Nevada Early Voting Latino Turnout Controversy

On November 8, 2016, Trump filed a lawsuit claiming early voting polling places in Clark County, Nevada, were kept open too late. These precincts had high turnout of Latino voters. Nevada state law explicitly states that polls are to stay open to accommodate eligible voters in line at closing time. Hillary Clinton campaign advisor Neera Tanden says the Trump campaign is trying to suppress Latino voter turnout. A political analyst from Nevada, Jon Ralston tweeted that the Trump lawsuit is “insane” in a state that clearly allows the polls to remains open until everyone in line has voted. Former Nevada Secretary of StateRoss Miller, posted the statute that states “voting must continue until those voters have voted”. Miller said: “If there are people in line waiting to vote at 7 pm, voting must continue until everyone votes…. We still live in America, right?”

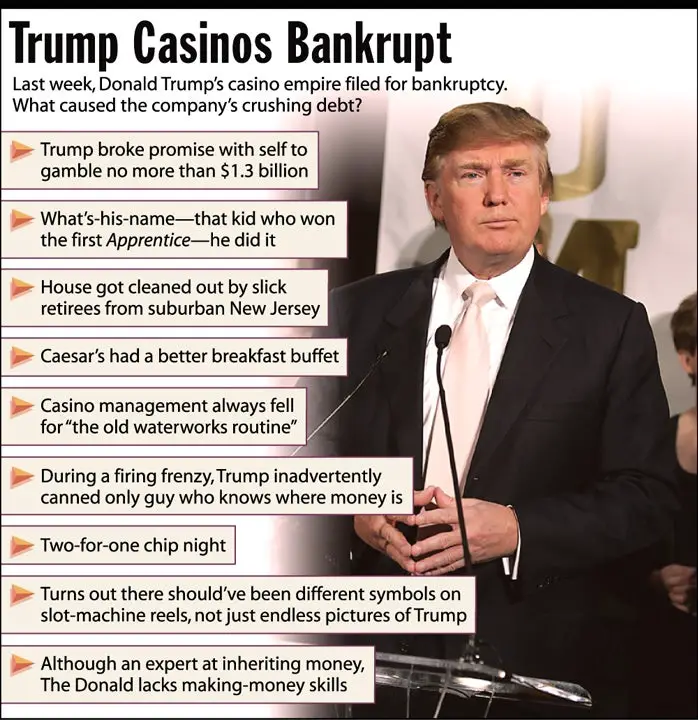

How Is Donald Trump Able To File For Bankruptcy So Many Times

Prior to the 2016 presidential election, when people discussed then-candidate Donald Trump, they often focused on his personal finances and how he had run his businesses. One of the common refrains had to do with his bankruptcies. According to pundits and critics, Trump had been unsuccessful in business, having to file bankruptcy several times in order to get by. Some people may have seen those stories and read the reports only to wonder how a person can declare bankruptcy so many times. For someone with the wealth of Donald Trump, how is it possible to keep declaring bankruptcy?

Donald Trump and personal bankrtupcyTo understand Donald Trump and bankruptcy, one must first understand the distinction between personal finances and business finances. Businesses are separate entities according to the law. In particular, corporations have their own legal personhood. They are specifically created so that people can avoid personal financial liability if things happen to go wrong. With this in mind, Donald Trump has actually never declared personal bankruptcy. In each instance, his bankruptcy has been a result of a business failure rather than a personal failure.

There have been many other business bankruptcies. Most of those have involved casinos. While Trump has tried hard in the casino business, he has had a number of failures there. On top of that, his Trump Plaza Hotel had to declare bankruptcy in order to seek ample protections.

We Have A Company Thats Really Got Great Potential 2005

Though he has acknowledged mistakes in piling crippling debt on Trump Hotels and Casino Resorts, Donald Trump has steadfastly maintained that his resorts were the best-run and highest-performing casinos in Atlantic City.

The casinos have done very well from a business standpoint, he told Playboy magazine in 2004. People agree that theyre well run, they look good and customers love them.

In reality, the revenue at Mr. Trumps casinos had consistently lagged behind their competitors for a decade before larger forces ravaged the industry. Beginning in 1997, his share of the Atlantic City gambling market began to slip from its peak of 30 percent.

