Is A Corporate Tax Cut Really What The Economy Needs Right Now

Wyden, the top Democrat on the Senate Finance Committee, said while wealthy Americans are celebrating their tax savings from the past two years, working people feel like an afterthought.

Perhaps it’s an acknowledgement of that sentiment that the president is now talking about another round of tax cuts, after the 2020 election. “We’re going to be doing a major middle-income tax cut, if we take back the House,” Trump promised in November.

Individual Income Tax Rates

The TCJA lowered tax rates, but it kept seven income tax brackets. The brackets correspond with more favorable spans of income under the TCJA, however. Each bracket accommodates more income.

The highest tax bracket starts at just over $510,000 in taxable income for single people and $610,000 for married couples as of 2019. These taxpayers are subject to a 37% rate on incomes over these thresholds after exemptions and deductions.

| 2017 Income Tax Rate |

These income levels are adjusted somewhat each year to keep pace with inflation.

The $2 Trillion Scenario

The most pessimistic estimate of the legislation’s budget effects came from the Committee for a Responsible Federal Budget , which argued on Dec. 18, 2017, that Congress is using a flawed baseline to measure the law’s budget effects .

These “gimmicks,” the think tank argues, obscure $570 billion to $725 billion in extra costs over 10 years, bringing the price of the law to $2 to $2.2 trillion. Factoring in expected economic growth , the cost falls to $1.5 trillion to $1.7 trilliontriple the Tax Foundation’s dynamic estimate. That does not count additional debt service costs, though. With interest, the law could cost $1.9 trillion to $2 trillion.

Read Also: Could Trump Be The Antichrist

Biden Said ‘no New Taxes’ Would Be Raised On Anyone Making Less Than $400000

The former vice president has said a tax increase for those making less than $400,000 is not a part of his plan.

In a joint interview with Harris, Biden told ABC News, “I will raise taxes for anybody making over $400,000,” and anyone making less than that would face “no new taxes.”

In an interview with CNBC in May, Biden said, “Nobody making under 400,000 bucks will have their tax raised. Period.”

The Washington Post reported in May on Biden’s announcement that he is firm on not raising taxes on the middle class.

The Biden campaign could not be reached for comment. Campaign spokesman Michael Gwin told Reuters that Biden has made clear that no one making less than $400,00 would see their taxes raised.

“Moreover, Biden will give millions of middle-class families a tax cut through new refundable credits that lower the cost of health insurance, help first-time homebuyers buy a house and assist working families to pay for child care,” Gwin said.

Biden’s Plan Raises Taxes For High

Similar analyses of Biden’s tax plan note that corporate tax rates would increase.

“Biden would raise the corporate tax rate from 21 to 28 percent,” the Committee for a Responsible Federal Budget estimated, and his tax plan would raise somewhere between $3.35 trillion to $3.67 trillion over a decade if enacted in full starting in 2021.

Based on information released by the Biden campaign and conversations with its staff, the Tax Policy Center found that “high-income taxpayers would face increased income and payroll taxes.”

The top tax rate is 37% for individual single taxpayers with incomes greater than $518,400 and $622,050 for married couples filing jointly, according to the IRS.

The Tax Foundation and the Committee for a Responsible Federal Budget said Harris and Biden proposed raising the top marginal income tax rate to 39.6%.

The screenshot from Fox Business Network accurately says Harris proposed raising the corporate income tax rate from 21% to 35% and imposing a 0.2% financial tax rate on stock trades and a 0.1% rate on bond trades as a candidate, according to the Tax Foundation.

Details about the “4% extra tax on $100K+ households” were not included. Per The Tax Foundation, Harris floated a 4% income-based insurance premium on households making more than $100,000 a year to fund her “Medicare for All” plan.

Recommended Reading: Is Trump Going To Win

Increases Income And Wealth Inequality

“Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.–Congressional Budget Office“

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: “Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation’s wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers the tax bill is a natural consequence of their long effort to bend American politics to serve their interests.” The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and -2.0% for the bottom 50%.

How Healthcare Is Going To Be Impacted By The Trump Tax Plan

Healthcare expense deductions have been expanded for both 2018 and 2019. Taxpayers can make deductions if their payments account for more than 7.5% of their income. Previously, this was 10% for people born after the year 1952. Now it applies to everyone, with seniors born before this year still maintaining this deduction.

The Obamacare tax has also been removed. If you dont have health insurance, you wont have to pay the extra tax. However, there are fears that 13 million people could drop their insurance entirely for this. Some doctors also say that healthcare costs will rise due to people avoiding preventative care.

Read Also: How To Contact Melania Trump

Taxpayers Who Claim The Standard Deduction

You’ll win on two levels if you claim the increased standard deduction because it’s bigger than your itemized deductions. First, it will reduce your taxable income more than past years. Second, you can skip the complicated process of itemizing. That not only saves you time, but it will also save you money if you no longer have to pay a tax advisor.

