Which Us President Spent The Most On The National Debt

A 472% increase in the rate of daily debt. Abraham Lincolns years in the Oval Office saw the largest percentage increase in National Debt under any President, increasing 2859% overall However, Martin Van Buren is the President who spent the most consistently with average yearly debt increasing 375.32% compared to Lincolns 148.36%

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Drawback Of Measuring Debt By President

Neither of the techniques mentioned above is a very accurate way to measure each president’s impact on the national debt because the president doesn’t have much control over the national debt during their first year in office.

For example, President Donald Trump took office in January 2017. He submitted his first budget in May. It covered the 2018 fiscal year, which didn’t begin until October 1, 2017. Trump operated the first part of his term under President Barack Obama’s budget for fiscal year 2017, which ended on Sept. 30, 2017.

While the time lag may make it seem confusing, Congress intentionally sets it up this way. An advantage of the federal fiscal year is that it gives the new president time to put together their budget during their first months in office.

Recommended Reading: What’s Trump’s Phone Number

Effects On Corporate Taxation And Behavior

The Institute on Taxation and Economic Policy reported in December 2019 that:

- The Tax Act lowered the statutory corporate tax rate from 35% to 21% in 2018, although corporations continued to reduce their taxes below the statutory rate via loopholes. The Tax Act closed some old loopholes, but created new ones.

- The effective corporate tax rate in 2018 was the lowest rate in 40 years, at 11.3%, versus 21.2% on average for the 2008â2015 period.

- Of 379 profitable Fortune 500 corporations in the ITEP study, 91 paid no corporate income taxes and another 56 paid an average effective tax rate of 2.2%.

- If the 379 businesses had instead paid the 21% tax rate, it would have generated an additional $74 billion in tax revenue.

The Economic Policy Institute reported in December 2019 that:

- Working people saw no discernible wage increase due to the Tax Act. The tight labor market and higher state-level minimum wages can explain the wage growth in 2018.

- The Tax Act has not increased business investment, with the small increase in 2018 a “natural bounceback” from a weak 2015â2016, and a sizable decline in 2019.

- Companies used much of the tax benefit for stock buybacks, to the tune of $580 billion in 2018, an increase of 50% from 2017.

Biden Releases $58t Budget Claims Deficit Cut Despite Massive Spending

Bidens recent deficit-reduction bragging didnt mention that he wants to increase the deficit even more. Last week, he put taxpayers on the hook for $5.8 billion in debt from people who attended Corinthian Colleges. Now he wants taxpayers to pay hundreds of billions more so other students dont have to pay.

Biden also bragged about a record 6.7 million jobs created last year the most in the first year of any president in American history. But the president didnt create those jobs.

In panic over COVID, governments shut down so many businesses that they raised the unemployment rate to 14.7%. Biden then slowed hiring further by giving non-workers extended unemployment benefits and fat stimulus checks. For many people, that meant they could make as much, or more, collecting unemployment. No wonder they didnt go back to work.

Finally, most benefits have run out, so of course, we have job growth now. Its not because of anything good that Biden did.

Under Biden, Trump and Obama, federal spending almost doubled.

Hope for future spending responsibility is bleak. Bidens 10-year outlook still would rack up $14.4 trillion in deficits, reports Bloomberg. More money gets printed, inflation gets worse and the national debt grows.

Politicians need to make actual cuts to make a difference in our debt.

Budget cuts are needed to give our children hope for a prosperous future. But Biden wont do that.

You May Like: How To Talk To Trump

Income And Wealth Inequality

The New York Times editorial board characterized the tax bill as both a consequence and a cause of income and wealth inequality: “Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation’s wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers the tax bill is a natural consequence of their long effort to bend American politics to serve their interests.” The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

The share of income going to the top 1% has doubled, from 10% to 20%, since the pre-1980 period, while the share of wealth owned by the top 1% has risen from around 25% to 42%. Despite President Trump promising to address those left behind, the Tax Cuts and Jobs Act would make inequality far worse:

