Who Used The Qbi Deduction In 2018

Trumpâs tax reform created the qualified business income deduction . You donât need to itemize to take the QBI deduction and itâs available for taxpayers who have certain types of business income or who earned dividends from certain types of investments .

That means if you make money from certain types of investments, you can pay less on your income taxes thanks to the QBI deduction. Taxpayers across all income ranges did claim the deduction, but high-income taxpayers claimed the QBI deduction more frequently and received more on average.

Nationally, the average QBI deduction was $7,947 in 2018. Of tax returns with an AGI of less than $100,000, only 8.8% claimed the QBI deduction. The average value of their deduction was $2,134. Tax returns with AGI of $100,000 or more claimed the QBI deduction nearly one third of the time for an average deduction of $15,222. Moving up the income ladder, nearly half of all tax returns with AGI of at least $250,000 claimed the QBI deduction in 2018, and got an average deduction of $36,455.

Did Trumps Tax Cut Improve The Economy

One major reason that President Trump said he wanted to pass his tax plan was to improve the economy. He believed there would be more business investment, which would stimulate the economy and, in turn, help working Americans.

On the basis of the stock market and gross domestic product , the economy is in fact performing very well. But those trends already existed before the TCJA became law. The unemployment rate â 3.5% in February 2020 â has reached its lowest level in more than 50 years, but data from the U.S. Bureau of Labor Statistics shows that unemployment has been steadily declining since 2010. There isnât currently enough evidence to show that Trumpâs tax cuts lowered the unemployment rate more quickly. Preliminary data from the U.S. Bureau of Economic Analysis , released in February, also suggests that GDP has actually been slowing as of late.

Along with the U.S. bringing in less tax revenue since Trumpâs tax reform, the U.S. deficit has increased significantly. Data from the Federal Reserve Bank of St. Louis shows that the federal deficit grew 17% from 2017 to 2018 and 26% from 2018 to 2019. Federal debt passed $1 trillion in 2019 and the Congressional Budget Office expects the deficit to average $1.4 trillion from 2021 to 2030. Whether the size of the deficit should matter is an issue still being debated by economists, but itâs clear that Trump himself expected his tax cuts to not just lower the deficit but pay it off entirely.

Sign up now

The Effect On The Federal Deficit

Official estimates found that the TCJA would have been expected to add between $1 trillion and $2 trillion to the federal deficit before 2025. However, the COVID-19 pandemic and federal spending in response increased the federal deficit much more quickly. It’s now much more difficult to determine what the deficit would have been as a result solely of the TCJA. As of October 2020, the federal deficit was more than $3.1 trillion. In 2017, the deficit was $665 billion.

Read Also: Was Melania Trump A Prostitute

Biden Wants To Raise Taxes Yet Many Trump Tax Cuts Are Here To Stay

While Democrats have vowed to repeal the former presidents signature 2017 law, his successor is more likely to tinker with it, given constraints.

- Read in app

WASHINGTON Donald J. Trump has left the White House. But many of his signature tax cuts arent going anywhere.

Democrats have spent years promising to repeal the 2017 Tax Cuts and Jobs Act, which Republicans passed without a single Democratic vote and was estimated to cost nearly $2 trillion over a decade. President Biden said during a presidential debate in September that he was going to eliminate the Trump tax cuts.

Mr. Biden is now in the White House, and his party controls both chambers of Congress. Yet he and his aides are committing to only a partial rollback of the law, with their focus on provisions that help corporations and the very rich. Its a position that Mr. Biden held throughout the campaign, and that he clarified in the September debate by promising to only partly repeal a corporate rate cut.

In some cases, including tax cuts that help lower- and middle-class Americans, they are looking to make Mr. Trumps temporary tax cuts permanent.

Mr. Biden did not include any tax increases in the $1.9 trillion stimulus plan he proposed last week, which was meant to curb the pandemic and help people and companies endure the economic pain it has caused.