Impacts On The Economy

The tax plan makes the U.S. progressive income tax more regressive. Tax rates are lowered for everyone, but they are lowered the most for the highest-income taxpayers.

The increase in the standard deduction could benefit millions of taxpayers. But for many income brackets, that won’t offset lost deductions.

The Trump tax cuts could cost the government $1 trillion, according to the Joint Committee on Taxation . The $1 trillion figure is the result of the overall $1.5 trillion the TCJA would cost minus the roughly $456 billion it would create via an annual 0.7% growth in gross domestic product.

The Tax Foundation made a slightly different estimate. The tax cuts themselves would cost $1.47 billion but savings from eliminating the ACA mandate and GDP growth would offset that figure by $700 billion.

The plan would boost gross domestic product by 1.7% a year, create 339,000 jobs, and add 1.5% to wages.

The U.S. Treasury reported that the bill would bring in around $1.8 trillion in new revenue and projected economic growth of 2.9% a year, on average.

With the likely outcome of the tax cuts being increased debt, it’s important to understand how that debt affects the GDP. The World Bank estimates that for every percentage point that a nation’s debt-to-GDP ratio increases above 77%, that nation’s GDP will decrease by 1.7%.

The U.S. debt-to-GDP ratio was 104% before the TCJA took effect.

Recommended Reading: What Has Trump Done For Middle Class

Changes To The Tax Code

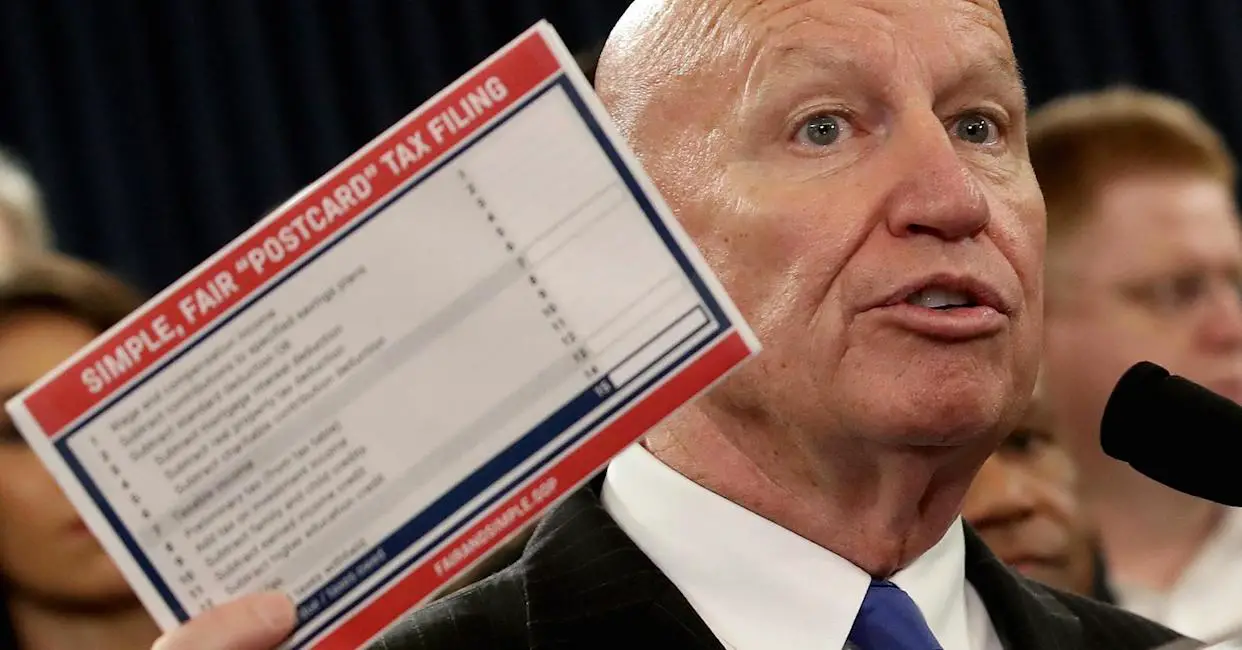

President Trump signed the Tax Cuts and Jobs Act into law on Dec. 22, 2017, bringing sweeping changes to the tax code. How people feel about the $1.5+ trillion overhauls depend largely on their opinion of Trump’s presidency. Individually, how the changes were felt depended on factors like income level, filing status, and deductions. Those living in a high-tax state with soaring property values may have paid more in taxes in 2019.

For the wealthy, banks, and other corporations, the tax reform package was considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax, and more. Financial services companies stood to see huge gains based on the new, lower corporate rate , as well as the more preferable tax treatment of pass-through companies. Some banks said their effective tax rate would drop under 21%.

