Losers: People Who Didn’t Adjust Their Withholding

When the IRS updated its tax-withholding tables to reflect the new law, it also revamped its Form W-4 a document employees use to ensure they’re pulling enough income tax from their paycheck.

Some taxpayers are at risk of paying too little tax during the year, including former itemizers and individuals with side gigs.

“If you’re making side income, you have no withholding on it, then you’ve underpaid the taxes and you ultimately owe money,” Perry said.

If you were significantly underwithheld in 2019, it’s too late to right the ship.

However, you can head off a similar disappointment next year if you get your prior year’s tax return and crunch the numbers on the IRS’s tax withholding calculator.

Did The Trump Tax Cuts Work The Answer May Not Be What You Think

A common justification for raising corporate tax rates is that cutting tax rates back in 2017 didnt work so well. So whether for reasons fiscal or egalitarian, its good policy to reverse some or all of President Trumps Tax Cuts and Jobs Act.

Certainly a cursory glance at the statistics which is what the they didnt work claim is based on shows GDP growth, productivity, and business investment about the same heading into the pandemic. Not much sign of the sharp and sustained surge that some proponents promised. President Trump, for instance, said the tax cuts would be rocket fuel for the economy. But as The Wall Street Journal concluded in early 2020: Early growth in business investment seems to have faded overall economic growth rose before pulling back again. Cross-border investment patterns have changed only modestly.

A couple things to keep in mind, however: For starters, many GOP politicians and pundits argued for the tax cuts in a way most economists didnt. While the former said the tax cuts would radically alter investment incentives and unleash a flood of corporate cash into the domestic economy from overseas holdings, the latter made arguments more like this one from AEI economist Alan Viard :

One reason the trade wars may have undercut the tax cuts was because of the massive business uncertainty they created. In a new analysis by Hites Ahir, Nicholas Bloom, and Davide Furceri, the researchers note the following:

Income Tax Calculator: Estimate Your Taxes

Congress enacted the trickle-down tax cuts, known as the Tax Cuts and Jobs Act, in December 2017, aimed at accelerating growth. The argument in favor of these cuts went something like this: Giving corporations a lot more money and showering the richest households would give them more cash to invest. This would lower the cost of investing and spark a boom in investments in new manufacturing plants, office buildings, vehicle fleets and energy upgrades, among other things. These new investments would translate into faster productivity growth, higher economic growth and stronger wage and employment gains. That was at least the argument for selling lopsided tax cuts for the biggest winners in the current economy.

But the first step in this chain faster business investment growth never happened. This should not have been surprising. Corporations were already profitable and sat on piles of cash in 2017. The richest households had also reaped the benefits of the economic expansion since 2009. And interest rates were very low. Yet none of these factors were enough to spark an investment boom. Those looking for cheap money for their investments didnt have to look far. The problem was that there werent enough companies looking to invest.

Don’t Miss: Americus Trumpus

State And Local Taxes

Taxpayers can deduct a maximum of $10,000 from the total of their state and local income taxes or sales taxes, and their property taxes . This measure might hurt itemizers in high-tax states such as California, New York, and New Jersey.

The $10,000 cap applies whether you are single or married filing jointly. If you are married filing separately, this figure drops to $5,000.

How The Tcja Tax Law Affects Your Personal Finances

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

What follows is an overview of the Tax Cuts and Jobs Act and some changes you can expect to affect your taxes in the near term. We also give an overview of some much-discussed proposals that didn’t happen. While this guide is not an exhaustive list of every change to the tax code, it does cover the key elements that will affect the most people.

How the tax bill affects you depends on your personal situation: how many children you have, how much you pay in mortgage interest and state/local taxes, how much you earn from work, and more.

