The 2017 Tax Law Doesnt Help The Middle Class

The new tax lawknown as the Tax Cuts and Jobs Act will exacerbate this trend. The benefits of the law tilt toward the well-off both now and in the future, according to the distributional analysis of the Tax Policy Center. By 2027, benefits of the tax law flow entirely to the rich.

To be fair, Republicans hope to extend the tax law beyond 2027, but thats highly unlikely. There is also an argument that increased investment will lead to higher wages in the long run. The theory is that the lower corporate rate and temporarily expanded business expensing will spur investment in the United States, leading to more capital, and more productive workers. As worker productivity rises, firms will boost wages. All of this would happen gradually over the long term.

Ial List Of Tax Provisions Affecting Middle

- Tax exclusion for employer-sponsored health insurance and deduction for self-employed health insurance premiums: 79 million

- Head of household status: 22.1 million

- American Opportunity Tax Credit : 10.2 million

- Student loan interest deduction: 12.1 million

- Tuition and fees deduction: 1.7 million

- Above-the-line deduction for teachers out-of-pocket expenses: 3.8 million

- Tax credit for adoption: 74,000

- Tax exclusion for most Social Security benefits: 29 million

- Additional standard deduction for the blind and elderly: 14.8 million

- Above-the-line deduction for certain business expenses, including travel expenses for armed forces reservists: 152,000

Note: Number of tax filing units claiming each provision from the IRS Statistics of Income for the 2014 tax year. The totals do not add because many families may claim multiple tax benefits. Figure for the health insurance exclusion and deduction is an estimate of the number of tax units benefiting from those provisions from the Tax Policy Center. Roughly 160 million Americans are covered by employer plans.23

Again, it is also possible that Trump could amend his tax plan to make it more generous for middle-class and working families. But until the Trump administration fills in the missing details, those families will have little idea how it will affect them personallybut plenty of reason to be wary.

Life Satisfaction And Views Of Personal Finances Across Social Classes

Assessments of life satisfaction differ across self-identified social classes, with some of the widest differences seen between the views of the lower class and those of the upper and middle classes.

Majorities across groups say they are very satisfied with their family life. However, somewhat greater shares of those in the upper class and middle class say this than of those in the lower class .

About three-quarters of upper-class adults say they are very satisfied with their present housing situation 68% of those in the middle class also say this. Among lower-class adults, far fewer say they are very satisfied with their current housing.

Similarly, most upper- and middle-class adults say they are very satisfied with their education, compared with 43% of lower-class adults.

Among those currently employed, 62% of upper-class adults say they are very satisfied with their current job, while about half of those in the middle class say they are very satisfied with their job. Among employed adults who describe themselves as lower class, 40% say they are very satisfied with their current job.

As the country has recovered from the Great Recession, assessments of personal finances have improved across most groups, particularly among those who describe themselves as middle class.

Among those who say they are middle class, positive personal financial ratings are up 12 points, from 43% who described their finances as excellent or good in 2011 to 55% in the current survey.

You May Like: Did Donald Trump Serve In The Military

Irs Data Proves Trump Tax Cuts Benefited Middle Working

President Biden and congressional Democrats Build Back Better Act is now in the hands of the Senate. That legislative bodys 50-50 partisan split will undoubtedly make the bills passage difficult.

In order for BBB to become law, Democratic Senate leadership will need to convince moderates such as Sens. Kyrsten Sinema and Joe Manchin that the legislations $2.4 trillion price tag can be offset by expanding the IRS and its enforcement efforts while imposing substantial tax reform measures.

Congressional Democrats have argued that one of the best ways to pay for the legislation is to raise taxes on wealthy households, which, according to many on the left, have benefited disproportionately and unfairly from the 2017 tax reform law passed by Republicans and signed by former President Trump. The latest data, however, proves that this claim is pure mythology.

Income data published by the IRS clearly show that on average all income brackets benefited substantially from the Republicans tax reform law, with the biggest beneficiaries being working and middle-income filers, not the top 1 percent, as so many Democrats have argued.

Filers who earned $50,000 to $100,000 received a tax break of about 15 percent to 17 percent, and those earning $100,000 to $500,000 in adjusted gross income saw their personal income taxes cut by around 11 percent to 13 percent.

