Make A Charitable Contribution

Last, but not least, you can consider donating your stimulus check to a cause you believe in. Aside from an already long list of federally recognized charities that would be thrilled to receive funding, there are federally recognized charities providing medical services and supplies, local organizational funding, community support, and education, tied directly to the COVID-19 pandemic.

The only question now is, what do you plan to do with your stimulus check?

The Motley Fool has a disclosure policy.

What If I Need To Change My Bank Account Information Since I Filed

The Get My Payment tool doesnt allow people to change their bank account information already on file with the IRS, in order to help protect against potential fraud, the IRS website says. The Get My Payment tool also does not allow people to update their direct deposit information once their Economic Impact Payment has been scheduled for delivery.

However, people who did not use direct deposit on their last tax return to receive a refund, or when their direct deposit information was inaccurate and resulted in a refund check, will be able to provide that information and speed their payment with a deposit into their bank account, the IRS website says.

If the bank account you used on your tax return has since been closed, the IRS says the bank will reject the deposit and you will be issued your payment to the address we have on file for you.

If you split your tax refund between multiple accounts, the IRS will send your stimulus payment to the first account you listed on Form 888. If your direct deposit is rejected, your payment will be mailed to the address we have on file for you, the IRS says.

If youve had to make an electronic payment to the IRS in the past which includes Direct Debit Installment Agreements the IRS will not use that account information to send your stimulus payment. Instead, the IRS says you must fill out your direct deposit information through the Get My Payment app or wait for your payment to come in the mail.

What If I Owe Child Support Payments Owe Back Taxes Or Student Loan Debt

If you are overdue on child support or owe back taxes or student loan debt, you could see your stimulus check reduced or eliminated based on the amount you owe. The Bureau of the Fiscal Service will send you a notice if this happens.

Your payment will not be interrupted if you owe back taxes or have student loan debt you will receive the full amount.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

Also Check: What Are Trump’s Economic Policies

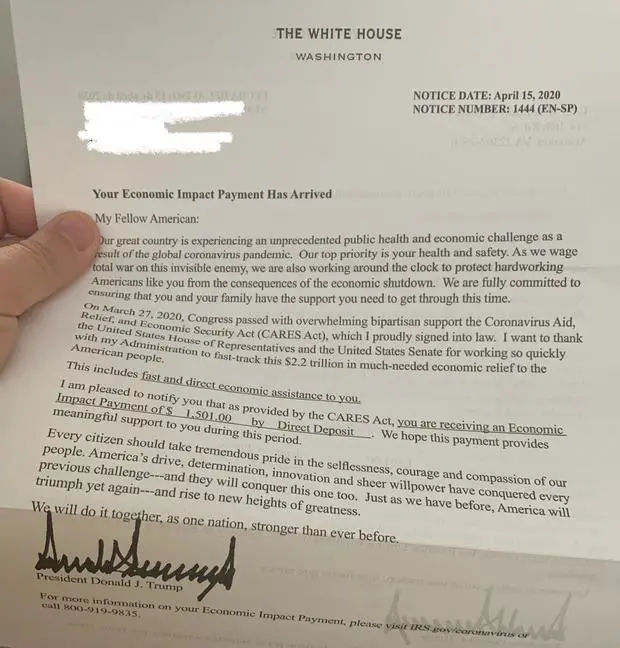

From The First Stimulus Check Via The Cares Act Through December’s Bill And The American Rescue Plan Whats The Difference Between What Biden And Trump Offer

On 14 January, Joe Biden released details of his American Rescue Plan, just weeks after Congress had passed the $900 billion emergency covid-19 relief bill in late December, breaking a nine-month long stalemate in negotiations between Republican and Democrat lawmakers.

The size of the new proposed package makes it the largest stimulus bill since the CARES Act was signed last March. Whether the plan will pass through Congress in its current form remains to be seen, with several Democrats objecting to anything below a $2,000 stimulus check and even moderate Republicans objecting to the principle of a third stimulus so soon after the second.

Susan Collins dismissed massive stimulus package. We just passed $900 billion worth of assistance why we would have a package that big now? Maybe a couple of months from now the needs will be evident and we will need to do something significant. But I’m not seeing it right now

Manu Raju

Retirement Plans And Retirement Accounts

- Waives the 10% tax penalty for early distributions from IRAs, 401 plans, 403 plans, and 457 plans if:

- The individual, their spouse, or their dependent has been diagnosed with COVID-19

- The individual experienced adverse financial consequences because they were quarantined, furloughed, or laid off, or because their employer reduced their working hours or

- The individual experienced adverse financial consequences because the individual is unable to work due to lack of child care.

- A plan administrator is allowed to rely on the participant’s assertion that one of these events occurred.

