Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

How The Budget Process Works

When discussing presidents and budget deficits, it’s essential to keep some things in mind. First, Congress must approve all spending while a president proposes an annual budget. The president’s power over the budget is never absolute. It can be severely limited if the opposition party holds a majority in either the House of Representatives or the Senate or if they hold the majority in both.

Another thing to know is that “discretionary” spending accounts for only about one-third of the typical U.S. budget. The majority is “mandatory” spending that is dictated by law. The most significant sources of mandatory spending are Medicare and Social Security.

In addition, the federal fiscal year runs from Oct. 1 to Sept. 30. This means that during a new president’s first year in office, the budget that is in place was passed during their predecessor’s term. However, incoming administrations can request additional spending upon taking office.

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

Also Check: How Often Does Trump Lie

How Much Has The National Debt Increased Under President Trump

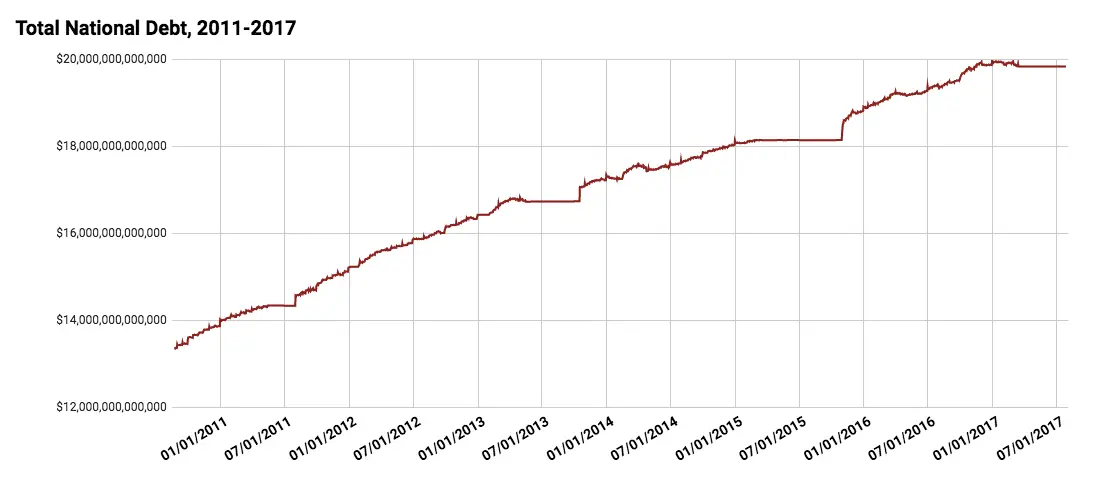

When Trump was inaugurated on January 20, 2017, the national debt stood at about $19.9 trillion. As he leaves office this month, the national debt has grown to about $27.7 trillion. Thats an increase of 39.2 percent.

In September 2017, Trump signed a bill that raised the debt ceiling. On that same day, the national debt reached $20 trillion for the first time in the countrys history. According to Treasury Direct which reports the national debt data at the end of each month in February 2019, the national debt was $22 trillion.

Content

Tracking The Federal Deficit: November 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $146 billion in November, the second month of fiscal year 2021. This deficit was the difference between $365 billion of spending and $219 billion of revenue. Spending in November, however, was artificially lowered by the fact that November 1 fell on a weekend, causing $63 billion worth of payments that would normally be made in November to be made in October instead. If those payments had been made in November as usual, this months spending and deficit would each have been $63 billion greater, or $428 billion and $209 billion . In the first two months of this fiscal year, the federal government has run a deficit of $430 billion, $87 billion more than at this point last fiscal year. Compared to this point last fiscal year, spending has run 9% higher while revenues have fallen by 3%.

Revenues also fell by 3% from last November, mostly reflecting a drop in withheld individual income and payroll taxes due to lower levels of employment.

Also Check: How Much Has Trump Added To The National Debt

How The National Debt Has Changed Under Trump

The national debt over the nationâs history has grown from a modest $83.7 million under George Washington to a whopping $23.3 trillion today.

But the debt has had some significant spikes for some very important reasons, and there was a brief period of time, one year to be exact, where the debt was entirely paid off.

In 1835, Andrew Jackson paid off the national debt through severe cost-cutting and land sell-offs. Jacksonâs distrust of banks led him to redistribute funds to the states, which in turn caused an economic bubble, which led to recession. Restarting the national debt to reinvigorate the economy was inevitable.