Don’t Miss: How Many Times Did Trump Lie

Changes To The Tax Code

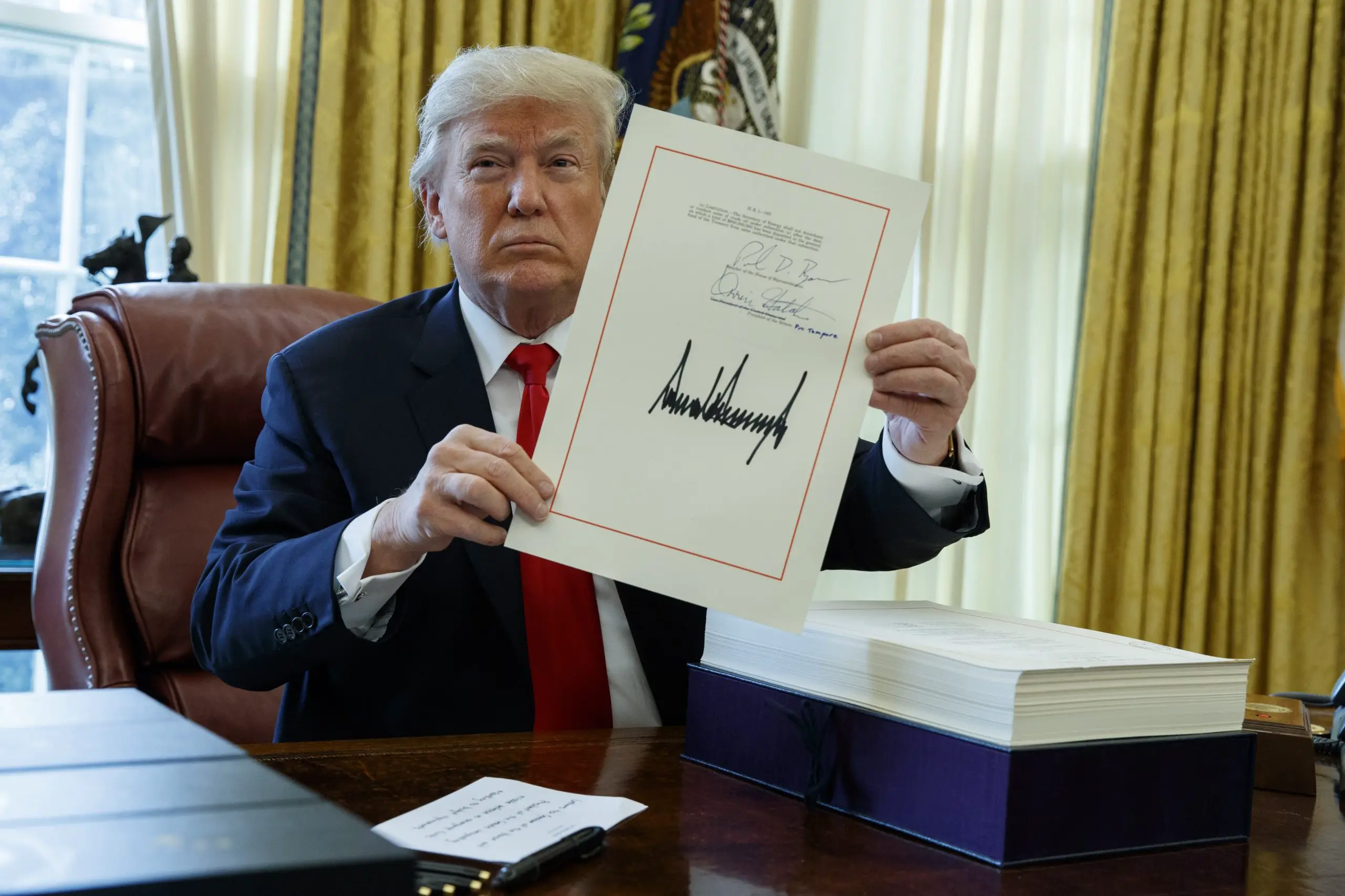

President Trump signed the Tax Cuts and Jobs Act into law on Dec. 22, 2017, bringing sweeping changes to the tax code. How people felt in principle about the $1.5+ trillion overhauls depended to some extent on their opinion of Trump’s presidency. Individually, the impact of the changes depended on factors like income level, filing status, and deductions. Those living in a high-tax state with soaring property values may have paid more in taxes in 2019.

For the wealthy, banks, and other corporations, the tax reform package was considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax, and more. Financial services companies stood to see huge gains based on the new, lower corporate rate , as well as the more preferable tax treatment of pass-through companies. Some banks said their effective tax rate would drop under 21%.

Given the popular criticism of the tax overhaul’s disparities, coupled with GOP losses in the 2018 midterm elections, as well Trump’s potential trade war muting the benefits of the tax cuts for voters, there were discussions surrounding tax reforms. The reforms could make individual tax cuts permanent and encourage retirement savings and business innovation. More on that later.

The Promised Boom In Business Investment Never Happened

In the year following the tax cut, business investment increasedbut not by nearly as much as the tax cut proponents predictions would have implied. Furthermore, a study by the International Monetary Fund concluded that the relatively healthy business investment in 2018 was driven by strong aggregate demand in the economynot the supply-side factors that tax cut proponents used to justify the tax cut. In other words, the increase in business investment from the relatively weak 2015-2016 period seems like another example of an economic indicator returning to more-normal levels.

Worse, business investment has slowed more recently. The most recent data show that private nonresidential investment actually declined in the second quarter of 2019, contributing to an overall slowdown in growth. Federal Reserve Chairman Jay Powell pointed to the continued softness expected in business investment and declining output in manufacturing sector as reasons for the Feds recent rate cut. Measures of the investments that companies are planning have also . As analysts at the nonpartisan Tax Policy Center wrote recently, This slowdown in business purchases of plant and equipment contrasts sharply with President Trumps rosy forecast of a long-term investment boom that would lead to annual wage increases of $4,000 or more. Moreover, investment in housing has declined every quarter since the passage of the tax legislation.

