Tax Cuts And Jobs Act Of 2017

| Long title | An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 |

|---|---|

| Tax Cuts and Jobs ActGOP tax reformCut Cut Cut Act | |

| Enacted by | |

| Internal Revenue Service | |

| Legislative history | |

|

Some critics in the media, think tanks, and academia assailed the law, mainly based on forecasts of its adverse impact , disproportionate impact on certain states and professions and the misrepresentations made by its advocates. Some of the reforms passed by the Republicans have become controversial within key states, particularly the $10,000 cap on state and local tax deductibility, and were challenged in federal court before being upheld. According to an aggregation of polls from Real Clear Politics, 34% of Americans were in favor of the new plan, 39% not in favor, and 28% unsure.

Workers Barely Benefited From Trumps Sweeping Tax Cut Investigation Shows

Big companies drove the 2017 Tax and Jobs Act, but did not commit to any specific wage hikes, the Center for Public Integrity found

Big companies drove Donald Trumps tax cut law but refused to commit to any specific wage hikes for workers, despite repeated White House promises it would help employees, an investigation shows.

The 2017 Tax and Jobs Act the Trump administrations one major piece of enacted legislation did deliver the biggest corporate tax cut in US history, but ultimately workers benefited almost not at all.

This is one of the conclusions of a six-month investigation into the process that led to the tax cut by the Center for Public Integrity, a not-for-profit news agency based in Washington DC.

The full findings, based on interviews with three dozen key players and independent tax experts, and analysis of hundreds of pages of government documents, are .

Family Credits And Deductions

The law temporarily raises the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The child credit can only be claimed if the taxpayer provides the child’s Social Security number. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income exceeds $400,000 . These changes expire in 2025.

Read Also: How Many Times Did Trump Lie

Impact Of Tcja Cuts Becoming Permanent

Congress could choose to make the individual cuts permanent before they expire. If that happens, the cost of the tax cuts would rise to $2.3 trillion instead of $1.5 trillion over the next 10 years.

A separate analysis found that while the TCJA would result in increased economic growth, all of the revenue from this growth would go toward paying for the cuts. The cost is too high for the tax cuts to pay for themselves. Instead, the deficit and debt would continue to grow.

Explaining The Trump Tax Reform Plan

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didn’t change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time.

But how did this happen? Let’s take a closer look at President Trump’s changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

Recommended Reading: Will Trump Forgive Student Loans

The $2 Trillion Scenario

The most pessimistic estimate of the legislation’s budget effects came from the Committee for a Responsible Federal Budget , which argued on Dec. 18, 2017, that Congress is using a flawed baseline to measure the law’s budget effects .

These “gimmicks,” the think tank argues, obscure $570 billion to $725 billion in extra costs over 10 years, bringing the price of the law to $2 to $2.2 trillion. Factoring in expected economic growth , the cost falls to $1.5 trillion to $1.7 trilliontriple the Tax Foundation’s dynamic estimate. That does not count additional debt service costs, though. With interest, the law could cost $1.9 trillion to $2 trillion.

Five Good Reasons It Doesn’t Feel Like The Trump Tax Cut Benefited You

Tweet This

As tax day approaches, American taxpayers will wonder if they benefited from the Trump tax cut. Most people dont think they did. Only 17% of Americans think the bill is reducing their taxes, even though the nonpartisan Tax Policy Center estimated that up to 80% would see some reduction in their federal taxes. There are five reasons for this mismatch between reality and impressions.

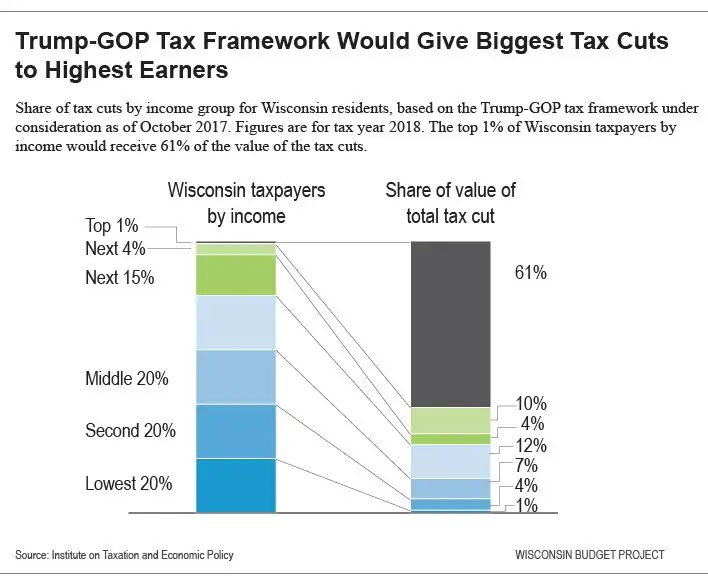

First, many people will technically have lower taxes, but the cuts are so tiny as to be hardly noticeable. The Tax Policy Center estimates the 60% of Americans at the lower end of the income distribution will have federal tax savings of less than $1,000. Also, most people believe the tax cuts didnt benefit people like them but only the very wealthy. They are right. Those in the top 1% save $51,000.

