Issues With Chapter 7 Conversion

When you file for Chapter 13 bankruptcy, part of the process will be that the court will officially approve a repayment plan you must follow to receive a final discharge. If you cant agree on a plan that the court will approve, in some cases, you can convert your filing to Chapter 7.

However, if you already filed once, you have these varying time requirements before your second discharge. So, converting a Chapter 13 filing to Chapter 7 can be a problem. You may be past the amount of time required to receive a discharge with Chapter 13, but not long enough to receive a discharge with Chapter 7.

This makes having the right bankruptcy services on your side even more essential on a second bankruptcy, because you may be navigating some tough waters.

How To File A Motion To Extend The Automatic Stay

If you want to extend the automatic stay, you must file a motion with the court. In your motion, youll explain why your previous bankruptcy was dismissed and why the court should extend the stay in your current case. Youll have to prove that you filed the subsequent bankruptcy in good faith .

The specific procedures for filing a motion to extend the automatic stay depend on the rules in your jurisdiction. But the following are typically the most common steps you must take:

Find and complete the appropriate forms. Each bankruptcy district has forms for specific motions and notices. Check with your local bankruptcy court to find all paperwork related to motions to extend the automatic stay. But be aware that your jurisdiction may not have a standard form to fill out. In that case, you will have to create the motion and declarations. You can find your courts website using the Federal Court Finder tool.

Obtain a hearing date and file the motion. In most cases, you will need to obtain a hearing date from the court before filing the motion . Keep in mind that the filer must complete the hearing before the stay expires, so typically you must file your motion immediately after filing your case. Youll tell the court why your first bankruptcy was dismissed and explain why this case is filed in good faith. Then youll serve the paperwork on the bankruptcy trustee and your creditors .

You May Like: What Does Dave Ramsey Say About Bankruptcy

Trump: Good Or Bad Business Record

So how are we to rate Donald Trumps business acumen in relative terms? Is the cautious businessman who minimizes risk, rarely fails, and shows a moderate return better than the brash businessman who often takes on highly risky pursuits, strikes out a lot, but also hits his share of grand slams? Thats too subjective a question for us to answer, and the few numbers offered in this trope arent very informative.

Its an oft-cited statistic that Donald Trump has 515 companies, but a number of those businesses are only connected to him in tangential ways and arent owned or directly controlled by him.

Its also an oft-cited statistic that about 80-90% of businesses fail within the first year to eighteen months, but such numbers typically refer to startups and small businesses, while much of Donald Trumps business empire involves expanding and building on existing large business lines and ventures.

The most important takeaway from this trope might be that you cant sum up the world of big business. much less any presidential candidates qualifications, with a couple of numbers devoid of explanation or context.

You May Like: Donald Trump Kkk Parents

Examining Donald Trumps Chapter 11 Bankruptcies

personal bankruptcyFact-checking claims about Donald Trumps four bankruptcies.Chapter 7Chapter 13Joel R. Spivack Esq. is an experienced bankruptcy attorney who specializes in helping individuals through personal bankruptcy. Contact him today to help you explore your legal options so that you can move on with your life and make a fresh financial start. Examining Donald Trumps Chapter 11 BankruptciesSpivack Law

A Certain Commander In Chief Has A Long History Of Being Accused Of Screwing Over The Little Guy

President Trump has long claimed to be a fierce defender of the “forgotten” American. In his unsettlingly dark inauguration address, for example, Trump declared: “The forgotten men and women of our country will be forgotten no longer. Everyone is listening to you now. … And I will fight for you with every breath in my body, and I will never, ever let you down.”

But Trump has long made a career of letting down just these sorts of Americans.

Despite his fiery rally rhetoric and over-the-top working-class bluster, Trump’s hypocrisy on this score has always been gobsmackingly obvious, since in his former life as a real estate tycoon he left a long trail of small businesses and independent contractors feeling bilked or burned.

Granted, fights between developers and contractors over payments are not uncommon in the construction and real estate business. But consultants and lawyers in the industry say that Trump’s tactics like using last-minute excuses to either refuse payment or renegotiate terms were especially cutthroat and petty.

Let’s take a brief tour of some of the Americans left burned by the president.

1. Trump’s personal driver

2. A Philadelphia cabinet maker

3. A paint seller and event workers in Florida

4. A drapery business in Las Vegas

According to court records, Walters never had a dispute with any other client.

5. A toilet maker in Atlantic City

As to how Trump stacks up on those metrics, I leave it to readers to judge.

Read Also: Was Melania Trump A Prostitute

One Case Pending Within 12 Months

If you had one prior bankruptcy case pending within the previous 12 months dismissed, you could probably file a second case, but the automatic stay will last for only the first 30 days of the latter case. Creditors will have to stop their collection actions, but only for 30 days. After that, the automatic stay will naturally end unless you get court approval to extend.

It Will Be The Best 1996

Donald Trump has said that his brushes with financial disaster in the early 1990s reminded him of a lesson his father had taught him: Do not leave yourself on the hook for loans.

