Reviewing The Commitment To American Growth Act

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Bidens tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act and create or expand other tax provisions designed to boost domestic investment.

Provisions That Hurt Many Low

In addition to failing to address the economic challenges that low- and moderate-income people face, the 2017 tax law included provisions that will hurt many such households. For example, it:

Further, even before adding $1.9 trillion to deficits for tax cuts tilted to the top, the laws drafters made clear in their budget proposals and statements that their preferred way of addressing deficits would be to cut programs that help families of limited means afford health care, food, housing, and other basic needs. For example, those budgets have consistently featured large cuts in Medicaid, which provides health and nursing home care to millions of these families. Low- and moderate-income Americans should not now be left holding the tab for tax cuts tilted to the top, through cuts to, or underinvestment in, critical priorities. Instead, lawmakers can reverse course and raise substantially higher progressive revenues to meet national challenges.

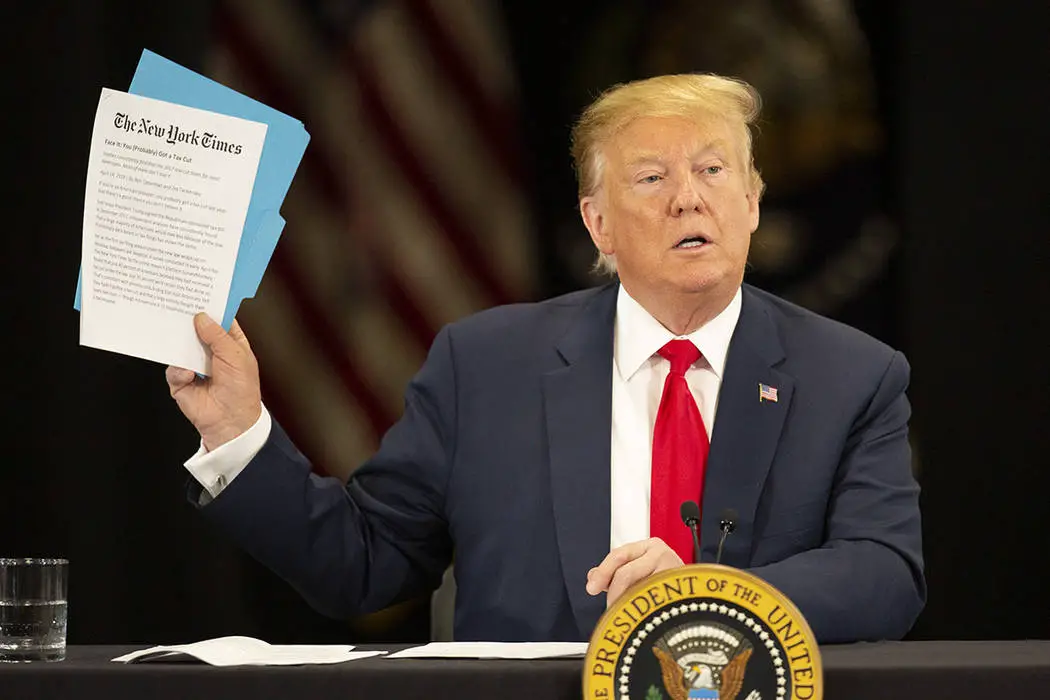

Did The Rich Get All Of Trump’s Tax Cuts

Whether the Tax Cuts and Jobs Act disproportionately helped the rich may be 2020s biggest political issue. Treasury Secretary Steve Mnuchin claims that it benefited most Americans. Senator Bernie Sanders it a massive giveaway to the rich.

Whos right?

Unfortunately, no one can tell from the TCJA studies done to date. Those studies, produced by government agencies and D.C. think tanks, do conventional fiscal analysis, which, truth be told, has four fatal flaws.

First, its static. It considers only taxes paid in the current year. But TCJA impacts, and differentially so, every households future taxes.

Second, conventional TCJA analysis classifies households as rich or poor based on current-year income. This means a billionaire investor who realizes no capital gains can be classified as poor even though shes rich.

Third, it lumps together the old and the young. But the young have higher incomes not because theyre richer but because theyre working.

Fourth, conventional analysis takes current-year, after-tax income as the measure of welfare. But consumption , both current and future, is what economics, as well as the public, ultimately care about.

