Tracking The Federal Deficit: March 2020

The Congressional Budget Office reported that the federal government generated a $117 billion deficit in March, the sixth month of fiscal year 2020. Marchs deficit is a $30 billion decrease from the $147 billion deficit recorded a year earlier in March 2019. Marchs deficit brings the total deficit so far this fiscal year to $741 billion, which is 7% higher than the same period last year. Total revenues so far in FY2020 increased by 6% , while spending increased by 7% , compared to the same period last year.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first six months of FY2020, federal reserve remittances increased by 22% because of lower short-term interest rates, which decreased the Federal Reserves interest expenses and increased its payments to the Treasury. As in previous months, the rise in spending was driven by increasing expenditures on the military , Social Security, Medicare, and Medicaid , and net interest on the public debt . Notably, the March 2020 report was not significantly impacted by the new coronavirus pandemic nor the federal governments emergency measures responding to it. CBO anticipates that those budgetary effects will be more noticeable in April.

President Trumps $4 Trillion Debt Increase

If the recent budget deal is signed into law, it will be the third major piece of deficit-financed legislation in President Trump’s term. In total, we estimate legislation signed by the President will have added $4.1 trillion to the debt between 2017 and 2029. Over a traditional ten-year budget window, the President will have added $3.4 to $3.8 trillion to the debt. The source of the debt expansion is split relatively evenly between tax and spending policy.

The Tax Cuts and Jobs Act was the single largest contributor to the $4.1 trillion figure, increasing debt by $1.8 trillion through 2029 . This number could easily climb higher if lawmakers extend the individual tax cuts that are set to expire after 2025, which would add another $1 trillion to the debt.

The Bipartisan Budget Act of 2018 was nearly as costly on an annual basis, adding nearly $450 billion to the debt due to its two-year nature. However, the Bipartisan Budget Act of 2019 would effectively make the increases in the BBA 2018 permanent, and in doing so, add another $1.7 trillion to the debt through 2029.

Smaller pieces of legislation are responsible for nearly $150 billion of debt. This includes several different bills containing disaster relief or emergency spending and continued delays of three Affordable Care Act taxes, among other bills.

Debt Added Since 2017 Over Different Periods

| Legislation |

|---|

Tracking The Federal Deficit: July 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $61 billion in July, the tenth month of fiscal year 2020. Although this Julys deficit was actually smaller than last Julys $120 billion deficit, the change does not represent an improved fiscal condition but a mere timing shift. The deadline for non-withheld individual and corporate income taxes, normally in April, was delayed until July of this year, causing an unusual spike in July revenue . Even this influx of taxes was overcome by monthly outlays that, at $624 billion, were 68% greater than last Julys. The cumulative budget deficit for FY2020 now stands at $2.8 trillion, more than triple the deficit at this point last year.

Analysis of notable trends: Stepping back from monthly fluctuations caused by the change in filing deadlines, total revenue so far this fiscal year is down 1% from this point last year. Revenues through this March had actually been 6% higher than through the same point last fiscal year, as higher individual and corporate earnings led to greater individual and corporate income tax receipts. Then the pandemic hit. From April through July, revenues are 10% lower than over same months last year, a combination of economic damage and legislation that gave individuals and corporations greater tax deductions.

Also Check: When Can You Vote For Trump

The Claim: Trump Increased The National Debt By $83 Trillion In 4 Years

During his 2016 campaign, Trump ran on a promise to strengthen the country’s economy, which would in turn improve Americans’ quality of life. Trump’s promise to improve the economy included a pledge to eliminate the national debt within eight years.

The national debt doesn’t typically impact the day-to-day lives of most Americans unless it reaches a tipping point, which would slow the economy.

Under Trump’s first four years as president, the national debt has markedly increased, including significant spending by the federal government to combat the COVID-19 pandemic.

The Instagram page Occupy Democrats reposted a meme made by the Biden support group Ridin’ with Biden that states, “Hey Republicans do you still care about the national debt? Because Trump just increased it by $8.3 TRILLION in four years. Just sayin.”

USA TODAY has reached out to the page for comment.

