Has Trump Helped Small Business During His First 100 Days

President Donald Trump walks down the steps of Air Force One upon his arrival at Detroit… Metropolitan Airport, Wednesday, March 15, 2017, in Romulus, Mich.

April 29 will mark Donald Trumps first 100 days in office. The 100-day benchmark has been used as a barometer for success since Franklin D. Roosevelt, and while many say it doesnt hold the same weight it used to, it stilloffers a chance for the new president to build a coalition and enact his own agenda. Despite Trumps recent comment that the 100-day mark is a ridiculous standard, its a good time to stop and look at the impact his first 100 days have had on small businesses.

At the start of his presidency, I covered how Trumpschanges at the Small Business Administration would affect small businesses, and how Linda McMahon plans on running the administration. A lot has happened since then, so heres a look at the top five stories from his first 100 days in office that impact small businesses moving forward.

The Promise to Empower Women in Business

Ushering in a New Era at the Small Business Administration

Trumps new administrator of the SBA, Linda McMahon, is also a champion for women. She founded Womens Leadership LIVE, which aims to educate, inspire and empower women to stand out as catalysts for change and to build a world where women obtaining and exercising power is both expected and commonplace. While being sworn in, Linda McMahon echoed Trumps desire to ease regulations on small businesses.

The State Of Small Business Is Strong

As President TrumpDonald TrumpBiden sends 2016 climate treaty to Senate for ratificationUS, China ease restrictions on journalists Americans keep spending MORE heads into his final State of the Union ahead of the 2020 election, he should take the opportunity to explain how the policies of his administration are largely responsible for the flourishing economy that is raising the standards of living for ordinary Americans everywhere. Trump should contrast this success with the economic disaster that would occur from the socialist policies of Bernie Sanders, who looks poised to win the Iowa caucus, or any of the other Democratic candidates.

The State of the Union offers Trump a rare opportunity to cut through the partisan filters of the mainstream media and speak directly to Americans about how policies that favor growth and workers, such as trade deals, tax cuts, and deregulation, are padding the pocketbooks of workers across the nation. Although his economic successes do not usually generate many front page headlines, they certainly should be trumpeted.

Take home pay adjusted for inflation for the average middle class family has risen to a record of $66,000 under this administration. Democrats in Iowa may have not gotten the message, but Trump has addressed wage stagnation. Wages are rising partly because of the tight labor market. The unemployment rate is at a half century low of 3.5 percent. There are one million more available jobs than the number of unemployed people.

Proposals To Improve Regulations In The Biden Era

President Bidens Modernizing Regulatory Review initiative offers an excellent opportunity to focus on this problem. One possible solution to reducing the regulatory burden for small businesses might involve reducing the overall number and cost of regulations. This is the route the Trump administration took with its requirement that agencies offset the costs of new regulations with equivalent regulatory savings and eliminate two rules for every new one adopted. That may or may not be a wise approach, but it appears to be a non-starter in the Biden administration. Alternative ways to address the problem dovetail perfectly with the types of initiatives the administration has already said it would like to pursue. Here are a few ideas.

At the very least, agencies should be mindful of the fact that large businesses are more capable of hiring expensive law firms and lobbying shops to request special regulatory exemptions. When an agency grants a waiver to a large firm, the agency should publicly announce its decision and strongly consider extending it to all firms so that smaller players are not at a competitive disadvantage. And in some cases, it may make sense to provide a special carve-out to small businesses when the effects of their activities are minimal or when they face an especially heavy burden.

Read Also: When Did Trump Ban Travel From China

Family Capitalism And The Small Business Insurrection

The growing militancy of the Republican right is less about an alliance of small business against big business than it is an insurrection of one form of capitalism against another: the private, unincorporated, and family-based versus the corporate, publicly traded, and shareholder-owned.

For much of the 2016 presidential campaign, progressive commentators struggled to comprehend the foundations of Trumps popular support. Many assumed that the strident right-wing populism he unleashed was a long overdue reaction to the decades of wage stagnation endured by the industrial working class. True enough, Trump assiduously targeted this demographic during his campaign. Guided by Steve Bannon, he selectively presented himself as an advocate for a blue-collar welfarism of the kind briefly entertained by Richard Nixonerstwhile friend of the hard-hat workerand later embodied by Nixon adviser Pat Buchanan. It was this incarnation that explains much of the early confusion regarding his political intentions. But while Trumps pandering to Rust Belt Democrats won him critical margins in Ohio and Pennsylvania, the few hundred thousand industrial workers who voted for him were hardly sufficient to constitute a long-term advantage. Nor were they representative of Trumps crusaders as a whole, the most passionate of whom were first politicized by the Tea Party movement.

