costs

The distribution of impact from the final version of the Act by individual income group varies significantly based on the assumptions involved and point in time measured. In general, businesses and upper income groups will mostly benefit regardless, while lower income groups will see the initial benefits fade over time or be adversely impacted. CBO reported on December 21, 2017, that: “Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.”

For example:

- During 2019, income groups earning under $20,000 would contribute to deficit reduction , mainly by receiving fewer subsidies due to the repeal of the individual mandate of the Affordable Care Act. Other groups would contribute to deficit increases , mainly due to tax cuts.

- During 2021, 2023, and 2025, income groups earning under $40,000 would contribute to deficit reduction, while income groups above $40,000 would contribute to deficit increases.

- During 2027, income groups earning under $75,000 would contribute to deficit reduction, while income groups above $75,000 would contribute to deficit increases.

The TPC also estimated the amount of the tax cut each group would receive, measured in 2017 dollars:

Tax Cuts For The Wealthy Who Will Create Tremendous Jobs

A: I’m really calling for major jobs, because the wealthy are going create tremendous jobs. They’re going to expand their companies. I’m getting rid of the carried interest provision. And if you reallylook, it’s not a tax. It’s really not a great thing for the wealthy. It’s a great thing for the middle class. It’s a great thing for companies to expand. And when these people are going to put billions and billions of dollars into companies, and whenthey’re going to bring $2.5 trillion back from overseas, where they can’t bring the money back, because politicians like Secretary Clinton won’t allow them to bring the money back, because the taxes are so onerous, and the bureaucratic red tape is sobad. It’s probably $5 trillion that we can’t bring into our country. With a little leadership, you’d get it in here very quickly, and it could be put to use on the inner cities and lots of other things, and it would be beautiful.

Don’t Miss: How To Email President Trump Directly

Internal Revenue Code Of 1954

On August 16, 1954, in connection with a general overhaul of the , the IRC was greatly reorganized by the and expanded ” rel=”nofollow”> Pub.L. 83â591). was the principal drafter of the Internal Revenue Code of 1954. The code was published in volume 68A of the . To prevent confusion with the 1939 Code, the new version was thereafter referred to as the “Internal Revenue Code of 1954” and the prior version as the “Internal Revenue Code of 1939”. The lettering and numbering of subtitles, sections, etc., was completely changed. For example, section 22 of the 1939 Code was roughly analogous to section 61 of the 1954 Code. The 1954 Code replaced the 1939 Code as title 26 of the .

The 1954 Code temporarily extended the ‘s 5 percentage point increase in corporate tax rates through March 31, 1955, increased deductions by providing additional depreciation schedules, and created a 4 percent dividend tax credit for individuals.

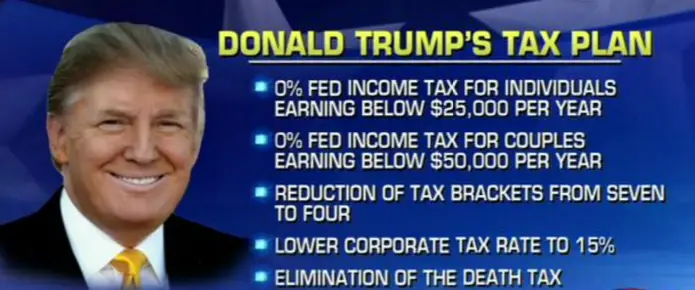

What Trump Has Promised On Tax Reform

Trump’s plan, revealed during the campaign, centers around nixing income taxes for individuals making less than $25,000 a year or for couples making less than $50,000 per year. “They get a new one page form to send the IRS saying, ‘I win,'” says Trump’s tax reform plan from the campaign. “The Trump plan eliminates the income tax for over 73 million households.”

“All other Americans will get a simpler tax code with four brackets 0%, 10%, 20% and 25% instead of the current seven,” the plan states, adding that the higher brackets would have fewer options for deductions. “Simplifying the tax code and cutting every Americans taxes will boost consumer spending, encourage savings and investment, and maximize economic growth.”