World War I led to the debt increasing by more than $21 billion to a total of $24 billion. Two decades later, Franklin Delano Roosevelt would see the national debt rise from $22 billion to over $205 billion dollars, largely due to World War II. The Wars in Iraq and Afghanistan added $2.1 trillion to the debt just in George W. Bushâs administration alone. US Debt by President: By Dollar and Percentage Both Bush and Obama had massive stimulus packages to fight the 2008 recession that each added hundreds of billions to the national debt.

How Much Will Trump Add To The National Debt During His Presidency

If the budget deal eventually makes it to Trumps desk and gets his signature, the 45th president will have personally added $4.1 trillion to the national debt in a little over two years in office, according to a new analysis from the Committee for a Responsible Federal Budget, which advocates for balanced budgets.

Debt Increase by President for Every Fiscal Year Since 1914 1 FY 2020 $4.226 trillion 2 FY 2019 $1.563 trillion 3 FY 2018 $1.272 trillion 10

Using Treasury Directs data, from the time Trump took office in January 2017 through September of this year, the national debt rose from $19.9 trillion to $26.9 trillion, which is an increase of $7 trillion in Trumps first term. The claim in the post has been rated PARTLY FALSE.

Read Also: Is There A Trump Rally Tonight

Return To Record Deficits

When he took office in 2001, President George W. Bush cited the Clinton surplus as evidence that taxes were too high. He pushed through significant tax cuts and oversaw an increase in spending, and the combination again drove the U.S. budget into the red.

The deficit reached a record $458 billion in 2008, Bush’s last year in office, and would triple the following year as the Bush and Obama administrations faced the Global Financial Crisis.

