Trump Tax Plan Lowers Corporate Tax Rate

Before 2018, the corporate tax rate was 35%. The TCJA reduced the rate to 21%. This flat rate applies to all corporate income . The intent was to give corporations a financial break that would be passed on to the employees, and subsequently the economy. However, the jury is still out and many believe it is too soon to tell as of 2022 whether the plan helped with that goal. A lot has happened since then with the pandemic and record high inflation.

Us Tax Cuts: Are They The Biggest In American History

Claim: President Donald Trump has said that the recently passed Republican tax reform legislation is the biggest tax cut in US history.

Verdict: It is not the biggest tax cut in US history, measured as either a percentage of US GDP or in absolute terms. It is however, the biggest corporate tax cut in US history.

Its tax day in America something most Americans dread.

But this year, the filing of both personal and corporate taxes has become even more complicated due to the recently passed tax reform bill in the United States.

President Donald Trump touted the legislation in a speech on 16 April in Hialeah, Florida, saying: We have the biggest tax cut in history, bigger than the Reagan tax cut. Bigger than any tax cut.

But while most Americans are filing for 2017 and so wont feel the biggest impact until next year is the claim true?

Trumps Tax Cuts Would Add $245 Trillion To The Debt

Donald Trumps tax-cut plan could add as much as $24.5 trillion to the national debt over the coming 20 years unless it is accompanied by steep cuts in spending and entitlement programs, a new analysis finds.

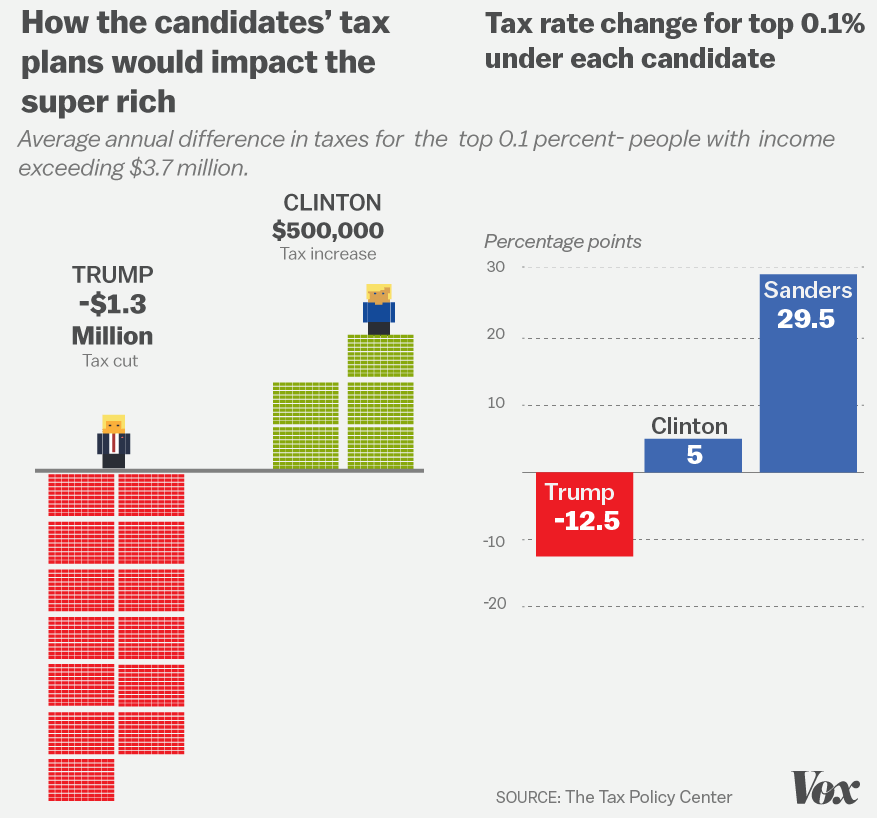

The paper published by the Tax Policy Center, a joint venture by the Urban Institute and Brookings Institution, provides a sobering reminder that many of the generous tax cut plans being floated by Trump, former Florida Gov. Jeb Bush and other candidates carry enormous long-term price tags. Some of them, if adopted, would spark a renewal of the long-term debt crisis and could undermine the very economic recovery that GOP and Democratic presidential candidates alike are promising.