For single filers under Trump’s plan, those earning $150,001 and up would pay the top rate of 25 percent as well as 20 percent on capital gains. Tax brackets for 2016 range from 10 percent for single people making less than $9,275 to 39.6 percent for single filers making $415,050 or more.

The president has also pledged to eliminate the Alternative Minimum tax, which affects high-income Americans who take lots of deductions. Tax returns from 2005 showed Trump paid most of his taxes that year because of the AMT.

The federal corporate tax rate ranges from 15-35 percent, according to the Government Accountability Office.

Also Check: What Is Trump’s Real Approval Rating

Cutting Taxes & Boosting Economy Most Important To People

TRUMP: We have to make our country successful, as it was prior to the plague. Now we’re rebuilding it and we’re doing record numbers, 11.4 million jobs in a short period of time. We had the best Black unemployment numbersin the history of our country. Hispanic, women, Asian, people with diplomas, with no diplomas, MIT graduates number one in the class, everybody had the best numbers. And you know what? The other side wanted to get together. They wanted to unify.Success is going to bring us together. I’m cutting taxes, and he wants to raise everybody’s taxes and he wants to put new regulations on everything. He will kill it. If he gets in, you will have a Depression.

BIDEN:I represent all of you, whether you voted for me or against me. We’re going to choose science over fiction. We’re going to choose hope over fear. What is on the ballot is the character of this country. Decency, honor, respect.

The Standard Deduction Vs Itemized Deductions

A single filer’s standard deduction increased from $6,350 in 2017 to $12,200 in 2019. The deduction for married joint filers increases from $12,700 in 2017 to $24,400 in 2019.

The Tax Foundation estimated in September 2019 that only about 13.7% of taxpayers would itemize on their 2018 returns due to these changes. That’s less than half of the 31.1% who would have itemized before the TCJA.

That would save them time in preparing their taxes. It might also hurt the tax preparation industry and decrease charitable contributions, which are an itemized deduction.

Read Also: Does Trump Take A Salary

Perverse Incentives In The Tcja May Be Encouraging Investment Overseas Rather Than In The United States

While cutting corporate tax rates, the 2017 tax law also overhauled the tax rules for U.S. companies overseas profits. In fact, one of the claimed selling points of the TCJA was that the legislation would allow U.S. firms to access profits that had been trapped overseas by the old international tax system, enabling them to invest more in the United States. In reality, these profits were never really trapped overseas, and past experience had demonstrated that extending special low tax rates to past overseas profits would not boost jobs or investment in the United States.

It is still early, but a new study finds evidence that the TCJA is producing more investment overseas than in the United States. The study found that since the passage of the TCJA, the multinational firms that had been subject to high repatriation costsin other words, the very firms that proponents claimed would be able to tap their trapped cash to invest in the United Stateshave increased their investment overseas rather than in the United States. Pointing to the incentives created by the GILTI and FDII provisions, the authors conclude that these early results with a stated goal of the TCJA to spur domestic economic growth. If the tax law is incenting U.S. firms to locate more tangible assets overseas instead of in the United States, it would put U.S. workers at a further disadvantage.

Budget Deficits And Debt

Fiscal year 2018 results

CBO reported that the budget deficit was $779 billion in fiscal year 2018, up $113 billion or 17% from 2017. The budget deficit increased from 3.5% GDP in 2017 to 3.9% GDP in 2018. Revenues fell by 0.8% GDP due in part to the Tax Act, while spending rose by 0.4% GDP. Total tax revenues in dollar terms were similar to 2017, but fell from 17.2% GDP to 16.4% GDP , below the 50-year average of 17.4%. Individual income tax receipts rose by $96 billion as the economy grew, rising from 8.2% GDP in 2017 to 8.3% GDP in 2018. Corporate tax revenues fell by $92 billion due primarily to the Tax Act, from 1.5% GDP in 2017 to 1.0% GDP in 2018, half the 50-year average of 2.0% GDP. Fiscal year 2018 ran from October 1, 2017 to September 30, 2018, so the deficit figures did not reflect a full year of tax cut impact, as they took effect in January 2018.

