What We Don’t Know

There are some caveats to keep in mind when assessing the data in the Trump Organization’s financial disclosure forms.

First, the data is unaudited, self-reported data, meaning that readers have to take the company’s word that it’s accurate.

Second, many of the numbers listed as “income” from certain assets seem, instead, to be the revenue from those businesses. This was confirmed when data from Trump’s tax returns were released by The New York Times showing that many of the businesses have been losing money, including some of the largest revenue producers, such as Trump National Doral golf resort.

That being the case, the financial numbers don’t show the amount of money that the former president actually took home as income. For example, in Trump’s 2017 disclosure, he listed his income for the Trump National Doral golf resort as $75 million, which matches the revenue number reported to Miami-Dade County. Net operating income for the resort for that year was dramatically smaller at $4.3 million.

Getting a clear picture of the former president’s businesses is further complicated by the fact that income and asset values are listed in very wide ranges. For example, Mar-a-Lago Club is listed as having a value of “over $50,000,000.” The Trump National Golf Club in Charlotte is listed as worth between $5 million and $25 million.

Schism Has Emerged Between Shares And Warrants Of Blank

Former President Donald Trumps new social-media venture has become popular among individual investors.

Traders are struggling to place a consistent value on Donald Trumps new social-media venture, a business that hasnt offered much in the way of details but one that supporters think is destined to take off.

Shares and warrants ofDigital World Acquisition Corp. DWAC -1.67% , the special-purpose acquisition company that is merging with Trump Media & Technology Group, tell two different valuation stories. The SPACs shares have traded around $80 in recent days, preserving a 700% rally since the deal was announced in October. They are up more than 60% this year, bucking a broad selloff that has sent other SPACs and stocks that are popular among individual investors, such asGameStop Corp. , tumbling.

The stocks current price implies a valuation of several billion dollars for Mr. Trumps startup, a remarkable figure considering little is known about the company other than that it plans to launch a new social-media platform called Truth Social and capitalize on his following. The company said in December it had $1 billion in commitments from investors as part of its SPAC deal and that California Republican Rep. Devin Nunes was leaving the House of Representatives to become the companys chief executive.

Some analysts say Mr. Trumps new company is overvalued given that its main product hasnt launched and faces a crowded social-media landscape.

Biggest Spac Rally Ever

Investors trying to predict where the SPAC’s shares are heading next say they have little to go by. Many of them found a presentation that Trump Media released last week on its business plan to be voluminous in its aspirations but thin on financial details.

Those who argue the stock could go even higher point to the large social media following Trump enjoyed before he was banned for encouraging his supporters to participate in the U.S. Capital attack on Jan. 6. He had 89 million followers on Twitter, 33 million on Facebook and 24.5 million on Instagram, according to the presentation.

Investors bearish on the stock point to failures of other right-wing social media apps such as Parler. The fact that the rally in Digital World shares is already the biggest ever for a SPAC makes it more likely that people would be buying at the peak, they argue.

SPACs had lost much of their luster with retail investors before the Trump media deal came along. Many of these investors were left with big losses after the companies that merged with SPACs failed to deliver on their ambitious financial projections.

Jay Ritter, a finance professor at the University of Florida who focuses on capital markets, said a big risk for investors was the possibility that Digital World and Trump Media would seek to renegotiate the deal in light of the SPAC’s stock rally, to keep more of the new company for themselves at the expense of retail investors.

Register now for FREE unlimited access to Reuters.com

Read Also: Trump Lies How Many

Trump Ruffin Tower Llc

- 2019 Revenue: $27,677,448, divided between $4,414,500 in condo sales and $23,262,948 in hotel revenue

- 2018 Revenue: $28,558,298, divided between $6,002,244 in condo sales and $22,556,054 in hotel revenue

- 2019 Asset Value: Over $50,000,000

- Business Type: Hotel and Condominium Complex

Trump Ruffin Tower LLC manages the Trump International Hotel and Tower in Las Vegas. Constructed in 2008, the tower is a combination hotel and condominium development.

It struggled as the Great Recession hit when it opened more than a decade ago, devastating the real estate market. Plans for a second tower were scrapped.

Elon Musk Boosts Twitter Hurts Dwac Stock

Truth Social’s biggest competitor is Twitter, and the latter company got a massive boost after Tesla CEO Elon Musk snapped up a massive slice of the company.

Musk reported in a filing to the SEC that he now owns about 73.5 million shares of Twitter. The stake was valued at $2.89 billion as of the Apr. 1 closing price.

Elon Musk is now the largest shareholder, owning more stock than the firm’s famous founder Jack Dorsey.

The tech billionaire turned down the chance to join the Twitter board, and went on to strike a deal to acquire the company for 54.20 a share. It comes after the Twitter have adopted a so-called poison pill measure in an attempt to fight him off.