$8 Trillion In New Legislation And White House Policies

During President Trumps four years in office, he signed legislation that cumulatively added $7,787 billion to 10-year deficits. His policies reduced tax revenues by $2,098 billion, increased spending by $4,912 billion, and added $777 billion in interest costs.

The main components are listed in Figure 4, and summarized below:

Don’t Miss: Did Trump’s Tax Cuts Help The Middle Class

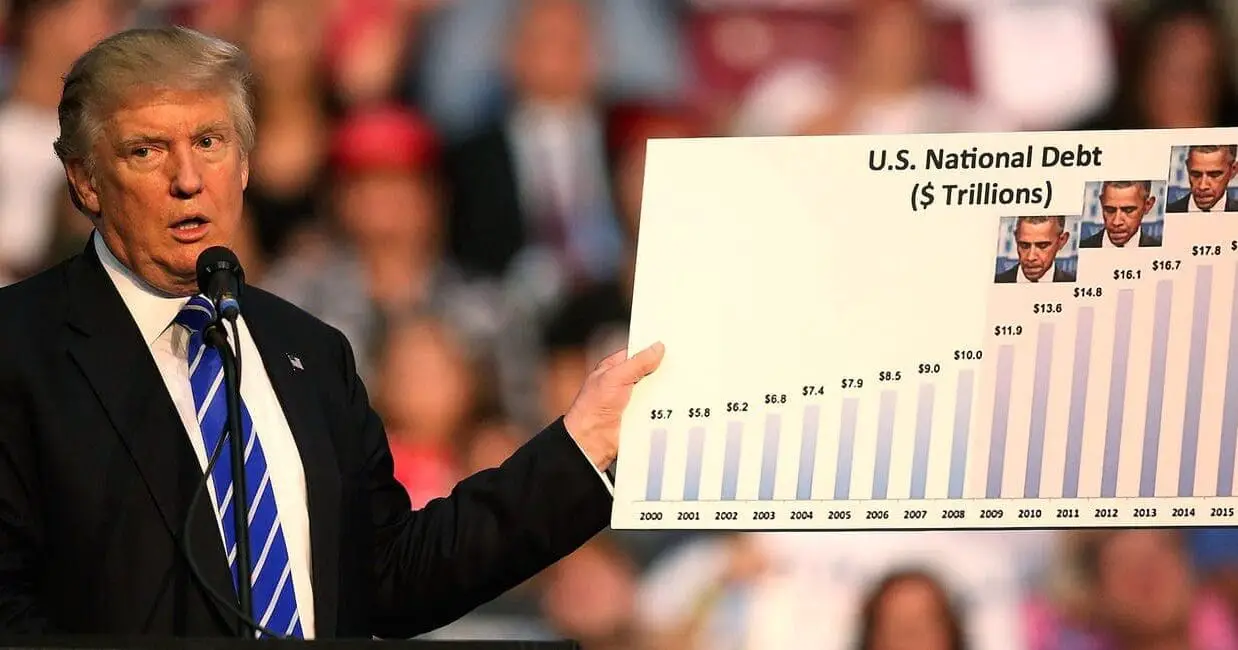

Which Presidents Contributed The Most To The Debt

For example, President Bushs stated budget deficits totaled $3.294 trillion. But he added $5.849 trillion to the debt. He borrowed the rest from Social Security in off-budget transactions. Having said that, the president with the highest deficits are still the presidents who contributed the most to the debt.

Tracking The Federal Deficit: October 2018

Analysis of Notable Trends in October 2018:The Congressional Budget Office reported that the federal government generated a $98 billion deficit in October, the first month of Fiscal Year 2019. Octobers deficit is 56 percent higher than the deficit recorded a year earlier in October 2017. Total revenues increased by 7 percent , while spending increased by 18 percent , compared to a year earlier.

Read Also: When Is The Next Trump Rally Schedule

Tracking The Federal Deficit: March 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $658 billion in March 2021, the sixth month of fiscal year 2021. This months deficitthe difference between $267 billion in revenue and $925 billion in spendingwas $487 billion greater than last Marchs . The federal deficit has now swelled to $1.7 trillion in fiscal year 2021, 129% higher than at this point last year. While revenues have grown 6% year-over-year, cumulative spending has surged 45% above last years pacelargely a result of the COVID-19 pandemic, its economic fallout, and the federal governments fiscal response.