Read Also: Jobs Created By Trump

The Effect Of Tax Brackets

President Trump initially proposed to lower income taxes and reduce the number of tax brackets from seven to three12%, 25%, and 35%. That didn’t happen. The TCJA still provides for seven brackets, but they’ve been reduced somewhat: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The brackets in 2017, before the TCJA, were: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

The New Standard Deduction Helped Some Taxpayers

The TCJA nearly doubled the standard deduction from $6,350 for single filers in 2017 to $12,000 in 2018. The standard deduction lowers your taxable income the amount of your income that you actually pay income tax on so a higher deduction means paying less income tax overall.

However, the higher standard deduction didnt benefit everyone equally for two main reasons:

-

The loss of personal exemptions

-

Changes to itemized deductions

Recommended Reading: How Much Is A Night At Trump Tower

How Income Taxes Change

We still have seven brackets for income tax but lower tax rates. These changes will become apparent in the withholding for February 2018 paychecks. This only lasts until 2026, though.

The standard deduction you can now take has been doubled to $12,000 per single person. Married and joint taxpayers will see their deduction go up to $24,000 from $12,700, but in 2026 it will return to the 2017 level.

This is big news because 94% of taxpayers take a standard deduction.

Personal exemptions, however, are a thing of the past. That $4,150 deduction for each person claimed is a thing of the past. Now families with children may see their tax credits go up.

Most itemized deductions are also gone, which includes moving expenses and those paying alimony . Itemized deductions still apply for people in the military, making charitable donations, saving for retirement, and interest on student loans.

A big change is how the deduction on mortgage interest has been limited. It now only applies to the initial $750,000 of the mortgage. Also, you cant take a deduction for interest on equity lines of credit. If you already have a mortgage, though, the rules remain the same.

Trumps Tax Cuts Helped Billionaires Pay Less Than The Working Class For First Time

Economists calculate richest 400 families in US paid an average tax rate of 23% while the bottom half of households paid a rate of 24.2%

They were billed as a middle-class miracle but according to a new book Donald Trumps $1.5tn tax cuts have helped billionaires pay a lower rate than the working class for the first time in history.

In 2018 the richest 400 families in the US paid an average effective tax rate of 23% while the bottom half of American households paid a rate of 24.2%, University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman calculate in their new book, The Triumph of Injustice.

Taxes on the rich have been falling for decades. In 1960 the 400 richest families paid as much as 56% in taxes, by 1980 the rate had fallen to 40%. But Trumps tax cuts his most significant legislative victory proved a tipping point.

Thanks to the controversial tax package the top 0.1% of US households were granted a 2.5% tax cut that pushed their rate below that of the lower 50% of US earners.

This is a revolutionary change and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor, and as wages start going up at levels that you havent seen in many years, Trump said in September 2017 as he fought to pass the tax package.

Read Also: Superpowerchecks.com Review

Increases Income And Wealth Inequality

“Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.–Congressional Budget Office“

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: “Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation’s wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers the tax bill is a natural consequence of their long effort to bend American politics to serve their interests.” The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and 2.0% for the bottom 50%.

Buying Insurance Through The Aca

The American Rescue Plan of 2021 reduces the cost of Marketplace plans, increases the tax credits for many Americans, and expands eligibility for the tax credits starting April 1, 2021. The average Marketplace user will pay $85 less every month per policy.

The Republicans got their wish to see the individual health insurance mandate penalty repealed. This change means that people who dont buy health insurance will not have to pay a fine to the Internal Revenue Service .

Don’t Miss: Trump Tower Nightly Cost

Family Credits And Deductions

The law temporarily raised the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The child tax credit can only be claimed if the taxpayer provides the child’s Social Security number. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income exceeds $400,000 . These changes expire in 2025.

Corporate Revenue Has Dropped Precipitously Since Trumps Tax Cut

While the promised benefits of Trumps corporate tax cuts have yet to materialize, the costs can be seen dramatically in the data on corporate tax revenue. As a result, since the law passed in December 2017, revenues from corporate taxes have fallen by more than 40 percent, contributing to the largest year-over-year drop in corporate tax revenue that we have seen outside of a recession. This has added even more to deficits than experts had previously predicted. The U.S. Treasury reported that from fiscal year 2017 to FY 2018, the federal budget deficit increased by $113 billion while corporate tax receipts fell by about $90 billion, which would account for nearly 80 percent of the deficit increase. Though the Trump administration and the Congressional Budget Office projected corporate revenues to bounce back somewhat in FY 2019, there is no sign yet that that is happening, with 11 of 12 months having already been reported for FY 2019.

Don’t Miss: How Much Is A Night At The Trump Hotel