Promise: A Simpler Tax Code

Some aspects of the law did make filing tax returns easier.

For individuals, the law boosted the standard deduction, which allowed millions of people to skip itemizing on their annual tax returns. It also raised the threshold for a parallel system of taxation meant to target people who take an outsize amount of credits and deductions, known as the alternative minimum tax, and eliminated a similar system for corporations.

But other changes to the tax codesuch as a 20% write-off for owners of pass-through businesses, and the laws byzantine international provisionswere far from simple, even before the IRS wrote hundreds of pages of regulations for how to follow them.

Beyond the code, Republicans promised that people would be able to do their taxes on a postcard-sized form.

That was somewhat true in 2018, when the IRS shrunk the Form 1040 from two full pages to a small one-page document. However, for that year, lines for reporting income, credits, and deductions were shifted to six separate attached schedules.

Then, in 2019, the IRS reverted to a two-page 1040 form, and the agency reduced the number of schedules to threesomewhat placating accountants who complained that the previous years postcard was a mess.

The Tcja Gave Corporations An Even Bigger Tax Cut Than Originally Projected

Since the TCJA was enacted, corporate tax revenue has been down from its projected level by about one-third, even as pretax corporate profits have continued to rise toward historic highs. The main reason for the drop in corporate tax revenue is obvious: The TCJA slashed the corporate rate by 40 percent, from 35 percent to 21 percent. But the falloff in corporate revenue has been even sharper than expected.

Several months before the TCJA was enacted, the Congressional Budget Office projected that corporate tax revenues for fiscal years 2018 and 2019 would total $668 billion. In the forecast published soon after the TCJA was enacted, however, the CBO projected $519 billion in corporate tax revenue over those two yearsa $149 billion decrease. Actual corporate tax revenue over that period came in significantly lower, at $435 billiona $233 billion drop. Essentially, corporations have already received $233 billion in tax cuts, $84 billion more than the CBO projected. To put that in perspective, the federal government spent just $47 billion on Pell Grants over the past two years.

The CBOs adjusted forecasts now put the 10-year cost of corporate tax cuts at roughly $750 billion, $400 billion more than the pre-TCJA projections. That figure includes the temporary revenue from the TCJAs repatriation provision, which gave corporations steeply discounted tax rates on stockpiles of overseas profits from prior years.

Trump Tax Plan Doubles The Estate Tax Deduction

The estate tax applies when multimillionaires transfer property to heirs. The Trump tax plan doubled the lifetime estate tax deduction from the 2017 value of $5.49 million for individuals up to $11.18 million. This higher limit, which allows wealthy families to transfer more money tax-free to their heirs, has increase each year since. In 2019, it rose to $11.4 million before increasing to $11.58 million in 2020. The limit swelled to $11.7 million in 2021 and $12.06 million in 2022.

Also Check: Melania Trump Prostitution

Tax Increases To Fund Infrastructure Program

Corporate tax proposals included in the American Jobs Plan, the administrations infrastructure proposal, advance tax policies promoted throughout Bidens presidential election campaign. The plans corporate tax policy goals include incentivizing job creation and investment in the U.S., stopping corporate profit-shifting to tax havens, and ensuring that large corporations pay their fair share of taxes.

The Biden administrations tax proposals would raise the corporate tax rate, impose new minimum taxes to prevent profitable U.S. businesses from escaping taxes through aggressive tax planning, repeal incentives for offshoring jobs, end preferences for the fossil-fuel industry, and strengthen corporate tax law enforcement by the IRS.

The corporate tax changes in the American Jobs Plan would raise tax revenue to help pay for the plans programs and investments in infrastructure, which range from transportation and roads to broadband, water resources, healthcare facilities, education, and more. The estimated $2.3 trillion cost of the American Jobs Plan, the scope of the investments proposed to be made over 10 years, and the tax increases intended to support it have generated substantial policy and political debate.

Why Were The Individual Tax Cuts Not Made Permanent To Begin With

Procedural rules in the Senate and an unwillingness to constrain spending forced Congress to make the majority of the Tax Cuts and Jobs Act temporary.

Tax cuts for individuals, which are the largest tax cuts in the package, expire in 2025. Since Congress has already agreed to this package of tax cuts, it should be its first priority in Tax Reform 2.0 to make the entire law permanent.