It would be a grave mistake for Democrats to eliminate key parts of this important legislation.

Trump Weighing 10 Percent Middle

The proposal is mostly designed to set up a contrast with Democrats ahead of the November elections.

President Donald Trump. | Mark Wilson/Getty Images

02/14/2020 01:14 PM EST

President Donald Trumps long-promised Tax Cuts 2.0 plan will be released in September, with a 10 percent cut for middle-income taxpayers under discussion, a top White House official said today.

In a meeting in the Oval, I guess two days ago, he looked at me and he said, Lets get it out by September,National Economic Council Director Larry Kudlow told Fox Business Network. Wed love to have a 10 percent middle-class tax cut, and we would love to strengthen and make permanent some of other tax cuts.

It will come out sometime in September, he said.

As the timing of the plans release indicates, the proposal is mostly designed to set up a contrast with Democrats ahead of the November elections. Democrats tax plans are focused on raising taxes on the rich.

Stung by criticism their 2017 tax overhaul didnt do enough for average Americans, Republicans have been raising the prospect of another round of tax cuts for almost two years. Among the ideas that have been under consideration is what the administration envisions as a 15 percent tax rate on the middle class, though its unclear how that would work.

Trump first raised the possibility of a Phase Two tax cut in March 2018.

Read Also: How To Talk To President Trump

Biden Wants To Raise Taxes Yet Many Trump Tax Cuts Are Here To Stay

While Democrats have vowed to repeal the former presidents signature 2017 law, his successor is more likely to tinker with it, given constraints.

WASHINGTON Donald J. Trump has left the White House. But many of his signature tax cuts arent going anywhere.

Democrats have spent years promising to repeal the 2017 Tax Cuts and Jobs Act, which Republicans passed without a single Democratic vote and was estimated to cost nearly $2 trillion over a decade. President Biden said during a presidential debate in September that he was going to eliminate the Trump tax cuts.

Mr. Biden is now in the White House, and his party controls both chambers of Congress. Yet he and his aides are committing to only a partial rollback of the law, with their focus on provisions that help corporations and the very rich. Its a position that Mr. Biden held throughout the campaign, and that he clarified in the September debate by promising to only partly repeal a corporate rate cut.

In some cases, including tax cuts that help lower- and middle-class Americans, they are looking to make Mr. Trumps temporary tax cuts permanent.

Mr. Biden did not include any tax increases in the $1.9 trillion stimulus plan he proposed last week, which was meant to curb the pandemic and help people and companies endure the economic pain it has caused.

Trump Tax Cuts Helped Billionaires Pay Less Taxes Than The Working Class In 2018

US President Donald Trump claps during a campaign rally in Rio Rancho, New Mexico, on September 16, … 2019.

AFP/Getty Images

For the first time in American history, the 400 wealthiest people paid a lower tax rate than any other group, according to a new study by economists Emmanuel Saez and Gabriel Zucman at the University of California, Berkeley.

The startling data was brought to light on Monday in a New York Times column, and is based on an analysis by Saez and Zucman in their new book, The Triumph Of Injustice.

Some critics of the new research say that the data is skewed, or even potentially wrong. However, the fact that the ultra-rich potentially pay a lower tax rate than the working class is a massive problem. The Trump administrations tax cuts for the wealthy highlight the fact that policy is moving in the wrong direction. Especially when theres worry of a potential recession.

Bill Gates agrees and has previously said, Theres no doubt that what we want government to do in terms of better education and better health care means that we need to collect more in taxes. And theres no doubt that as we raise taxes, we can have most of that additional money come from those who are better off… I need to pay higher taxes.

Before your palms start sweating dont worry I dont think we should raise your taxes. We are talking about the top .01%. Those who own yachts and airplanes.

Read Also: Is Trump Closing The Borders

How Trump Has Betrayed The Working Class

Trumps corporate giveaways and failure to improve the lives of ordinary working Americans are becoming clearer by the day

Trump is remaking the Republican party into what?

For a century the GOP has been bankrolled by big business and Wall Street. Trump wants to keep the money rolling in. His signature tax cut, two years old last Sunday, has helped US corporations score record profits and the stock t reach all-time highs.

