Who Benefited From The Trump Tax Cuts

Various reports show that the TCJA lowered taxes for most Americans. However, analyses have also shown that the overall effects have largely benefited corporations and wealthy Americans more than middle-class and low-wage workers. The corporate tax cuts, in particular, failed to translate to the promised wage and economic growth.

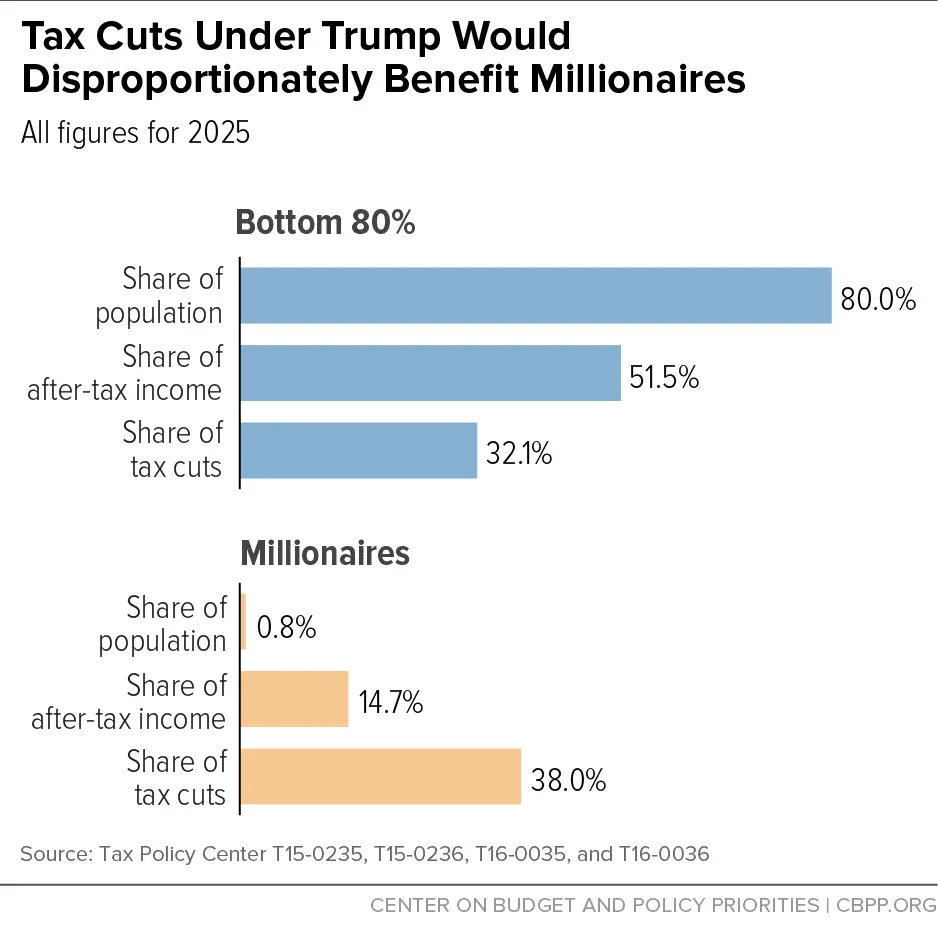

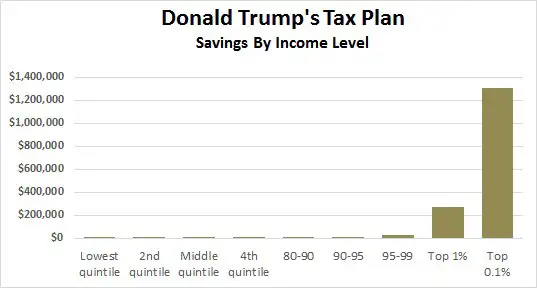

Rich People Gained More Than Poor People

About 66% of taxpayers saw their federal tax bill decline by more than $100 in 2018, the congressional Joint Committee on Taxation reported in March. And according to the tax preparation giant H& R Block, total liabilities are down by nearly 25%. But the magnitude of those reductions varies a lot according to how much money you make, and has hadthe overall effect of widening income inequality in America.

