Donald Trumps Companies Filed For Bankruptcy 4 Times

Trump still touts his business sense and wealth as qualifications for president.

Donald Trumps Bankruptcy History

Trump has built an American empire from Las Vegas to New York with towering hotels and sparkling casinos. Forbes estimates hes worth $2.7 billion. But not all of Trumps business ventures have been constant money-makers. In 1991, 1992, 2004, and again in 2009, Trump branded companies or properties have sought Chapter 11 protection.

Ive used the laws of this country to pare debt. Well have the company. Well throw it into a chapter. Well negotiate with the banks. Well make a fantastic deal. You know, its like on The Apprentice. Its not personal. Its just business,Trump told ABCs George Stephanopoulos last Thursday.

A business declaring bankruptcy is nothing new in corporate America, where bankruptcy is often sugar-coated as restructuring debt. But it might seem alarming to everyday Americans who cant get a bank to restructure their home loans. If you want to get Donald Trump hot under the collar, accuse him of declaring bankruptcy.

Doug Heller, the executive director of Consumer Watchdog, said Trump is the most egregious, almost comical example of the disparity between what the average American faces when going through bankruptcy and the ease with which the very rich can move in and out of bankruptcy.

Im a much bigger businessman. I mean, my net worth is many, many, many times Mitt Romneys, Trump said.

The 3rd Windfall: The Presidency

A new revenue stream became obvious in The Times analysis of Trumps tax documents: presidential visitors.

Trumps winter White House, the Mar-a-Lago club in Palm Beach, Florida, pocketed an extra $5 million more off new members starting in 2015, and in 2017 the Billy Graham Evangelistic Association paid at least $397,602 to Trumps hotel in Washington, DC.

Also, despite Trump saying he wouldnt pursue new foreign deals as president, his first two years as president saw revenue from abroad reach $73 million.

My grandmother died in 2003, the same year Trump set a record by divesting his stake in the General Motors building for $1.4 billion. Trump had bought the building back in 1998 in partnership with Conseco, a financial-services firm. By the time they sold, Conseco was in bankruptcy, having collapsed under the weight of its debt, The Times reported.

Its a great building in a great location, Trump said at the time. I did a great job in order to make it a great building.

Trump put up just $11 million himself in the initial purchase of the building, The Times reported.

As for my grandmother, she never liked Trump. I remember asking her why, and she responded, Because hes a Democrat.

You May Like: How To Send A Tweet To Donald Trump

What Is At Stake For Donald Trump Its Certainly Not Just The Election

The brilliant businessman must repay more than $400m within four years. Next weeks vote could determine whether he can

Going bankrupt once is unfortunate. Going bankrupt twice looks like carelessness. Driving your companies into bankruptcy six times, however, as Donald Trump has done, makes you a brilliant businessman.

That is according to the US president, anyway. Trump, a self-described king of debt, is proud of his multiple business bankruptcies, boasting frequently about how he has brilliantly exploited corporate bankruptcy laws in order to wriggle out of his companies financial obligations. Time and time again, Trump has managed to make others employees, investors and banks pay for his failures. Trump, who has never declared personal bankruptcy, has been able to protect his own assets and move on to the next fiasco.

But is Teflon Dons luck finally running out? With just days to go until the US election, Trump is facing a potentially crippling combination of financial stressors. His business empire has been hit hard by the pandemic according to a recent report by the Washington Post, Trumps golf clubs and hotels are practically empty. They were not doing that well before the pandemic: the New York Times investigation into Trumps taxes last month found his businesses were losing money at a staggering rate.

-

Arwa Mahdawi is a Guardian columnist

Also Check: What Kind Of Jobs Has Trump Created

Personal Vs Business Bankruptcy

Theres an important distinction to be made. Trump has never actually filed for personal bankruptcy. Instead, four of his businesses have filed for Chapter 11 bankruptcy.

Taj Mahal was the first in 1991 and was followed by the Trump Plaza Hotel the next year. After over 10 years of general stability, the Trump Hotels and Casino Resorts filed in 2004 and the Trump Entertainment Resorts in 2009.