Tracking The Federal Deficit: March 2020

The Congressional Budget Office reported that the federal government generated a $117 billion deficit in March, the sixth month of fiscal year 2020. Marchs deficit is a $30 billion decrease from the $147 billion deficit recorded a year earlier in March 2019. Marchs deficit brings the total deficit so far this fiscal year to $741 billion, which is 7% higher than the same period last year. Total revenues so far in FY2020 increased by 6% , while spending increased by 7% , compared to the same period last year.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first six months of FY2020, federal reserve remittances increased by 22% because of lower short-term interest rates, which decreased the Federal Reserves interest expenses and increased its payments to the Treasury. As in previous months, the rise in spending was driven by increasing expenditures on the military , Social Security, Medicare, and Medicaid , and net interest on the public debt . Notably, the March 2020 report was not significantly impacted by the new coronavirus pandemic nor the federal governments emergency measures responding to it. CBO anticipates that those budgetary effects will be more noticeable in April.

Also Check: How To Reach Donald Trump

How Did The National Debt Increase

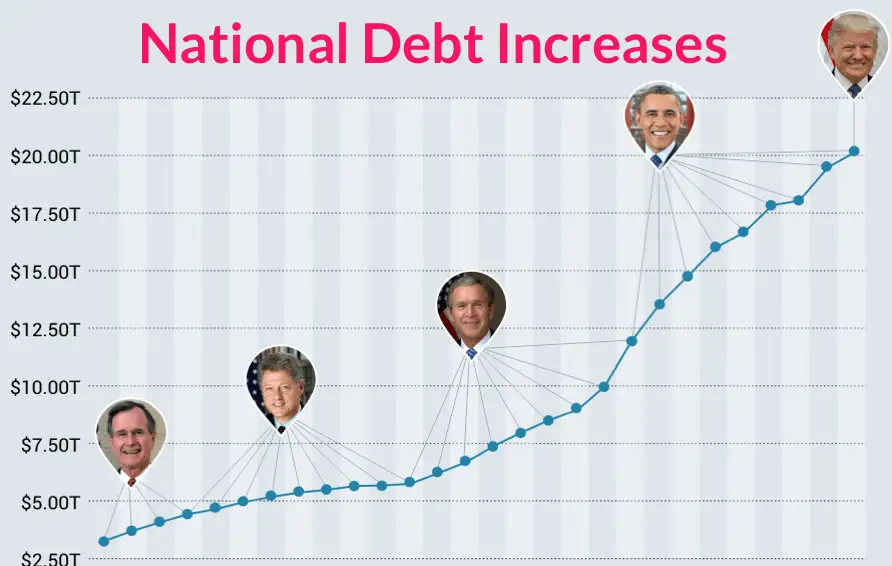

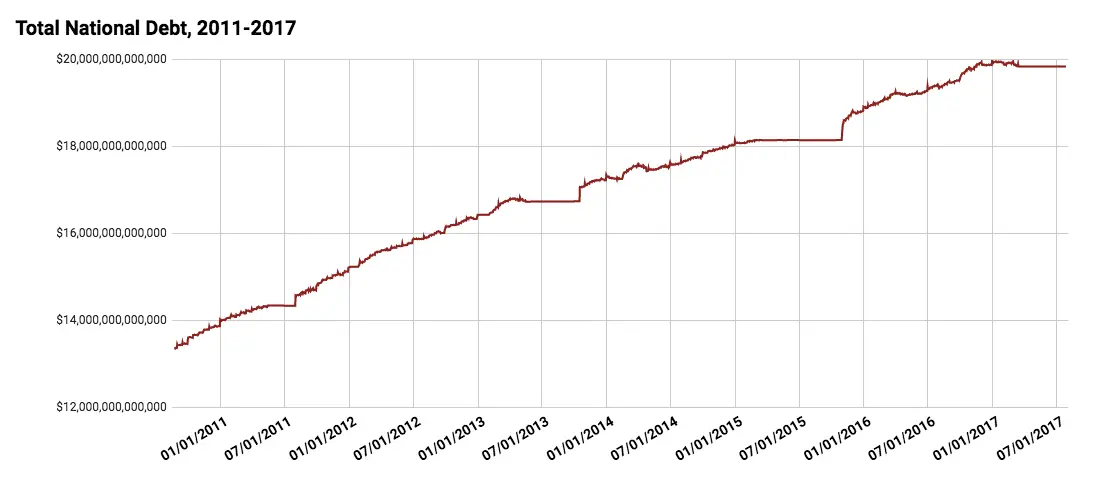

At first it seemed that Trump was lowering the debt. It fell $102 billion in the first six months after he took office. The debt was $19.9 trillion on Jan. 20, the day Trump was inaugurated. It was $19.8 trillion on July 30, thanks to the federal debt ceiling.