But this was before Musk revealed he has secured financing for the deal. It has since emerged that the eccentric executive will serve as temporary CEO if he completes the $44 billion buyout.

A key rationale for Truth Social is many critics say Twitter restricts free speech. But if Musk completes the takeover and pushes to address this, then it undercuts the appeal of the rival Trump product.

But cracks are appearing in the deal. The eccentric executive tweeted the deal is “temporarily on hold” over concerns spam and fake accounts represent more than 5% of users.

Wedbush analyst Daniel Ives said Musk is signaling he is getting cold feet on the deal.

Recommended Reading: Cost Of Room At Trump Tower

Trump Stocks Promising Bigly Gains For Next Year

Former President Donald Trump continues to have a massive impact on the markets. Although he has left the White House, his influence is still felt with so-called Trump stocks.

Digital World Acquisition Corp wrapped up its IPO in September when it began trading under the ticker DWAC. In October, Trump Media & Technology Group announced a planned merger with DWAC. In the wake of this major announcement, several other companies are doing very well.

Consequently, investors are also earmarking these Trump stocks for big gains. With a mission to build digital properties to oppose liberal bias and censorship, Trump Media is launching Truth Social. According to the companys mission statement, this social media platform will encourage an open global conversation without discriminating based on ideology. Truth Social has avoided any major setbacks in its beta app launch. However, it did find itself at the center of a controversy after federal regulators started investigating them for their communication with Trump before details of the deal became public.

If you want to put your hard-earned money into DWAC, then volatility comes with the territory. That is why, if you are a conservative investor to achieve steady returns, then investing in Trump stocks is better than investing in DWAC directly.

-

CF Acquisition Corp VI

-

Salem Media Group

-

Grom Social Enterprises

-

Phunware

A Great Time To Buy One Of America’s Great Companies

John Rosevear : The former president always seemed to have a soft spot for Ford, and this is actually a good time to be thinking about an investment in the iconic American automaker. For starters, auto sales in the U.S. and Europe are likely to be on an upswing in 2021, as the COVID-19 pandemic recedes and Western economies get back to positive territory.

Ford’s all-new 2021 F-150 is arriving at dealers just in time for a post-COVID-19 recovery. It’s just one of several new Fords that could help the company outperform the market over the next several quarters. Image source: Ford Motor Company.

That bodes well for all automakers, of course. But it bodes especially well for the Blue Oval, which — as it did in 2010 and 2011 — is hitting the sweet spot of its new-product cycle at just the right time. Consider:

- A brand-new iteration of Ford’s most profitable product, the F-150 pickup, began shipping at the end of November. It’s selling very quickly at strong prices, and that’s likely to continue for at least a few quarters.

- SUVs: Ford’s stalwart Explorer and Escape are still fresh, the brand-new Bronco Sport is selling very well, and the much-anticipated Bronco is coming in a few months.

- The electric Mustang Mach-E is now arriving in U.S. showrooms, and interest is very high. Ford is likely to sell all it can make for at least the next year, and possibly longer.

Don’t Miss: Was Melania A Hooker

Donald J Trump Foundation

The Donald J. Trump Foundation was a U.S.-based private foundation established in 1988 for the initial purpose of giving away proceeds from the book Trump: The Art of the Deal by Trump and Tony Schwartz. The foundation’s funds mostly came from donors other than Trump, whose last personal contribution to the charity was in 2008. The top donors to the foundation from 2004 to 2014 were Vince and Linda McMahon of World Wrestling Entertainment, who donated $5 million to the foundation after Trump appeared at WrestleMania in 2007.

Per the foundation’s tax returns, its benefactors included healthcare and sports-related charities, as well as conservative groups. In 2009, for example, the foundation gave $926,750 to about 40 groups, with the biggest donations going to the Arnold Palmer Medical Center Foundation , the New York Presbyterian Hospital , the Police Athletic League , and the Clinton Foundation .

A 2018 suit by the New York State attorney general alleged that Trump had illegally used foundation funds to buy self-portraits, pay off his businesses’ legal obligations, and boost his presidential campaign. The judge ruled against the Donald J. Trump Foundation and ordered Trump to pay $2 million in damages. Trump agreed to give that money and the foundation’s remaining $1.8 million to 8 charities ranging from Army Emergency Relief to the United Negro College Fund to the US Holocaust Memorial Museum and to dissolve the foundation.

Business Career Of Donald Trump

| This article is part of a series about |

Donald Trump is an American businessman and television personality. He was the 45th president of the United States. He began his real estate career at his father’s company, Elizabeth Trump and Son, which he later renamed the Trump Organization. He rose to public prominence after concluding a number of highly publicized real estate deals in Manhattan, and his company now owns and licenses his name to lodging and golf courses around the world. Trump partly or completely owned several beauty pageants between 1996 and 2015. He has marketed his name to many building projects and commercial products. Trump’s unsuccessful business ventures have included numerous casinos and hotel bankruptcies, the folding of his New Jersey Generals football team, and the now-defunct Trump University.