Economic Growth Was Lackluster

Annual economic growth failed to accelerate under President Trump, denying him of his goal of 3 percent let alone 4, 5, and maybe even 6 percent growth each year. Annual economic growth averaged 2.5 percent across President Trumps first three years in office, in line with the average growth rate during President Obamas last three years. And while the economy grew by 3 percent in 2018, the best year of President Trumps term, the last time annual growth actually exceeded 3 percent was in 2015, under President Obama.

President Trumps failure to supercharge the economy is even clearer when narrowing in on his signature policy, the 2017 tax law. Economic growth in the eight quarters after the law was enacted averaged 2.4 percent, the same growth rate as in the eight quarters before the law. Notably, this growth was driven by government spending rather than by business investment or consumption, both of which slowed after enactment.

Recommended Reading: Can Bernie Sanders Defeat Trump

Pros And Cons Of The Trump Tax Plan

The Tax Cuts and Jobs Act, which went into effect on January 1, 2018, likely had a profound impact on your business and your business taxes. And if you have questions about the Trump tax breaks for small business, were here to help. The IRSâs tax code is complicated as it is. Now, with all of the tax code changes passed into law, how will the tax reform plan affect small businesses?

The updated tax code sets into motion new deductions and credits that affect each small businesss tax liability differently. If youre still trying to figure out how the Donald Trump tax plan will impact your small businesses this tax season, this breakdown will help.

Ways Trump Can Help Small

Optimism among small-business owners has soared as entrepreneurs hope that President-elect Donald Trump will enact policies aimed at helping them.

Trump has promised to ease regulation. While some on Main Street cheer the goal, changing anything substantial about regulation is easier said than done.

But there are other ways that a Trump administration can make life easier for small businesses. Consider this five-step plan his first 100 days agenda for Main Street.

Encourage large companies and the federal government to hire small businesses

“Trump should create tax requirements to source more from U.S. based small supply chain companies, and use incentives to get companies to pay these suppliers more quickly and invest in them with technology and skills training,”says Karen Mills, a senior fellow at the Harvard Business School and former head of the Small Business Administration. She served under President Obama from 2009 to 2013.

“Instead of squeezing their supply chain constantly, large companies, in exchange for enormous tax benefits, should treat their small business suppliers like partners, creating more value and more jobs at home.”

Also, Trump should maintain and potentially expand the Small Business Innovation Research program, a competitive awards-based program that aims to encourage small-business owners to pursue technical innovations, says, the Bernard L. Schwartz Chair in Economic Policy Development and a senior fellow in Economic Studies at Brookings.

Don’t Miss: How Old Is Trump And Biden

Ordering A Promotional $300 Million Ad Campaign For The President Using Public Health Funds

In the lead-up to the 2020 general election, the Department of Health and Human Services planned a $300 million taxpayer-funded ad campaign about Covid-19 with a theme pitched internally as Helping the President will Help the Country. Normally, the Centers for Disease Control and Prevention would lead such a campaign, but CDC director Robert Redfield testified at a Senate hearing that the agency has not had any involvement in the coronavirus campaign other than funding it. Instead, former HHS spokesperson Michael Caputo organized the effort, claiming that the president demanded that Caputo personally lead the campaign. As documented above, Caputo a political operative who joined HHS in April 2020 with no background in science or medicine has a history of interfering with the CDCs Covid-19 reports and accusing CDC scientists of sedition and having a resistance unit to undermine the president.

To finance the campaign, Caputos team used $300 million of the one billion dollars in emergency funds that Congress had appropriated to the CDC in April. The campaign which is slated to showcase movie stars and music stars talking about the Trump administrations response to the pandemic has faced criticism for diverting resources away from pressing public health needs, such as manufacturing personal protective equipment, developing treatments, or increasing testing.

