Joe Bidens Divide & Clunker Approach

Not that they needed one, but progressive wing nuts and their fellow travelers are getting another reason to hate President Trump. Hes proving that capitalism works.

The presidents policies of cutting high taxes and excessive regulations are sparking a stock market surge and soaring economic confidence.

Each day brings announcements from companies ranging from Apple to Walmart that they are giving bonuses and pay hikes, adding new jobs and increasing their investments in America.

Millions of workers will get the bonuses, most of which are for $1,000, and untold others will get new or higher-paying jobs.

Most of those workers also will see their take-home pay increase because they will get personal income tax cuts and a doubling of the standard deduction. Those changes will become apparent in a week or so when the new lower rates are applied to payrolls.

The cash-in-the-pocket benefits are great news to many families, but the boom is doing something else too: Its giving the millennials a firsthand lesson in economics.

Following eight slow-growth years under President Barack Obama and an election where their favorite candidate, Bernie Sanders, railed against the wealthy and promised free stuff for everybody else, many young Americans were taught that socialism is their friend and capitalism their enemy.

If they still have doubts, they need only ask their parents about their swelling 401 and IRA accounts as a result of the Dow Jones 45 percent climb since Trumps election.

Who Benefited From The Trump Tax Cuts

Various reports show that the TCJA lowered taxes for most Americans. However, analyses have also shown that the overall effects have largely benefited corporations and wealthy Americans more than middle-class and low-wage workers. The corporate tax cuts, in particular, failed to translate to the promised wage and economic growth.

Trumps Massive Tax Cuts For The Rich Would Increase Inequality And Threaten Programs That Are Vital For Working Families Including Medicare Medicaid And Social Security

Middle-class and working families would ultimately be hurt by the Trump tax plan whether or not it raises their taxes directly. With its enormous tax cuts for the rich, the Trump plan would increase inequality starve the government of revenue needed for investments and threaten the bedrock of the middle class, including Medicare, Medicaid, and Social Security.

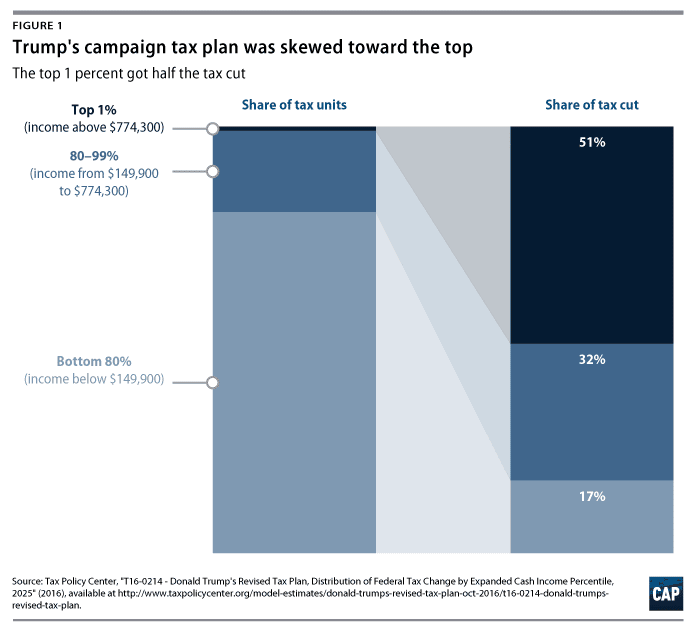

Under the broadly similar Trump campaign plan, more than half of the tax cuts benefited the top 1 percent. The bottom 80 percent of Americansthose with incomes under $150,000received only about one-sixth of the total tax cuts.

The result is a tax system that is much less fair for middle-class and working families and even greater after-tax income inequality.

The middle class would also stand to lose dearly if Congress gives away trillions in tax cuts tilted toward the top because the loss of revenue would inevitably increase pressure to cut critical programs including Medicare, Medicaid, and Social Security. The fact is that, with an aging population, more revenue is needed to maintain the promises the country has made to workersincluding the promise of basic retirement and health security that Medicare, Medicaid, and Social Security help fulfill.