Don’t Miss: How Many Lies Has Trump Told To Date

Budget Deficits And Debt

Fiscal year 2018 results

CBO reported that the budget deficit was $779 billion in fiscal year 2018, up $113 billion or 17% from 2017. The budget deficit increased from 3.5% GDP in 2017 to 3.9% GDP in 2018. Revenues fell by 0.8% GDP due in part to the Tax Act, while spending rose by 0.4% GDP. Total tax revenues in dollar terms were similar to 2017, but fell from 17.2% GDP to 16.4% GDP , below the 50-year average of 17.4%. Individual income tax receipts rose by $96 billion as the economy grew, rising from 8.2% GDP in 2017 to 8.3% GDP in 2018. Corporate tax revenues fell by $92 billion due primarily to the Tax Act, from 1.5% GDP in 2017 to 1.0% GDP in 2018, half the 50-year average of 2.0% GDP. Fiscal year 2018 ran from October 1, 2017 to September 30, 2018, so the deficit figures did not reflect a full year of tax cut impact, as they took effect in January 2018.

Ten-year forecasts

The non-partisan Congressional Budget Office estimated in April 2018 that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years, or about $1.891 trillion after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt.

The Joint Committee on Taxation estimated the Act would add $1,456 billion total to the annual deficits over ten years and described the deficit effects of particular elements of the Act on December 18, 2017:

Retirement Plans And Hsas

Health savings accounts were not affected by the law, and the traditional 401 plan contribution limit in 2019 increased to $19,000 and $25,000 for those aged 50 and older. The law left these limits unchanged but repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement Act in Dec. 2019, though, people can now contribute to their individual retirement accounts past the age of 70½.

The IRS makes cost-of-living adjustments to contributions for retirement savings accounts every year. For 2022, the annual contribution limit for 401 and other workplace retirement plans is $20,500, up from $19,500 in 2021. Employees over age 50 can contribute an additional $6,000 “catch-up”$26,500 in total.

Also Check: Trump Lies How Many

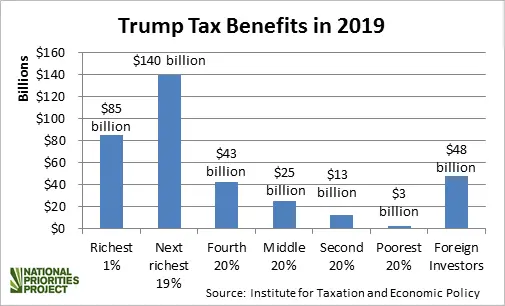

Key Facts: How Corporations Are Spending Their Trump Tax Cuts

Claims that corporations are sharing a big slice of their huge Trump tax cuts with employees through bonuses and wage hikes are mostly hype, the Trump Tax Cut Truths website of Americans for Tax Fairness shows.

The data on this website primarily covers Fortune 500 companies, whose revenues are two-thirds of the entire U.S. economy . But the universe is all Fortune 1000 corporations and businesses not on the Fortune 1000 that are included in the List of Tax Reform Good News maintained by Americans for Tax Reform.

Data estimates are based on information from corporations, the media, independent analysts or ATF research and cover activities since the tax law was passed on December 20, 2017. Sources for the data below can be found here or on the separate spreadsheets found here. See the Methodology explanation for more details.

HOW ALL OF AMERICAS BUSINESSES ARE SPENDING THEIR TRUMP TAX CUTS

HOW AMERICAS 500 RICHEST CORPORATIONS ARE SPENDING THEIR TRUMP TAX CUTS

ADDITIONAL DATA

EMPLOYEE BONUSES

- corporations, from the Fortune 500, have announced they are giving one-time bonuses due to the tax cuts for which we are able to estimate the cost.

- ATF estimates that million workers are getting $ billion in one-time bonuses , ranging from $50 to $6,000 per employee. Most of the bonuses are $1,000.

WAGE INCREASES

FRINGE BENEFITS & PENSION CONTRIBUTIONS

NEW INVESTMENTS

Child Tax Credits Saw Big Changes

Under the Trump tax plan, the Child Tax Credit increased to $2,000 per child under 17. The credit used to be $1,000. However, the Biden Administration subsequently expanded the CTC for 2021 to $3,000 per child under age 18 or $3,600 for each child you have under 6 years old. The 2021 CTC is also full refundable, so parents benefited from the credit regardless of whether they owe taxes or not.

The CTC expansion was a provision of Bidens American Rescue Plan, but was only included for tax year 2021. In 2022, the program revert to its former scope under Trump.

Recommended Reading: Was Melania Trump A Prostitute

Most Other Impacts: Either Too Soon To Tell Or Too Hard To See

The 2017 tax overhaul either pleased or dismayed a host of special interests, but its still difficult to know whether their respective hopes or fears came true.

Take the mortgage interest deduction, which was capped at $750,000 in total amount borrowed and also weakened by the doubling of the standard deduction. Realtors worried that would put people off from buying homes especially the most expensive ones.

So far, signals are mixed. New home sales increased in 2018 over the previous year, according to the National Association of Home Builders, even though construction permits leveled off. Researchers at the Federal Reserve Bank of New York found that some of that was likely due to several provisions in the tax overhaul, including the limitation on the mortgage interest deduction.

