What Is Trumpcare And The Effects Of The Act

Every nation needs to consider and plan the healthcare sector deeply to provide necessary medical guidance under its realm or umbrella. Health care is a critical section or genre that requires proper care and attention. Each year almost every country spends millions of bucks in the healthcare segment for ensuring appropriate medical benefits to its citizens. Health tops the priority list of every country because without good human resource we cannot expect a nation to progress in its future endeavours. Healthcare industry is also a complicated event even conceded by the present President of United States Donald Trump. And to guide or to provide a proper shape and size to the healthcare segment of America President Trump has introduced a set of new health care reform or collection of new rules that are acceptable to the world as Trump Care.

Heres Whats In Trumps Healthcare Plan

CLEVELAND, OHIO SEPTEMBER 29: U.S. President Donald Trump participates in the first presidential debate against Democratic presidential nominee Joe Biden, moderated by Fox News anchor Chris Wallace at the Health Education Campus of Case Western Reserve University on September 29, 2020 in Cleveland, Ohio. This is the first of three planned debates between the two candidates in the lead up to the election on November 3.

At the first presidential debate on September 29, moderator Chris Wallace asked President Trump, What is the Trump healthcare plan?

In the weeks since, the presidents team hasnt exactly been forthcoming with details. But President Trump has hardly been inactive on health care during his term. In fact, his administration has taken a number of important but underappreciated steps to boost consumer choice and affordability in the healthcare marketplace.

Take the administrations 2018 rule expanding access to association health plans. Under these plans, groups of small businesses or self-employed workers can band together to enroll in large-group insurance coverage. In some instances, a large-group plan can offer savings of nearly 20% compared to a small-group plan with the same benefits.

Before the rule was promulgated, small businesses had to have a commonality of interest aside from providing health insurance in order to sponsor an association plan. They also had to have at least one employee, so self-employed workers couldnt join.

By Ann Saphir

Medicaid Expansion In Practice

As of December 2019, 37 states had adopted the Medicaid extension. Those states that expanded Medicaid had a 7.3% uninsured rate on average in the first quarter of 2016, while the others had a 14.1% uninsured rate, among adults aged 18 to 64. Following the Supreme Court ruling in 2012, which held that states would not lose Medicaid funding if they did not expand Medicaid under ACA, several states rejected the option. Over half the national uninsured population lived in those states.

The estimated that the cost of expansion was $6,366 per person for 2015, about 49 percent above previous estimates. An estimated 9 to 10 million people had gained Medicaid coverage, mostly low-income adults. The estimated in October 2015 that 3.1 million additional people were not covered because of states that rejected the Medicaid expansion.

In many states income thresholds were significantly below 133% of the poverty line. Many states did not make Medicaid available to childless adults at any income level. Because subsidies on exchange insurance plans were not available to those below the poverty line, such individuals had no new options. For example, in Kansas, where only non-disabled adults with children and with an income below 32% of the poverty line were eligible for Medicaid, those with incomes from 32% to 100% of the poverty level were ineligible for both Medicaid and federal subsidies to buy insurance. Absent children, non-disabled adults were not eligible for Medicaid there.

Also Check: Is Trump Leading In The Polls

What Is The Ahca

In the simplest of terms, the American Health Care Act is a U.S. Congress bill designed to repeal and replace the ACA created by the former President Obama Administration. However, it is not set to repeal each aspect of the ACA.

The AHCA aims steadily make critical changes to some of the features. To use some examples, it addresses how consumers purchase insurance, doing away with Medicaid expansion, etc. A copy of the proposed legislation for the American Health Care Act 2017 is available to read online for those interested in a comprehensive look at President Trumps first attempt at healthcare reform.