Don’t Miss: What Is Donald Trump’s Number

Rich People Gained More Than Poor People

About 66% of taxpayers saw their federal tax bill decline by more than $100 in 2018, the congressional Joint Committee on Taxation reported in March. And according to the tax preparation giant H& R Block, total liabilities are down by nearly 25%. But the magnitude of those reductions varies a lot according to how much money you make, and has hadthe overall effect of widening income inequality in America.

Heres one way of looking at it: As a result of both the business and personal income tax cuts, households making between $500,000 and $1 million will see their after-tax income rise by an average of 5.2%. Households making less than $50,000 see only a 0.6% increase.

In part, thats because of a provision that allows taxpayers that earn money through pass-through businesses to take a deduction equal to 20% of that income. Pass-through businesses include everything from architecture firms to part-time landlords incorporated as partnerships and limited liability companies.

The people who are benefiting the most, and the people who are benefiting the most through pass-throughs, are really rich people, said Jason Oh, a tax law professor at the University of California-Los Angeles.

The tax acts unequal distribution of benefits is now prompting calls for further changes to even the scales.

Could The Revenue Shortfalls Be A Temporary Result Of Sudden Policy Change

For those who might argue to wait and see what has happened in 2019, the findings from the studies cited above offer little hope. On average, these models estimated that economic growth effects will only offset about a quarter of the 10-year revenue loss associated with the TCJA. Excluding the Tax Foundation, which is an outlier in these estimates, drops the average offset to less than 20%.

Recommended Reading: What Time Is President Trump Talking Tonight

Coronavirus And Cares Act Impact On Deficit

The CBO forecast in April 2020 that the budget deficit in fiscal year 2020 would be $3.7 trillion , versus the January estimate of $1 trillion . The COVID-19 pandemic in the United States impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel. About 20 million persons filed for unemployment insurance in the four weeks ending April 11. It caused the number of unemployed persons to increase significantly, which is expected to reduce tax revenues while increasing automatic stabilizer spending for unemployment insurance and nutritional support. As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.

CBO provided a preliminary score for the CARES Act on April 16, 2020, estimating that it would increase federal deficits by about $1.8 trillion over the 2020â2030 period. The estimate includes:

- A $988 billion increase in mandatory outlays

- A $446 billion decrease in revenues and

- A $326 billion increase in discretionary outlays, stemming from emergency supplemental appropriations.

Read Also: Rsbn On Directv

Differences Between The House And Senate Bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. For example:

In final changes prior to approval of the Senate bill on December 2, additional changes were made that were reconciled with the House bill in a conference committee, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

Read Also: Where To Buy Trump Flags

Some Taxpayers Missed Personal Exemptions

In 2017, each taxpayer could also claim a personal exemption worth $4,050 for themselves and for each dependent. This exemption lowered their taxable income because, along with the $6,350 standard deduction, a single filer with no kids would effectively deduct $10,400. This isnt much lower than the new standard deduction and for certain taxpayers it wouldnt result in much tax savings.

Example: Lets say a single parent has two children and qualifies as a head of household. In 2018, this parent would have gotten a standard deduction of $18,000 and their taxable income would be lowered by that amount. This is up from the head of household standard deduction of $9,350 in 2017, the last year before the tax reform took effect.

But in 2017, this parent would have been able to claim not only the standard deduction of $9,350 but also three personal exemptions worth a total of $12,150 , allowing them to lower their taxable income by $21,500. The result of the Trump tax reform is that, for this household, the new standard deduction is worth less than the combined value of the standard deduction and personal exemptions in 2017. The change could leave this single parent owing more in taxes.