- Distributions are still subject to income taxes, although the individual may choose to spread the payment of the income taxes over three years, rather than paying them all in one year. Alternatively, if the distributed amount is repaid into any , see ) IRA or employer-sponsored retirement plan within three years of receiving the early distribution, no income taxes will be due.

Recommended Reading: How To Send Letter To President Trump

Are Stimulus Checks Repaid

An example of an advance tax refund is a stimulus. It was enacted into law to make up for the revenue that was lost during the lockdown. No loan is being made. The fact that the stimulus is tax-free is also notable. The stimulus you receive wont be subject to taxation. Only incomes and lottery wins are taxable.

A method of easing the financial strain brought on by Covid-19 is to offer stimulus checks. Although college students were not eligible for the schemes first and second rounds, they did qualify for the third round if they met the requirements as either dependents or independents.

For college students who support themselves, the stimulus provides an alternate source of funding because there is no payback and the money is not taxable. If the parent claims their college student as a dependent on their tax returns, they will also be eligible for the charge.

For tax refunds, checks are either mailed to the address listed on your IRS documentation or are deposited into your bank account. You might want to confirm your eligibility with the IRS.

Invest It In The Stock Market

If you have a healthy emergency fund, you might consider investing your Trump stimulus check directly into the stock market. Over the long run, the stock market has returned an average of 7% annually, inclusive of dividend reinvestment. This means the typical investor is going to double their money about once every decade. Plus, no asset class has consistently outperformed the stock market over the long run.

You May Like: How Much Does It Cost To Stay At Trump Hotel

Comedian Chugs Beer Thrown At Her By Pro

President Trump on Sunday signed a $2.3 trillion COVID-19 relief and government funding bill that includes $600 stimulus checks for most Americans, after refusing to accept the deal for days.

The nearly 5,600-page bill passed the House and Senate by overwhelming margins Monday night, just hours after its text was released.

Trump signed it several days after saying the legislation was a disgrace and calling on Congress to up the relief payments to $2,000 and scale back spending.

In a statement Sunday night, the president said he would ask for millions of dollars in spending to be removed from the bill.

I will sign the Omnibus and Covid package with a strong message that makes clear to Congress that wasteful items need to be removed, Trump said.

While the president insisted he would send Congress a redlined version with items to be removed under the rescission process, those are merely suggestions to Congress. The bill, as signed, would not necessarily be changed.

The bill authorizes direct checks of $600 for people earning up to $75,000 per year. The amount decreases for higher earners, and people who make over $95,000 get nothing.

Theres an additional $600-per-child stimulus payment.

In his statement, Trump said Congress on Monday would vote on a separate bill to increase payments to individuals from $600 to $2,000.

Therefore, a family of four would receive $5,200, the president said about the increase, which would require Republican approval.

What Does Trump Want For Checks

Trump posted a video to Twitter calling for the $600 per individual or $1,200 per couple to be increased to $2,000 and $4,000, respectively. He called on Congress to send him an amended bill, something Democrats immediately welcomed. In a rare Christmas Eve session of the House, Republicans blocked a move to increase the stimulus check size to $2,000.

The Democratic-led House supports the larger checks and voted overwhelmingly Monday to increase COVID-19 relief checks to $2,000, but Senate Majority Leader Mitch McConnell on Tuesday blocked Democrats’ push for bigger $2,000 COVID-19 relief checks. He said the chamber would begin a process to address the issue.

Also Check: Did Trump Donate His Salary

I Dont Typically File A Tax Return What Can I Do

If you dont usually file a tax return and are on Social Security, Railroad Retirement or Social Security Disability Insurance, you dont have to do anything. The IRS will use the information it has on file about you to calculate and send your payment. Those automatic payments should begin arriving next week, the IRS said on April 24.

Recipients of Supplemental Security Income as well as veterans and their beneficiaries who receive Compensation and Pension benefit payments from the Department of Veterans Affairs will also receive their payments automatically. The IRS said on April 24 that SSI and veterans benefit recipients should receive their automatic payments by mid-May.

If you made less than $12,200 in 2019, or $24,400 for married couples, and thus didnt have to file a federal income tax return, you can still receive a stimulus payment. Visit this IRS page:Non-Filers: Enter Payment Info Here and input your information. Youll have to provide your name, mailing address, email address, date of birth and valid Social Security number. Youll also have to provide the name and Social Security number for each of your dependents. And if you have them, prepare to provide your Identity Protection Personal Identification Number , a state issued ID and your bank account information. The IRS has a detailed guide on what to expect when you file. The tool is also available in Spanish.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: How To Send A Letter To Trump

How To Sign Up For Trump Bonus Checks

Wondering how to sign up for Trump Bonus Checks?