Did The Rich Get All Of Trumps Tax Cuts

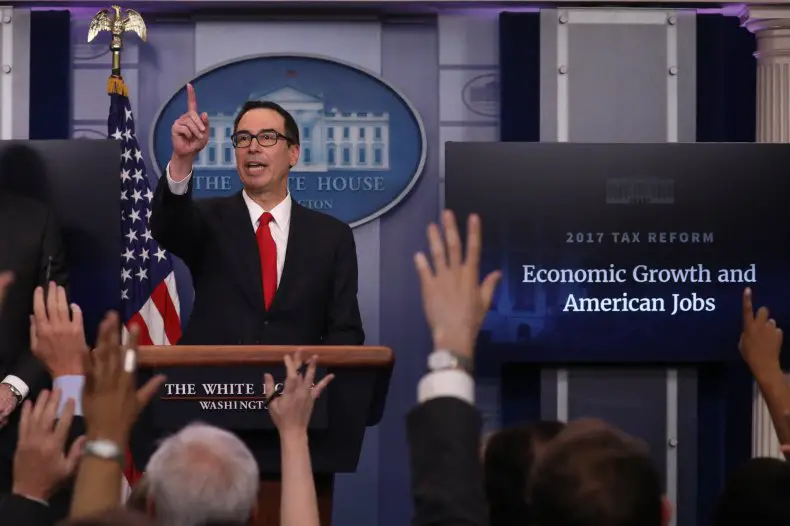

Whether the Tax Cuts and Jobs Act disproportionately helped the rich may be 2020s biggest political issue. Treasury Secretary Steve Mnuchin claims that it benefited most Americans. Senator Bernie Sanders it a massive giveaway to the rich.

Whos right?

Unfortunately, no one can tell from the TCJA studies done to date. Those studies, produced by government agencies and D.C. think tanks, do conventional fiscal analysis, which, truth be told, has four fatal flaws.

First, its static. It considers only taxes paid in the current year. But TCJA impacts, and differentially so, every households future taxes.

Second, conventional TCJA analysis classifies households as rich or poor based on current-year income. This means a billionaire investor who realizes no capital gains can be classified as poor even though shes rich.

Third, it lumps together the old and the young. But the young have higher incomes not because theyre richer but because theyre working.

Fourth, conventional analysis takes current-year, after-tax income as the measure of welfare. But consumption , both current and future, is what economics, as well as the public, ultimately care about.

Why are the outstanding economists working in Washington doing highly misleading tax analysis? The answers I get are, first, members of congress are their clients and are used to seeing the wrong numbers presented in the wrong way. Second, members of congress arent smart enough to process the right numbers.

Don’t Miss: What Is Donald Trump’s Credit Score

Tax Returns And Withholding

Tax filing season brings up many questions for taxpayers, such as, How big will my tax refund be? or, Will I have a balance due when I file taxes this year? Changes to withholding tables in the aftermath of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily translate to increased tax liabilities.

The chart below shows the aggregate amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped across all income groups over the same period. This pattern is similar to tax year 2018, when aggregate refunds also fell for most income groups.

A Tale Of Two Tax Policies: Trump Rewards Wealth Biden Rewards Work

During the 2016 campaign, President Donald Trump promised tax cuts that would create jobs and provide substantial savings for working families. What did he deliver?

For four years, Trump has relentlessly pursued an economic agenda that rewards wealth over work and favors multinational corporations over small businesses. After first trying to strip health care protections away from more than 100 million Americans with pre-existing conditions, President Trump spent the remainder of his first year in office fighting for a $1.5 trillion tax giveaway primarily for large corporations and the wealthy. His Republican allies in Congress even admitted they needed to pass the bill to satisfy their donors. Almost immediately after signing the bill into law, Trump flew to Mar-a-Lago to tell his clubs wealthy members, you all just got a lot richer.

But middle-class Americans were largely left out. Tax experts estimate that over the long run, 83% of Trumps tax giveaway will flow to the top 1% of earners in this country. And, while our country faces an unconscionable racial wealth gap, the average Black and Latino family received less than half the tax savings as the average white family. Trump even snuck in a hidden middle-class tax hike that will kick in after he leaves office to pay for this permanent corporate tax giveaway.

I. Trumps Tax Proposal In An Economic Crisis: A New Billionaire Tax Cut

Just a few examples of the harmful impact of Trumps corporate tax giveaway include:

Recommended Reading: Was Melania Trump A Prostitute

Other Changes To Corporate Taxes

The TCJA eliminates the corporate AMT. The corporate AMT had a 20% tax rate that kicked in if tax credits pushed a firm’s effective tax rate below 20%. Under the AMT, companies could not deduct research and development.

Trump’s tax plan incorporated elements of a territorial tax system in what was previously a “worldwide” taxation of companies operating abroad. Under the worldwide system, multinationals are taxed on foreign income earned.

They don’t pay the tax until they bring the profits home. As a result, many corporations leave their revenue parked overseas.

The adoption of elements of territorial taxation allows companies to repatriate the approximately $1 trillion they hold in foreign cash stockpiles. They pay a one-time tax rate of 15.5% on liquid assets and 8% on illiquid assets.

The Federal Reserve found that U.S. firms repatriated $777 billion in 2018 that’s 78% of offshore cash holdings. Instead of investing those funds, corporations increased buybacks of their stocks to improve share prices.

The TCJA also allows oil drilling in the Arctic National Wildlife Refuge. The drilling provision is estimated to add around $1.8 billion in revenue over 10 years.