Second, as Forbes contributor Howard Gleckman explained, the tax changes affected withholding through increases in the standard deduction and other provisions, especially the limit on deductibility of state and local taxes . But many taxpayers didnt change their withholding allowances, so they may not have withheld the correct amounts in each time period. This means their tax refund is smaller than expected. The smaller-than-expected refund could be feeding a perception that taxes have increased even when they fell slightly.

Don’t Miss: What Kind Of Jobs Has Trump Created

Does The Trump Tax Cut Give 83 Percent Of The Benefits To The Top 1 Percent

REP. DAVID N. CICILLINE :We need a tax cut for middle-class families, not 83 percent of it going to the top 1 percent, richest people in this country, and the most powerful corporations.

Well, I have got to push back on that, because 80 percent of the tax cut plan didnt go to the top 1 percent. As you know, congressman, the tax cut plan lowered all income levels, and they double the standard deduction. So that talking point . . .

CICILLINE:

BARTIROMO:No, it is true.

CICILLINE:

BARTIROMO:Congressman, its just not true. You know it, and I know it. Let me ask you

CICILLINE: It is true.

BARTIROMO:Part of maybe you get there because the corporate rate was cut. Are you saying you want to have the corporate

CICILLINE:Thats right. Thats right.

BARTIROMO:So you want the corporate rate at 35 percent?

CICILLINE: So, you acknowledge its right

BARTIROMO:Congressman

CICILLINE: that 83 percent does go to the top 1 percent.

BARTIROMO:All right. Congressman, do you want to raise the corporate tax rate? Is that what youre saying?

CICILLINE: Well, I dont what I say we have to do is, we have to be responsible about that. We created a $2 trillion deficit by giving 83 percent of the tax cut to the top 1 percent. And now Republicans are proposing to cut Social Security and Medicare to pay for that. Thats not acceptable.

BARTIROMO:Look, I understand that you want to keep with this talking point that is inaccurate. Thats fine.

CICILLINE:No, its a fact.

Promise: A Simpler Tax Code

Some aspects of the law did make filing tax returns easier.

For individuals, the law boosted the standard deduction, which allowed millions of people to skip itemizing on their annual tax returns. It also raised the threshold for a parallel system of taxation meant to target people who take an outsize amount of credits and deductions, known as the alternative minimum tax, and eliminated a similar system for corporations.

But other changes to the tax codesuch as a 20% write-off for owners of pass-through businesses, and the laws byzantine international provisionswere far from simple, even before the IRS wrote hundreds of pages of regulations for how to follow them.

Beyond the code, Republicans promised that people would be able to do their taxes on a postcard-sized form.

That was somewhat true in 2018, when the IRS shrunk the Form 1040 from two full pages to a small one-page document. However, for that year, lines for reporting income, credits, and deductions were shifted to six separate attached schedules.

Then, in 2019, the IRS reverted to a two-page 1040 form, and the agency reduced the number of schedules to threesomewhat placating accountants who complained that the previous years postcard was a mess.

Recommended Reading: Did Trump Get Rid Of The Pandemic Response Team

Fact Sheet: Biggest Winners From Trumps Tax Law

Trump promised he would deliver middle-class tax cuts that would create jobs and provide substantial savings for working families. Instead, the biggest winners from Trumps tax law were big corporations, the wealthiest Americans, and the Trump family, while middle-class Americans were largely left behind.

Big corporations:

-

Large corporations had their effective tax rate cut to the lowest level in and nearly 100 profitable companies saw their tax bills cut to zero under Trumps tax law.

-

Instead of using their tax savings to benefit workers, large corporations announced billions in stock buybacks for their investors while they laid off workers and closed stores,

Big pharma:

-

Four big pharmaceutical companies combined for a $7 billion windfall under the first year of Trumps tax law, and benefited from shifting profits to tax havens while they cut investments in research.

-

The biggest pharmaceutical companies announced more than $45 billion in stock buybacks after the Trump tax, but made no plans to lower drug prices that consistentlyincreased while Trump was in office.

Big oil:

-

Many big oil companies avoided paying any federal taxes in the first year under Trumps tax law.

-

Oil companies spent their tax cut windfall on payouts to wealthy shareholders rather than hiring, pay raises or expansion.

