What Are The Policy Options For Dealing With The Debt

Politicians and policy experts have put forward countless plans over the years to balance the federal budget and reduce the debt. Most include a combination of deep spending cuts and tax increases to bend the debt curve.

Cut spending. Most comprehensive proposals to rein in the debt include major spending cuts, especially for growing entitlement programs, which are the main drivers of future spending increases. For instance, the 2010 Simpson-Bowles plan, a major bipartisan deficit-reduction plan that failed to win support in Congress, would have put debt on a downward path and reduced overall spending, including military spending. It also would have reduced Medicare and Medicaid payments and put Social Security on a sustainable footing by reducing some benefits and raising the retirement age. However, Biden plans to address gaps in the U.S. social safety net, which could increase demand for more long-term funding.

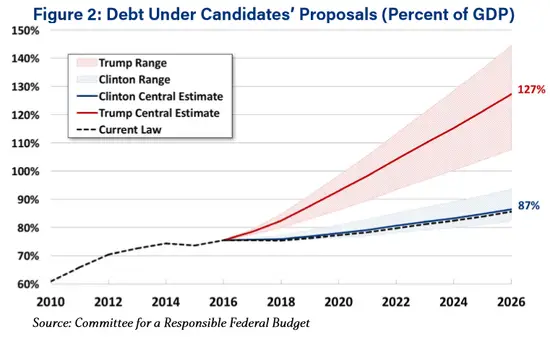

Some optimists believe that the federal government could continue expanding the debt many years into the future with few consequences, thanks to the deep reservoirs of trust the U.S. economy has accumulated in the eyes of investors. But many economists say this is simply too risky. The debt doesnt matter until it does, says Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget. By taking advantage of our privileged position in the global economy, we may well lose it.

Mandatory Spending Outstrips Investment In The Future

Mandatory and investment spending as a percentage of total U.S. government spending from 1970 to 2019. Mandatory spending includes programs such as Social Security and Medicare, while investment includes infrastructure, research and development, education and training.

Spending more and more on past promises and shrinking the proportion of spending for the future doesnt bode well for our kids and grandkids. Had Trump done what he said hed do and paid off part of the national debt before COVID-19 struck rather than adding significantly to the debt, the situation would be considerably less dire. And had Trump done a better job of coping with COVID-19, the economic and human costs wouldve been greatly reduced.

In addition to forcing us to reduce the proportion of the budget spent on the future to help pay for the past, theres a second reason that huge and growing budget deficits matter: interest costs.

Bigger debt ultimately means bigger interest costs, even in an era when the Federal Reserve has forced down Treasury rates to ultralow levels. The governments interest cost was around $523 billion in the 2020 fiscal year. That outstrips all spending on education, employment training, research and social services, Treasury data shows.

How Is The Covid

In response to the pandemic, the federal government has spent trillions of dollars to boost the economy, including on stimulus checks for citizens and aid for businesses and state and local governments. According to the Congressional Budget Office , these measures swelled the federal deficit to $3.1 trillion in 2020, about 15 percent of GDP and the highest level since World War II. Even before the pandemic, the CBO projected that annual deficits would breach the $1 trillion mark in 2020 and remain above that level indefinitely.

More on:

Debt held by the publicthe measure of how much the government owes to outside investorswas $16.9 trillion in 2019. That was more than double the amount in 2007, an increase to almost 80 percent of GDP from 35 percent. Before accounting for spending to combat COVID-19, publicly held U.S. debt was set to nearly double to more than $29 trillion over the next decade. Now, it is about $22 trillion, and its projected to be double the size of the economy by 2051.

You May Like: How Much Did Trump Cut From Cdc

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Why Is Raising The Debt Limit So Difficult

For many years, raising the debt ceiling was routine. But as the political environment has become more polarized, brinkmanship over the debt ceiling has increased. The House used to employ the Gephardt Rule, which required the debt limit to be raised when a budget resolution was passed, but that was for the most part phased out during the 1990s.

During the 2011 debt ceiling battle, some argued that President Barack Obama had the power to unilaterally lift the debt ceiling. Former President Bill Clinton said at the time that if he were still in office he would invoke the 14th Amendment, which says the validity of U.S. debt shall not be questioned, raise the debt ceiling on his own and force the courts to stop him.

Mr. Obama and his lawyers disagreed and opted against that approach. After leaving office, Mr. Obama acknowledged that he and Treasury officials considered several creative contingency plans, such as minting a $1 trillion coin to pay off some of the national debt. In a 2017 interview, he described the idea as wacky.

Read Also: What Is The Approval Rating Of Trump

The Claim: Trump Increased The National Debt By $83 Trillion In 4 Years

During his 2016 campaign, Trump ran on a promise to strengthen the country’s economy, which would in turn improve Americans’ quality of life. Trump’s promise to improve the economy included a pledge to eliminate the national debt within eight years.