Given the popular criticism of the tax overhaul’s disparities, coupled with GOP losses in the 2018 midterm elections, as well Trump’s potential trade war muting the benefits of the tax cuts for voters, there were discussions surrounding tax reforms. The reforms could make individual tax cuts permanent and encourage retirement savings and business innovation. More on that later.

Why Corporations And The Wealthy Should Back Democrats’ Middle

Joe BidenManchin lays down demands for child tax credit: reportAbrams targets Black churchgoers during campaign stops for McAuliffe in VirginiaPentagon, State Department square off on Afghanistan accountabilityMORE and the Democratically controlled Congress are poised to enact one of the largest middle-class tax cuts in American history. But the fate of that tax cut depends on raising taxes on the wealthiest individuals in the country as well as a hike in the corporate tax rate.

While the devil is always in the details, if these taxes on the highest earners and corporations are raised reasonably and responsibly, they should support Democratic efforts to give urgent and meaningful tax relief to roughly 100 million Americans, relief that will have the added benefit of growing the economy.

For decades, the wages of the middle class and hourly wage workers barely budged. Meanwhile, the salaries of senior executives have enjoyed a steady, upward escalator ride surpassed only by the investments they hold. No one should begrudge their success nor that of American businesses that have done well and created jobs and opportunities for countless millions. But no one can credibly argue that Americas vast middle and working classes have benefited to the level of past economic eras.

Jim Kessler is executive vice president for policy at Third Way, a centrist Democratic think tank.

Also Check: Where Is Trump In The Polls

Did The Rich Get All Of Trump’s Tax Cuts

Whether the Tax Cuts and Jobs Act disproportionately helped the rich may be 2020s biggest political issue. Treasury Secretary Steve Mnuchin claims that it benefited most Americans. Senator Bernie Sanders it a massive giveaway to the rich.

Whos right?

Unfortunately, no one can tell from the TCJA studies done to date. Those studies, produced by government agencies and D.C. think tanks, do conventional fiscal analysis, which, truth be told, has four fatal flaws.

First, its static. It considers only taxes paid in the current year. But TCJA impacts, and differentially so, every households future taxes.

Second, conventional TCJA analysis classifies households as rich or poor based on current-year income. This means a billionaire investor who realizes no capital gains can be classified as poor even though shes rich.

Third, it lumps together the old and the young. But the young have higher incomes not because theyre richer but because theyre working.

Fourth, conventional analysis takes current-year, after-tax income as the measure of welfare. But consumption , both current and future, is what economics, as well as the public, ultimately care about.

Why are the outstanding economists working in Washington doing highly misleading tax analysis? The answers I get are, first, members of congress are their clients and are used to seeing the wrong numbers presented in the wrong way. Second, members of congress aren’t smart enough to process the right numbers.

How Income Taxes Change

We still have seven brackets for income tax but lower tax rates. These changes will become apparent in the withholding for February 2018 paychecks. This only lasts until 2026, though.

The standard deduction you can now take has been doubled to $12,000 per single person. Married and joint taxpayers will see their deduction go up to $24,000 from $12,700, but in 2026 it will return to the 2017 level.

This is big news because 94% of taxpayers take a standard deduction.

Personal exemptions, however, are a thing of the past. That $4,150 deduction for each person claimed is a thing of the past. Now families with children may see their tax credits go up.

Most itemized deductions are also gone, which includes moving expenses and those paying alimony . Itemized deductions still apply for people in the military, making charitable donations, saving for retirement, and interest on student loans.

A big change is how the deduction on mortgage interest has been limited. It now only applies to the initial $750,000 of the mortgage. Also, you cant take a deduction for interest on equity lines of credit. If you already have a mortgage, though, the rules remain the same.

Don’t Miss: What Has Donald Trump Done

How Much Did The Tax Cuts Help The Economy

Pence gave credit to Trump for Americas economic growth prior to the COVID-19 crisis, claiming that Trump was able to turn the economy around by cutting taxes and rolling back regulations.

The unemployment rate did reach a record low at one point during Trumps administration, hitting 3.5% in late 2019 a 50-year low.

But according to Alan Blinder, a member of President Clintons Council of Economic Advisors and an economics professor at Princeton, the state of the economy is more influenced by what happened before you became president. By the time Trump inherited the economy, the unemployment rate was already on a downward trend.

Wilking said most economists would agree the tax law had a short-term stimulative effect, albeit far more modest than proponents of the bill initially claimed. Trump, for example, claimed that wages would jump after he cut business tax rates.

Wages did increase in 2018, but not by very much, Wilking noted.

Supporters of the tax bill also said it would lead to a rise in corporate investing. But Wilking said that corporate investment has remained steady, as corporations engaged in share buybacks, rather than new projects. In 2018, companies spent $200 billion more on stock buybacks than on research and development.

And while Trump said the economy would grow between 4% and 4.5% after his tax cuts, it ended up growing 2.9% almost two years after the bill was signed into law.