The homeownership rate, however, has continued to rebound from a low in 2016. And the housing market is subject to so many other factors from mortgage interest rates to the price of concrete that its hard to isolate the impact of a tweaked tax provision.

Big Changes To State And Local Tax Deductions

During initial talks, Republicans called for eliminating almost all itemized deductions, including state and local tax deductions, but keeping those for charitable deductions and mortgage interest. Ultimately, the TCJA capped SALT deductions to $10,000 .

Previously, taxpayers who itemized could deduct their state and local income, property and general sales tax payments on their federal tax returns. This was especially useful for residents of high-tax states like California and New Jersey.

Don’t Miss: How Many Bankruptcies Has Trump Filed

Arctic National Wildlife Refuge Drilling

The Act contains provisions that would open 1.5 million acres in the Arctic National Wildlife Refuge to oil and gas drilling. This major push to include this provision in the tax bill came from Republican Senator Lisa Murkowski. The move is part of the long-running Arctic Refuge drilling controversy Republicans had attempted to allow drilling in ANWR almost 50 times. Opening the Arctic Refuge to drilling “unleashed a torrent of opposition from conservationists and scientists.” Democrats and environmentalist groups such as the Wilderness Society criticized the Republican effort.

Gop Tax Plan: Who Benefits

First, lets look at the big picture. Overall, the GOP tax framework would be a net tax cut for taxpayers in 2018 and 2027, according to the TPC analysis .

In 2018, all income groups would see their average taxes fall, but some taxpayers in each group would face tax increases. Those with the very highest incomes would receive the biggest tax cuts, the TPC report says. The tax cuts are smaller as a percentage of income in 2027, and taxpayers in the 80th to 95th income percentiles would, on average, experience a tax increase.

TPC separates taxpayers into five groups, or quintiles, based on their income. Which income groups make up the middle class? There is no standard definition for the term, as we wrote back in 2008. We found then that the vast majority of Americans had said in polls that they consider themselves to be middle class or upper-middle class or working class.

Thats still true today. In a , 44 percent said they were middle class, 28 percent chose working class and 18 percent said upper-middle class.

Relatively few consider themselves to be lower class or upper class, at 8% and 2%, respectively, Gallup said. Overall, middle class is the label Americans use more than any other to describe their social class, providing a useful catchphrase for politicians interested in appealing to the broadest swath of the public.

Well leave that for readers to judge.

Recommended Reading: How Many Lies Has Trump Been Caught In

The Promised Boom In Business Investment Never Happened

In the year following the tax cut, business investment increasedbut not by nearly as much as the tax cut proponents predictions would have implied. Furthermore, a study by the International Monetary Fund concluded that the relatively healthy business investment in 2018 was driven by strong aggregate demand in the economynot the supply-side factors that tax cut proponents used to justify the tax cut. In other words, the increase in business investment from the relatively weak 2015-2016 period seems like another example of an economic indicator returning to more-normal levels.

Worse, business investment has slowed more recently. The most recent data show that private nonresidential investment actually declined in the second quarter of 2019, contributing to an overall slowdown in growth. Federal Reserve Chairman Jay Powell pointed to the continued softness expected in business investment and declining output in manufacturing sector as reasons for the Feds recent rate cut. Measures of the investments that companies are planning have also . As analysts at the nonpartisan Tax Policy Center wrote recently, This slowdown in business purchases of plant and equipment contrasts sharply with President Trumps rosy forecast of a long-term investment boom that would lead to annual wage increases of $4,000 or more. Moreover, investment in housing has declined every quarter since the passage of the tax legislation.

Ctc Gains May Have Just Cancelled Out Other Losses

As mentioned earlier, some families may have owed more tax because the expansion of the standard deduction meant the loss of personal exemptions. The TCJA expanded a few tax credits and deductions, including the child tax credit, and families may have needed to claim them just to offset the loss of personal exemptions.

Example: A two-parent family with two children may have actually owed more in taxes in 2018 than in 2017. The following table shows how:

| Tax Break Type | |

|---|---|

| $30,900 | $28,000 |

This family received a standard deduction of $24,000 in 2018. The family would have effectively received a deduction of $28,900 in 2017, because of the combined standard deduction and personal exemptions . In this scenario, the family could need to claim the child tax credit of $2,000 per child in 2018 just to break even. Even then, the total value of the combined standard deduction and CTC in 2018 would be less than the combined value of the standard deduction, personal exemptions, and CTC in 2017 .

So while Trumps tax reform allowed families to claim a higher child tax credit, some families may not have saved very much from it. As the IRS releases more data, it will be possible to look at whether the combined effect of the TCJA changes were enough to help certain working-class families save money.

Recommended Reading: Laura Kirilova Chukanov