Here Are President Trump’s Past And Present Views On How Best To Fix Social Security

In case you haven’t heard, America’s most important social program, Social Security, is in a bit of trouble. A number of ongoing demographic changes have Social Security on track to completely exhaust its $2.9 trillion in asset reserves by 2035. Should this happen, Social Security wouldn’t be bankrupt, but it would mean sweeping benefit cuts to then-current and future retired workers of up to 23%.

Social Security needs a fix, and it’s lawmakers on Capitol Hill who will have to deliver that resolution. That’s why it’s more important now than ever to know where the leading 2020 presidential candidates stand on Social Security. Today, we’ll take a closer look at incumbent Republican Donald Trump’s viewpoints on Social Security.

What Has Trump Done To Tackle Social Security’s Cash Shortfall During His First Three Years In Office

So, what has Donald Trump done to improve Social Security while in office? With the president clearly averse to tackling the issue directly and potentially losing votes, Trump has instead focused his efforts on indirect solutions, the most notable of which is the passage of the Tax Cuts and Jobs Act .

When signed into law in December 2017, the TCJA represented the most sweeping tax overhaul in the U.S. in over three decades. It lowered the tax liability of most working Americans, while capping the marginal corporate income-tax rate at 21%, down from a peak of 35%. In essence, it was a tax cut designed to stimulate economic growth by encouraging businesses to innovative, hire, and expand, as well as encourage consumer spending.

How does this help Social Security, you ask? The program has three sources of funding: a 12.4% payroll tax on earned income, the interest income earned on its asset reserves, and the taxation of benefits. The former, the payroll tax on earned income of up to $137,700 , is the program’s workhorse. In 2018, it was responsible for $885 billion of the $1 trillion in revenue collected. The thinking here is that if tax cuts can bolster economic growth, workers should see an increase in wages and/or income, leading to more payroll tax being collected. This increase in payroll tax collected should put Social Security on better financial footing.

White House Budget Cuts Social Security Disability Benefits

On the campaign trail, President Donald Trump said he was going to break the typical Republican mold by not pushing cuts to Social Security.

But his first annual White House budget does call for some cuts, to the tune of about $72 billion over 10 years.

White House budget director Mick Mulvaney told reporters that this doesn’t mean Trump broke his promise. His reasoning: The budget doesn’t cut from the Social Security retirement program.

The cuts are all concentrated in the Social Security disability insurance program, which the White House wants to reform in order to reduce fraud and close loopholes.

In 2016, about 10.6 million Americans received disability benefits through Social Security, and about 50.2 million people received Social Security retirement and survivor benefits, according to the Social Security Administration.

Mulvaney said he believes most Americans associate Social Security with retirement, not disability benefits.

“If you ask, 999 people out of 1,000 would tell you that Social Security disability is not part of Social Security,” Mulvaney said. “It’s old-age retirement that they think of when they think of Social Security.”

This may very well be the case, but it does not change the fact that disability benefits are structurally part of Social Security.

The White House budget is just a proposal. Congress has to decide whether to take these suggestions and turn them into law.

Read Also: What Kind Of Jobs Has Trump Created

Despite Promises Trump Takes Aim At Social Security Medicare

“I’m not going to cut Social Security like every other Republican and I’m not going to cut Medicare or Medicaid,” Donald Trump in 2015. “Every other Republican’s going to cut, and even if they wouldn’t, they don’t know what to do because they don’t know where the money is. I do. I do.”

As regular readers may recall, this became a staple of his entire national candidacy: no matter what, Americans could count on him to champion these social-insurance programs. Ahead of the 2016 race, Trump wanted everyone to know that entitlement cuts, as far as he was concerned, are off the table.