Why are the outstanding economists working in Washington doing highly misleading tax analysis? The answers I get are, first, members of congress are their clients and are used to seeing the wrong numbers presented in the wrong way. Second, members of congress aren’t smart enough to process the right numbers.

Don’t Miss: What Are The Polls For Donald Trump

Differences Between The House And Senate Bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. For example:

In final changes prior to approval of the Senate bill on December 2, additional changes were made that were reconciled with the House bill in a conference committee, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

In the Senate, Republicans “eager for a major legislative achievement after the Affordable Care Act debacle … have generally been enthusiastic about the tax overhaul.”

A number of Republican senators who initially expressed trepidation over the bill, including Ron Johnson of Wisconsin, Susan Collins of Maine, and Steve Daines of Montana, ultimately voted for the Senate bill.

Where Did The $15 Trillion In Trump Tax Cuts Go

But according to a new report from the independent Congressional Research Service, they did no such thing.

Trump said the economy would grow at 4% to 4.5% after the tax cuts. Its grown at 2.9%, which is still pretty good, but nothing new, according to Joel Slemrod, an economics professor at the University of Michigan.

The economy has been doing well since the tax cut. It was doing well for several years before the tax cut, he said.

Most of us are paying a little bit less in taxes, but Howard Gleckman at the Tax Policy Center said the real winners are corporations they saw their tax rate cut almost in half. He said companies were all of a sudden sitting on piles of cash.

They looked around to see what they could do with it, whether they could make productive investments in workers or productive investments in new capital, new equipment, and they decided that they couldnt, he said. So what did they do with the money? They just gave it to the shareholders.

Not to their workers. The president said wages would grow substantially and quickly as a result of the tax cuts. But were not seeing that.

What we are seeing is companies buying their stock back from shareholders. So if you have stock in your portfolio, youre a little bit richer.

Anyone who has a substantial stock market investment portfolio has seen that portfolio probably having done better than it would have absent the legislation, said David Gamage, who teaches tax law at Indiana University.

Read Also: How To Vote For Trump

Dozens Of Large Profitable Firms Paid No Federal Income Tax In 2018 And Us Collections Fell By Almost A Third An Unprecedented Drop During A Strong Economy

6:00 AM on Jan 12, 2020 CST

Two years ago, President Donald Trumps tax cuts slashed corporate rates from 35% to 21%, and the big gift to business was one reason the tax law wasnt popular.

Heres another reason to complain: Many companies arent paying even the lower rate.

In 2018, the first year under the new law, 379 profitable companies in the Fortune 500 paid an average effective rate of 11.3%, according to a study by the Institute on Taxation and Economic Policy, a progressive think tank in Washington.

Thats the lowest rate since the institute began studying the issue in 1984. In its previous study, which tracked results from 2008 to 2015, large, profitable companies paid an average of 21.2% higher than in 2018 but far lower than the 35% maximum.

Tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect, Matthew Gardner, a senior fellow and co-author of the report, wrote last month. This means these companies sheltered almost half of their U.S. pretax income from federal income tax in 2018.

For 91 companies, nearly a quarter of those examined, their 2018 federal tax bill was zero or they got a tax rebate, the group said. The list includes heavyweights like Amazon, Chevron and Netflix. As a group, the 91 companies earned a combined $101 billion in pretax profits.

As an investor, I want to know why a company has low taxes, Lusch said.

Some Taxpayers Missed Personal Exemptions

In 2017, each taxpayer could also claim a personal exemption worth $4,050 for themselves and for each dependent. This exemption lowered their taxable income because, along with the $6,350 standard deduction, a single filer with no kids would effectively deduct $10,400. This isnt much lower than the new standard deduction and for certain taxpayers it wouldnt result in much tax savings.

Example: Lets say a single parent has two children and qualifies as a head of household. In 2018, this parent would have gotten a standard deduction of $18,000 and their taxable income would be lowered by that amount. This is up from the head of household standard deduction of $9,350 in 2017, the last year before the tax reform took effect.

But in 2017, this parent would have been able to claim not only the standard deduction of $9,350 but also three personal exemptions worth a total of $12,150 , allowing them to lower their taxable income by $21,500. The result of the Trump tax reform is that, for this household, the new standard deduction is worth less than the combined value of the standard deduction and personal exemptions in 2017. The change could leave this single parent owing more in taxes.