Heres one way of looking at it: As a result of both the business and personal income tax cuts, households making between $500,000 and $1 million will see their after-tax income rise by an average of 5.2%. Households making less than $50,000 see only a 0.6% increase.

In part, thats because of a provision that allows taxpayers that earn money through pass-through businesses to take a deduction equal to 20% of that income. Pass-through businesses include everything from architecture firms to part-time landlords incorporated as partnerships and limited liability companies.

The people who are benefiting the most, and the people who are benefiting the most through pass-throughs, are really rich people, said Jason Oh, a tax law professor at the University of California-Los Angeles.

The tax acts unequal distribution of benefits is now prompting calls for further changes to even the scales.

How The Trump Tax Plan Negatively Impacts Small Businesses

Although Trumps tax plan brings several new credits and increased deductions, the Tax Cuts and Jobs Act also removes some benefits and tax tools that small business owners used to take advantage of across all sectors.

With that in mind, itâs important to remember that each industry will be affected by changes to the Trump tax code differently. Some of these tax changes could impact your small business by increasing your tax burden. Here is a list of all the changes that could negatively impact your business.

Don’t Miss: How Many Lies Has Trump Told As President

Updates To Accounting Methods

The Donald Trump tax plan lets more companies take advantage of the cash method of accounting, rather than the accrual method. Using the cash method of accounting, revenue is recorded as soon as the cash is received from customers, and expenses are recorded as soon as theyâre paid to suppliers and employees. Thatâs different from the accrual method, in which revenue is recorded when itâs earned and expenses are only recorded when consumed.

The time difference is the important part. Under the accrual method, business owners could get stuck waiting until they sell inventory to deduct the cost of it, rather than being able to deduct it when they make the purchase.

Generally, manufacturing businesses are required to use the accrual method, but the new tax plan raises the annual revenue threshold from $5 million to $25 million, drastically increasing the number of businesses that can qualify for an exemption from that rule.

Thatâs a huge benefit for any manufacturing businesses and for any small businesses that deal with inventory. And hereâs why: Accrual accounting requires that income and expenses be booked when they are owed, rather than when they are paid or received. It can be costly to figure out the value of inventoryâespecially for small businesses who operate in volatile markets where pricing is always fluctuating.

A Change In Priorities

This increase in the federal debt means that formerly budget-conscious Republicans in Congress have done an about-face on fiscal policy.

For example, in 2011, Republicans supported the Budget Control Act, which automatically cut spending across the board between 2013 and 2021. These mandatory spending cuts were called “sequestration.”

In 2013, Republicans threatened to not raise the debt ceiling to force budget cuts. That would have forced the U.S. to default on its debt. Fortunately, better-than-expected revenue meant that the debt ceiling debate was postponed until the fall.

In these instances, congressional Republicans were focused on limiting debt and deficit growth at the expense of government functioning. However, with the TCJA, Congress passed a law that significantly increased both deficit spending and the federal debt.

Recommended Reading: Donald Trump 156 Iq

Tax Increases To Fund Infrastructure Program

Corporate tax proposals included in the American Jobs Plan, the administrations infrastructure proposal, advance tax policies promoted throughout Bidens presidential election campaign. The plans corporate tax policy goals include incentivizing job creation and investment in the U.S., stopping corporate profit-shifting to tax havens, and ensuring that large corporations pay their fair share of taxes.

The Biden administrations tax proposals would raise the corporate tax rate, impose new minimum taxes to prevent profitable U.S. businesses from escaping taxes through aggressive tax planning, repeal incentives for offshoring jobs, end preferences for the fossil-fuel industry, and strengthen corporate tax law enforcement by the IRS.