Ial List Of Tax Provisions Affecting Middle

- Tax exclusion for employer-sponsored health insurance and deduction for self-employed health insurance premiums: 79 million

- Head of household status: 22.1 million

- American Opportunity Tax Credit : 10.2 million

- Student loan interest deduction: 12.1 million

- Tuition and fees deduction: 1.7 million

- Above-the-line deduction for teachers out-of-pocket expenses: 3.8 million

- Tax credit for adoption: 74,000

- Tax exclusion for most Social Security benefits: 29 million

- Additional standard deduction for the blind and elderly: 14.8 million

- Above-the-line deduction for certain business expenses, including travel expenses for armed forces reservists: 152,000

Note: Number of tax filing units claiming each provision from the IRS Statistics of Income for the 2014 tax year. The totals do not add because many families may claim multiple tax benefits. Figure for the health insurance exclusion and deduction is an estimate of the number of tax units benefiting from those provisions from the Tax Policy Center. Roughly 160 million Americans are covered by employer plans.23

Again, it is also possible that Trump could amend his tax plan to make it more generous for middle-class and working families. But until the Trump administration fills in the missing details, those families will have little idea how it will affect them personallybut plenty of reason to be wary.

You May Like: How To Text Trump To 88022

Retirement Plans And Hsas

Health savings accounts were not affected by the law, and the traditional 401 plan contribution limit in 2019 increased to $19,000 and $25,000 for those aged 50 and older. The law left these limits unchanged but repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement Act in Dec. 2019, though, people can now contribute to their individual retirement accounts past the age of 70½.

The IRS makes cost-of-living adjustments to contributions for retirement savings accounts every year. For 2022, the annual contribution limit for 401 and other workplace retirement plans is $20,500, up from $19,500 in 2021. Employees over age 50 can contribute an additional $6,000 “catch-up”$26,500 in total.

Biden Wants To Raise Taxes Yet Many Trump Tax Cuts Are Here To Stay

While Democrats have vowed to repeal the former presidents signature 2017 law, his successor is more likely to tinker with it, given constraints.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

WASHINGTON Donald J. Trump has left the White House. But many of his signature tax cuts arent going anywhere.

Democrats have spent years promising to repeal the 2017 Tax Cuts and Jobs Act, which Republicans passed without a single Democratic vote and was estimated to cost nearly $2 trillion over a decade. President Biden said during a presidential debate in September that he was going to eliminate the Trump tax cuts.

Mr. Biden is now in the White House, and his party controls both chambers of Congress. Yet he and his aides are committing to only a partial rollback of the law, with their focus on provisions that help corporations and the very rich. Its a position that Mr. Biden held throughout the campaign, and that he clarified in the September debate by promising to only partly repeal a corporate rate cut.

In some cases, including tax cuts that help lower- and middle-class Americans, they are looking to make Mr. Trumps temporary tax cuts permanent.

Mr. Biden did not include any tax increases in the $1.9 trillion stimulus plan he proposed last week, which was meant to curb the pandemic and help people and companies endure the economic pain it has caused.

Recommended Reading: How Much Has Trump Raised The National Debt

Corporate Income Taxes Were Way Down In 2018

One of the biggest results of Trumps tax cuts was lowering the corporate income tax rate to 21% from 35%. This change appears to have benefited businesses greatly, because the corporate income tax payments collected by the IRS decreased by 22.4% from 2018 than 2017.

Looking just at year-over-year returns, businesses enjoyed an increase of 33.8% in tax refunds nationally from 2017 to 2018. The average business income refund varied by state, but businesses in some states appear to have received a major windfall. In Maryland, for example, businesses received total refunds worth 238.6% more .

The tax savings that businesses received from President Trumps tax plan could offset the benefits of the tax reform to workers. The lower corporate tax rate is also a permanent change to the U.S. tax code, but the lower tax rates for individuals are temporary and will expire in 2025. That means workers could receive a tax increase in five years even as businesses continue to pay a lower rate.

Trump Republicans Reveal Tax Plan: What To Know

John Roberts shares a roundup of the president’s remarks.

President Donald Trump and Republicans are rolling out their plan to reform the tax system and enact cuts for certain individuals and businesses.