Big banks:

The wealthiest Americans:

Donald Trump and his family:

Real estate developers:

CEOs and wealthy shareholders:

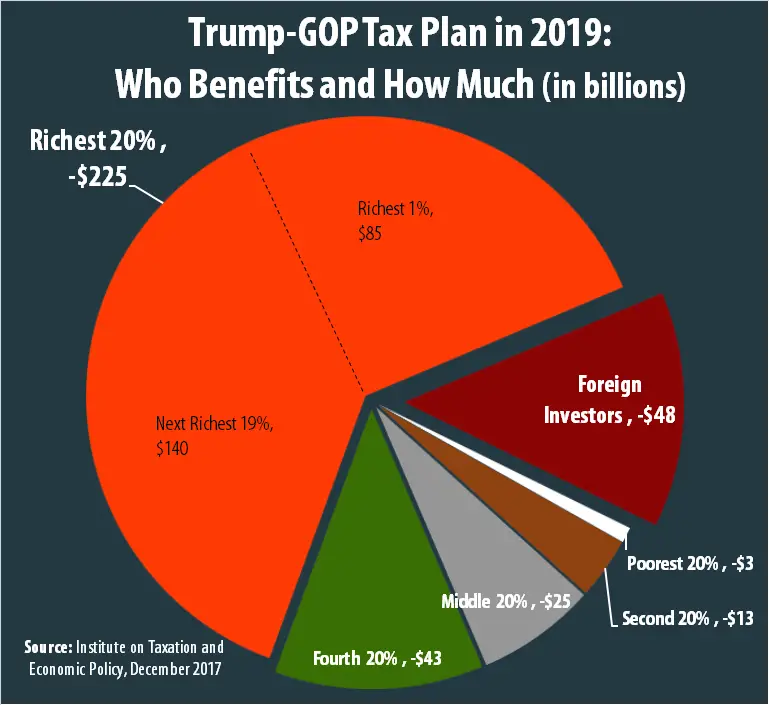

Foreign investors:

Lobbyists:

The Ballyhooed Tax Cut Bonuses Were A Mirage

Finally, recent data show that the tax bill did not lead to a meaningful increase in worker bonuses, debunking the forceful public relations campaign waged by the proponents of the tax cuts and the corporations receiving them.

Immediately following Trumps tax cut, corporations began announcing bonuses attributed to the TCJA. But new data show that this may have been nothing more than tax-motivated timing shifts. This is because corporations were able to take deductions on bonuses that they gave out in 2017 and early 2018 against the higher tax rate, making them more valuable than if they had handed the bonuses out later in the year. This created an incentive for corporations to shift up any bonuses that they planned to give out later. Now that this method of tax planning is no longer available, employers have reduced the value of bonuses, which have now fallen lower than their pre-TCJA levelsshowing that the much-hyped benefit for workers was illusory.

Don’t Miss: Can You Email President Trump

All Of The Above Is Acceptable

Republican lawmakers also boosted the value of their stock holdings when they encouraged American corporations to repatriate money they were holding overseas. The tax law decreed that future foreign profits would not be taxed at high rates, and that previously earned profits stashed abroad an estimated $2.7 trillion would be taxed one time at no more than 15.5 percent.

In 2017, Apple was sitting on $250 billion in overseas profits. In January 2018, the month after President Donald Trump signed the tax bill into law, the tech behemoth and third-largest American company said it would pay the new, lower tax and start bringing the cash home. Just four months later, Apple said it would buy back $100 billion of its stock and hike its dividend by 16 percent. Apple shares increased almost 9 percent by the weeks end. In April 2019, Apple announced $75 billion more in buybacks, a move analysts said would likely drive its stock price higher. A day after the announcement, shares increased in value nearly 5 percent. The stock continued to hit record highs late last year.

Robert Reich: Guess Who Benefits From Trump’s Tax Cuts

Trump and congressional Republicans are engineering the largest corporate tax cut in history in order “to restore our competitive edge,” as Trump says.

Our competitive edge? Who’s us ?

Most American corporations especially big ones that would get most of the planned corporate tax cuts have no particular allegiance to America. Their only allegiance is to their shareholders.

For years they’ve been cutting the jobs and wages of American workers in order to generate larger profits and higher share prices.

Some of these jobs have gone abroad or been outsourced to lower-paid contractors in America. Others have been automated. Most of the remaining jobs pay no more than they did four decades ago, adjusted for inflation.

When GM went public again in 2010 after being bailed out by American taxpayers, it boasted of making 43 percent of its cars in places where labor is less than $15 an houroften outside the United States. And it got its American unions to agree that new hires would be paid half the wages and benefits of its old workers.

Capital is global. Big American corporations are “American” only because they’re headquartered and legally incorporated in the United States. But they could leave at a moment’s notice. They also employ or contract with workers all over the world.

And they’re owned by shareholders all over the world.

So when taxes of “American” corporations are cut, foreign investors get a windfall.

Don’t Miss: What Is The Latest News On Donald Trump

What Were The Income Adjustments

Excluding active military service members, above that, the payment for relocation costs is eradicated. Those who pay for food cannot deduct it anymore as an income adjustment. This amendment shall apply to divorces issued on or after 1 January 2018. TCJA maintains the pension savings deduction. It also enables 701? 2 or older people to transfer immediately from their individual pension plans to trained charity organizations up to $100,000 per annum.