Analysis of Notable Trends: Adjusted for timing shifts, outlays in March 2021 were $517 billion greater than last March, an increase of 127%. Unemployment insurance, refundable tax credits, and the Small Business Administrations Paycheck Protection Program accounted for most of the increaseboth from March to March and from last fiscal year to this one. Spending on refundable tax credits was $346 billion higher in March 2021 than March 2020, mostly due to the payment of pandemic recovery rebates authorized by the Consolidated Appropriations Act and American Rescue Plan Act..

Under Trump’s Administration America’s National Debt Has Increased By Nearly $7 Trillion

The U.S. national debt has ballooned under the administration of President Donald Trump, increasing by nearly $7 trillion in less than four years.

Trump took office in January 2017 after promising to eliminate the national debt during his presidency. When he took the presidential oath, the national debt stood at about $19.95 trillion. As of August of this year, the national debt was estimated to stand at about $26.73 trillionan increase of about $6.78 trillion during Trump’s tenure and a drastically different result from what the president promised.

While trillions of dollars have been added to the national debt over the past few months due to massive financial stimulus spending to address the economic fallout of the coronavirus pandemic, economists point out that the debt was already increasing significantly prior to the COVID-19 outbreak. Before the pandemic, the debt had increased to more than $23 trillion in January. This occurred despite strong economic growth during Trump’s first three years in office.

“Measured as a fraction of the economy, we have had deficits as large or larger in the past as in the first three years of the Trump administration. But those were generally in times of recession or crisis,” Hoyt Bleakley, a professor of economics at the University of Michigan, told Newsweek.

Don’t Miss: What Is The Approval Rating For Trump

Fact Check/did Federal Debt Fall Over President Trump’s First Month In Office

On February 25, President Donald Trump tweeted, “The media has not reported that the National Debt in my first month went down by $12 billion vs a $200 billion increase in Obama first .”

Did these changes in the national debt occur as President Trump claimed?

Yes. Total debt fell $11.988 billion over Trump’s first month in office and grew $211.811 billion over former President Obama’s first month. Total debt is approaching $20 trillion, and relatively small month-to-month fluctuations are common.

Tracking The Federal Deficit: April 2020

The Congressional Budget Office reported that the federal government generated a $737 billion deficit in April, the seventh month of fiscal year 2020. Aprils deficit is a $897 billion swing from the $160 billion surplus recorded a year earlier in April 2019. Aprils shortfall brings the total deficit so far this fiscal year to $1.48 trillion, which is 179% higher than the same period last year. Total revenues so far in FY2020 decreased by 10% , while spending increased by 29% , compared to the same period last year.

Don’t Miss: Where Are Future Trump Rallies

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

How Much Each Us President Has Contributed To The National Debt

Former U.S. presidents gather in the Oval Office.

- Print icon

- Resize icon

Donald Trump claimed on the campaign trail that, as president, he would completely eliminate the then$19 trillion in national debt. Lets just say hes not exactly on track.

Since he made that promise in early 2016, the debt has ballooned to $21.7 trillion, and his tax cuts are expected to drive that number higher.

But before you jump on the Trump-bashing bandwagon, it might be helpful to see how we got in this debt-riddled position.

Cost-estimating website HowMuch.net crunched numbers from the U.S. Treasury as well as various data points uncovered by the Balance to come up with this colorful, and very telling, history of Americas debt problem:

Of note, the visual lumps together all the presidents from 1780 to 1913 and uses inflation-adjusted dollars to make a fair comparison.

As you can see, Barack Obama takes the crown with almost $9 trillion added to the heap, though Trump may surpass that by the time hes done. Percentage-wise, however, Ronald Reagan gets the nod, considering U.S. debt nearly tripled during his terms.