Publicly revealed Wednesday, the dramatic tax overhaul plan heralded as a “once in a generation” opportunity was months in the making, and Trump himself implored lawmakers to work on his plan and cut taxes for the middle class.

Trump campaigned on the promise of overhauling the tax code, and senior administration officials said this plan is largely similar to what Trump has called for.

Should the tax reform plan pass, it would be the first major overhaul of the system in decades. The plans framework is the product of the so-called Big Six: Treasury Secretary Steven Mnunchin House Ways and Means chair Kevin Brady, R-Texas Senate Finance chair Orrin Hatch, R-Utah House Speaker Paul Ryan, R-Wis. White House economic policy chief Gary Cohn and Senate Majority Leader Mitch McConnell, R-Ky.

Heres what to know about the plan:

Also Check: How Do I Write To Donald Trump

Student Loans And Tuition

The House bill would have repealed the deduction for student loan interest expenses and the exclusion from gross income and wages of qualified tuition reductions. The new law left these breaks intact and allowed 529 plans to be used to fund K to 12 private school tuitionup to $10,000 per year, per child. Under the SECURE Act of 2019, the benefits of 529 plans were expanded, allowing plan holders to also withdraw a maximum lifetime amount of $10,000 per beneficiary penalty-free to pay down qualified student debt.

The Republican Tax Law Boosted The Fortunes Of Americas Wealthiest While Increasing Insecurity For Us Manufacturing Workers

Blogging Our Great Divide

We gave you the greatest, biggest tax cut in history! crowed President Trump at a recent rally in Prescott, Arizona.

If that rally crowd had been packed with billionaires, they wouldve had good reason to applaud. But for ordinary working families, the 2017 Republican tax law is nothing to cheer about.