Trump claims his personal finances were only involved in the Taj Mahal Chapter 11 bankruptcy filing. This is the reason Trump has been able to come out on top after multiple filings. Not involving his personal finances in the corporations operations protected his own bank account from total ruin.

Trump understands the difference between business and personal bankruptcies quite well. If you run your own business, its important that you do too.

Business Bankruptcy:

Filed by a business or an individual in the case that business-related debts cannot be paid. Corporations and partnerships, in which the entities are separate from the owners, may file for Chapter 7 or Chapter 11 bankruptcy.

Sole proprietorships, in which the owner is legally responsible for business-related debts, may file for Chapter 7, Chapter 11 or Chapter 13 bankruptcy.

Personal Bankruptcy:

Filed by an individual in the case that personal debts cannot be paid. Individuals typically file for Chapter 7 or Chapter 13 bankruptcy.

You May Like: What Is A Bankruptcy Petition Preparer

How Is Donald Trump Able To File For Bankruptcy So Many Times

Prior to the 2016 presidential election, when people discussed then-candidate Donald Trump, they often focused on his personal finances and how he had run his businesses. One of the common refrains had to do with his bankruptcies. According to pundits and critics, Trump had been unsuccessful in business, having to file bankruptcy several times in order to get by. Some people may have seen those stories and read the reports only to wonder how a person can declare bankruptcy so many times. For someone with the wealth of Donald Trump, how is it possible to keep declaring bankruptcy?

Donald Trump and personal bankrtupcyTo understand Donald Trump and bankruptcy, one must first understand the distinction between personal finances and business finances. Businesses are separate entities according to the law. In particular, corporations have their own legal personhood. They are specifically created so that people can avoid personal financial liability if things happen to go wrong. With this in mind, Donald Trump has actually never declared personal bankruptcy. In each instance, his bankruptcy has been a result of a business failure rather than a personal failure.

There have been many other business bankruptcies. Most of those have involved casinos. While Trump has tried hard in the casino business, he has had a number of failures there. On top of that, his Trump Plaza Hotel had to declare bankruptcy in order to seek ample protections.

Recommended Reading: How Much Does It Cost To Stay At Trump Hotel

Lawsuits Over Congressional Subpoenas

In March 2019, the House Committee on Oversight and Reform opened an investigation into Trumps finances, and issued a subpoena for ten years of his tax returns. Trump later sued the chairman of the committee, Rep. Elijah Cummings, seeking to quash the subpoena.

In April 2019, Trump sued Deutsche Bank, bank Capital One, his accounting firm Mazars USA, and House Oversight Committee chairman Elijah Cummings, in an attempt to prevent congressional subpoenas revealing information about Trumps finances. On May 20, 2019, DC District Court judge Amit Mehta ruled that Mazars must comply with the subpoena. Trumps attorneys filed notice to appeal to the Court of Appeals for the DC Circuit the next day. On May 22, 2019, judge Edgardo Ramos of the federal District Court in Manhattan rejected the Trump suits against Deutsche Bank and Capital One, ruling the banks must comply with congressional subpoenas.

On 25 February 2021, the House Oversight Committee in the 117th Congress, reissued the subpoena to Mazars USA for the same documents it had previously sought.

Also Check: Trump Hotel Room Cost

Were Watching Trumps 7th Bankruptcy Unfold

As a businessman, Donald Trump ran 6 businesses that declared bankruptcy because they couldnt pay their bills. As the president running for a second term, Trump is repeating some of the mistakes he made as a businessman and risking the downfall of yet another venture: his own political operation.

In the 1980s, Trump was a swashbuckling real-estate investor who bet big on the rise of Atlantic City after New Jersey legalized gambling there. He acquired three casinos that by 1991 couldnt pay their debts. The Taj Mahal declared bankruptcy in 1991, the Trump Plaza and the Trump Castle in 1992. Lenders restructured the debt rather than liquidate and Trump put his casino holdings into a new company that went bankrupt in 2004. The company that emerged from that restructuring declared bankruptcy in 2009. Trumps 6th bankruptcy was the Plaza Hotel, which he bought in 1988. It went bankrupt by 1992.