What Is Different About The American Health Care Act / Better Care Reconciliation Act And The Affordable Care Act

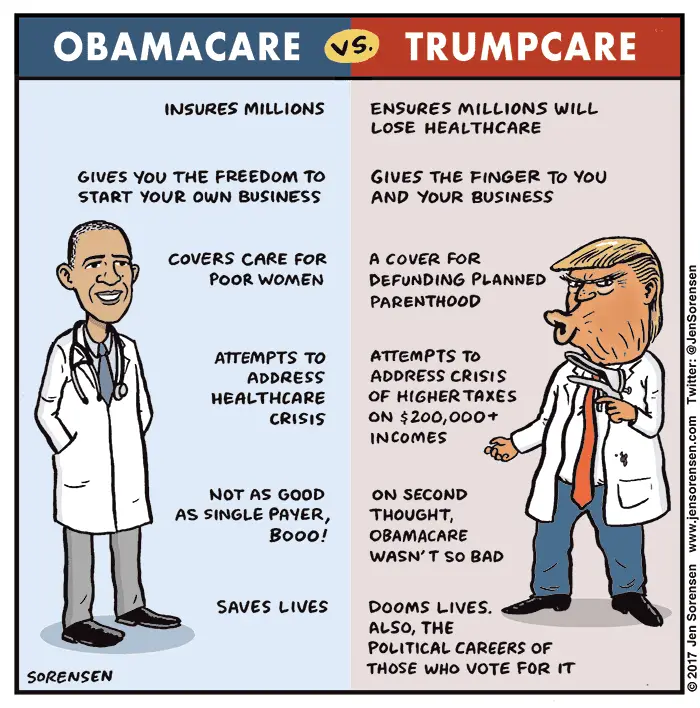

We explain the difference between ObamaCare and TrumpCare to show how TrumpCare and ObamaCare are different.

The goal of this page is to compare TrumpCare to ObamaCare in the form it was before Trump took office. To do that we will look at Trumpcare as it existed in July of 2017 when Congress and the administration were attempting to pass a repeal and replace plan and compare it to the Affordable Care Act as it existed before Trump took office and began making changes.

In other words, this page reflects all changes up to the July 13th, 2017 changes to the Better Care Reconciliation Act of 2017 , but does not include later changes like the executive order to repeal the individual mandate or the administrations backing of the court case that could declare the ACA illegal .

Recommended Reading: What Is Trump Going To Do With Medicare

An Overview Of Trumpcare

Above we covered what is happening, below is what Trump promised on his website.

The two are aligned, but none of the big promises he made like healthcare for everybody have been kept. We only got a way better plan. Perhaps it was meant as wordplay to insinuate supporting Ryans Better Way plan word-for-word with a few tweaks.

The bottom line here is we got a more centered plan. We got phase one of the plan on his site, not the one we heard about rhetorically in Trumps speeches.

With that in mind, the information below is still useful for understanding TrumpCare in its current iteration.

On his website, the TrumpCare plan listed is part a rehash of the Republican playbook, insurance across state lines, HSAs, get the sick out of the healthcare system to keep costs down, and part, an oddly socially liberal market-based healthcare reform and cracking down on big pharma.

The new The American Health Care Act is pretty much what Trump promised .

Despite some of the expected Republican views being included in his written plan, some parts of the plan and the words that Trump says paint a very different picture.

Below well look at what Trumps written position and past statements could mean for the future of healthcare reform, and how TrumpCare is different from ObamaCare. Make sure to see our review of The American Health Care Act for an idea of how it is the same and different than TrumpCare as written on DonaldJTrump.com.

Changes To Charitable Deduction Rules

The CARES Act provides a new above the line charitable contribution deduction of up to $300 to individuals who do not itemize their deductions. Thus, individuals who claim the standard deduction can still obtain the benefit of a deduction for qualifying charitable contributions. For individuals who do itemize their deductions, the CARES Act permits a charitable contribution deduction of up to 100 percent of their AGI.

Both the above the line deduction and the increased limitation require the contribution to be made during 2020, in cash, and to a public charity or foundation. Contributions made to a supporting organization or a donor-advised fund do not qualify for either the above the line deduction or the increased limits.

Read Also: What Trump Has Done For The Economy

Despite All These Positives There Are Certainly Some Disadvantages Of Obamacare As Listed Below

- Many Americans have higher insurance premiums than they once did.

- Many Americans have had to choose high deductible health insurance plans to afford their premiums.

- Americans who do not hold health insurance were fined.

- The United States needed higher tax revenue to pay for the ACA.