Related: Experts Predict Rising Deficits and Debt in GOP Candidates Tax Plans

The numbers are startling, according to the new report: Trumps proposals for consolidating and slashing individual and corporate tax rates and getting rid of the estate tax would reduce federal revenues by an estimated $9.5 trillion over the coming decade and an additional $15 trillion over the subsequent 10 years. And thats before accounting for the governments added interest costs from having to borrow substantial sums to make up for the revenue shortfall and keep the government operating.

Finally, Trump has pledged to eliminate the estate tax which would be a boon to farmers and ranchers as well as average Americans.

Related: Trump Vows Lower Tax Rates, Revised Trade Agreements, Deep Spending Cuts

You May Like: How Many Bernie Supporters Voted For Trump

Ctc Gains May Have Just Cancelled Out Other Losses

As mentioned earlier, some families may have owed more tax because the expansion of the standard deduction meant the loss of personal exemptions. The TCJA expanded a few tax credits and deductions, including the child tax credit, and families may have needed to claim them just to offset the loss of personal exemptions.

Example: A two-parent family with two children may have actually owed more in taxes in 2018 than in 2017. The following table shows how:

|

Tax Break Type |

|

|---|---|

|

$30,900 |

$28,000 |

This family received a standard deduction of $24,000 in 2018. The family would have effectively received a deduction of $28,900 in 2017, because of the combined standard deduction and personal exemptions . In this scenario, the family could need to claim the child tax credit of $2,000 per child in 2018 just to break even. Even then, the total value of the combined standard deduction and CTC in 2018 would be less than the combined value of the standard deduction, personal exemptions, and CTC in 2017 .

So while Trumps tax reform allowed families to claim a higher child tax credit, some families may not have saved very much from it. As the IRS releases more data, it will be possible to look at whether the combined effect of the TCJA changes were enough to help certain working-class families save money.

The Right Question: What Would Revenues Have Been Without The Tcja

The most appropriate test of the revenue impact of the TCJA is to compare actual revenues in FY2018 with predicted revenues in FY2018 assuming Congress had not passed the legislation. In fact, the actual amount of revenue collected in FY2018 was significantly lower than the Congressional Budget Offices projection of FY2018 revenue made in January 2017before the tax cuts were signed into law in December 2017. The shortfall was $275 billion, or 7.6% of revenues that were expected before the tax cuts took place. Given that the economy grew, and in the absence of another policy that could have caused a large revenue loss, the data imply that the TCJA substantially reduced revenues .

You May Like: Is Trump Losing His Mind

Losers: People Who Didn’t Adjust Their Withholding

When the IRS updated its tax-withholding tables to reflect the new law, it also revamped its Form W-4 a document employees use to ensure they’re pulling enough income tax from their paycheck.

Some taxpayers are at risk of paying too little tax during the year, including former itemizers and individuals with side gigs.

“If you’re making side income, you have no withholding on it, then you’ve underpaid the taxes and you ultimately owe money,” Perry said.

If you were significantly underwithheld in 2019, it’s too late to right the ship.

However, you can head off a similar disappointment next year if you get your prior year’s tax return and crunch the numbers on the IRS’s tax withholding calculator.

Were The Tcjas Revenue Effects Anticipated

None of these findings should be surprising. Almost every major analysis of the legislation correctly predicted that revenues would fall in 2018 relative to a scenario without the tax cuts, with sources ranging from government entities such as the CBO and the Joint Committee on Taxation, to non-governmental think tanks such as the Urban-Brookings Tax Policy Center and the Tax Foundation, academic researchers in studies by Robert Barro and Jason Furman, and in analyses using the Penn-Wharton Budget Model.

Also Check: What Are Trump’s Economic Policies

Less Generous Tax Rules For Research Expenditures

If the tax rules followed economic logic, the cost of investments in research would be deducted from taxable income over time as the fruits of that research lose value. Until now, the tax rules treated research much more generously, allowing businesses to deduct the entire amount of those expenses in the year that they are incurred. Under the 2017 law, starting this year, companies are required to deduct those costs over 5 years.

Personal Exemption And Healthcare Mandate

The law suspended the personal exemption, which was $4,150, through 2025. The law also ended the individual mandate, a provision of the Affordable Care Act or “Obamacare” that provided tax penalties for individuals who did not obtain health insurance coverage, in 2019. the taxpayer will still be exposed to a penalty for not being covered by health insurance all year.)