My father knew, like I knew, you dont personally guarantee, Mr. Trump is quoted saying in TrumpNation: The Art of Being the Donald, by Timothy L. OBrien, a former reporter for The Times. Ive told people I didnt follow my own advice.

His agreements with lenders and the two casino bankruptcies in those years still left Mr. Trump personally responsible for more than $100 million in debt, and his agreements had only delayed the day of reckoning to June 30, 1995.

He dealt with that danger by first shifting much of his personal debt onto his casinos, then onto a new group: .

Step 1 came in 1993, when his company sold more junk bonds, adding another $100 million in debt to the Trump Plaza casino. More than half of the new money went to pay off Mr. Trumps unrelated personal loans.

Then, in June 1995, with the risk of being forced into bankruptcy just weeks away, Mr. Trump shifted ownership of the Plaza casino to a new, publicly traded company: Trump Hotels and Casino Resorts. In the initial public offering, 10 million shares were sold at $14. At the same time, the company also sold another $155 million in junk bonds, at a 15.5 percent interest rate.

Indeed, the company posted losses of $66 million in 1996, $42 million in 1997 and $40 million in 1998. Those losses would continue.

Read Also: Does Joni Ernst Wear A Wig

Despite Holding Huge Assets Trump Needs Money More Than His Presidential Predecessors Ever Did But He Faces Multiple Barriers Of His Own Making

Find your bookmarks in your Independent Premium section, under my profile

Find your bookmarks in your Independent Premium section, under my profile

As Trump knows only too well, lawyers are expensive

What next for Donald Trump? World leaders dont, as a rule, go hungry upon leaving office. There are positions on corporate boards to take up, lucrative speaking engagements to be booked, handsome advances for books even if they dont sell quite as well as expected . The consulting opportunities are endless, as Tony Blair has proved. Theyre not always terribly savoury but that usually merits only passing attention.

Trump, however, is in the difficult position of needing the money more than any of his predecessors did, despite holding huge assets. He also faces barriers of his own making the insurrection he fomented the most obstructive of all to at least some of the perks former presidents typically enjoy. Many of the people who welcomed George W Bush and cut him a cheque when he wasnt painting wont want to associate with Trump.

His legal problems, meanwhile, are just beginning and legal experts consider the idea of Trump preemptively pardoning himself a non-starter. Besides, this would only cover federal, and not state, offences.

Remington: Oldest Us Gunmaker Files For Bankruptcy

The oldest gun manufacturer in the US, Remington Outdoor, has filed for bankruptcy in the wake of slumping sales.

The firm, founded more than 200 years ago, filed for bankruptcy protection to cut a deal with its creditors.

Remingtons chief financial officer said the companys sales dropped significantly in the year before its bankruptcy, court papers show.

The filing comes amid fresh demands for greater gun control in the US.

A shooting at a Florida high school in February has revived the debate on gun control, and on Saturday hundreds of thousands of protesters took to the streets of US cities.

Some US retailers have raised the age limit for certain firearms purchases to 21 or stopped stocking semi-automatic weapons.

Also Check: Will My Spouses Bankruptcy Affect Me

Read Also: How Much Did Trump Lie

Need Help Filing A New Bankruptcy

If you find it necessary to file another bankruptcy, we can discuss your situation in depth and complete privacy by phone or at a sit down free consultation.

Orange County bankruptcy attorney, Norma Duenas, is an experienced bankruptcy attorney who graduated from the University of San Diego Law School, Cum Laude. Ms. Duenas has handled many complex Chapter 7 and Chapter 13 bankruptcy cases. She has previously assisted clients in litigation, immigration matters and has handled hundreds of Chapter 7 and Chapter 13 bankruptcy cases in the Riverside, Orange County, Los Angeles, Temecula and Murrieta areas of Southern California.

If youd like to have a no cost consultation with bankruptcy attorney Duenas, you can make an appointment with our founding attorney, Norman Duenas, by calling or if its after hours and well get back to you.

Dont Miss: Can You File Bankruptcy On Ssi Overpayment

How Soon Can You File For Chapter 13 After Chapter 7 Bankruptcy

In order to get debts discharged through Chapter 13, you must wait four years after filing a Chapter 7 bankruptcy.

You can file for Chapter 13 before four years if no debts were discharged in the Chapter 7 filing, but if you had debts discharged in Chapter 7 and want to have debts discharged in Chapter 13, you must wait four years.

Dont Miss: What Is Epiq Bankruptcy Solutions Llc

Also Check: How Many Lies Has Trump Told As President

How Trump Leveraged Other Peoples Money To Make Bankruptcy Work For Him: A Timeline

Donald Trump is the self-proclaimed king of debt. Before becoming president, he built his brand and companies with massive amounts of borrowed money.

Allmand Law teamed up with James Publishing to illustrate this timeline by Mother Jones, outlining Trumps Bankruptcies: How Trump Leveraged Other Peoples Money to Make Bankruptcy Work for Him.