- Some have seen their Obamacare coverage canceled mid-year for no reason.

Return Of Skinny Insurance Plans

With the initial enactment of the ACA, health insurance policies had to have minimum levels of coverage. Pursuant to the ACA, short-term policies with less coverage could only be used to a consumer for three months.

The Trump Administration changed the availability of these skinny policies. A consumer can now have a skinny policy for 364 days. When that initial time period lapses, a consumer can renew a skinny policy for up to three more years.

The full repeal of the ACA proved impossible when Republicans controlled the White House and both Houses of Congress. When the GOP lost the House of Representatives in the 2018 election, no further meaningful discussion occurred on Capitol Hill regarding further changes to the ACA. Discussions and debate about further changes to ACA are not likely to occur until after the 2020 election. Moreover, the scope of such a post-2020 election will be governed significantly by which party controls the White House, the House of Representatives, and the Senate.

Ranking the Best Healthcare Management Degree Programs

Don’t Miss: Where Can I Get Trump 2020 Yard Signs

Businesses Connected To Politicians And Political Donors

Businesses owned by the president, senior government officials, and their immediate families are ineligible for funds distributed through the $500 billion Economic Stabilization Fund. A business falls into this category if it is at least 20% owned or controlled by a person in the restricted group. Such businesses may nonetheless still be eligible for funds distributed through the $669 billion Paycheck Protection Program or through the $15 billion change to the tax code.

Jared Kushner’s businesses may generally be eligible for relief under the Economic Stabilization Fund because, according to The New York Times, he usually owns less than 20% of his family’s real estate projects.

On April 21, the Trump Organization said it would not seek a Small Business Administration federal loan. ” rel=”nofollow”> federal building in Washington, D.C. Eric Trump said he hoped the General Services Administration would treat the Trump Organization “the same” as its other tenants.)

Clay Lacy Aviation, a California-based private jet charter company that serves business executives and celebrities, received a government grant of nearly $27 million that it does not have to repay. In 2016, the company’s founder, Clay Lacy, donated $47,000 to the Republican Party after it officially nominated Trump and also donated the maximum allowable $2,700 directly to the Trump campaign.

Student Grants Student Loans And Work

- Creates a 14-billion-dollar higher education emergency relief fund to provide cash grants to college students for costs such as course materials, technology, food, housing, and child care. Each college will determine which of its students receive cash grants. This was divided into three pieces: $12.5 billion in formula funds, at least half of which must be given directly to students, $1 billion for institutions serving minorities, and $350 million in supplemental funds for small institutions with unmet needs. Though the Department of Education issued guidance that international and undocumented students are ineligible for these funds, this was challenged in a lawsuit.

- Payments of student loan principal and interest of by an employer to either an employee or a lender is not taxable to the employee if paid between March 27, 2020, and December 31, 2020. The maximum amount that is tax-free is $5,250 per employee.

- For college students in a Federal Work-Study Program, allows a school to continue to pay a student if the student is unable to fulfill their work-study obligation due to the COVID-19 public health emergency.

- Gives students and colleges flexibility regarding the requirements for federal student financial aid during the COVID-19 pandemic.

- Suspends payments and accrual of interest on federal student loans through September 30, 2020. Suspends garnishments and tax refund interception related to federal student loans through September 30, 2020.

Also Check: What Is The Latest News On Trump

News Update For Dec 13 2016

ACA Repeal Set to Begin Early Next Year

- On Monday, December 12, Senate Majority Leader Mitch McConnell said that the Senate will begin voting to repeal the Affordable Care Act shortly after Jan 1. And then we will work expeditiously to come up with a better program than current law, because current law is simply unacceptable and not sustainable. However, McConnell did not give an answer on a timeline for a replacement.

- Although Republicans plan to repeal much of the ACA, they say they dont want to do any harm to the millions of people who get health coverage under the law. Health insurance consultants argue that repealing the healthcare law and expecting that insurance market remain healthy may be fantasy.