In this time of worry for many Americans people are wondering, How do I sign up for Trump Bonus Checks?.

Trump Bonus Checks is a directive claiming it can help you start receiving $1,000s per months in checks.

In this article Im going to share more info and answer commonly asked questions!

Before I start

If youre tired of scams and want a real solution for making money online check out my recommendation below.

Its helped me earn over $300k in the last 12 months alone:

In this review Ill be answering commonly asked questions such as:

Here is the table of contents for what we will cover:

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

You May Like: What Is Trump’s Popularity Right Now

What If My Stimulus Check Was Lost Stolen Or Destroyed

If your payment was direct deposited, first check with your bank, payment app, or debit card company to make sure they didnt receive it.

You can request a trace of your stimulus check to determine if your payment was cashed. Only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check.

How to start a payment trace: You can mail or fax Form 3911 to the IRS or call 800-829-1954. Click here for specific instructions on how to complete Form 3911 for tracking your first stimulus check.

If the IRS discovers that your check was not cashed, your check will be reversed. You can now claim the payment.

If the IRS discovers that your check was cashed, the Treasury Department will send you a claim package with instructions. Upon review of your claim, the Treasury Department will determine if the check can be reversed. If the check is reversed, you can now claim the payment.

If the check is not reversed, contact the tax preparer who filed your return. If you are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

It can take up to 6 weeks to receive a response from the IRS.

How Is My Second Stimulus Check Calculated

The IRS relies on your tax return to calculate whether you qualify for the second stimulus check. So your eligibility was based on your 2019 tax returns, which you filed by July 15, 2020.

According to the text released by Congressional leaders, the COVID-19 relief bill notes those with an adjusted gross income over certain limits receive a reduced amount of money, with the checks phasing out entirely at higher incomes.

Your AGI is calculated by subtracting the deductions that you made during the tax year from your gross income .

Heres a quick breakdown of the AGI limits for the $600 stimulus checks:

- Single filer checks begin to phase out at AGIs above $75,000.

- Head of household checks start getting phased out at incomes over $112,500.

The IRS reduces stimulus payments by 5% for the total amount that you made over the AGI limit. This means that for every $100 that you make over the limit, your check goes down by $5. At high enough incomes, the checks phase out entirely. So if you earned over $87,000 as an individual taxpayer, $174,000 as a joint filer, or $124,500 as a head of household, you do not get a stimulus payment. The following calculator allows you to calculate your benefit amount:

This second round of stimulus checks is currently half the maximum amount of the first stimulus checks that were included in the CARES Act in March.

Don’t Miss: What Did Trump Say About Romney

Your Stimulus Check May Not Happen

This is lower likelihood, but this last minute veto threat from the president could cause Congress and the White House to reach a stalemate. If the president will veto any legislation without a $2,000 stimulus check, and Congress is unwilling to approve a higher stimulus check, then you may not get a stimulus checkat least now. If Congress and the president dont agree on a revised stimulus package, then Congress could wait until the next congressional term to reconsider. Deferring stimulus checks again could mean a stimulus check next year , or no stimulus check at all. Its also worth noting how this latest development could impact the runoff elections in Georgia for the U.S. Senate. Voters are watching, and the outcome of the stimulus package saga could impact who wins the elections, and ultimately, power in Congress. This latest stimulus update could help Republican candidates in Georgia, if moderate Republican and independent voters are grateful to the president for fighting for more financial relief. That said, fiscal conservatives oppose further government spending, and likely wouldnt want want the Republican candidates to support a $2,000 stimulus check. Similarly, if Congress and the president cant agree on the size of the second stimulus check, then voters may not like the gridlock in Washington and resulting delayed financial relief.

The Senate Holds The Key To More Cash

Consumers whose finances have been crushed by COVID have been hungry for more cash from Washington. They largely used the first batch to cover basics including groceries and utility bills, a survey from the U.S. Bureau of Labor Statistics found.

Some also invested the money, the survey said, or used it to pay for various other needs. That may have included buying affordable life insurance, as sales have surged this year in the shadow of the pandemic.

The U.S. House voted 275-134 on Monday to increase the payments to $2,000. Forty-four Republicans joined the Democrats who control the House to pass the bill.

But the legislation is now stuck in the Republican-run Senate. Majority Leader Mitch McConnell has blocked quick approval of bigger checks and doesn’t seem inclined to bring the matter to a formal vote.

“The Senate is not going to be bullied into rushing out more borrowed money into the hands of Democrats’ rich friends who don’t need the help,” McConnell said Wednesday in a speech on the Senate floor.

Still, the president isn’t giving up. “2000 ASAP!” Trump tweeted on Wednesday.

Read Also: Is There A Republican Running Against Trump