Also Check: What Did Trump Say Last Night

When Tax Cuts Don’t Work

Supporters of tax cuts believe in the theory of supply-side economics. This theory states that freeing up businesses to grow more will drive broader economic growth. When the government cuts taxes or regulations, companies will hire more workers. The resulting job growth creates more demand, which boosts the economy.

Supply-side economics is the opposite of Keynesian theory, which holds that consumer demand drives the economy. It supports more government spending on infrastructure, unemployment benefits, and education.

In general, tax cuts work when the economy is sluggish, businesses need money, and tax rates are high. For example, the Treasury Department found that the Bush tax cuts gave the economy a short-term boost, because the economy had been in a recession. The tax cuts gave businesses extra capacity that they could put to use immediately.

According to a 2017 survey, many large corporations said that they didnt need the money from the Trump administration’s tax cuts. They were sitting on a record $2.3 trillion in cash reserves, double the level in 2001.

Instead of using the money from tax cuts to increase production, create more jobs, or raise wages, the CEOs of Cisco, Pfizer, and Coca-Cola instead planned to use the additional cash to pay dividends to shareholders. The CEO of Amgen would use the proceeds to buy back shares of stock.

As a result, the corporate tax cuts in the TCJA would boost stock prices but wouldn’t create jobs.

How Tax Rates Work

Remember that the tax rates are marginal. The tax rate of your total income applies only to the income earned in that bracket. For instance, if youre single and your taxable income is $300,000 in 2021, only the income you earn past $207,351 will be taxed at the rate of 35% shown on the corresponding federal income tax chart above. The lower rates apply to income in the corresponding brackets.

This is important to consider when thinking about deductions and figuring out your taxable income. Just because your total income reaches a new tax bracket, doesnt mean all your money is taxed at that rate. In fact, it only applies to anything above the threshold for the new bracket.

You May Like: How Many People Voted For Trump In 2016

Who Used The Qbi Deduction In 2018

Trumps tax reform created the qualified business income deduction . You dont need to itemize to take the QBI deduction and its available for taxpayers who have certain types of business income or who earned dividends from certain types of investments .

That means if you make money from certain types of investments, you can pay less on your income taxes thanks to the QBI deduction. Taxpayers across all income ranges did claim the deduction, but high-income taxpayers claimed the QBI deduction more frequently and received more on average.

Nationally, the average QBI deduction was $7,947 in 2018. Of tax returns with an AGI of less than $100,000, only 8.8% claimed the QBI deduction. The average value of their deduction was $2,134. Tax returns with AGI of $100,000 or more claimed the QBI deduction nearly one third of the time for an average deduction of $15,222. Moving up the income ladder, nearly half of all tax returns with AGI of at least $250,000 claimed the QBI deduction in 2018, and got an average deduction of $36,455.

Winners: Families With Kids Under 17

The 2018 tax overhaul doubled the child tax credit to $2,000 per kid under age 17. Higher-income households are also able to claim this break.

Under the old law, the child tax credit began to phase out at $75,000 of adjusted gross income for single taxpayers .

Today, the phaseout of the child tax credit starts at $200,000 of AGI for singles or $400,000 for married couples.

Read Also: How To Work For Trump

Theres A Good Reason Biden Wants To Roll Back Only Part Of The 2017 Reduction In Corporate Taxes

Its a hard truth for many partisans to accept: Sometimes your political enemy manages to do a good thing. Maybe your enemy stumbles into it by accident or misleads voters to make it happen. But none of that means that they cant, on occasion, make what turns out to be a pretty smart and beneficial decision.

Sorry, Democrats, but President Trumps big corporate tax cut was just such a good thing. Thats why President Biden wants to keep lots of it.

Unlike with his $1.9 trillion COVID-19 relief bill, which is being financed by government borrowing, Biden wants to raise taxes to pay for some portion of his new proposal that would spend trillions on infrastructure, R& D, and Medicaid home services. Among the tax hikes being considered, Biden would raise the top corporate tax rate to 28 percent from 21 percent.