Revenues at other Atlantic City casinos rose 18 percent from 1997 through 2002 Mr. Trumps fell by 1 percent.

Competition grew more intense in 2003, when the Borgata Hotel Casino and Spa opened. The $1.1 billion, 40-story resort redefined the concept of an Atlantic City luxury casino. Revenues at Trump casinos dropped another 6 percent in a little more than a year.

Had Mr. Trumps revenues grown at the rate of other Atlantic City casinos, his company could have made its interest payments and possibly registered a profit. But with sagging revenues and high costs, his casinos had too little money for renovations and improvements, which are vital for hotels to attract guests. The public company never logged a profitable year.

I think the biggest thing is, it understates his compensation, Mr. Cox said.

Recommended Reading: How Much Does It Cost To Stay At Trump Hotel

Donald Trumps Business Failures Were Very Real

- Save Story

Save this story for later.

- Save Story

Save this story for later.

Many of Donald Trumps tweets arent worth paying attention to, but on Tuesday morning he posted a pair that demanded inspection. Like many other people, me included, the President had apparently been reading a story in the Times that punctured the mythology surrounding his business career. Based on Internal Revenue Service transcripts of Trumps tax returns from 1985 to 1994, the Timesreport said that Trumps core businesses racked up losses of more than a billion dollars in a ten-year period. During 1990 and 1991, the story said, Trumps losses were so large that they were more than double those of the nearest taxpayers in the I.R.S. information for those years.

Trump could simply have ignored the report or dismissed it as old news. But, with cable-news networks featuring it prominently, and the Daily News, one of Trumps home-town papers, running the front-page headline BIGGEST LOSER, he did what he usually does and counterattacked. This is what he wrote on Twitter:

These are significant sums, certainly. But, as the Times article points out, depreciation charges arent nearly large enough to create the massive losses that Trumps businesses incurred. Some fraction of Donald Trumps losses can be attributed to depreciation, Susanne Craig, one of the authors of the Times piece, wrote in a , responding to Trump. We found most of it was just bad business.

Personal Vs Corporate Bankruptcy

One point of clarification: Trump has never filed personal bankruptcy, only corporate bankruptcy related to some of his business interests. I have never gone bankrupt, Trump has said.

Here is a look at the six Trump corporate bankruptcies. The details are a matter of public record and have been widely published by the news media and even discussed by Trump himself.

You May Like: What Does Trump Think About Health Care

Lawsuits Over Congressional Subpoenas

In March 2019, the House Committee on Oversight and Reform opened an investigation into Trump’s finances, and issued a subpoena for ten years of his tax returns. Trump later sued the chairman of the committee, Rep. Elijah Cummings, seeking to quash the subpoena.

In April 2019, Trump sued Deutsche Bank, bank Capital One, his accounting firm Mazars USA, and House Oversight Committee chairman Elijah Cummings, in an attempt to prevent congressional subpoenas revealing information about Trump’s finances. On May 20, 2019, DC District Court judge Amit Mehta ruled that Mazars must comply with the subpoena. Trump’s attorneys filed notice to appeal to the Court of Appeals for the DC Circuit the next day. On May 22, 2019, judge Edgardo Ramos of the federal District Court in Manhattan rejected the Trump suits against Deutsche Bank and Capital One, ruling the banks must comply with congressional subpoenas.

On 25 February 2021, the House Oversight Committee in the 117th Congress, reissued the subpoena to Mazars USA for the same documents it had previously sought.

How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more. Join today.

Don’t Miss: What Does Trump Say About Immigration

Bankruptcy Is Not Synonymous With Failure

Although a corporate bankruptcy filing often indicates that a business is in a perilous financial condition, it doesnt necessarily sound the death knell for that business. The provisions of Chapter 11 of the U.S. Bankruptcy Code allow businesses to find ways to reduce their debt and restructure their operations without having to be shut down and liquidated to satisfy debts instead of closing their doors, businesses can stay open, pay their employees, and take in revenue while developing a budget and a repayment plan for creditors .

