Family Credits And Deductions

The law temporarily raised the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The child tax credit can only be claimed if the taxpayer provides the child’s Social Security number. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income exceeds $400,000 . These changes expire in 2025.

How Itemized Deductions Changed

If taxpayers incur certain types of expenses, they can deduct the expenses on their federal taxes. These are called itemized expenses and you take them as itemized deductions instead of taking the standard deduction. That means your itemized deductions need to be worth more than your standard deduction to be worth claiming.

The TCJA made multiple changes to itemized deductions, like putting a $10,000 limit on the state and local tax deduction and eliminating a number of miscellaneous deductions. The new, higher standard deduction also means fewer taxpayers are able to itemize, because they need to have about twice as much in itemized deductions in to make itemizing worth it.

IRS data from 2020 shows that 30.9% of taxpayers itemized deductions in 2017, but only 11.3% itemized in 2018 88.4% of taxpayers took the standard deduction in 2018.

Taxpayers claimed the following types of itemized deductions about 60% less in 2018:

-

The medical expenses deduction was claimed 57.2% less in 2018 than 2017.

-

The mortgage interest deduction was claimed 60.9% less in 2018 than 2017.

-

The charitable contributions deduction was claimed 63.5% less in 2018 than 2017.

-

The deduction for total taxes paid, which includes the SALT deduction, was claimed 64.5% less in 2018 than 2017.

Trump’s 2017 Tax Cuts Helped Super

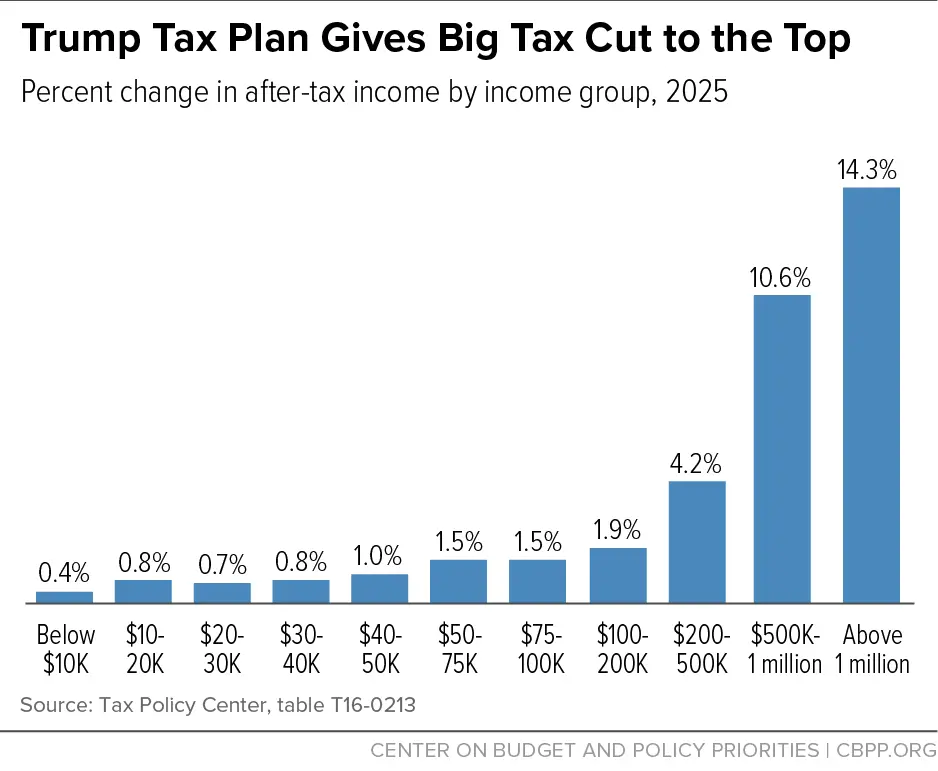

The Trump administration’s deficit-bloating package of tax cuts passed by Congress in 2017 led the following year to the 400 wealthiest families in Americaall of them with a net worth in the billions of dollarspaying a lower tax rate than the bottom 50 percent of households.

That is according to a new analysis by two economists in their bookThe Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Payset to be published on October 15. The authors are Emmanuel Saez and Gabriel Zucman, both economics professors at UC Berkeley.

After collating the data going back decades, Saez and Zucman showed that since the 1960s the effective rate paid by the richest 400 families has been in general decline amid tax cuts and the emergence of sophisticated tax avoidance. Then, in 2018, their tax rate fell sharply.

According to The Washington Post, the pair found those families paid an effective average tax rate of 23 percent that year, below the 24.2 percent paid by the bottom half of American households. Back in the 1960s, the richest were paying close to 60 percent and the bottom half just over 20 percent.

“As a group, and although their individual situations are not all the same, the Trumps, the Zuckerbergs, and the Buffetts of this world pay lower tax rates than teachers and secretaries,” the book states. “How can a tax system that many view as progressive be, in fact, so regressive?”