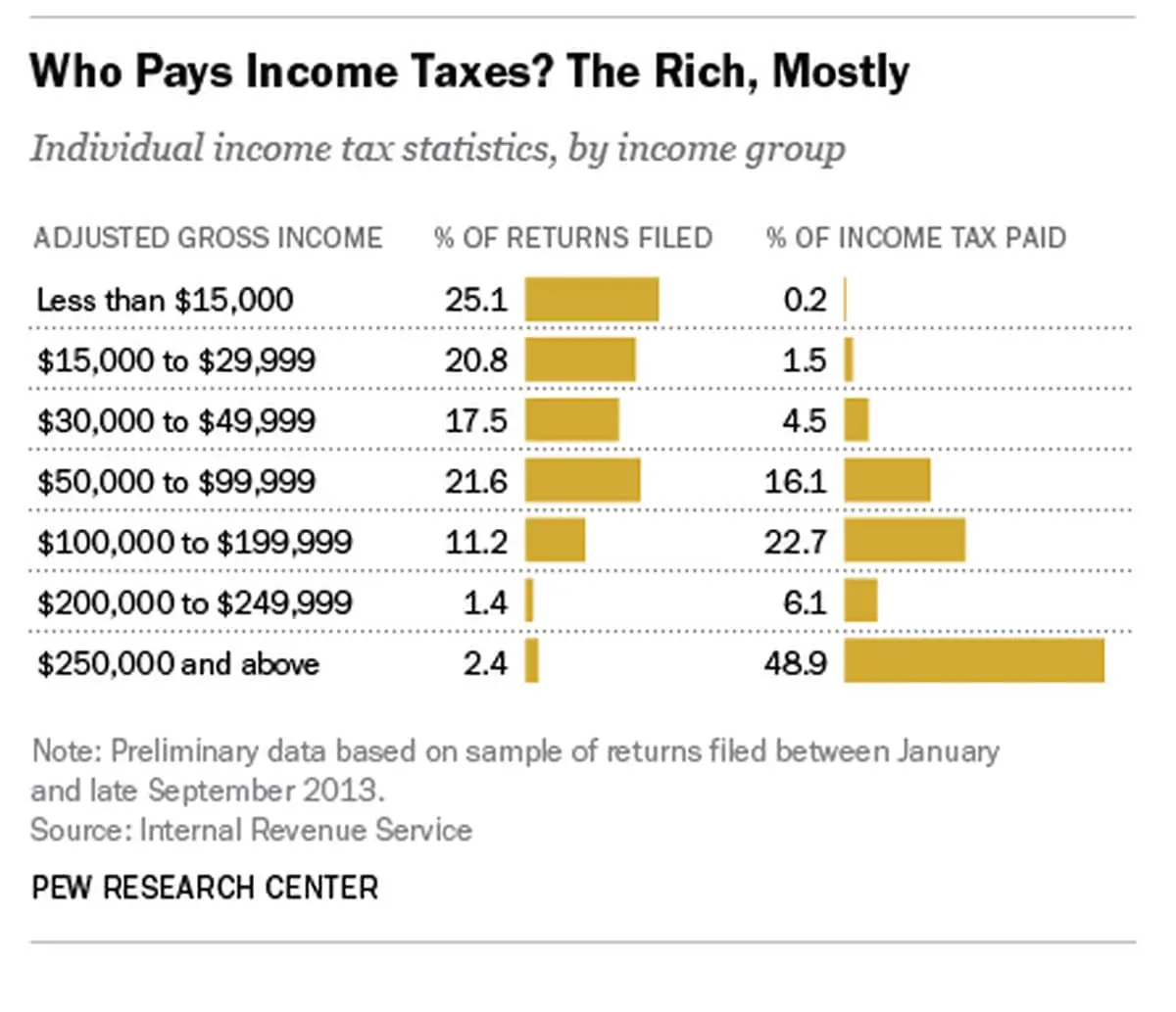

Trumps tax cuts for the rich are a major factor in the stunning growth in U.S. billionaires wealth even as millions of other Americans are suffering. The billionaire class enjoyed a 6.6 percent reduction in their top marginal income tax rate, leaving them with even more money to cash in on stock market gains spurred by the laws 40 percent cut in the corporate tax rate.

Americas wealthiest reap the vast bulk of Wall Street rewards not just because they have a vastly larger ownership share , but also because they can afford to hire investment managers with the technological advantages to run circles around Mom and Pop investors.

As of October 13, 2020, the combined fortunes of the nations 644 billionaires totaled a jaw-dropping $3.88 trillion up 40.7 percent since 2017, the year before the tax cuts went into effect.

Trumps perverse, job-killing corporate tax incentive is one cause of the dismal growth in U.S. manufacturing employment in 2018 and 2019, the first two years of the Republican tax law. The number of these traditionally high-paying jobs increased only 3 percent during this pre-pandemic period.

Topics

Also Check: Where To Write To President Trump

Did The Ctc Help Low

The CTC can only bring your tax liability how much income tax you owe for the year to $0. If the CTC brings your tax liability below $0, you can get the remaining part of it refunded to you through the additional child tax credit, or ACTC.

The ACTC was claimed more in 2018, overall, but taxpayers with an AGI of less than $25,000 claimed the ACTC 10.9% less. Taxpayers with AGI under $10,000 saw the biggest decline in ACTC filings, claiming it 19.4% less in 2018 than 2017. This drop in ACTC claims suggests that low-income Americans may not have gotten the full child tax credit they were entitled to, even though more families were eligible to claim the credit overall.

A Timeline Of The President’s Policies

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

Donald Trump promised to be the greatest job-producing president in U.S. history. During his 2016 campaign, he pledged to create 25 million jobs in the next 10 years. However, due to the COVID-19 pandemic, there were 3.1 million fewer jobs in December 2020 than in January 2017 when Trump took office.

If Donald Trump had been able to keep his campaign promise, he would have beaten the current record-holder, President Bill Clinton, who during his two terms.

To create those jobs, Trump told the Economic Club of New York he wanted to establish a national goal of 4% economic growth. Let’s look at the details of his policies and how they’ve worked during his term.

Also Check: How Many Manufacturing Jobs Has Trump Created