Trumps Wasteful Tax Cuts Lead To Continued Trillion Dollar Deficits In Expanding Economy

The Federal Deficit Will Total $1 Trillion in 2020 According To The Congressional Budget Office

Getty

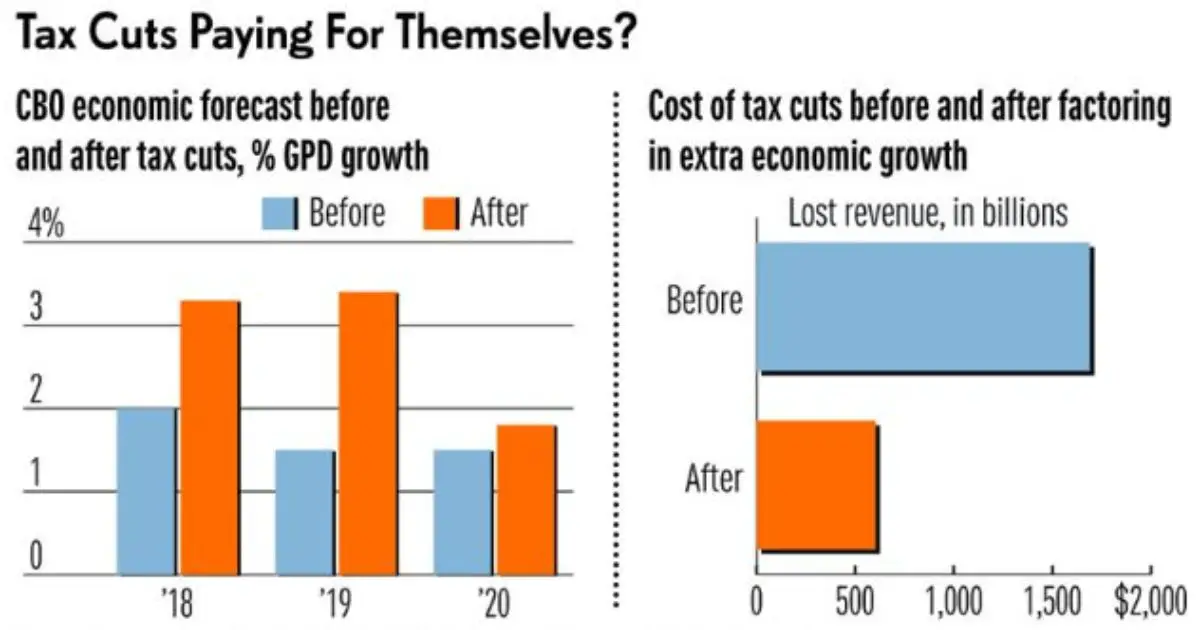

Less than a week after Treasury Secretary Mnuchin repeated the fanciful claim that the Trump tax cuts of 2017 would pay for themselves, the non-partisan Congressional Budget Office proved him wrong. If tax cuts actually paid for themselves, they would reduce deficits based on faster revenue growth that comes from faster economic growth. Deficits immediately shot up after the 2017 supply-side tax cuts. And CBO forecasts that those deficits will continue to stay high for the foreseeable future. This is the opposite of tax cuts paying for themselves.

CBO released its regular update to the economic and budget outlook on January 28. The new estimates show a deficit of $1 trillion for 2020. This is the equivalent of 4.6% of gross domestic product. The federal budget deficit will grow to 5.4% of GDP by 2030, according to GDP.

This is a much worse outlook for the current deficit than CBO showed just before Congress passed the Trump tax cuts. In June 2017, CBO anticipated a deficit of 3.6% of GDP for 2020. The current deficit is thus 27.8% greater than CBO projected before the tax cuts. Moreover, this one percentage point difference in the current projected deficit and the prior projection equals $221 billion for 2020. This is a substantial gap that follows in large part from the tax cuts, especially since the economy continued to grow during this time.

The Tcja Gave Corporations An Even Bigger Tax Cut Than Originally Projected

Since the TCJA was enacted, corporate tax revenue has been down from its projected level by about one-third, even as pretax corporate profits have continued to rise toward historic highs. The main reason for the drop in corporate tax revenue is obvious: The TCJA slashed the corporate rate by 40 percent, from 35 percent to 21 percent. But the falloff in corporate revenue has been even sharper than expected.

Several months before the TCJA was enacted, the Congressional Budget Office projected that corporate tax revenues for fiscal years 2018 and 2019 would total $668 billion. In the forecast published soon after the TCJA was enacted, however, the CBO projected $519 billion in corporate tax revenue over those two yearsa $149 billion decrease. Actual corporate tax revenue over that period came in significantly lower, at $435 billiona $233 billion drop. Essentially, corporations have already received $233 billion in tax cuts, $84 billion more than the CBO projected. To put that in perspective, the federal government spent just $47 billion on Pell Grants over the past two years.