Read Also: Does Trump Wear A Toupe

Trump Tax Cuts Results: Full Review

The Tax Cuts and Jobs Act, championed by President Trump and congressional Republicans, spurred a boom in economic growth that took Americans off the sidelines and got them back to work. Thanks to these reforms, our economy doesnt have to strain under a tax code from 1986, but will recover with a modern, dynamic tax code that promotes growth.

To download this factsheet as a PDF, .

MORE JOBS AND INVESTMENT

- Lowered tax rates for job creators of all sizes.

- Made it easier for companies to bring jobs and investments back to the U.S.

How the Economy Responded:

FAIRER TAXES

- Simplified that tax filing process for millions of workers.

- Eliminated the Alternative Minimum Tax for most taxpayers.

- Expanded popular savings tools, like 529 accounts.

How the Economy Responded:

- Millions of Hours Saved. Nearly nine out of 10 Americans took the standard deduction in 2019, no longer needing to go through the complicated process of itemizing.

- Revenues Soared. Breaking dire predictions from experts, federal revenues reached an all-time high, due to more Americans working, bigger paychecks, and businesses expanding.

BIGGER PAYCHECKS

- Cut income tax rates across the board.

- Nearly doubled the standard deduction.

- Doubled the Child Tax Credit.

How the Economy Responded:

Want to read more on the fight against Coronavirus? Read our Coronavirus Bulletin here which contains our extensive FAQ about recent federal actions.

Was this message forwarded to you? to subscribe to our emails.

Promise: A Level Playing Field

A businesss tax rate depends on, among other things, its structure.

Most businesses are structured as pass-through or flow-through entities, with the owners facing individual tax rates and no tax on the entities themselves.

On the surface, dropping the corporate tax rate to 21% from 35% while only lowering the top individual rate to 37% from 39.6% might seem unfair. So the law includes a special deduction for pass-through owners, allowing them to shield up to 20% of their income from those businesses from individual taxes.

But it isnt as simple as comparing the corporate and individual tax rates.

After a C corporations profits are taxed at the corporate rate, the remaining profits that go to shareholders get taxed at the capital gains rate, too. Depending on how much profit is doled out to those shareholders, the total rate on corporate profits could be well above the individual tax rates pass-through owners faced prior to the tax code overhaul. Thats still the case, albeit to a lesser extent, with that 20% deduction.

Just in terms of fairness, the pass-throughs still have an advantage, said Richard Prisinzano, director of policy analysis at the Penn Wharton Budget Model. Its just been diminished.

Don’t Miss: What College Did Trump Graduate From

Some Taxpayers Missed Personal Exemptions

In 2017, each taxpayer could also claim a personal exemption worth $4,050 for themselves and for each dependent. This exemption lowered their taxable income because, along with the $6,350 standard deduction, a single filer with no kids would effectively deduct $10,400. This isnt much lower than the new standard deduction and for certain taxpayers it wouldnt result in much tax savings.

Example: Lets say a single parent has two children and qualifies as a head of household. In 2018, this parent would have gotten a standard deduction of $18,000 and their taxable income would be lowered by that amount. This is up from the head of household standard deduction of $9,350 in 2017, the last year before the tax reform took effect.

But in 2017, this parent would have been able to claim not only the standard deduction of $9,350 but also three personal exemptions worth a total of $12,150 , allowing them to lower their taxable income by $21,500. The result of the Trump tax reform is that, for this household, the new standard deduction is worth less than the combined value of the standard deduction and personal exemptions in 2017. The change could leave this single parent owing more in taxes.

Unfortunately I Was Honest

Seven weeks after the tax act became law, Dana Trier spoke at an American Bar Association tax section luncheon in San Diego. As he was Treasurys chief tactician for the bill, the audience of tax lawyers hung on his every word. Unfortunately, that day, he would later say, I was honest. When asked about the bills pass-through provisions, he said they would be a feast for tax lawyers. He recalled being asked about a flawed part of the carried interest provisions: I said something like, This statute referring to the carried interest provision is not a paragon of sophistication. His comments were widely reported, and some thought he was talking about the whole bill. Trump administration officials called him on the carpet. On Feb. 23 he resigned.

Trier said that there were good themes in the bill. He sees the territorial approach to international tax, even though flawed, as a start. Lower taxes for business and immediate write-off of some investment appealed to Triers pro-growth instincts. But in interviews with the Center, he expressed disappointment with how the bill turned out. Parts were not well thought through and known problems were not corrected because of the speed with which it passed.

Don’t Miss: How Many Lies Has Trump Told To Date

Losers: Residents Of High

Theupside of residing in states with high income and property taxes including New Jersey, New York and California was that you could write off tens of thousands of dollars in state and local levies if you itemized your tax return.

For instance, New Yorkers who itemized returns in 2017 claimed an average state and local tax deduction of $23,804, according to the Tax Policy Center.

Under the new law, that write-off has been limited to $10,000.