Yet that sizable increase would reverse only a portion of Trumps corporate tax reductions. In one of the key provisions of the Tax Cuts and Jobs Act, passed in December 2017, the top federal corporate income tax rate was lowered to 21 percent from 35 percent. In one fell swoop, the United States went from having the highest corporate tax rate among rich countries to one that was about average.

James Pethokoukis is the Dewitt Wallace Fellow at the American Enterprise Institute and a columnist for The Week. Follow him on Twitter .

Student Loans And Tuition

The House bill would have repealed the deduction for student loan interest expenses and the exclusion from gross income and wages of qualified tuition reductions. The new law left these breaks intact and allowed 529 plans to be used to fund K to 12 private school tuitionup to $10,000 per year, per child. Under the SECURE Act of 2019, the benefits of 529 plans were expanded, allowing plan holders to also withdraw a maximum lifetime amount of $10,000 per beneficiary penalty-free to pay down qualified student debt.

Also Check: Does Donald Trump Have Adhd

Lower Rates Higher Standard Deduction

The Tax Cuts and Jobs Act trimmed individual tax rates overall, lowering the top rate to 37% from 39.6%.

Corporations also saw their levies fall, as their income tax rates declined to 21% from 35%.

At the same time, the standard deduction for single filers went up to $12,000 in 2018 from $6,350 in 2017 .

The 2018 tax overhaul also curbed certain itemized deductions.

It also did away with personal exemptions, which once were $4,050 for yourself and each dependent in your household.

Due to the higher standard deduction, fewer people itemized on their returns.

More than 14.6 million individual income tax returns claimed itemized deductions, such as charitable giving write-offs and property taxes paid, during the 2018 tax year, according to IRS data through July 25, 2019 the most recent figures available.

In comparison, 42.2 million returns filed for the 2017 tax year used itemized deductions, according to IRS data through July 25, 2018.

Law Does Relatively Little For Low

I have just outlined the three fundamental flaws of the 2017 tax law. Let me now examine in more detail how the 2017 tax largely leaves behind low- and moderate-income Americans and indeed hurts many.

The 2017 tax law should have placed top priority on raising the living standards of low- and moderate-income households, given decades of stagnant working-class incomes and growing income inequality. The share of after-tax income flowing to the bottom 60 percent fell by 3.8 percentage points between 1979 and 2015, while the share flowing to the top 1 percent rose by 5.6 percentage points. And looking at the working class a racially and geographically diverse group often defined as families with working-age adults in which no one has a college degree real working-class median income rose by only about 3 percent from 1979 to 2015.

Don’t Miss: Did Trump Sign The Bill

Impact Of Tcja Cuts Becoming Permanent

Congress could choose to make the individual cuts permanent before they expire. If that happens, the cost of the tax cuts would rise to $2.3 trillion instead of $1.5 trillion over the next 10 years.

A separate analysis found that while the TCJA would result in increased economic growth, all of the revenue from this growth would go toward paying for the cuts. The cost is too high for the tax cuts to pay for themselves. Instead, the deficit and debt would continue to grow.

Who Benefited From The Trump Tax Cuts

Various reports show that the TCJA lowered taxes for most Americans. However, analyses have also shown that the overall effects have largely benefited corporations and wealthy Americans more than middle-class and low-wage workers. The corporate tax cuts, in particular, failed to translate to the promised wage and economic growth.

Don’t Miss: Did Judge Judy Vote For Trump

How Did The Tax Brackets Change

The biggest changes under the new Trump tax plan came for those in the middle of the chart. A married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2017. For 2018, 2019 and beyond, their highest tax rate is just 24%. That led to a fairly significant difference in take-home pay.

Those who earn less may also see a bit of a break. A single person making $39,000 in taxable income in 2017 saw a rate of 25%. In 2018, 2019 and beyond, that rate dropped to 12%.

You also get a tax break if youre among the countrys highest earners. The highest tax bracket used to carry a 39.6% rate and apply to single people earning more than $418,401 and married couples filing jointly who earned more than $470,701 in taxable income. Now the highest rate, which is just 37%, applies to income over $539,900 for single people and $647,850 for joint filers.

Other notable Trump tax overhaul changes include:

Individual tax provisions are going to expire after 2025. So when you file in 2026, rates will go back to those before Trumps 2018 changes.