Trump signed a bill increasing the debt ceiling on Sept. 8, 2017. The debt exceeded $20 trillion for the first time in U.S. history later that day. Trump signed a bill on Feb. 9, 2018, suspending the debt ceiling until March 1, 2019. The total national debt was at $22 trillion by February 2019. Trump again suspended the debt ceiling in July 2019 until after the 2020 presidential election.

The debt hit a record $27 trillion on Oct. 1, 2020 before reaching further peaks in 2021 that caused Congress to act again to raise the debt limit in December.

Trump oversaw the fastest increase in the debt of any president, almost 36% from 2017 to 2020.

Tracking The Federal Deficit: January 2020

The Congressional Budget Office reported that the federal government generated a $32 billion deficit in January, the fourth month of fiscal year 2020. Januarys deficit is a $40 billion change from the $9 billion surplus recorded a year earlier in January 2019. Januarys deficit brings the total deficit so far this fiscal year to $388 billion, which is 25% higher than the same period last year . Total revenues so far in FY2020 increased by 6% , while spending increased by 10% , compared to the same period last year. (After accounting for timing shifts, spending rose by 6% or $90 billion.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first four months of FY2020, revenue from corporate income taxes rose by 27% . Additionally, Federal Reserve remittances increased by 14% partly due to lower short-term interest rates that reduced its interest expenses. On the spending side, after accounting for timing shifts, total Social Security, Medicare, and Medicaid outlays rose by 6% . Outlays for the Department of Defense rose by 7% , largely for procurement and research and development.

Also Check: When Was Trump A Democrat

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

Tracking The Federal Deficit: January 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $165 billion in January, the fourth month of fiscal year 2021. This months deficitthe difference between $552 billion of spending and $387 billion of revenuewas $132 billion greater than last Januarys. But federal finances deteriorated more than the raw numbers suggest. Adjusting for shifts in the timing of some payments, the deficit this January would have been $211 billion greater than last Januarys. The federal deficit has now reached $738 billion so far this fiscal year, an increase of 120% over the same point last year . Compared to the same point last fiscal year, cumulative revenues have ticked up 1%, but cumulative spending has surged 27%mostly due to the COVID-19 pandemic and the federal response to it.

Increased spending so far this fiscal year has likewise mostly resulted from pandemic relief. About 60% of the increase in cumulative year-to-date spending has come from refundable tax credits and unemployment insurance benefits . Outlays from the Public Health and Social Services Emergency Fund are also up $26 billion compared to the first four months of fiscal year 2020, and Medicaid spending is $29 billion greater.

Revenues rose 4% from last January, thanks to greater revenue from individual income, payroll, and corporate income tax revenue.

Read Also: How Can I Support President Trump

Series: A Closer Look

Examining the News

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as theyre published.

This story was co-published with The Washington Post.

One of President Donald Trumps lesser known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch. The financial burden that hes inflicted on our government will wreak havoc for decades, saddling our kids and grandkids with debt.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

Tracking The Federal Deficit: November 2018

The Congressional Budget Office reported that the federal government generated a $203 billion deficit in November, the second month of Fiscal Year 2019, for a total deficit of $303 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in November would have been roughly $158 billion, according to CBO. Novembers deficit is 46 percent higher than the deficit recorded a year earlier in November 2017. Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 18 percent , compared to the same period last year.

Analysis of Notable Trends in November 2018: Department of Homeland Security spending fell by 46 percent relative to November 2017, reflecting a decrease in spending on disaster relief. Conversely, Social Security spending increased by 5 percent compared to November 2017.

Also Check: Has Trump Been Impeached Yet

End Of Fiscal Year 2018

This entry reflects the U.S. Treasury Departments official end-of-year spending, revenue, and deficit figures for Fiscal Year 2018, as released in its Final Monthly Treasury Statement for Fiscal Year 2018.