According to the Congressional Budget Office , repealing the measure is likely to reduce federal deficits by around $338 billion from 2018 to 2027, but lead 13 million more people to live without insurance at the end of that period, pushing premiums up by an average of around 10%. Unlike other individual tax changes, the repeal will not be reversed in 2025.

Senators Lamar Alexander and Patty Murray proposed a bill, the Bipartisan Health Care Stabilization Act, on Mar. 19, 2018, to mitigate the effects of repealing the individual mandate. The CBO estimated that this legislation would still leave 13 million more people uninsured after a decade. The bill failed to make it into the $1.3 trillion spending bill that was passed on Mar. 23, 2018. As such, the burden of providing affordable health insurance will be on states and health insurers.

Also Check: How Can You Contact President Trump

Many Large Profitable Corporations Are Paying No Tax

Researchers at the Institute on Taxation and Economic Policy surveyed corporate financial reports for the first year that the TCJA was in effect and recently published their findings. Examining 379 profitable Fortune 500 companies, they found that the companies paid an average effective tax rate of just 11.3 percent on their U.S. income in 2018slightly more than half of the 21.2 percent average effective rate that large corporations paid from 2008 to 2015. Shockingly, ITEP found that 91, or nearly one-quarter, of these major corporations paid no federal income tax on their U.S. income in 2018.

Impact Of Tcja Cuts Becoming Permanent

Congress could choose to make the individual cuts permanent before they expire. If that happens, the cost of the tax cuts would rise to $2.3 trillion instead of $1.5 trillion over the next 10 years.

A separate analysis found that while the TCJA would result in increased economic growth, all of the revenue from this growth would go toward paying for the cuts. The cost is too high for the tax cuts to pay for themselves. Instead, the deficit and debt would continue to grow.

Recommended Reading: What Is The Approval Rating Of President Trump

Winners: High Earners Who Formerly Paid The Amt

Under the old law, taxpayers with higher incomes were subject to something known as the alternative minimum tax.

These filers would calculate their income tax liability twice: once under the ordinary rules and again with the AMT, which would bar you from claiming certain write-offs and itemized deductions.

You would then look at your liabilities under the ordinary rules and the AMT and pay whichever tax was the highest.

The number of people who think they’re worse off versus those who are actually worse off is driven by this perception of whether the refund went up or down.Ed ZollarsCPA at Thomas Zollars & Lynch

The Tax Cuts and Jobs Act raised the 2018 AMT exemption to $109,400 for married taxpayers, from $84,500. For single filers, the exemption rose to $70,300, from $54,300.

The AMT tweak is forecast to reduce the number of people paying the AMT to 200,000 per year through 2025 which is when this change will expire compared to 5 million in 2017, prior to the tax overhaul, the Tax Policy Center found.

“Under today’s laws, it’s highly unlikely you’ll be in the AMT, said Jeffrey Levine, CPA and CEO of BluePrint Wealth Alliance in Garden City, New York.

An Exhaustive Lobbying Campaign

Almost immediately after Mr. Trump signed the bill, companies and their lobbyists including G.E.s Mr. Brown began a full-court pressure campaign to try to shield themselves from the BEAT and GILTI.

The Treasury Department had to figure out how to carry out the hastily written law, which lacked crucial details.

Chip Harter was the Treasury official in charge of writing the rules for the BEAT and GILTI. He had spent decades at PwC and the law firm Baker McKenzie, counseling companies on the same sorts of tax-avoidance arrangements that the new law was supposed to discourage.

Starting in January 2018, he and his colleagues found themselves in nonstop meetings roughly 10 a week at times with lobbyists for companies and industry groups.

The Organization for International Investment a powerful trade group for foreign multinationals like the Swiss food company Nestlé and the Dutch chemical maker LyondellBasell objected to a Treasury proposal that would have prevented companies from using a complex currency-accounting maneuver to avoid the BEAT.

The groups lobbyists were from PwC and Baker McKenzie, Mr. Harters former firms, according to public lobbying disclosures. One of them, Pam Olson, was the top Treasury tax official in the George W. Bush administration.

This month, the Treasury issued the final version of some of the BEAT regulations. The Organization for International Investment got what it wanted.

You May Like: Is There A Trump Care

How Itemized Deductions Changed

If taxpayers incur certain types of expenses, they can deduct the expenses on their federal taxes. These are called itemized expenses and you take them as itemized deductions instead of taking the standard deduction. That means your itemized deductions need to be worth more than your standard deduction to be worth claiming.