The CBOs adjusted forecasts now put the 10-year cost of corporate tax cuts at roughly $750 billion, $400 billion more than the pre-TCJA projections. That figure includes the temporary revenue from the TCJAs repatriation provision, which gave corporations steeply discounted tax rates on stockpiles of overseas profits from prior years.

What’s Wrong With The Status Quo

People on both sides of the political spectrum agree that the tax code should be simpler. Since 1986, the last time a major tax overhaul became law, the body of federal tax lawbroadly definedhas swollen from 26,000 to 70,000 pages, according to the House GOP’s 2016 reform proposal. American households and firms spent $409 billion and 8.9 billion hours completing their taxes in 2016, the Tax Foundation estimates. Nearly three-quarters of respondents told Pew four years ago, that they were bothered “some” or “a lot” by the complexity of the tax system.

An even greater proportion was troubled by the feeling that some corporations and some wealthy people pay too little: 82% said so about corporations, while 79% said so about the wealthy. While the new tax law cuts a number of itemized deductions, most of the loopholes and giveaways that were slated for repeal in earlier bills have been retained in some form.

The individual tax rate schedule, which Trump would have cut to three brackets, remains at seven. In other words, this legislation may do relatively little to simplify the tax code. The other issues that the Pew survey indicates that bother people the mosttaxes for wealthy individuals and corporationsare likely to be exacerbated by the law.

You May Like: How Much To Stay In Trump Tower

Estate Tax Changes Help High

Estate taxes apply to the value of a persons estate when that person passes away. Estates are only subject to estate tax if theyre worth at least a certain value, known as the estate tax exemption. The Tax Cuts and Jobs Act doubled the exemption from $5.49 million in 2017 to $11.18 million in 2018. That means only very wealthy estates have to pay estate tax. The estate tax exemption is also set to increase every year as of 2022, the exemption is $12.06 million.

The number of estate tax returns decreased slightly from 2017 to 2018, but the total value of estate taxes collected by the IRS in 2018 was 3.8% higher than in 2017. It’s unclear from currently available data if this increase is due to the TCJA, or if it’s simply variation from one year to the next. Future IRS data should provide more clarity.

Its worth noting that Trumps tax reform did not change the actual estate tax rates. It only increased the exemption so that fewer estates would have to pay the tax, even though few estates had to pay the tax in the first place.

$39 Trillion In Additional Deficits

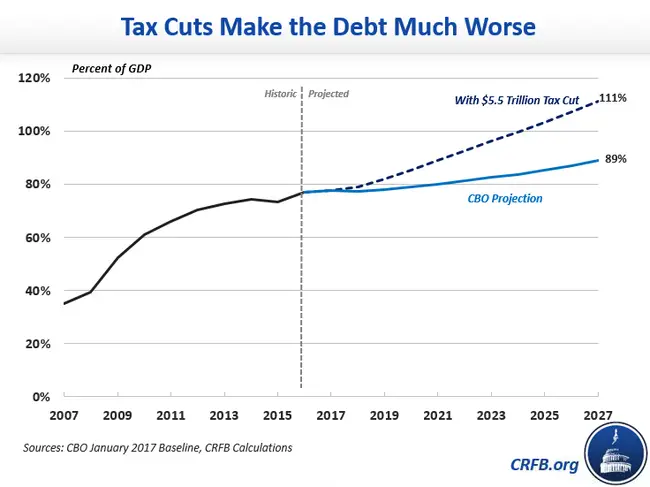

When President Trump took office in January 2017, he inherited a growing economy and budget deficits that had gradually fallen to 3% of GDP in the years since the Great Recession. At this time, the Congressional Budget Office projected that the $585 billion budget deficit from 2016 would dip to $487 billion by 2018, before the baby boomerdriven rise in Social Security and Medicare costs would gradually push deficits up to $1.4 trillion by 2027. Overall, CBO projected that $10.0 trillion in deficits over the 20172027 period would drive the debt held by the public to $24.9 trillion .

Instead, as Trump left office, the 20172027 budget deficits were estimated at $13.9 trillion$3.9 trillion higher than the inherited projection. During each of Trumps four years in the White House, the actual deficit exceeded the original CBOs projections by at least $100 billion. For the first time in American history, the deficit in fiscal year 2020amid a massive bipartisan fiscal response to the pandemicreached $3 trillion .

The president left office with a $2.3 trillion deficit projected for 2021. Potential budget savings forecast for the 2022 through 2027 period are driven by the expiration of expensive legislation as well as economic and technical re-estimates, not by any deficit-reduction legislation signed by President Trump.

Don’t Miss: Was Melania Trump A Prostitute

The Trump Administration Claimed Its Corporate Tax Cuts Would Translate Into A $4000 Raise For The Average Household

In selling the large corporate tax cut to Congress and a skeptical American public, the Trump administration claimed that corporate tax cuts would ultimately translate into higher wages for workers. The tax cuts would trickle down to workers through a multistep process. First, slashing the corporate tax rate would increase corporations after-tax returns on investment, inducing them to massively boost spending on investments such as factories, equipment, and research and development. This investment boom would give the average worker more and better capital to work with, substantially increasing the overall productivity of U.S. workers. In other words, they would be able to produce more goods and services with every hour worked. And finally, U.S. workers would capture the benefits of their increased productivity by successfully bargaining for higher wages.