The total deficit for FY 2018 is $779 billion, with total spending clocking in at $4.1 trillion and total revenue at $3.3 trillion. The deficit grew by 17 percent compared to FY 2017 and is the highest federal deficit in six years . While spending grew by about 3 percent in FY 2018, revenue grew by less than 1 percent . Disturbingly, federal interest payments on the debt spiked to $372 billion up 20 percent from FY 2017 reflecting the largest year-over-year increase in over a decade .

The Deficit Tops $1 Trillion

The U.S. budget deficit exploded in fiscal year 2009, ultimately reaching $1.4 trillion under President George Bush and the incoming Obama administrations struggled to contain the economic fallout from the financial crisis. Most of that deficit was created on Bush’s watch, but Obama and the Democratic-controlled Congress added hundreds of billions of dollars to it in early 2009.

The deficit would remain above $1 trillion through the 2012 fiscal year but would be slashed to as low as $440 billion in the later years of Obama’s presidency.

Relative to the size of the nation’s economy, the biggest U.S. deficits in history were seen during World War II.

Recommended Reading: How To Donate To The Trump Campaign

The Claim: Trump Increased The National Debt By $83 Trillion In 4 Years

During his 2016 campaign, Trump ran on a promise to strengthen the country’s economy, which would in turn improve Americans’ quality of life. Trump’s promise to improve the economy included a pledge to eliminate the national debt within eight years.

The national debt doesn’t typically impact the day-to-day lives of most Americans unless it reaches a tipping point, which would slow the economy.

Under Trump’s first four years as president, the national debt has markedly increased, including significant spending by the federal government to combat the COVID-19 pandemic.

The Instagram page Occupy Democrats reposted a meme made by the Biden support group Ridin’ with Biden that states, “Hey Republicans do you still care about the national debt? Because Trump just increased it by $8.3 TRILLION in four years. Just sayin.”

USA TODAY has reached out to the page for comment.

Fact Check: Did The National Debt Double Under Obama

tweet this show comments

President Donald Trump claimed Feb. 15 that former President Barack Obama put on more debt on this country than every president in the history of our country combined.

Verdict: True

Public debt more than doubled in the eight years of Obamas presidency, rising from $6.3 trillion to $14.4 trillion. Gross federal debt which includes the amount owed to Social Security and other government accounts nearly, but did not quite, double.

Fact Check:

Trump held a press conference Feb. 15 at the White House to declare a national emergency at the southern border. After his remarks, Trump took questions from reporters, including one about his plan to combat the growing national debt.

Trump said economic growth will straighten it out and criticized Obamas management of the debt. When I took over, we had one man that put on more debt than every other president combined, he said.

The national debt can be divided into two parts the amount owed to the public, including private citizens, foreign governments and international investors, and whats known as intragovernmental holdings, the amount owed to the Social Security Trust Fund and other government accounts.

While the national debt has been increasing for decades due to near-annual budget deficits, it grew dramatically under Obama, increasing from $10.6 trillion in January 2009 to $19.9 trillion in January 2017, according to Treasury Department figures.

Have a fact check suggestion? Send ideas to

Also Check: Where To Get A Trump Shirt

Tracking The Federal Deficit: June 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $88 billion in June 2022, the ninth month of FY2022. This deficit was the difference between $461 billion in receipts and $548 billion in spending and was roughly half the size of the deficit recorded in June 2021.This years June receipts were up by $11 billion compared to last year, as individual tax refunds declined $16 billion less than they were last June due in part to changes in tax-filing deadlines.

Analysis of notable trends: Over the first nine months of FY2022, the federal government ran a deficit of $514 billion23% the size of the deficit over the same period in FY2021 , and 69% of that recorded at this point in FY2019 , prior to the COVID-19 pandemic. Strong revenue growth and lower levels of spending contributed to the shrinking deficit. So far this year, revenues totaling $3.8 trillion were $779 billion greater than over the same period in FY2021. Individual income and payroll tax receipts largely drove this spike, increasing $690 billion as wages and salaries continued to increase amid a tight labor market. Corporate tax revenues also rose by $41 billion . Unemployment insurance receipts rose by $14 billion as states continued to replenish their trust funds, and customs duties and excise tax receipts went up by $16 billion and $11 billion respectively, reflecting an increase in imports and economic activity.