To spur even more corporate generosity for the 2020 election, Trump is suggesting more giveaways. Acting chief of staff Mick Mulvaney recently told an assemblage of CEOs that Trump wants to go beyond his 2017 tax cut.

Trump also wants to expand his working-class base. In rallies and countless tweets he claims to be restoring the American working class by holding back immigration and trade.

Most incumbent Republicans and GOP candidates are mimicking Trumps economic nationalism. As Trump consigliere Stephen Bannon boasted recently: Weve turned the Republican party into a working-class party.

Keeping the GOP the Party of Big Money while making it over into the Party of the Working Class is a tricky maneuver, especially at a time when capital and labor are engaged in the most intense economic contest in more than a century because so much wealth and power are going to the top.

Recommended Reading: What Does Impeachment Mean For Trump

Cutting Capital Gains Taxes Would Almost Exclusively Benefit The Wealthy

Another potential element of the administrations Tax Cuts 2.0 plan is cutting capital gains by indexing them for inflation. The Trump administration has thus far not acted on this idea but has long considered doing so by regulationthough the administrations legal authority to act without legislation is highly dubious. Indexing capital gains means that taxpayers basis in an assetgenerally speaking, the cost of acquiring itwould be adjusted for inflation from the time of acquisition. This change would reduce the amount of gain that a taxpayer is required to report when they sell the asset. This particular proposal is estimated to reduce revenues by somewhere between $100 billion and $200 billion over a decade. Because the majority of capital assets are owned by the wealthy, more than 80 percent of the benefit would go to just the top 1 percent of taxpayers, making this proposal even more skewed to the wealthy than the TCJA.

Recommended Reading: Where To Buy Trump Stickers

Did Trumps Tax Cut Improve The Economy

One major reason that President Trump said he wanted to pass his tax plan was to improve the economy. He believed there would be more business investment, which would stimulate the economy and, in turn, help working Americans.

On the basis of the stock market and gross domestic product , the economy is in fact performing very well. But those trends already existed before the TCJA became law. The unemployment rate 3.5% in February 2020 has reached its lowest level in more than 50 years, but data from the U.S. Bureau of Labor Statistics shows that unemployment has been steadily declining since 2010. There isnt currently enough evidence to show that Trumps tax cuts lowered the unemployment rate more quickly. Preliminary data from the U.S. Bureau of Economic Analysis , released in February, also suggests that GDP has actually been slowing as of late.

Along with the U.S. bringing in less tax revenue since Trumps tax reform, the U.S. deficit has increased significantly. Data from the Federal Reserve Bank of St. Louis shows that the federal deficit grew 17% from 2017 to 2018 and 26% from 2018 to 2019. Federal debt passed $1 trillion in 2019 and the Congressional Budget Office expects the deficit to average $1.4 trillion from 2021 to 2030. Whether the size of the deficit should matter is an issue still being debated by economists, but its clear that Trump himself expected his tax cuts to not just lower the deficit but pay it off entirely.

Ready to shop for life insurance?

Trump Tax Cuts And The Middle Class: Here Are The Facts

Ever since Congressional Republicans passed the Tax Cuts and Jobs Act in 2017, the left has sought to portray the tax cuts as a bad deal for the middle class.

Now that they have taken back Congress, Democrats on Capitol Hill are holding a hearing on Wednesday to examine how the middle class is faring. While they will undoubtedly use this hearing to score political points, the fact is the tax cuts have created unprecedented prosperity for the middle class in the form of higher wages, more take-home pay, more jobs and new employee benefits.

Rather than disputing these facts, Democrats argue that the bill was a scam for American families. They have seized on the news that the average tax refund is slightly down at the start of tax season as proof that the tax cuts have left families worse off. This criticism is misleading on various fronts.

For one, this data reflects a single week of tax filing season and it is likely that the size of refunds will increase as tax season continues Morgan Stanley analysts have predicted that refunds will increase by 26 percent.

In addition, the size of a tax refund means nothing without also comparing the change in paychecks. In net, the overwhelming number of filers will be better off as an estimated 90 percent of Americans are seeing a tax cut.

TCJA wins

This positive news is not anecdotal.

More good news

In addition to these employee benefits, Americas middle class is seeing direct tax relief.