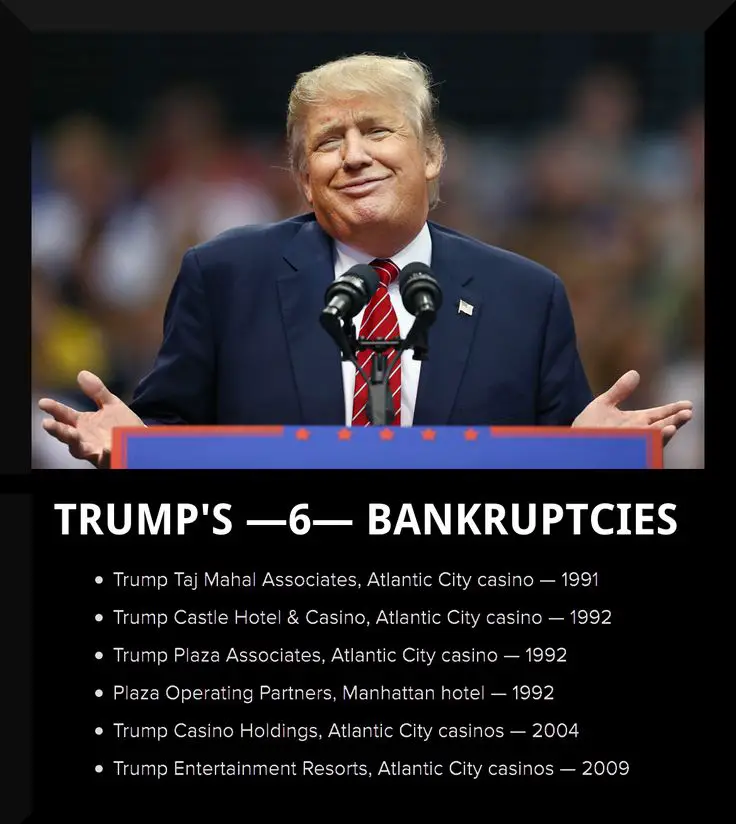

In the 1980s, Trump amassed casinos, hotels, an airline, and a 282-foot mega yacht. But his gold-plated bubble popped. By June 1990, Trump was unable to make loan payments on his $3.4 billion in outstanding debts. In total, Trump businesses filed for bankruptcy six times.

In many ways, Trumps path to bankruptcy is just like that of many other business owners. His ambition was bigger than his financial resources. Risky business decisions didnt play out as planned. And his attempts to restructure his debt were unsuccessful. But, in classic Trump form, there are flourishes of scandal.

So how did he rebound and rebuild? Trump, along with his bankruptcy attorneys and financial advisors, used federal bankruptcy laws to their advantage. While investors and creditors lost a lot of their money, Trump was highly compensated for his day-to-day work, earned fees during the property transfers, and slashed his personal debts.

Donald J Trump Foundation

The Donald J. Trump Foundation was a U.S.-based private foundation established in 1988 for the initial purpose of giving away proceeds from the book Trump: The Art of the Deal by Trump and Tony Schwartz. The foundation’s funds mostly came from donors other than Trump, whose last personal contribution to the charity was in 2008. The top donors to the foundation from 2004 to 2014 were Vince and Linda McMahon of World Wrestling Entertainment, who donated $5 million to the foundation after Trump appeared at WrestleMania in 2007.

Per the foundation’s tax returns, its benefactors included healthcare and sports-related charities, as well as conservative groups. In 2009, for example, the foundation gave $926,750 to about 40 groups, with the biggest donations going to the Arnold Palmer Medical Center Foundation , the New York Presbyterian Hospital , the Police Athletic League , and the Clinton Foundation .

A 2018 suit by the New York State attorney general alleged that Trump had illegally used foundation funds to buy self-portraits, pay off his businesses’ legal obligations, and boost his presidential campaign. The judge ruled against the Donald J. Trump Foundation and ordered Trump to pay $2 million in damages. Trump agreed to give that money and the foundation’s remaining $1.8 million to 8 charities ranging from Army Emergency Relief to the United Negro College Fund to the US Holocaust Memorial Museum and to dissolve the foundation.

Also Check: Trump Donates Salary To Rebuild Military Cemeteries

Due To His Indebtedness His Reliance On Income From Overseas And His Refusal To Authentically Distance Himself From His Hodgepodge Of Business Trump Represents A Profound National Security Threat

Topics

https://mybs.in/2YQPBJm

In a tour de force of hard won reporting, the New York Times has put numerical clothing on what weve known about President Donald Trump for decades that, at best, hes a haphazard businessman, human billboard and serial bankruptcy artist who gorges on debt he may have a hard time repaying.

The Times, in a news story published Sunday evening that disclosed years of the presidents tax returns, also put a lot of clothing on things we didnt know. Trump paid just $750 in federal income taxes in 2016, the year he was elected president, and the same amount …

TO READ THE FULL STORY, NOW AT JUST Rs

Key stories on business-standard.com are available to premium subscribers only.

Already a premium subscriber?