How Much Will The National Debt Be Worth In 2051

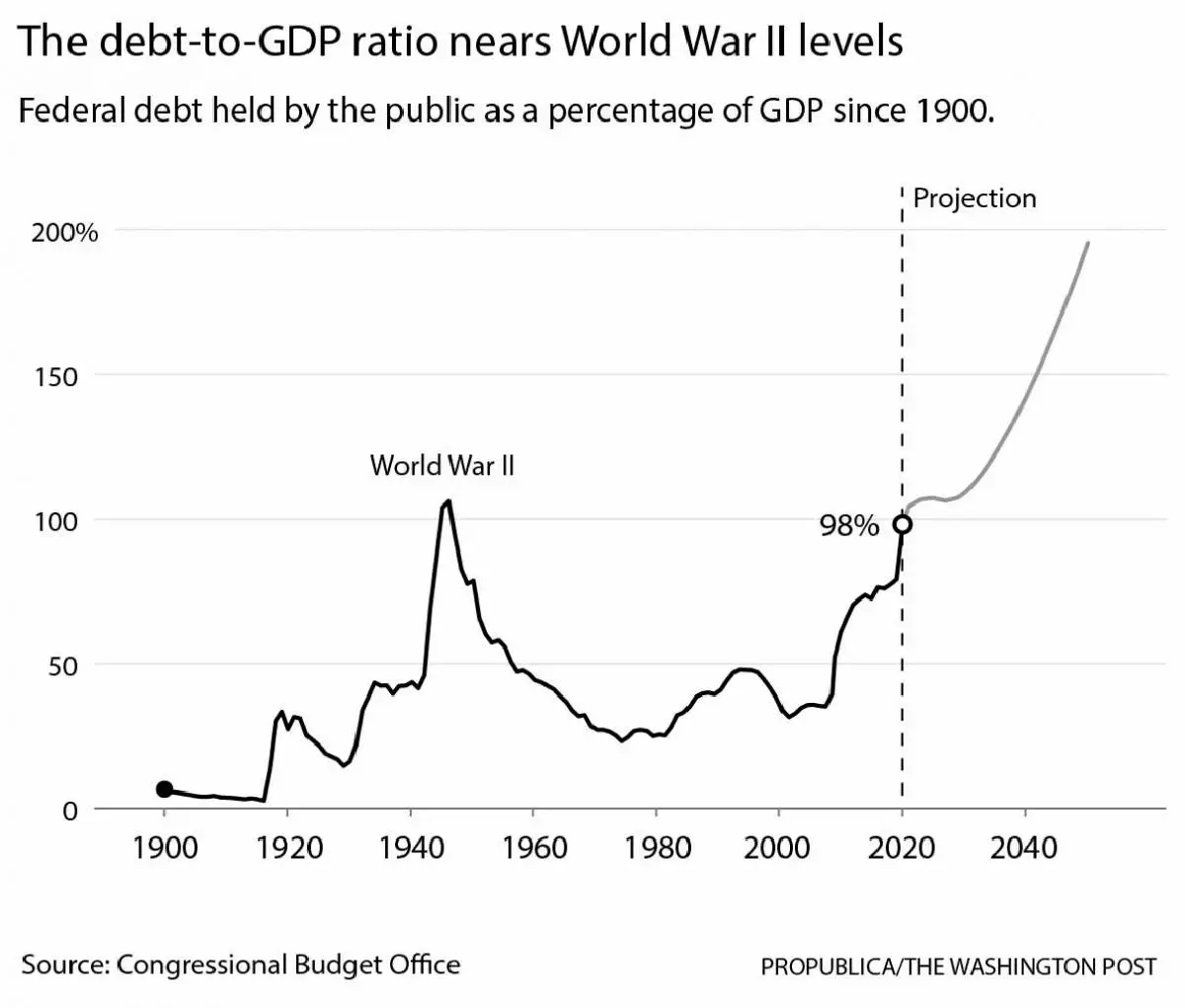

Over the next three decades, net interest payments on the debt are projected to hit new records totaling more than $60 trillion and, by 2051, taking up nearly half of all federal revenues and measuring nearly 9% of the gross domestic product, economists warn.

You would rather have no debt, of course, Mr. Rogoff said of the $30 trillion total. But compared to other issues at the moment thats not the principal problem.

With no fanfare and little notice, the national debt has grown by more than $4 trillion during George W. Bushs presidency. Its the biggest increase under any president in U.S history. On the day President Bush took office, the national debt stood at $5.727 trillion.

You May Like: Is Donald Trump The Worst President Ever

What Is The National Debt Of China

The national debt of the Peoples Republic of China is the total amount of money owed by the central government, local governments, government branches and state organizations of China. As of 2020, Chinas total government debt stands at approximately CN¥ 46 trillion , equivalent to about 45% of GDP.

Tracking The Federal Deficit: September 2021

The federal deficit for September 2021 was $59 billion, approximately $65 billion less than the deficit for September 2020. This deficit was the difference between revenues of $460 billion and spending of $519 billion. Although individual and corporate tax payments in September typically produce a large surplus, COVID-19 relief spending eclipsed them and led to a September deficit for the second year in a row.

Revenues increased by $87 billion in relation to the same month last year. The increase was mostly caused by a 23% rise in income and payroll taxes and a 71% increase in corporate income tax receipts.

Spending rose $22 billion year-over-year. Notably, spending by the Department of Education was 107% higher than in September 2020. An upward revision of $95 billion to the departments estimated net subsidy costs of loans and loan guarantees was driven partially by pandemic-related causesincluding the extension of pauses on the payment of loan principal and interest and the collection of loans in defaultand partially by re-estimates of how much the federal government would be repaid on its outstanding portfolio. Spending on refundable tax credits increased $21 billion year-over-year primarily due to the monthly advanced Child Tax Credit payments authorized by the American Rescue Plan earlier this year.

Don’t Miss: How Do You Contact Donald Trump

Tracking The Federal Deficit: May 2019

The Congressional Budget Office reported that the federal government generated a$207 billiondeficit inMay, the eighth monthof Fiscal Year 2019, for a total deficit of $738 billionso far this fiscal year.Maysdeficit is41 percent more than the deficit recorded a year earlier inMay 2018. If not for timing shifts of certain payments, the deficit would have been7 percent larger than the deficit inMay 2018. Total revenues so far inFiscal Year 2019increased by2 percent , while spending increased by9 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Corporate income tax receipts were down by 9 percent compared to last year, reflecting the lower marginal corporate tax rate enacted in the Tax Cuts and Jobs Act of 2017. Further, customs duties increased by 78 percent versus last year, due to the imposition of new tariffs. On the spending side, Department of Defense spending increased by 10 percent compared to last year, particularly on military operations, maintenance, procurement, and R& D. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

Tracking The Federal Deficit: July 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $301 billion in July, the tenth month of fiscal year 2021. Because August 1 fell on a weekend in both 2020 and 2021, certain federal programs that typically pay out large sums on the first of the month did so twice in July. If not for these timing shifts, the deficit would have been $60 billion less last month. Julys deficit was the difference between $261 billion in revenue and $562 billion in spending. Monthly receipts dropped 54% compared to last July due to 2021s return to the regular April and June tax filing deadlines for individual and corporate tax payments.