After being inaugurated as U.S. president in January 2017, Trump resigned all management roles within the Trump Organization, and delegated company management to his sons Donald Jr. and Eric. However, Trump retained his financial stake in the work document, leaving ongoing concerns about possible conflicts of interest.

Read Also: Fred Trump Arrested At Klan Rally

Whats The Name Of Trumps New Stock

Digital World Acquisition Corp. of Trump Holdings, LLC . There are stock gains after the target launching date is set for the social media app. After it was announced that the former Presidents plans for a social media application would launch by the end of February, shares of the company connected to that application jumped sharply.

Is Trump A ‘conservative’ Investor

Trump appears to invest conservatively given his large holdings in bonds and cash. He holds a lot of money in checking and savings accounts at banks as well as money market funds. This money is easy to access, but it’s been a lousy investment in recent years with interest rates stuck near 0%.

The biggest holding for Trump though hedge funds. These funds are supposed to be run by the smartest minds on Wall Street who charge high fees by promising that they will limit losses when the market sours. However, a lot of hedge funds have had terrible performance lately, including some that Trump owns.

Trump has several million invested with hedge fund king John Paulson. Paulson became a billionaire by foreseeing America’s housing crisis early, but his picks since haven’t been nearly as stellar.

The other large bet in Trump’s hedge fund portfolio is on the BlackRock Obsidian Fund. Trump has over $25 million there. The BlackRock fund made headlines in January for suffering its worst start to a year in nearly two decades. Performance has reportedly rebounded somewhat since.

Read Also: Number Of Trump Lies To Date

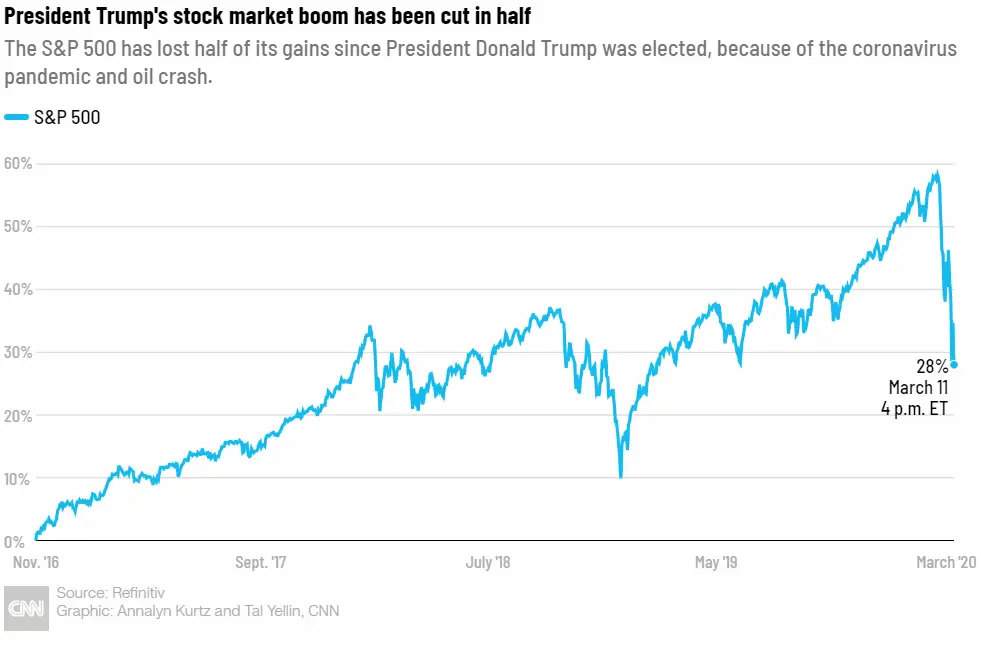

The Markets Cumulative Performance Since The Presidents Election Has Decelerated Quickly

President Trump speaks during a Coronavirus Task Force press conference at the White House on March 17, 2020.

President Trump has often bragged about how the stock market has performed since he was elected, but that can be a dangerous game, especially during the coronavirus crisis.

Heres a chart that shows a mixed stock market track record, at best, for the president. That is, assuming you buy the argument that he should be credited or criticized for how well the market performs.

Can Politicians Invest In The Stock Market

Legislators Andy Levin and Jacky Moynihan held a press conference on Capitol Hill to introduce the EV Freedom Act on February 6, 2020, in Washington. In the absence of public information about Congress members that can be utilized by them to profit from the stock market, individual stocks can be bought and held in their own account.

Don’t Miss: Fact Check Trumps Lies