Related Articles

Don’t Miss: What Has Trump Done For Middle Class

Tax Returns And Withholding

Tax filing season brings up many questions for taxpayers, such as, How big will my tax refund be? or, Will I have a balance due when I file taxes this year? Changes to withholding tables in the aftermath of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily translate to increased tax liabilities.

The chart below shows the aggregate amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped across all income groups over the same period. This pattern is similar to tax year 2018, when aggregate refunds also fell for most income groups.

Trying To Tie Access To Basic Health Care To Work

Styna Lane suffers from chronic illnesses that leave her susceptible to joint dislocations, fainting spells and anaphylactic reactions. The 29-year-old from Ohio requires a chest port and relies on Medicaid to cover her prescriptions and treatments, which total more than $4,000 a month. But starting next year, she could lose her Medicaid coverage.

The Trump Administration invited states to apply for waivers that allow them to tie coverage to work requirements, and over a dozen, including Ohio, have done so. Though people with disabilities should be exempt, some who suffer from chronic illness are in a gray area. I know people will combat it with Well, if youre genuinely that ill, youll have no problem getting the exemption. But thats just not how our system works, says Lane, who was previously denied a disability exemption for food stamps. Unfortunately, a lot of people slip through those cracks.

From 2018 to 2020, courts have blocked the Medicaid work requirement in four states. Some courts have ruled that it defeats the primary legislative purpose of Medicaid, to provide health coverage to the poorest Americans.

Most states have put the work requirements on hold, pending the outcome of multiple court battles.

Read Also: Can Trump Be Elected In 2020

Trumps Rumored Tax Cuts 20 Proposals Arent Focused On The Middle Class

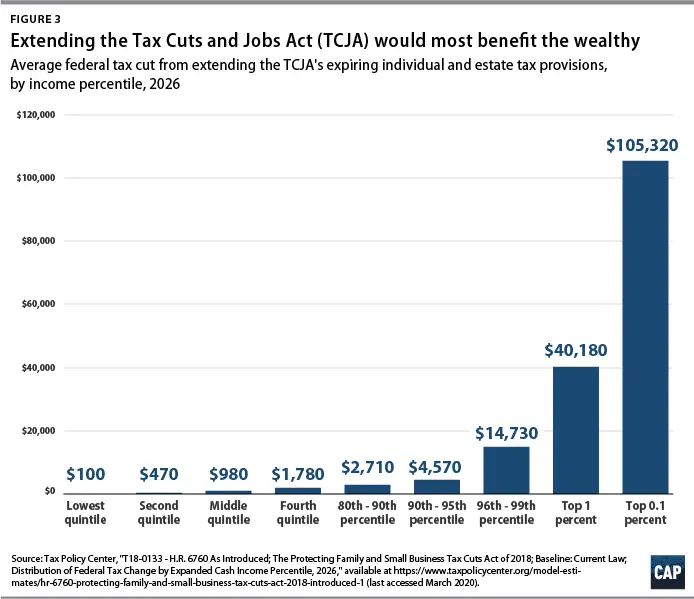

The rumored elements of the Trump administrations Tax Cuts 2.0 plan are skewed to people with higher incomes, just like the 2017 tax law.

In 2017, President Donald Trump and congressional Republicans enacted the so-called Tax Cuts and Jobs Act a tax plan that was heavily skewed toward wealthy Americans. Ever since, they have been floating rumors about a new tax proposal, which they are calling Tax Cuts 2.0. This time, they say, the tax plan will actually be focused on the middle class. No specific plan has been released, but some of the White Houses policy discussions have leaked in the press. True to form, the tax cuts they are considering are hardly focused on the middle class. The rumored elements of Tax Cuts 2.0 include:

- Lowering the tax rate for the 22 percent bracket to 15 percent. This would make no difference for most middle-class families while benefiting high-income people the most.

- Indexing capital gains for inflation. This would provide a windfall for wealthy investors.

- Extending the individual and estate tax provisions of the TCJA beyond their scheduled expiration date. This would permanently lock in tax cuts that are skewed to the wealthy.

- Creating a new tax-preferred savings vehicle. This would only double down on the tax codes already very top-heavy investment tax breaks.

- Implementing even more corporate tax cuts. This would overwhelmingly benefit the wealthy, who own most of the corporate stock.