Increases Income And Wealth Inequality

Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.Congressional Budget Office

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nations wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers the tax bill is a natural consequence of their long effort to bend American politics to serve their interests. The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and 2.0% for the bottom 50%.

Don’t Miss: Trump Tower Hotel Cost

Retirement Plans And Hsas

Health savings accounts were not affected by the law, and the traditional 401 plan contribution limit in 2019 increased to $19,000 and $25,000 for those aged 50 and older. The law left these limits unchanged but repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement Act in Dec. 2019, though, people can now contribute to their individual retirement accounts past the age of 70½.

The IRS makes cost-of-living adjustments to contributions for retirement savings accounts every year. For 2022, the annual contribution limit for 401 and other workplace retirement plans is $20,500, up from $19,500 in 2021. Employees over age 50 can contribute an additional $6,000 “catch-up”$26,500 in total.

Gop Tax Law Made History But Not In The Way Republicans Claimed

President Trump said that the tax law unleashed an economic miracle. While we have yet to see this miracle materialize, Republicans did achieve something unprecedented with their tax cuts: deficits are growing larger even as the economy grows stronger.

As Director Hall noted during his testimony, this is a new development in our history. During periods of low unemployment and strong economic growth, we would expect higher revenue to drive down deficits. In the last half-century, deficits averaged 1.5 percent of GDP in years when the unemployment rate was below 6 percent. In years when unemployment fell below 5 percent as they have since 2016 average deficits were just 0.7 percent of GDP.

In contrast, the deficit is projected to rise from 3.8 percent of GDP in 2018 to 4.2 percent of GDP this year, and average 4.4 percent of GDP over the next 10 years. Rather than use the strengthening economy as an opportunity to get our fiscal house in order, Republicans broke a well-established relationship between stronger growth and lower deficits.

Read Also: Does Trump Wear A Toupe

Could The Revenue Shortfalls Be A Temporary Result Of Sudden Policy Change

For those who might argue to wait and see what has happened in 2019, the findings from the studies cited above offer little hope. On average, these models estimated that economic growth effects will only offset about a quarter of the 10-year revenue loss associated with the TCJA. Excluding the Tax Foundation, which is an outlier in these estimates, drops the average offset to less than 20%.

Some Taxpayers Missed Personal Exemptions

In 2017, each taxpayer could also claim a personal exemption worth $4,050 for themselves and for each dependent. This exemption lowered their taxable income because, along with the $6,350 standard deduction, a single filer with no kids would effectively deduct $10,400. This isnt much lower than the new standard deduction and for certain taxpayers it wouldnt result in much tax savings.

Example: Lets say a single parent has two children and qualifies as a head of household. In 2018, this parent would have gotten a standard deduction of $18,000 and their taxable income would be lowered by that amount. This is up from the head of household standard deduction of $9,350 in 2017, the last year before the tax reform took effect.

But in 2017, this parent would have been able to claim not only the standard deduction of $9,350 but also three personal exemptions worth a total of $12,150 , allowing them to lower their taxable income by $21,500. The result of the Trump tax reform is that, for this household, the new standard deduction is worth less than the combined value of the standard deduction and personal exemptions in 2017. The change could leave this single parent owing more in taxes.

Recommended Reading: Cost Of Room At Trump Tower

Trumps Tax Cuts Would Add $245 Trillion To The Debt

Donald Trumps tax-cut plan could add as much as $24.5 trillion to the national debt over the coming 20 years unless it is accompanied by steep cuts in spending and entitlement programs, a new analysis finds.

The paper published by the Tax Policy Center, a joint venture by the Urban Institute and Brookings Institution, provides a sobering reminder that many of the generous tax cut plans being floated by Trump, former Florida Gov. Jeb Bush and other candidates carry enormous long-term price tags. Some of them, if adopted, would spark a renewal of the long-term debt crisis and could undermine the very economic recovery that GOP and Democratic presidential candidates alike are promising.

Related: Experts Predict Rising Deficits and Debt in GOP Candidates Tax Plans

The numbers are startling, according to the new report: Trumps proposals for consolidating and slashing individual and corporate tax rates and getting rid of the estate tax would reduce federal revenues by an estimated $9.5 trillion over the coming decade and an additional $15 trillion over the subsequent 10 years. And thats before accounting for the governments added interest costs from having to borrow substantial sums to make up for the revenue shortfall and keep the government operating.

Finally, Trump has pledged to eliminate the estate tax which would be a boon to farmers and ranchers as well as average Americans.

Related: Trump Vows Lower Tax Rates, Revised Trade Agreements, Deep Spending Cuts

Explaining The Trump Tax Reform Plan

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didn’t change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time.

But how did this happen? Let’s take a closer look at President Trump’s changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

Read Also: Trump Tower Chicago Cost Per Night