Half of that goes to the state of Alaska. But drilling in the refuge won’t be profitable until oil prices are higher than 2020 levels because the cost to extract the oil is between $45 and $55 a barrel.

Trumps Tax Cuts Helped Billionaires Pay Less Than The Working Class For First Time

Economists calculate richest 400 families in US paid an average tax rate of 23% while the bottom half of households paid a rate of 24.2%

They were billed as a middle-class miracle but according to a new book Donald Trumps $1.5tn tax cuts have helped billionaires pay a lower rate than the working class for the first time in history.

In 2018 the richest 400 families in the US paid an average effective tax rate of 23% while the bottom half of American households paid a rate of 24.2%, University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman calculate in their new book, The Triumph of Injustice.

Taxes on the rich have been falling for decades. In 1960 the 400 richest families paid as much as 56% in taxes, by 1980 the rate had fallen to 40%. But Trumps tax cuts his most significant legislative victory proved a tipping point.

Thanks to the controversial tax package the top 0.1% of US households were granted a 2.5% tax cut that pushed their rate below that of the lower 50% of US earners.

This is a revolutionary change and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor, and as wages start going up at levels that you havent seen in many years, Trump said in September 2017 as he fought to pass the tax package.

You May Like: Contact The President Trump

Corporate Income Taxes Were Way Down In 2018

One of the biggest results of Trumpâs tax cuts was lowering the corporate income tax rate to 21% from 35%. This change appears to have benefited businesses greatly, because the corporate income tax payments collected by the IRS decreased by 22.4% from 2018 than 2017.

Looking just at year-over-year returns, businesses enjoyed an increase of 33.8% in tax refunds nationally from 2017 to 2018. The average business income refund varied by state, but businesses in some states appear to have received a major windfall. In Maryland, for example, businesses received total refunds worth 238.6% more .

The tax savings that businesses received from President Trumpâs tax plan could offset the benefits of the tax reform to workers. The lower corporate tax rate is also a permanent change to the U.S. tax code, but the lower tax rates for individuals are temporary and will expire in 2025. That means workers could receive a tax increase in five years even as businesses continue to pay a lower rate.

Impacts On The Economy

The tax plan makes the U.S. progressive income tax more regressive. Tax rates are lowered for everyone, but they are lowered the most for the highest-income taxpayers.

The increase in the standard deduction could benefit millions of taxpayers. But for many income brackets, that won’t offset lost deductions.

The Trump tax cuts could cost the government $1 trillion, according to the Joint Committee on Taxation . The $1 trillion figure is the result of the overall $1.5 trillion the TCJA would cost minus the roughly $456 billion it would create via an annual 0.7% growth in gross domestic product.

The Tax Foundation made a slightly different estimate. The tax cuts themselves would cost $1.47 billion but savings from eliminating the ACA mandate and GDP growth would offset that figure by $700 billion.

The plan would boost gross domestic product by 1.7% a year, create 339,000 jobs, and add 1.5% to wages.

The U.S. Treasury reported that the bill would bring in around $1.8 trillion in new revenue and projected economic growth of 2.9% a year, on average.

With the likely outcome of the tax cuts being increased debt, it’s important to understand how that debt affects the GDP. The World Bank estimates that for every percentage point that a nation’s debt-to-GDP ratio increases above 77%, that nation’s GDP will decrease by 1.7%.

The U.S. debt-to-GDP ratio was 104% before the TCJA took effect.

Read Also: Does Trump Donate To Charity

Growth And Budget Impacts

Treasury Secretary Steven Mnuchin claimed that the Republican tax plan would spur sufficient economic growth to pay for itself and more, saying of the “Unified Framework” released by Senate, House and Trump administration negotiators in Sept. 2017:

“On a static basis our plan will increase the deficit by a trillion and a half. Having said that, you have to look at the economic impact. There’s 500 billion that’s the difference between policy and baseline that takes it down to a trillion dollars, and there’s two trillion dollars of growth. So with our plan we actually pay down the deficit by a trillion dollars and we think that’s very fiscally responsible.”

The idea that cutting taxes boosts growth to the extent that government revenue actually increases is almost universally rejected by economists, and for a long time, the Treasury did not release the analysis Mnuchin bases his predictions on. The New York Times reported on Nov. 30, 2017, that a Treasury employee, speaking anonymously, said no such analysis exists, prompting a request from Sen. Elizabeth Warren that the Treasury’s inspector general investigate.

On Dec. 11, 2017, the Treasury released a one-page analysis claiming that the law will increase revenues by $1.8 trillion over 10 years, more than paying for itself, based on high growth projections:

- 2.5% real GDP growth in 2018

- 2.8% in 2019

- 3.0% for the following eight years