Trumps surprise victory in 2016 paralleled the arrival of the brash upstart in Atlantic City more than 30 years earlier. But in the fourth year of his presidency, the Trump operation is once again reeling. Voters give him poor marks for handling the coronavirus crisis, underscored by an outbreak at the White House that infected Trump himself. Democrat Joe Biden is beating Trump is most swing states and an Election Day blowout is possible. Trump has suggested he wont leave office if he loses, threatening a constitutional crisis and his own political legacy.

Read more:

Also Check: Was Melania Trump A Prostitute

Admirably Tough Or Downright Slimy Your Call

Donald Trump has ticked off a whole lot of different groups during his outspoken and unconventional run for the presidency. Few small business owners are among them.

Back during the primaries when he was an unlikely challenger to a slew of other more mainstream Republican candidates, Trump managed to attract the support of a whopping 41 percent of small business owners despite the crowded field. Even after a year of gaffes and controversy, more recentpolls suggest small business owners remain among Trumps most stalwart supporters.

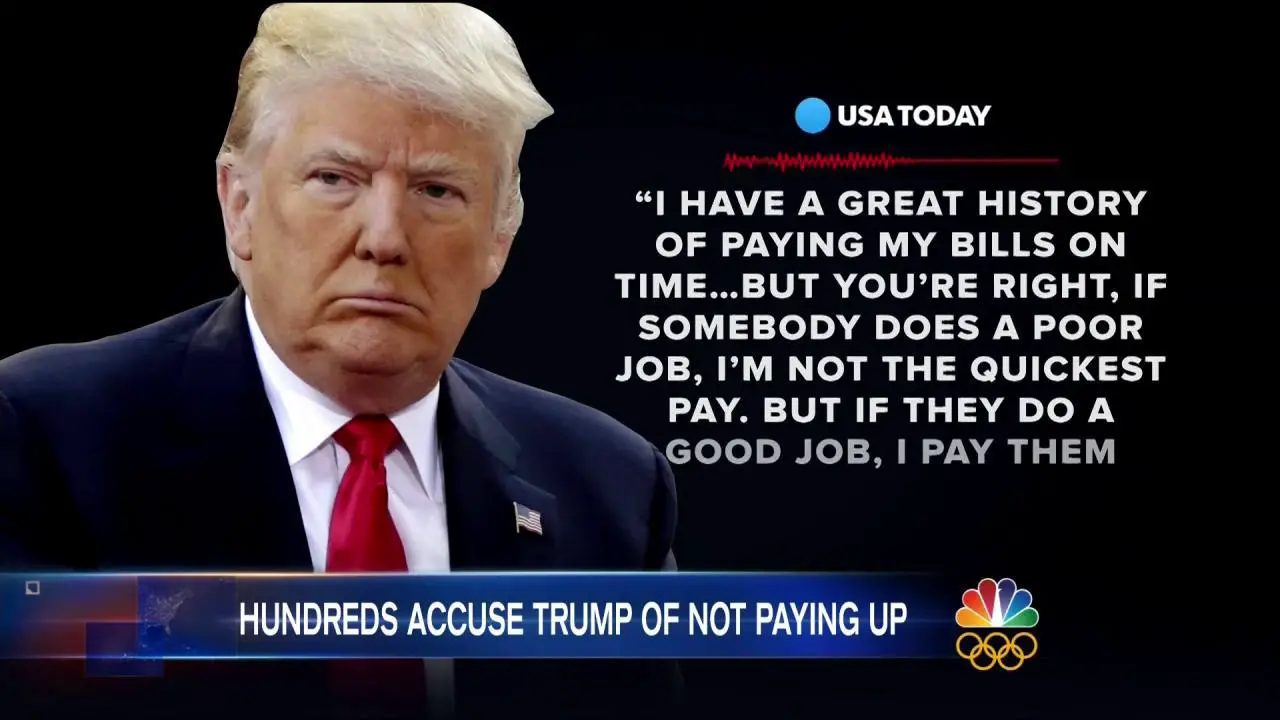

But there are some interesting and very vocal exceptions the many small business owners Donald Trump has stiffed in his long career as a real estate tycoon.