Myth : Conservative Tax Proposals Are Primarily About Helping Small

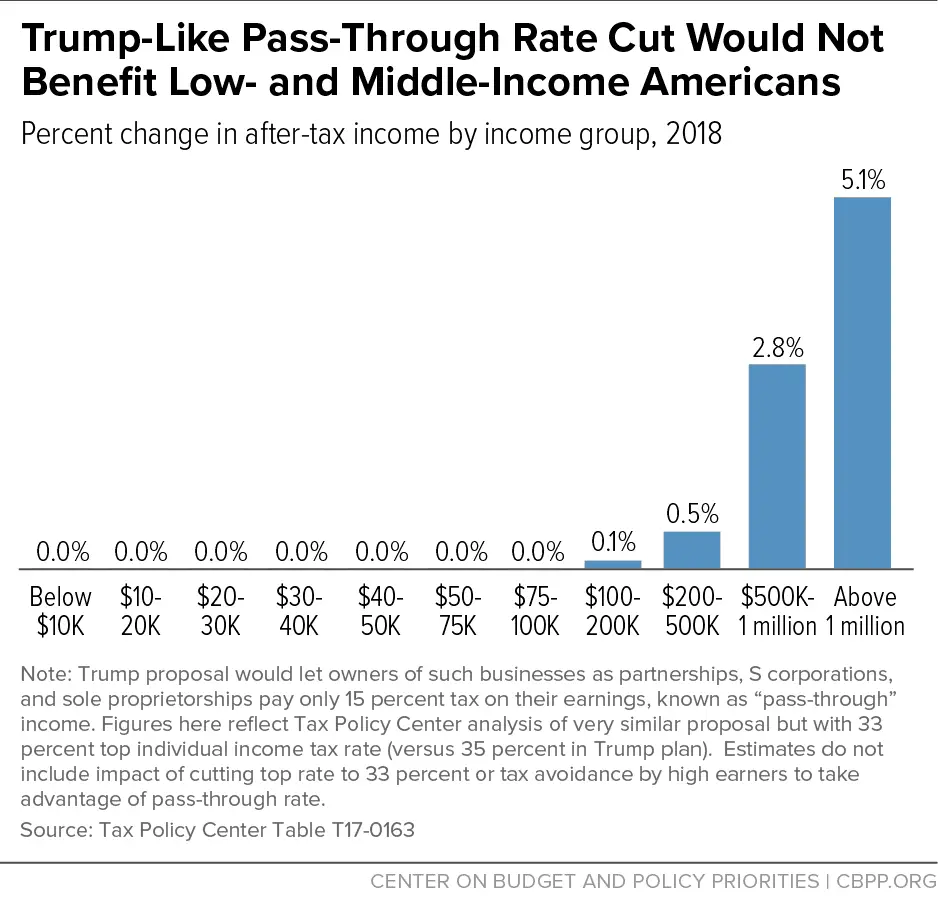

President Trump and House Republicans are arguing for huge tax breaks under the premise that they will help small businesses and the economy grow. Research shows, however, that the primary beneficiaries of conservative tax proposals are large corporations and the very wealthy. Current conservative proposals would reduce the top tax rate on pass-through business incomeor business income taxed at the individual rateto somewhere between 15 percent and 20 percent. But an analysis from the Tax Policy Center found that 92 percent of taxpayers with significant pass-through business income already fall in the 25 percent tax bracket or lower.

These proposalsprovide the greatest benefit for very wealthy individuals such as hedge fund managershardly anybodys idea of a small-business owner. One National Bureau of Economic Research working paper found that pass-through business income is already taxed at very low rates and mostly goes to the wealthy. Indeed, income from partnershipsthe leading type of pass-through incomewas taxed at just a 16 percent average effective rate in 2012, despite 70 percent of it going to households in the top 1 percent of income.

Recommended Reading: When Did Donald Trump Get Impeached

Small Business Loan Program Runs Out Of Money As Jobless Claims Top 22 Million

BK Technologies Inc., a maker of public safety communications gear, received $2.196 million. Its board shares three directors with another recipient, Ballantyne Strong Inc., a holding company with cinema products and digital signage operations. Ballantyne received $3.174 million under the program.

Representatives of both companies did not immediately respond to requests for comment.

Hallador Energy, a coal company in Denver that snared $10 million under the program, is among the recipients with ties to the Trump administration. Last year it hired Scott Pruitt, a former administrator of the Environmental Protection Agency under Trump, to lobby on its behalf, disclosure records show.

A lawyer for Pruitt told NBC News, “Please be advised that any inference that Mr. Pruitt had knowledge of or involvement in whatever Hallador may have submitted … is false.”

In an email, Pruitt said he had not had any involvement with Hallador Energy since May 2019. “I advised and represented them with regard to policy discussions exclusively as a subject matter expert regarding Indiana’s public utility commission and Indiana statutes,” he said.

Lowering Taxes For Small Businesses

When it comes to taxes, Trump has already been at the center of controversy.