Millions With Preexisting Conditions Could be Denied Coverage

A study from the Kaiser Family Foundation found that 52 million non-elderly adult Americans with a preexisting condition would be at risk of being denied coverage if they were buying a health insurance policy in the individual market prior to the ACA. So without ACA protections for preexisting conditions, this group would likely be turned downed by insurance companies if a repeal happens. More details on people at the highest risk can be found in this Kaiser Health News article.

Maga In Medical Care: What Is Trumpcare

The MAGA movement has made it to medical care. While many supporters would have liked to have seen more changes in health care during President Trump’s first term, it’s clear that this historic president has already made huge changes to the U.S. medical system.Americans no longer have to pay not to have health insurance with the ending of Obamacare’s “individual mandate,” and government relief programs are reducing the cost of healthcare people all over the USA. Learn more about Trumpcare changes and how to make the most of the current administration’s health care policies.

Also Check: How To Write To Donald Trump

Executive Order On Protecting And Improving Medicare For Our Nations Seniors

The White House, October 3, 2019

Section 1. Purpose. The proposed Medicare for All Act of 2019, as introduced in the Senate would destroy our current Medicare program, which enables our Nations seniors and other vulnerable Americans to receive affordable, high-quality care from providers of their choice. Rather than upend Medicare as we know it, my Administration will protect and improve it.

Medicare for All would not only hurt Americas seniors, it would also eliminate health choices for all Americans. Instead of picking the health insurance that best meets their needs, Americans would generally be subject to a single, Government-run system. Private insurance for traditional health services, upon which millions of Americans depend, would be prohibited. States would be hindered from offering the types of insurance that work best for their citizens. The Secretary of Health and Human Services would have the authority to control and approve health expenditures such a system could create, among other problems, delays for patients in receiving needed care. To pay for this system, the Federal Government would compel Americans to pay more in taxes. No one neither seniors nor any American would have the same options to choose their health coverage as they do now.

Sec. 3. Providing More Plan Choices to Seniors.

ensure that, to the extent permitted by law, FFS Medicare is not advantaged or promoted over MA with respect to its administration.

Sec. 9.

Sec. 11.

Exclusion For Certain Employer Payments Of Student Loans

The CARES Act includes a provision allowing employers to provide a tax-free student loan repayment benefit to employees. The CARES Act allows an employer to contribute up to $5,250 annually toward an employees student loans, and this contribution is not included in the employees income. The annual limit applies to both the student loan payment as well as other educational assistance traditionally provided under an educational assistance program. It also disallows the employees deduction for interest paid on the student loan. This provision is effective for payments made after March 27, 2020 and before January 1, 2021.

Read Also: How Do I Call President Trump

Increase Consumer Insurance Protections

The ACA prohibits lifetime monetary caps on insurance coverage and limits the use of annual caps as well as establishes state rate reviews for insurance premium increases. It prohibits insurance plans from excluding coverage for children with preexisting conditions and canceling or rescinding coverage.

Healthcare Reform News Update For May 12 2017

Conservative Senators Begin Outlining Healthcare Reform Ideals

Conservative Republicans have several ideals for the healthcare bill they are currently drafting and negotiating with other members of the Senate:

- Change the AHCAs refundable tax credits to non-refundable tax credits

- Remove Medicaid expansion eligibility for able-bodied adults

- Repeal insurance regulations put in place by the ACA such as the requirement that plans dont charge higher premiums to people with pre-existing conditions or make states opt in.

Senate Assures Womens Involvement in Healthcare Reform

The Republican Senate has recently faced criticism pointing at the lack of women in the 13-member healthcare reform working group, despite the number of womens health issues at play. Senate Majority Leader Mitch McConnell has assured his colleagues, and the public, that women will not be excluded. According to a member of the GOP, The leader has assured us that at least one of the women will attend all of the meetings going forward.

McConnell extended invitations to three female colleagues for a Tuesday meeting of the working group, which Senator Shelley Moore Capito attended. A Thursday meeting was attended by Senator Joni Ernst. Additionally, McConnell has reportedly given an open invitation to any Republican Senator interested in attending the working groups meetings.

Senate May Revert to Income-Based Subsidies in Revised Healthcare Bill

Don’t Miss: What Candidate Can Beat Trump