“You can argue that those who live in Florida or in other low or zero state tax places fared better compared to high-tax states,” said John Voltaggio, CPA and managing director at Northern Trust.

Be aware that if you were hit by the AMT under the old law, you were probably not benefiting from the SALT deduction, either. “They weren’t able to deduct it anyway because of AMT,” Voltaggio said.

Millions Of Americans Seeing Shrinking Refunds Under Trump Tax Plan

Under the new law, a company’s income is only taxed in the country in which it is earned. The U.S. no longer taxes new foreign profits unless they reach a certain threshold, at which point the income is taxed at 10.5 percent, half that of the U.S. effective rate.

Take for example the giant technology hardware and services company IBM Corp., which consistently ranks among the biggest U.S. companies. The company had revenues of $79.6 billion, more than 60 percent of which came from outside the United States. To that end, IBM made a $2 billion tax payment on future foreign profits in 2018, according to its financial filings. Tax advisor Willens noted IBM elected to make the $2 billion tax payment on future overseas earnings in 2018 instead of down the road in the period it occurs as many companies will do.

Meantime, in the United States, IBM reported getting a federal refund of $342 million on its U.S. income before taxes of $500 million, according to ITEP and the company’s annual filing. That computes to an effective U.S. tax rate of negative 68 percent. Its worldwide profits were $8.7 billion â and its total tax provision was $2.6 billion including the foreign tax payment.

IBM did not return requests for comment. On a January conference call with investors, IBM Chief Financial Officer Jim Kavanaugh said it anticipated “an all-in rate of at least 11 percent to 12 percent” in 2019, but he did not elaborate.

Recommended Reading: Superpowerchecks.con

Tax Returns And Withholding

Tax filing season brings up many questions for taxpayers, such as, How big will my tax refund be? or, Will I have a balance due when I file taxes this year? Changes to withholding tables in the aftermath of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily translate to increased tax liabilities.

The chart below shows the aggregate amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped across all income groups over the same period. This pattern is similar to tax year 2018, when aggregate refunds also fell for most income groups.

The House And Senate Go Separate Ways

The July 27 joint statement from the Big Six held another important, if Delphic, message that was discernible only to the priests of the tax process. It said, in effect, that the House and Senate would go their own ways and write their own bills concurrently a stark deviation from past practice, in which the House writes the tax bill first, then the Senate makes additions and adjustments. In 1986, for instance, the Reagan-era tax act, after being approved by the House, was sent to the Senate, which worked on it for six months to create its version.

Trier explained: It was a kind of, a sort of an agreement, ultimately an agreement to disagree, so to speak, and for the House to go its way in its initial passage of the legislation and the Senate to go its way. And however that got resolved, it got resolved.

The agreement had risks. It could surely speed up the legislative process, which Republicans needed with time running out. But it could also be messy and confusing with two bills in play. It was too soon to tell, but at least both houses were using the Camp draft legislation as guidance. Perhaps they would agree on enough provisions to make this unorthodox process work.

Because the Constitution says that spending and revenue bills must originate in the House, House members felt a certain authority. They looked askance at their Senate colleagues, who they felt were not as serious.

Read Also: Tally Of Trump Lies

The Imperative Of Cutting The Corporate Rate

Until Nov. 8, 2016, Republicans thought the whole point of A Better Way was simply to frame discussions with Democrats on the upcoming tax reform debate. That was because many Republicans, including Trump himself, thought Hillary Clinton would be the next president.

Trumps election stunned millions. But not John Feehery, 55, a stocky, blunt-spoken partner at EFB Advocacy, a boutique PR and lobbying firm on Capitol Hill. Feehery was a respected voice who had handled the not-always-easy communications strategies for controversial GOP leaders Dennis Hastert and Tom DeLay. In March 2016, in his weekly column in The Hill, Feehery published a six-point letter arguing why Republicans should support Trump if he won his partys nomination.

Prior to that, in 2015, Feeherys firm was hired by the RATE Reforming Americas Taxes Equitably Coalition, which had been pushing for corporate tax cuts. EFB seemed well-suited for the job. We take complicated issues, and we turn them into compelling narratives, says the firms website. RATE had a membership of 35 major corporations, including AT& T Inc., Nike Inc., The Boeing Co., The Kraft Heinz Co., The Walt Disney Co. and Northrop Grumman Corp. In 2012 the coalition wrote Congress arguing that the corporate rate of 35 percent was the highest among industrialized nations, and in 2014 it pushed for a rate of 25 percent.

As for Feehery, he relied on Trumps own words in social-media blitzes.

The Effect Of Tax Brackets

President Trump initially proposed to lower income taxes and reduce the number of tax brackets from seven to three12%, 25%, and 35%. That didn’t happen. The TCJA still provides for seven brackets, but they’ve been reduced somewhat: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The brackets in 2017, before the TCJA, were: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Don’t Miss: Mary And Fred Trump In Kkk