Ten-year forecasts

The non-partisan Congressional Budget Office estimated in April 2018 that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years, or about $1.891 trillion after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt.

The Joint Committee on Taxationestimated the Act would add $1,456 billion total to the annual deficits over ten years and described the deficit effects of particular elements of the Act on December 18, 2017:

Recommended Reading: What Does Trump Call Bernie Sanders

Increases Income And Wealth Inequality

“Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.–Congressional Budget Office“

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: “Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation’s wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers the tax bill is a natural consequence of their long effort to bend American politics to serve their interests.” The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and -2.0% for the bottom 50%.

Changes To The Tax Code

President Trump signed the Tax Cuts and Jobs Act into law on Dec. 22, 2017, bringing sweeping changes to the tax code. How people feel about the $1.5+ trillion overhauls depend largely on their opinion of Trump’s presidency. Individually, how the changes were felt depended on factors like income level, filing status, and deductions. Those living in a high-tax state with soaring property values may have paid more in taxes in 2019.

For the wealthy, banks, and other corporations, the tax reform package was considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax, and more. Financial services companies stood to see huge gains based on the new, lower corporate rate , as well as the more preferable tax treatment of pass-through companies. Some banks said their effective tax rate would drop under 21%.

Given the popular criticism of the tax overhaul’s disparities, coupled with GOP losses in the 2018 midterm elections, as well Trump’s potential trade war muting the benefits of the tax cuts for voters, there were discussions surrounding tax reforms. The reforms could make individual tax cuts permanent and encourage retirement savings and business innovation. More on that later.

Also Check: How Many Times Has Trump Filed For Bankrupsy

More And More Democrats Embrace The ‘progressive’ Label Here’s Why

“Our proposals allow us to both address our perilously changing climate and create new, good jobs, all while strengthening the economy and reinvigorating local communities,” Neal said in a statement. “Taken together, these proposals expand opportunity for the American people and support our efforts to build a healthier, more prosperous future for the country.”

Trump Administration Predictions Of Tcja’s Impact

The analysis provided by the White House looked at the combined effect of the tax cuts and Trump’s Fiscal Year 2018 budget. The budget planned to boost growth through increased infrastructure spending, deregulation, and welfare reform.

Congress approved the budget plus additional appropriations. Trump asked for $1.15 trillion in discretionary spending Congress approved $1.3 trillion.

The Treasury report projected that the tax cuts and the budget would boost economic growth to 2.9% per year for the next 10 years. The report said that prosperity generated by the cuts and the budget would boost tax revenue enough to offset the tax cuts.

You May Like: What Is The J In Donald J Trump

Future Trends Of Tax Reform

Recovering from the COVID-19 pandemic is only one of the tax reform challenges facing governments.

- The balance of political power switches rapidly as the Democrats and Republicans alternate holding thin majorities in Congress with ever-shortening election cycles.

- In the short term, the Biden administrations proposed Made in America Tax Plan is intended to boost domestic manufacturing and reduce outsourcing.

- Work continues among nations on formulating a global tax policy that would make the international tax system more fair and more transparent.

- State and local governments will respond to anticipated budget shortfalls by looking for new sources of revenue via tax changes and other measures, including tax relief and incentives to spur economic activity.

Many tax professionals and government policymakers are looking beyond short-term tax reforms to ways of reimagining worldwide tax systems in light of fundamental changes in the way the world conducts business. Taxes are seen as a way to mitigate economic risk for companies, governments and individuals by taking advantage of digital technologies for more accurate tax assessment and collection.