The TCJA made multiple changes to itemized deductions, like putting a $10,000 limit on the state and local tax deduction and eliminating a number of miscellaneous deductions. The new, higher standard deduction also means fewer taxpayers are able to itemize, because they need to have about twice as much in itemized deductions in to make itemizing worth it.

IRS data from 2020 shows that 30.9% of taxpayers itemized deductions in 2017, but only 11.3% itemized in 2018 88.4% of taxpayers took the standard deduction in 2018.

Taxpayers claimed the following types of itemized deductions about 60% less in 2018:

-

The medical expenses deduction was claimed 57.2% less in 2018 than 2017.

-

The mortgage interest deduction was claimed 60.9% less in 2018 than 2017.

-

The charitable contributions deduction was claimed 63.5% less in 2018 than 2017.

-

The deduction for total taxes paid, which includes the SALT deduction, was claimed 64.5% less in 2018 than 2017.

Did The Tcja Spur Enough Growth To Maintain Federal Revenue Levels

While some TCJA supporters observe that nominal revenues were higher in fiscal year 2018 than in FY2017, that comparison does not address the question of the TCJAs effects. Nominal revenues rise because of inflation and economic growth. Adjusted for inflation, total revenues fell from FY2017 to FY2018 . Adjusted for the size of the economy, they fell even more.

Recommended Reading: How Many People Have Died Because Of Trump

Explaining The Trump Tax Reform Plan

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didnât change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time.

But how did this happen? Letâs take a closer look at President Trumpâs changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