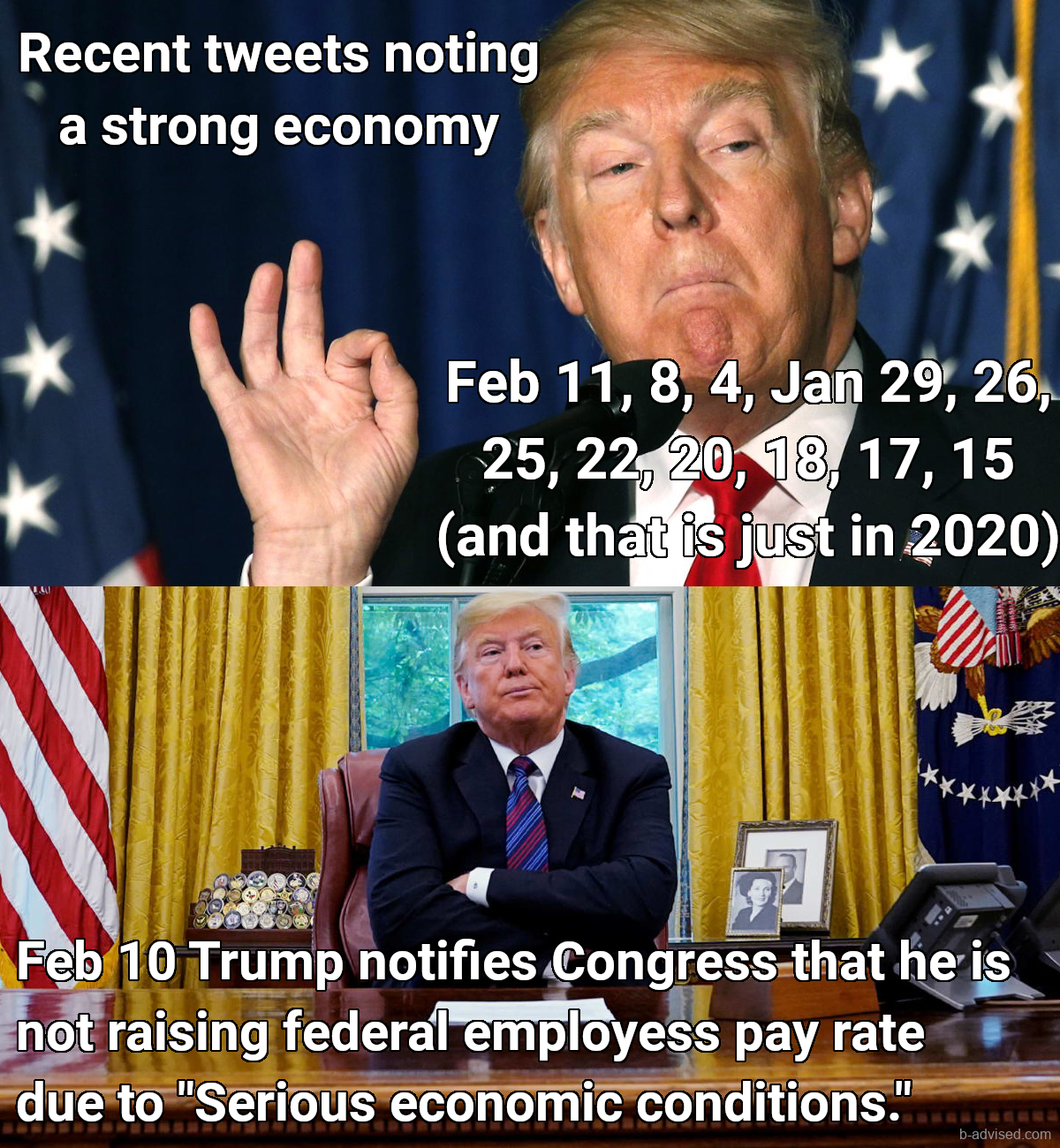

A few weeks ago, however, the Republican started hedging. Over the weekend, referring to the new White House budget, Trump’s promise not to cut Social Security, Medicare, or Medicaid quietly lost one of its three pillars. He tweeted, “We will not be touching your Social Security or Medicare in Fiscal 2021 Budget.”