The corporate tax changes in the American Jobs Plan would raise tax revenue to help pay for the plans programs and investments in infrastructure, which range from transportation and roads to broadband, water resources, healthcare facilities, education, and more. The estimated $2.3 trillion cost of the American Jobs Plan, the scope of the investments proposed to be made over 10 years, and the tax increases intended to support it have generated substantial policy and political debate.

Coronavirus And Cares Act Impact On Deficit

The CBO forecast in April 2020 that the budget deficit in fiscal year 2020 would be $3.7 trillion , versus the January estimate of $1 trillion . The COVID-19 pandemic in the United States impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel. About 20 million persons filed for unemployment insurance in the four weeks ending April 11. It caused the number of unemployed persons to increase significantly, which is expected to reduce tax revenues while increasing automatic stabilizer spending for unemployment insurance and nutritional support. As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.

CBO provided a preliminary score for the CARES Act on April 16, 2020, estimating that it would increase federal deficits by about $1.8 trillion over the 2020â2030 period. The estimate includes:

- A $988 billion increase in mandatory outlays

- A $446 billion decrease in revenues and

- A $326 billion increase in discretionary outlays, stemming from emergency supplemental appropriations.

Read Also: Rsbn On Directv

Federal Corporate Income Tax Receipts

During the six months following enactment of the Trump tax cut, year-on-year corporate profits increased 6.4%, while corporate income tax receipts declined 45.2%. This was the sharpest semiannual decline since records began in 1948, with the sole exception of a 57.0% decline during the Great Recession when corporate profits fell 47.3%.

Federal corporate income tax receipts fell from about $297 billion in fiscal year 2017 to $205 billion in fiscal year 2018, nearly one-third. This revenue decline occurred despite a growing economy and corporate profits, which ordinarily would cause tax receipts to increase. Corporate tax receipts fell from 1.5% GDP in 2017 to 1.0% GDP in 2018. The pre-Great Recession historical average was 1.8% GDP.

Explaining The Trump Tax Reform Plan

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didn’t change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time.

But how did this happen? Let’s take a closer look at President Trump’s changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

You May Like: Was Melania A Prostitute

Big Changes To State And Local Tax Deductions

During initial talks, Republicans called for eliminating almost all itemized deductions, including state and local tax deductions, but keeping those for charitable deductions and mortgage interest. Ultimately, the TCJA capped SALT deductions to $10,000 .

Previously, taxpayers who itemized could deduct their state and local income, property and general sales tax payments on their federal tax returns. This was especially useful for residents of high-tax states like California and New Jersey.

Corporate Income Taxes Were Way Down In 2018

One of the biggest results of Trumps tax cuts was lowering the corporate income tax rate to 21% from 35%. This change appears to have benefited businesses greatly, because the corporate income tax payments collected by the IRS decreased by 22.4% from 2018 than 2017.

Looking just at year-over-year returns, businesses enjoyed an increase of 33.8% in tax refunds nationally from 2017 to 2018. The average business income refund varied by state, but businesses in some states appear to have received a major windfall. In Maryland, for example, businesses received total refunds worth 238.6% more .

The tax savings that businesses received from President Trumps tax plan could offset the benefits of the tax reform to workers. The lower corporate tax rate is also a permanent change to the U.S. tax code, but the lower tax rates for individuals are temporary and will expire in 2025. That means workers could receive a tax increase in five years even as businesses continue to pay a lower rate.

You May Like: Cost To Stay In Trump Towers

Could The Revenue Shortfalls Be A Temporary Result Of Sudden Policy Change

For those who might argue to wait and see what has happened in 2019, the findings from the studies cited above offer little hope. On average, these models estimated that economic growth effects will only offset about a quarter of the 10-year revenue loss associated with the TCJA. Excluding the Tax Foundation, which is an outlier in these estimates, drops the average offset to less than 20%.

What Are Some Specific Changes To Businesses

- The Arctic National Wildlife Refuge now has legalized oil drilling. However, that wont be profitable unless oil prices rise to at least $70 per barrel.