Heres another look at how we got here from earlier in the year, when the debt first broke the $20 trillion barrier:

Its not all about the president, of course. He submits the budget, but fiscal policies are ultimately set by Congress. More important, outside factors like downturns and wars obviously make for uneven comparisons.

Don’t Miss: How To Get A Birthday Card From President Trump

Fiscal Year 2020 In Review

The federal government ran a deficit of $3.1 trillion in fiscal year 2020, more than triple the deficit for fiscal year 2019. This years deficit amounted to 15.2% of GDP, the greatest deficit as a share of the economy since 1945. FY2020 was the fifth year in a row that the deficit as a share of the economy grew. Revenues in FY2020 fell 1% from last year, while outlays surged 47%.

The FY2020 budget splits into two distinct halves: before and after COVID-19 and its economic fallout. In the first six months of the fiscal year , the deficit was running 8% above last years rate in the last six months , the deficit soared to eight times its level in those months last year.

Meanwhile, outlays in the first half of FY2020 grew 7% from last years rate. Then, from April through September, outlays almost doubled their level from those months last year, a $2 trillion increase. The character of spending increases also changed from the first to the second half of the year. From October through March, higher spending was driven by mandatory programsSocial Security, Medicare, and Medicaid. In the next six months, spending ballooned because of emergency responses to the pandemic and recession. Compared to the same months in FY2019, spending increased in April through September 2020 by:

It Rose Almost $78 Trillion During His Time In The White House Approaching World War Ii Levels Relative To The Size Of The Economy This Time Around It Will Be Much Harder To Dig Ourselves Out

One of President Donald Trumps lesser-known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

The growth in the annual deficit under Trump ranks as the third-biggest increase, relative to the size of the economy, of any U.S. presidential administration, according to a calculation by Eugene Steuerle, co-founder of the Urban-Brookings Tax Policy Center. And unlike George W. Bush and Abraham Lincoln, who oversaw the larger relative increases in deficits, Trump did not launch two foreign conflicts or have to pay for a civil war.

Economists agree that we needed massive deficit spending during the coronavirus crisis to ward off an economic cataclysm, but federal finances under Trump had become dire before the pandemic. That happened even though the economy was booming and unemployment was at historically low levels. By the Trump administrations own description, the pre-pandemic national debt level was already a crisis and a grave threat.

Also Check: How Can I Vote For Trump

Did Trump Fulfill His Campaign Promises To Cut The Debt

In July 2019, Trump suspended the debt ceiling until after the 2020 presidential election. 6 On Oct. 1, 2020, the debt hit a new record of $27 trillion. 3 Trump oversaw the fastest increase in the debt of any president, almost 36% from 2017 to 2020. Trump did not fulfill his campaign promise to cut the debt. Instead, he did the opposite.

Breaking Down Each President’s Debt Spending

The Treasury has tracked the daily accumulation of debt since January 1993, when President Bill Clinton was in the White House.

From January 20, 2017, to November 1, Trump piled $3.1 trillion onto the debt, amounting to a 16% increase. That’s significantly less than the $4.3 trillion President Barack Obama added from January 2009 to November 1, 2011, but far more than the $1.1 trillion Bush added in a similar period and the $794 billion Clinton did in 1,016 days as president.

There is a key distinction separating the circumstances behind Trump and Obama’s debt figures. Trump inherited an economy undergoing its longest sustained expansion. Obama, on the other hand, entered the White House as the nation veered into a recession that sparked massive stimulus spending and a bailout of the auto industry.

The accumulation in percentage terms adds another perspective:

- The federal debt increased by 19% through November 1 of Clinton’s first term in office and grew by 36% through fiscal 2000, the last of his presidency.

- For Bush, the debt grew by 20% through the same date and ended up swelling by 36% at the end of fiscal 2008.

- The debt surged by 41% in Obama’s first 1,012 days in office, ultimately ballooning by about 84% as fiscal 2016 drew to a close.

- Under Trump, the debt has grown by roughly 15% in three years so far, and the Congressional Budget Office projected that it could swell by 43% more by the end of fiscal 2024 at current spending levels.

Recommended Reading: How Many Times Did Donald Trump Go Bankrupt