Part of the problem is that the president quietly scrapped a prong from his three-pronged promise. The other part of the problem is that Trump’s newest boast isn’t true, either. As the Washington Postreported:

According to Republican rhetoric from the last decade, removing nearly a half-trillion dollars from Medicare through cuts to providers necessarily counts as “cutting” Medicare.

Don’t be surprised if Democrats exploit this opportunity for the next several months.

Trump Has Tossed Around A Number Of Surprising Solutions

Of course, it’s also important to understand that Trump’s views on Social Security have changed considerably over time, and he has, on occasion, tossed around a number of ideas that you may find surprising.

Back in 2000, in his book The America We Deserve, Trump proposed the idea of a one-time 14.25% tax on individuals with a net worth of more than $10 million. In Trump’s view, this one-time tax would have allowed the federal government to collect enough revenue to pay off its national debt , saving it $200 billion annually on interest payments. Trump proposed taking $100 billion of this $200 billion in annual savings and adding it to the Social Security program over a 10-year time frame.

Donald Trump has also loosely tossed around the idea of means-testing for benefits. Means-testing would partially reduce or eliminate Social Security benefits once an individual or couple crosses above a preset earnings threshold. Since Social Security was designed to predominantly protect low-income workers during retirement, such a move would ensure that the rich aren’t receiving payments they don’t need.

Trump even once offered up the idea of partially privatizing Social Security — a view he now steers clear of. In The America We Deserve, Trump suggests that workers have the option of utilizing personal accounts to invest in stocks, bonds, diversified mutual funds, and bonds funds.

The point being that Trump may be more open to a middle-ground solution than most folks realize.

Recommended Reading: How To Tweet President Trump

Trump’s Latest Plan To Undermine Social Security

Donald TrumpTrump goes after Cassidy after saying he wouldn’t support him for president in 2024Hillicon Valley Presented by Xerox Agencies sound alarm over ransomware targeting agriculture groupsMORErecently floated cutting the Social Security contribution rate. Voters should not be fooled by this Trojan horse. It looks like a gift to working Americans. In reality, it is part of a longstanding effort to end Social Security.

The proposed cut is supposedly about stimulating the economy. But there are many better ways to achieve that goal. Indeed, cutting the Social Security contribution rate is a particularly poor way. The largest breaks would go to those with higher incomes who are more likely to simply save the cut and less likely to spend it. Moreover, about one-fourth of those who work for state and local governments dont participate in Social Security. Therefore, they would get nothing.

If Trump truly wanted to stimulate the economy through tax breaks, there are much more targeted, efficient ways to do that. He could reinstate the Making Work Pay Tax Credit, which President Obama and the Democrats in Congress employed in 2009 and 2010. Unlike cutting the Social Security contribution rate, that tax cut was targeted to those who were least likely to simply save it and most likely to spend it in their local economies immediately.

Because they are premiums, not mere taxes, those funds are held in trust and can be used only for Social Security.

What Your Peers Are Reading

Trump interrupted: We also have assets that we never had. We never had growth like this. We never had a consumer that was taking in by different means over $10,000 a family.

Cuts to Social Security are already being planned. The Trump administration plans to issue a proposed rule in June to narrow the eligibility criteria used in assessing vocational factors when approving Social Security and Supplemental Security Income disability benefits for adults.

The Latest

The plan is a significant change that would affect about half of applicants for disability benefits, Kathleen Romig, a senior policy analyst at the Center on Budget and Policy Priorities in Washington, told ThinkAdvisor in a previous interview.

The proposed rule, which the Trump administration included in its 2019 fall unified regulatory agenda filed at the Office of Management and Budget, is super focused on a subset of applicants age 50 and above and have limited skills and education, Romig said.

On Thursday afternoon, Trump tweeted:

Democrats are going to destroy your Social Security. I have totally left it alone, as promised, and will save it!

Donald J. Trump

House Ways and Means Committee Chairman Richard Neal, D-Mass., and Social Security Subcommittee Chairman John Larson, D-Conn., issued a joint statement on Jan. 13 urging the Trump administration to reject this cruel proposed rule and reassess the Social Security Administrations priorities.