However, officials believe that he could do his part by cutting taxes for small businesses. Doing so would also mean lowering individual taxes.

The reason why is that the government taxes most small business owners on their individual returns, whereas it does not do so to large corporations. So Trump needs to look at a reducing individual taxes in order to maintain fairness among businesses.

See below for more information on this topic.

Don’t Miss: When Was Donald Trump Impeached

Tax Relief For The Middle Class

Passed $3.2 trillion in historic tax relief and reformed the tax code.

- Signed the Tax Cuts and Jobs Act the largest tax reform package in history.

- More than 6 million American workers received wage increases, bonuses, and increased benefits thanks to the tax cuts.

- A typical family of four earning $75,000 received an income tax cut of more than $2,000 slashing their tax bill in half.

- Doubled the standard deduction making the first $24,000 earned by a married couple completely tax-free.

- Doubled the child tax credit.

- Virtually eliminated the unfair Estate Tax, or Death Tax.

- Cut the business tax rate from 35 percent the highest in the developed world all the way down to 21 percent.

- Small businesses can now deduct 20 percent of their business income.

- Businesses can now deduct 100 percent of the cost of their capital investments in the year the investment is made.

- Since the passage of tax cuts, the share of total wealth held by the bottom half of households has increased, while the share held by the top 1 percent has decreased.

- Over 400 companies have announced bonuses, wage increases, new hires, or new investments in the United States.

- Over $1.5 trillion was repatriated into the United States from overseas.

- Lower investment cost and higher capital returns led to faster growth in the middle class, real wages, and international competitiveness.

Jobs and investments are pouring into Opportunity Zones.

The Cost Of The Trump And Biden Covid Response Plans

The COVID pandemic has caused considerable economic damage and human suffering. Policymakers responded aggressively this spring to address the economic fallout, as detailed at COVIDMoneyTracker.org, but have not agreed on further steps. Both President Donald Trump and former Vice President Joe Biden have proposed additional actions.

Our recent paper The Cost of the Trump and Biden Campaign Plans analyzed the budgetary effects of the policies proposed by both presidential candidates excluding their COVID response plans. Under our central estimate, we found the Trump plan would cost nearly $5 trillion and increase the national debt to 125 percent of Gross Domestic Product by 2030, while the Biden plan would cost $5.6 trillion and increase debt to 127 percent of GDP by 2030.

In this paper, we find President Trump has proposed between $530 billion and $870 billion of additional spending and tax relief to address the current public health and economic crisis, with a central estimate of $650 billion. We find Vice President Biden has proposed between $2.0 trillion and $4.2 trillion of additional measures to address the crisis, with a central estimate of $3.1 trillion.

You May Like: Has Trump’s Approval Rating Gone Up

This Is Not A Financial Crisis Mr Trump Said This Is Just A Temporary Moment In Time That We Will Overcome As A Nation And As A World

During his speech, President Trump said he will ask Congress to pass legislation that would ensure that working Americans impacted by the virus can stay home without fear of financial hardship. Among the proposals:

· Financial aid for workers who are sick, quarantined or caring for family members who are ill

· Postponement of the IRSs tax-payment deadline for some individuals and businesses

· Authorization for the Small Business Administration to offer an additional $50 billion in SBA loans at low-interest rates to help small businesses overcome temporary economic setbacks caused by the spread of the Coronavirus.

The Most Important Thing Biden Can Learn From The Trump Economy

A hot economy with high deficits didnt cause runaway inflation.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

By Neil Irwin

For all the problems that President Trumps disdain of elite expertise has caused over the last four years, his willingness to ignore economic orthodoxy in one crucial area has been vindicated, offering a lesson for the Biden years and beyond.

During Mr. Trumps time in office, it has become clear that the United States economy can surpass what technocrats once thought were its limits: Specifically, the jobless rate can fall lower and government budget deficits can run higher than was once widely believed without setting off an inflationary spiral.

Some leading liberal economists warned that Mr. Trumps deficit-financed tax cuts would create a mere sugar high of a short-lived boost to growth. The Congressional Budget Office forecast that economic benefits of the presidents signature tax law would be partly offset by higher interest rates that would discourage private investment.

And the Federal Reserve in 2017 and 2018 took action to prevent the economy from getting too hot driven by models suggesting that an improving labor market would eventually cause excessive inflation.

These warnings did not come true.

Just maybe, does the success of Trumponomics tell us that weve been doing something wrong for decades?

Read Also: What Is Trump Doing Now