The national debt doesn’t typically impact the day-to-day lives of most Americans unless it reaches a tipping point, which would slow the economy.

Under Trump’s first four years as president, the national debt has markedly increased, including significantspending by the federal government to combat the COVID-19 pandemic.

The Instagram page Occupy Democrats reposted a meme made by the Biden support group Ridin’ with Biden that states, “Hey Republicans do you still care about the national debt? Because Trump just increased it by $8.3 TRILLION in four years. Just sayin.”

USA TODAY has reached out to the page for comment.

Debt Ceiling Under Trump

The debt ceiling increased two times under President Donald Trump, but the Trump administration also tinkered with the budget and the debt ceiling in other ways throughout its four years. When Trump was sworn into office in January 2017, the national debt stood at $19.9 trillion. By November 2020, the debt had increased to over $27 trillion.

Under Trump the debt ceiling increased:

- by $1.7 trillion to $19.8 trillion in March 2017,

- by $2.2 trillion to $22 trillion in March 2019.

Trump suspended the debt ceiling in August 2019, through July 2021. At the time of the 2020 election, the national debt stood at over $27 trillion, the fastest rate of increase of the national debt of any modern president.

Recommended Reading: Why The Media Hates Trump

It Rose Almost $78 Trillion During His Time In The White House Approaching World War Ii Levels Relative To The Size Of The Economy This Time Around It Will Be Much Harder To Dig Ourselves Out

One of President Donald Trumps lesser-known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

The growth in the annual deficit under Trump ranks as the third-biggest increase, relative to the size of the economy, of any U.S. presidential administration, according to a calculation by Eugene Steuerle, co-founder of the Urban-Brookings Tax Policy Center. And unlike George W. Bush and Abraham Lincoln, who oversaw the larger relative increases in deficits, Trump did not launch two foreign conflicts or have to pay for a civil war.

Economists agree that we needed massive deficit spending during the coronavirus crisis to ward off an economic cataclysm, but federal finances under Trump had become dire before the pandemic. That happened even though the economy was booming and unemployment was at historically low levels. By the Trump administrations own description, the pre-pandemic national debt level was already a crisis and a grave threat.

Breaking Down Each President’s Debt Spending

The Treasury has tracked the daily accumulation of debt since January 1993, when President Bill Clinton was in the White House.

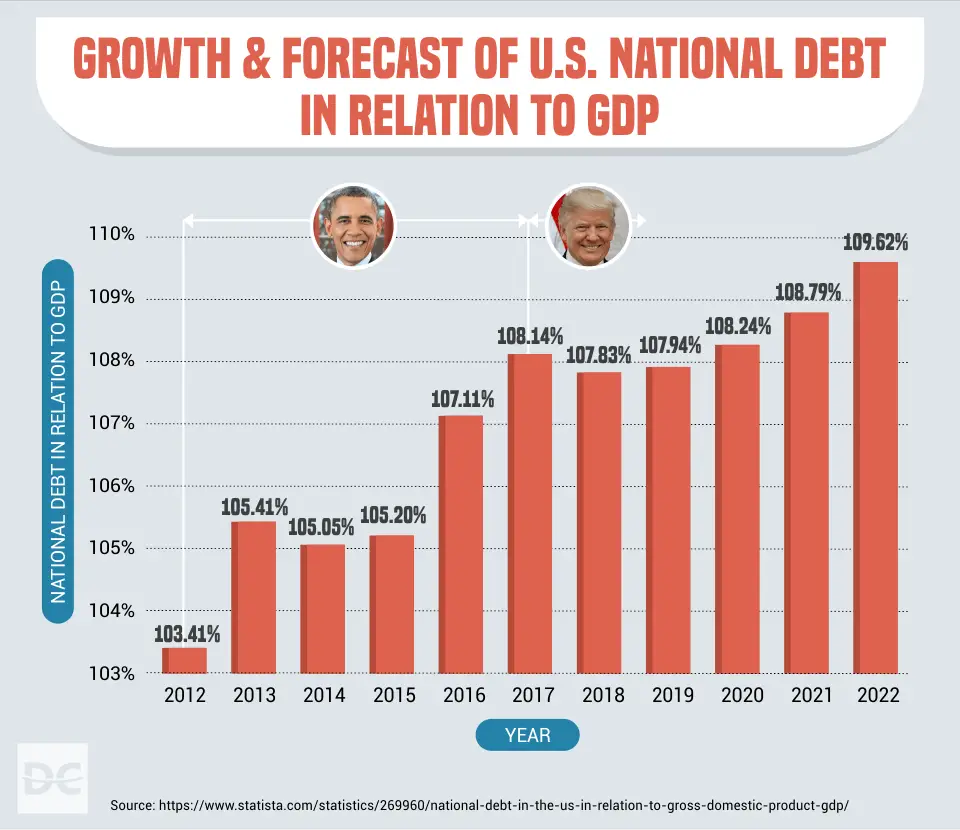

From January 20, 2017, to November 1, Trump piled $3.1 trillion onto the debt, amounting to a 16% increase. That’s significantly less than the $4.3 trillion President Barack Obama added from January 2009 to November 1, 2011, but far more than the $1.1 trillion Bush added in a similar period and the $794 billion Clinton did in 1,016 days as president.