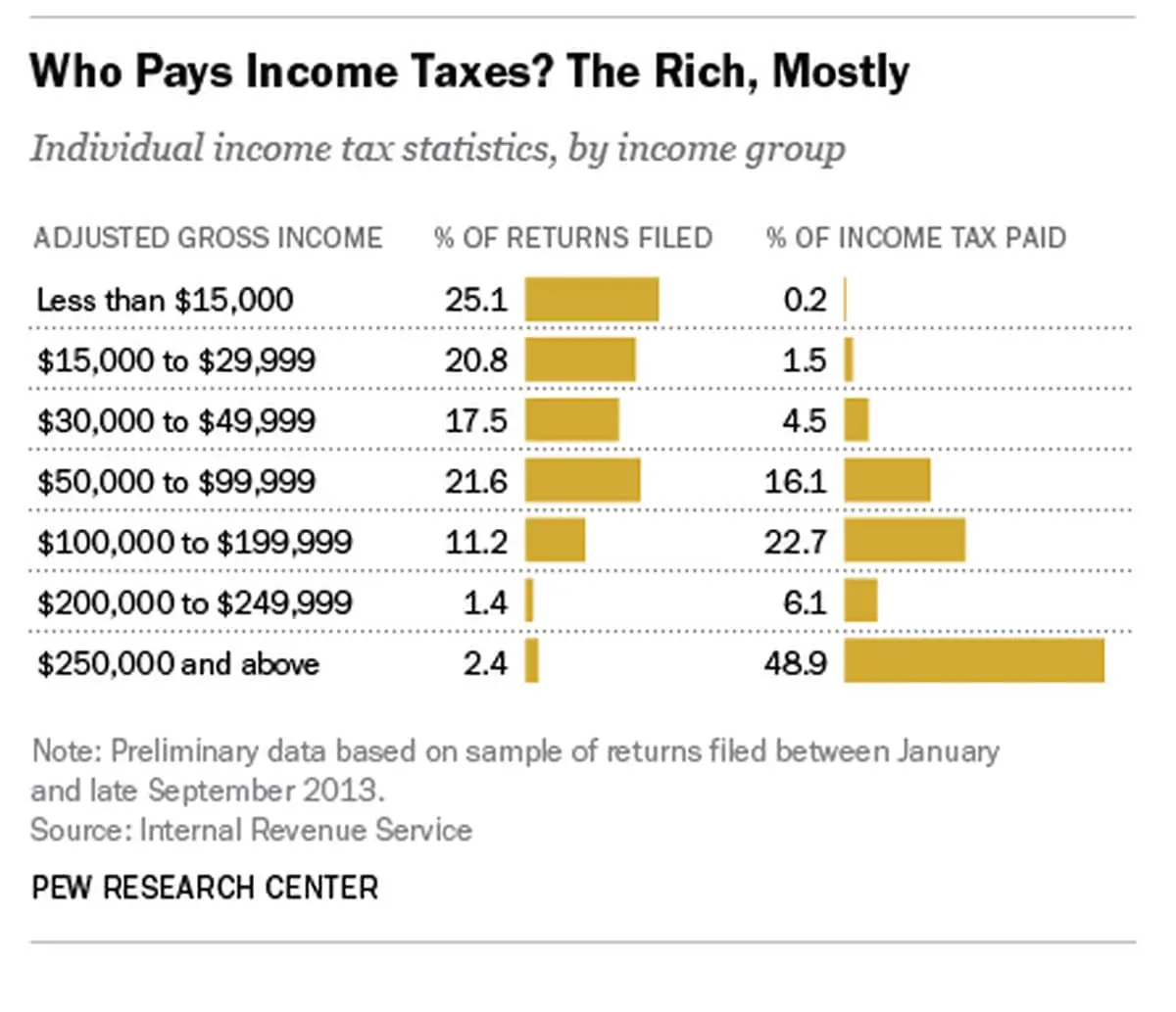

Who Benefited From The Trump Tax Cuts

Various reports show that the TCJA lowered taxes for most Americans. However, analyses have also shown that the overall effects have largely benefited corporations and wealthy Americans more than middle-class and low-wage workers. The corporate tax cuts, in particular, failed to translate to the promised wage and economic growth.

Don’t Miss: Who Is President Trump’s Chief Of Staff

The New Standard Deduction Helped Some Taxpayers

The TCJA nearly doubled the standard deduction from $6,350 for single filers in 2017 to $12,000 in 2018. The standard deduction lowers your taxable income the amount of your income that you actually pay income tax on so a higher deduction means paying less income tax overall.

However, the higher standard deduction didnt benefit everyone equally for two main reasons:

-

The loss of personal exemptions

-

Changes to itemized deductions

Gop Tax Law Made History But Not In The Way Republicans Claimed

President Trump said that the tax law unleashed an economic miracle. While we have yet to see this miracle materialize, Republicans did achieve something unprecedented with their tax cuts: deficits are growing larger even as the economy grows stronger.

As Director Hall noted during his testimony, this is a new development in our history. During periods of low unemployment and strong economic growth, we would expect higher revenue to drive down deficits. In the last half-century, deficits averaged 1.5 percent of GDP in years when the unemployment rate was below 6 percent. In years when unemployment fell below 5 percent as they have since 2016 average deficits were just 0.7 percent of GDP.

In contrast, the deficit is projected to rise from 3.8 percent of GDP in 2018 to 4.2 percent of GDP this year, and average 4.4 percent of GDP over the next 10 years. Rather than use the strengthening economy as an opportunity to get our fiscal house in order, Republicans broke a well-established relationship between stronger growth and lower deficits.

Read Also: Does Trump Wear A Toupe

Don’t Miss: What Has Trump Done During His Presidency

The Impossible Inevitable Survival Of The Trump Tax Cuts

How Democrats went from unanimous opposition to an unpopular policy to doing nothing about it in the five years since it became law.

Evan Vucci/AP Photo

President Donald Trump shakes hands with then-House Speaker Paul Ryan during an event after the passage of the “Tax Cut and Jobs Act Bill” on the South Lawn of the White House, Dec. 20, 2017.

Right as the Trump tax cuts were being finalized in December 2017, I wrote a piece for The New Republic about the silver lining that accompanied this large giveaway to the wealthy and well-connected. Democrats had put themselves in a straitjacket for years, with self-imposed paygo laws that they offset all new spending with revenue. That was fairly absurd in and of itself, but suddenly it was no longer a problem. The Trump tax cuts rolled back the estate tax, eliminated the alternative minimum tax, slashed the corporate tax rate, and created a new loophole, used mostly by the rich, for pass-through businesses.

Repealing those measures alone could net you around $3 trillionand all you would have to do is go back to the pre-Trump tax code circa fall 2017. Every Democrat in office at the time opposed the Trump tax cuts: Joe Manchin, Kyrsten Sinema, Josh Gottheimer, and Kurt Schrader every single one of the cast of characters that has become so familiar today. They all opposed it, and presumably would all be satisfied with a 2017-era tax code.