- Orphan drugs, which are designed to cure rare diseases, have seen their tax credit go down by half to 25%.

- Sin taxes on alcoholic drinks have been cut.

Read Also: Mary Fred Trump Kkk

Federal And Private Student Loans

Federal and private student loan debt discharged from death or disability will not be taxed from 2018 through 2025. This change will be a big help to unfortunate families. However, the law does not require private lenders to discharge the debt in the event of a death or disability.

Let’s say youre married and you have $30,000 in student loan debt. Under the old law, if you died or became permanently disabled and your lender discharged your debt, reducing it to zero, you or your estate would receive an income tax bill on that $30,000. If your marginal tax rate was 25%, your heirs or survivors would owe $7,500 in taxes. The TCJA tax reform eliminates that burden.

Distribution Of Benefits And Costs

The distribution of impact from the final version of the Act by individual income group varies significantly based on the assumptions involved and point in time measured. In general, businesses and upper income groups will mostly benefit regardless, while lower income groups will see the initial benefits fade over time or be adversely impacted. CBO reported on December 21, 2017, that: “Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.”

For example:

- During 2019, income groups earning under $20,000 would contribute to deficit reduction , mainly by receiving fewer subsidies due to the repeal of the individual mandate of the Affordable Care Act. Other groups would contribute to deficit increases , mainly due to tax cuts.

- During 2021, 2023, and 2025, income groups earning under $40,000 would contribute to deficit reduction, while income groups above $40,000 would contribute to deficit increases.

- During 2027, income groups earning under $75,000 would contribute to deficit reduction, while income groups above $75,000 would contribute to deficit increases.

The TPC also estimated the amount of the tax cut each group would receive, measured in 2017 dollars:

Read Also: Did Donald Trump Graduate From College

Are The Differences Between Projected And Actual Revenues Really Caused By The Tcja

These shortfalls cant be attributed to errors in the CBOs pre-TCJA forecast. To illustrate this, it makes sense to look at projected and actual payroll tax revenues, because the TCJA did not directly affect payroll taxes. In fact, payroll taxes fell only slightly1.7%from pre-TCJA projected values . This provides baseline credibility that reinforces the declines in other revenues.

Many More Families Could Lose Under Hidden Parts Of The Plan

The Trump one-pager was silent on a wide array of tax provisions that benefit middle-class and working families. But many of these provisions could be on the chopping block in tax reform. In fact, the White House has said that Any other deduction a person or business takes today is subject to potential elimination. And given that the specified tax cuts in Trumps plan dig at least a $3 trillion hole, Trump and Congress would have to eliminate many tax benefits for the middle class to make the plan come anywhere near adding up. During several months, Trump officials made the ludicrous claim that their tax cuts will pay for themselves through stronger economic growth. But no serious economist believes that, and the Trump administration has been widely criticized not only for relying on highly dubious economic forecasts in its budget, but for double counting the resulting revenue. Administration officials are now saying that they will partly or fully offset the cost of the proposed tax cuts by broadening the tax basethat is, by eliminating deductions, exclusions, and credits.

You May Like: Number Of Trump Lies To Date

How Did The Tax Brackets Change

The biggest changes under the new Trump tax plan came for those in the middle of the chart. A married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2017. For 2018, 2019 and beyond, their highest tax rate is just 24%. That led to a fairly significant difference in take-home pay.

Those who earn less may also see a bit of a break. A single person making $39,000 in taxable income in 2017 saw a rate of 25%. In 2018, 2019 and beyond, that rate dropped to 12%.

You also get a tax break if youre among the countrys highest earners. The highest tax bracket used to carry a 39.6% rate and apply to single people earning more than $418,401 and married couples filing jointly who earned more than $470,701 in taxable income. Now the highest rate, which is just 37%, applies to income over $539,900 for single people and $647,850 for joint filers.

Other notable Trump tax overhaul changes include:

Individual tax provisions are going to expire after 2025. So when you file in 2026, rates will go back to those before Trumps 2018 changes.