There is a key distinction separating the circumstances behind Trump and Obama’s debt figures. Trump inherited an economy undergoing its longest sustained expansion. Obama, on the other hand, entered the White House as the nation veered into a recessionthat sparked massive stimulus spending and a bailout of the auto industry.

The accumulation in percentage terms adds another perspective:

- The federal debt increased by 19% through November 1 of Clinton’s first term in office and grew by 36% through fiscal 2000, the last of his presidency.

- For Bush, the debt grew by 20% through the same date and ended up swelling by 36% at the end of fiscal 2008.

- The debt surged by 41% in Obama’s first 1,012 days in office, ultimately ballooning by about 84% as fiscal 2016 drew to a close.

- Under Trump, the debt has grown by roughly 15% in three years so far, and the Congressional Budget Office projected that it could swell by 43% more by the end of fiscal 2024 at current spending levels.

You May Like: How Does Biden Poll Against Trump

The National Debt Has Increased By Almost 36% Since Trump Took Office

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

During the 2016 presidential campaign, Republican candidate Donald Trump promised he would eliminate the nations debt in eight years. Instead, his budget estimates showed that he would actually add at least $8.3 trillion, increasing the U.S. debt to $28.5 trillion by 2025. However, the national debt reached that figure much sooner. When President Trump took office in January 2017, the national debt stood at $19.9 trillion. In October 2020, the national debt reached a new high of $27 trillion. That’s an increase of almost 36% in less than four years.

The national debt reached a new high of $28 trillion less than two months after President Trump left office.

Our Ruling: Partly False

The claim in the post has been rated PARTLY FALSE. The post is correct in its sentiment that the national debt has significantly increased during President Donald Trump’s first term, but the figure of $8.3 trillion is incorrect. In Trump’s first term, the national debt has increased by roughly $7 trillion.

Recommended Reading: Did Trump Cut Taxes For The Middle Class

Us House Votes For Short

WASHINGTON, Oct 12 – The Democratic-controlled U.S. House of Representatives gave final approval on Tuesday to legislation temporarily raising the government’s borrowing limit to $28.9 trillion, pushing off the deadline for debt default only until December.

Democrats, who narrowly control the House, maintained party discipline to pass the hard-fought, $480 billion debt limit increase by 219-206. The vote was along party lines, with every yes from Democrats and every no from Republicans.

President Joe Biden is expected to sign the measure into law before Oct. 18, when the Treasury Department has estimated it would no longer be able to pay the nation’s debts without congressional action.

House passage warded off concerns that the United States – the world’s largest economy – would go into default for the first time, but the temporary extension set the stage for continued fighting between the parties.

“We have temporarily averted crisis ahead of next weeks deadline, but come December, members of Congress will need to choose to put country before party and prevent default,” said Democratic Representative Richard Neal, chairman of the House Ways and Means committee.

Republicans insist Democrats should take sole responsibility for raising the debt limit because their party wants to spend trillions of dollars to expand social programs and tackle climate change.

MORE PARTISAN FIGHTING AHEAD

Trump Racks Up $8 Trillion In National Debt Throughout Presidency

President Donald Trump added nearly $8 trillion to the U.S. national debt throughout his presidency, according to the Washington Examiner.

Before Trump took office in 2016, the federal debt stood at roughly $20 trillion, but it has ballooned over the past four years to nearly $28 trillion as of Monday, the Examiner reported, citing data from the Treasury Department. Former President Barack Obama, who served two terms in office, increased the nations debt by roughly $9 trillion over the course of eight years, according to the Examiner.

tenure has been marked by a total disregard for any concern about mounting debt, fellow at the American Enterprise Institute, a conservative think tank, Jim Capretta told the Examiner. Trump saw that it would be to his political advantage to be very liberal in terms of spending and tax reductions happening simultaneously.

The presidents first-year tax cuts increased the debt by roughly $1.9 trillion over 10 years, and Trump hiked annual spending from $3.85 trillion to $4.6 trillion in 2020 all of which came before coronavirus-related expenditures, the Examiner reported citing the Congressional Budget Office and the Committee for a Responsible Federal Budget. The Republicans coronavirus relief debt has so far totaled roughly $1.8 trillion, according to the Examiner.

A Peterson Foundation billboard displaying the national debt is pictured along Fleur Drive on December 18, 2019 in Des Moines, Iowa.

Also Check: How To Get In Touch With Trump