Many of the United States largest and most prominent businesses have filed for Chapter 11 bankruptcy protection one or more times, including General Motors, Charter Communications, Delta Air Lines, Kmart, Macys, and the Texas Rangers baseball team.

Trump Castle Hotel And Casino

This one was opened in 1985 and went bankrupt in the year 1992. This property was also located in Atlantic City, and Trump had the most difficulties in covering its operational cost. To recover from the situation, the Trump association sold a 50% stake to the bondholders. However, the casino is still operating under new owners and a new name- the Golden Nugget.

Recommended Reading: Why Does President Trump Lie So Much

Trump Castle Associates 1992

In less than a year he was back in bankruptcy court for his other Atlantic City casinos. This bankruptcy included the Trump Plaza Hotel in New York, the Trump Plaza Hotel and Casino in Atlantic City as well as the Trump Castle Casino Resort. He gave up half his interest in the New York Plaza to Citibank, but retained his stake in the casinos.

Controversy Over Tax Returns

In October 2016, The New York Times published some tax documents from 1995. Trump claimed on his tax returns that he lost money, but did not recognize it in the form of canceled debts. Trump might have performed a stock-for-debt swap. This would have allowed Trump to avoid paying income taxes for at least 18 years. An audit of Trump’s tax returns for 2002 through 2008 was “closed administratively by agreement with the I.R.S. without assessment or payment, on a net basis, of any deficiency.” Tax attorneys believe the government may have reduced what Trump was able to claim as a loss without requiring him to pay any additional taxes. It is unknown whether the I.R.S. challenged Trump’s use of the swaps because he has not released his tax returns. Trump’s lawyers advised against Trump using the equity for debt swap, as they believed it to be potentially illegal.

After a protracted legal battle against subpoenas to release his tax returns, including two appeals to the United States Supreme Court, in February 2021 the high court permitted the records to be released to prosecutors and a grand jury.

Recommended Reading: Will Trump Forgive Student Loans

Judith And Nicolas Jacobson

Now divorced, the Jacobsons were a married couple who previously owned a chandelier business in West Palm Beach, Florida. In 2004, Trump ordered three fixtures worth $34,000 for his Mar-a-Lago resort from them, but then refused to pay in full, saying the Jacobsons’ work was shoddy, WSJ reports. They denied this claim but facing endless legal wrangling, the couple settled.

“A review of Palm Beach County court records showed no other payment disputes involving Classic Chandeliers. The shop later closed. Mr. Jacobson died in 2015,” notes the WSJ.

Trump defends his history of payment disputes as simply the expected cost of being a tough negotiator in a cutthroat business. The WSJ article, in particular, offers Trump’s camp ample space to respond. They strongly defend the tactics as hard but fair , but the paper notes that they “stood out as particularly aggressive in the industry and in the broader business world.”

Will Trump’s treatment of contractors affect whether or not you decide to vote for him?

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. for unlimited access.

‘keep The Donald Afloat’

” could have simply taken everything he had right then, but they wanted his cooperation,” said Lynn LoPucki, a bankruptcy expert and professor at UCLA Law School. “There’s that old saying, ‘If you owe your banks a little, you’re at their mercy. If you owe the banks a lot, the banks are at your mercy. They saw the best way for him to repay the money was to keep the Donald afloat.”

The Donald struck a deal with the banks to hand over half his ownership, and half of the equity, in the casino in exchange for a lower interest rate and more time to pay off his debt. He sold off his beloved Trump Princess yacht and the Trump Shuttle airplane to make his payments, and his creditors put him on a budget, putting a cap on his personal spending.

“The first one was a really big hit for him. They had him personally, and he ended up taking substantial losses in that bankruptcy. He also had the humiliation of having some bankers deciding how much money he could spend — the numbers are just astonishing — the amount of his monthly budget,” LoPucki said.

John Pottow, a bankruptcy expert and law professor at the University of Michigan, said banks would often agree to lose millions in reorganizations like Trump’s to prevent the massive losses they would incur if they foreclosed on the property.

“Banks will take considerable haircuts,” Pottow said. “It’s sort of like you have a sick patient so you cut off a couple toes to stop the gangrene. Now he’s missing a few toes, but he’s still alive.”

Don’t Miss: How Do I Get Ahold Of President Trump