Recently several media outlets have dug up a handful of business owners with worrying tales to tell of Trumps bullying, unfairness, and failure to pay. And while their numbers arent huge, there are enough of them to suggest a pattern of behavior that raises questions about whether pre-politics Trump was much of a friend to small business in practice. Here are a few of their stories:

What If My Previous Case Wasnt Discharged

Sometimes the bankruptcy court dismisses or ends a case without a discharge. That could happen if you failed to appear in court, ignored a court order or voluntarily dismissed your own case because a creditor filed a motion to continue collection efforts. If your case was dismissed, you have to wait 180 days to file again. Note that subsequent filings might not earn you the automatic stay of collection, repossession and foreclosure actions. So you may not be as shielded from creditors pursuing payment.

In other instances, courts can deny the discharge of your debts in a bankruptcy. Reasons for denial include failure to provide documents, hiding assets or perjury.

Also Check: Can You Be Fired For Filing Bankruptcy

Read Also: How To Contact The President Trump

How Long Do I Have To Wait Between Filing Bankruptcies

Bankruptcy is a legal process governed by the United States Bankruptcy Court. Bankruptcy can help consumers dig themselves out of a financial hole. Common reasons for filing bankruptcy include job loss, to halt foreclosure proceedings, large medical expenses and to stop garnishments. A 2005 study from Harvard University found that more than half of people file bankruptcy due to medical bills.

Also Check: Epiq Corporate Restructuring Llc Letter

Trumps Rebound Story Meets Mounting Bankruptcies

It wont exactly be an October surprise, but it could still be a shock: a wave of business failures hitting during the campaign season.

Local business site Yelp found that 55 percent of the firms that closed during the worst of the pandemic beginning in March are now permanently shuttered. | Eric Gay/AP Photo

09/03/2020 04:30 AM EDT

-

Link Copied

While President Donald Trump prepares to promote an economic rebound, a wave of business failures is set to tell another story.

Economic-relief money drying up in August and September will mark a final blow for some firms that had managed to hang on so far with government aid which now appears unlikely to be renewed for weeks, if ever. Cold weather and flu season could end outdoor dining, halt other indoor activities and contribute to Covid-19 outbreaks at workplaces. And economists expect weak demand and tight credit especially for smaller businesses to add to the tens of thousands of firms that have already collapsed amid the Covid-19 pandemic, while restraining entrepreneurs hoping to replace them.

All of it could complicate Trumps narrative of a robust American comeback. The president has been plotting a hopeful message since the depths of the pandemic this spring, but its increasingly at odds with the mounting toll of corporate bankruptcies and deepening wounds for small businesses still bleeding from the spring shutdowns.

Read Also: Superpowerchecks.com Review

We Have A Company Thats Really Got Great Potential 2005

Though he has acknowledged mistakes in piling crippling debt on Trump Hotels and Casino Resorts, Donald Trump has steadfastly maintained that his resorts were the best-run and highest-performing casinos in Atlantic City.

The casinos have done very well from a business standpoint, he told Playboy magazine in 2004. People agree that theyre well run, they look good and customers love them.

In reality, the revenue at Mr. Trumps casinos had consistently lagged behind their competitors for a decade before larger forces ravaged the industry. Beginning in 1997, his share of the Atlantic City gambling market began to slip from its peak of 30 percent.

Revenues at other Atlantic City casinos rose 18 percent from 1997 through 2002 Mr. Trumps fell by 1 percent.

Competition grew more intense in 2003, when the Borgata Hotel Casino and Spa opened. The $1.1 billion, 40-story resort redefined the concept of an Atlantic City luxury casino. Revenues at Trump casinos dropped another 6 percent in a little more than a year.

Had Mr. Trumps revenues grown at the rate of other Atlantic City casinos, his company could have made its interest payments and possibly registered a profit. But with sagging revenues and high costs, his casinos had too little money for renovations and improvements, which are vital for hotels to attract guests. The public company never logged a profitable year.

I think the biggest thing is, it understates his compensation, Mr. Cox said.