So far this fiscal year, the federal government has run a cumulative deficit of $2.5 trillion, the difference between $3.3 trillion in revenue and $5.9 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but nearly triple the FY2019 deficit .

Analysis of Notable Trends: Fiscal patterns over the past month continue to reflect the federal governments response to the COVID-19 pandemic, as well as the developing economic recovery.

Growth in federal revenues remains robust, increasing 17% compared to the same 10-month period in FY2020. This increase is indicative of a strengthening economy, with a steady inflow of individual income and payroll taxes from higher total wages and salaries, and corporate taxes from larger corporate profits, the latter of which increased 76% year-over-year.

You May Like: Who Would Win Biden Or Trump

Which Presidents Contributed The Most To The Debt

For example, President Bushs stated budget deficits totaled $3.294 trillion. But he added $5.849 trillion to the debt. He borrowed the rest from Social Security in off-budget transactions. Having said that, the president with the highest deficits are still the presidents who contributed the most to the debt.

How Much Will The Budget Deal Hike The National Debt

Indeed, the difficult decisions that will face future member of Congress only got more difficult on Thursday, as the House voted 284-149 to pass a two-year, $2.7 trillion budget deal that hikes federal spending by about $320 billion annually and is estimated to add about $1.7 trillion to the national debt over the next 10 years.

Also Check: What Is Trump Up To Now

How Much Does Rising Us Debt Matter

The massive borrowing due to the pandemic, along with Bidens big spending plans, has renewed debate over the peril posed by the national debt. Some economists fear that the United States will become stuck in a debt trap, with high debt tamping down growth, which itself leads to more debt. Others, including those who subscribe to the so-called modern monetary theory, say the country can afford to print more money.

Some say that servicing the debt could divert investment from vital areas, such as infrastructure, education, and the fight against climate change. There are also fears it could undermine U.S. global leadership by leaving fewer dollars for U.S. military, diplomatic, and humanitarian operations around the world. Other experts worry that large debts could become a drag on the economy or precipitate a fiscal crisis, arguing that there is a tipping point beyond which large accumulations of government debt begin to slow growth. Under this scenario, investors could lose confidence in Washingtons ability to right its fiscal ship and become unwilling to finance U.S. borrowing without much higher interest rates. This could result in even larger deficits and increased borrowing, or what is sometimes called a debt spiral. A fiscal crisis of this nature could necessitate sudden and economically painful spending cuts or tax increases.

Calculating The Annual Change In Debt

Conceptually, an annual deficit should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service, are considered “off-budget”, while most other expenditure and receipt categories are considered “on-budget”. The total federal deficit is the sum of the on-budget deficit and the off-budget deficit . Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998FY2001.

You May Like: Where To Get Trump Signs

What Was The National Debt Before The Crisis

The national debt was $9.2 trillion in December 2007, before the financial crisis of 2008. Hitting the $30 trillion mark is clearly an important milestone in our dangerous fiscal trajectory, Michael Peterson, head of the Peter G. Peterson Foundation, told The New York Times .

New York Americas national debt just hit another sobering milestone. Total public debt outstanding is now above $30 trillion, according to Treasury Department data published Tuesday. Government borrowing accelerated during the Covid-19 pandemic as Washington spent aggressively to cushion the economic blow from the crisis.

The $28 trillion gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself. Learn more about different ways to measure our national debt.

The National Debt Increased By Almost 36% During Trump’s Tenure

Joe Raedle / Staff / Getty Images

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

Republican candidate Donald Trump promised during the 2016 presidential campaign that he would eliminate the nations debt in eight years.

Instead, his budget estimates showed that he would actually add at least $8.3 trillion, increasing the U.S. debt to $28.5 trillion by 2025. But the national debt reached that figure much sooner. The national debt stood at $19.9 trillion when President Trump took office in January 2017, and it reached a high of $27 trillion in October 2020.

Also Check: How Much Money Has Trump Made Since Becoming President