Recommended Reading: How Many Times Did Trump Lie

Trump Proposed Cuts But Congress Didnt Bite

As a candidate, Donald Trump promised to make no cuts to Social Security. As president, he has periodically proposed policies that would cut aspects of the program, but so far, none of them have been enacted.

Trump released a proposed budget for 2021, as he had in previous years, that advocated cutting two disability programs administered by the Social Security Administration: Social Security Disability Insurance and Supplemental Security Income. Collectively, the two programs serve millions of Americans.

SSDI and SSI are separate from and smaller than the agency’s main retirement income program. SSDI benefits people with physical and mental conditions that are severe enough to permanently keep them from working. It is funded by Social Security payroll taxes. Meanwhile, SSI payments are limited to low-income Americans senior citizens, or adults or children who are disabled or blind. The payments are funded through general revenue from the Treasury.

Trump’s actions very well should have earned him a Promise Broken. He tried multiple times to break his own promise. But our promise meters are about outcomes. We’ve gotten complaints over the years about promises that couldn’t happen because they were blocked by Congress, but we repeatedly rated them on the outcome.

In this case, a Promise Broken rating would suggest that seniors had their Social Security benefits cut. But that isn’t the case.

Is Trump Defunding Social Security And Medicare Concerns Mount After President’s Executive Order

President Donald Trump’s Saturday decision to sign an executive order to defer payroll taxes has fueled concerns that he is attempting to defund Social Security and Medicare, with the latest order drawing criticism from conservatives and liberals alike.

“First one is on providing a payroll tax holiday to Americans earning less than $100,000 per year,” the president said during a Saturday press briefing. “In a few moments, I will sign a directive, instructing the Treasury Department to allow employers to defer payment of the employee portion of certain payroll taxes…”

Trump said that he would make the temporary tax deferral permanent if he was re-elected in November. “So I’m going to make them all permanent,” he said.

Notably, this is not a tax cut. Under the wording of the executive order, the payments would simply be deferred until next year unless further actions were taken.

Whether Trump’s executive orders, which also provided an extension of extra federal unemployment benefits at a reduced rate of $400 per month, will withstand legal scrutiny is a matter of debate. His decision came as Republicans and Democrats in Congress remained at an impasse over a new round of coronavirus economic stimulus legislation. Under the Constitution, Congress, not the Executive Branch, is granted power over spending federal funds.

Also Check: How Much Does It Cost To Stay At Trump Hotel

President Trumps Record On Social Security

In 2016, the president distinguished himself from other Republicans by promising to leave Social Security alone. Over the past four years, hes pretty much done just that.

There have been no Bush-like privatization plans from the Trump administration, no Simpson/Bowles-inspired murmings over cutting benefits or raising the full retirement age. Theres been no real plan to do much of anything. The Biden campaign ad is as close as theres been to a controversy, and even that misrepresents the presidents aims.

Should Trump win in November you can expect more of the same.

I haven’t seen anything discussed on Social Security reform, Andrew Biggs, a research fellow at the conservative-leaning think tank AEI told Forbes Advisor. The president has argued against any Social Security benefit cuts but hasn’t waded into how Social Security’s long-term funding should be secured.

While this should assuage any fears about changes to the Social Security status quo and soothe soon-to-be retirees worried about cuts to their monthly checks, its less than ideal that the Trump administration has no plans to shore up Social Securitys long-term finances.

Administration Revives Previous Proposal To Cut Social Security Disability Programs

In his 2019 budget proposal, President Donald Trump revived a proposal from his previous budget that would cut disability programs administered by the Social Security Administration.

Under the heading “reform disability programs,” the budget blueprint counts $72 billion in spending reductions over 10 years. These would be from two similarly named but distinct programs run by the Social Security Administration — Social Security Disability Insurance and Supplemental Security Income .

SSDI benefits people with physical and mental conditions that are severe enough to permanently keep them from working. It is funded by Social Security payroll taxes. Meanwhile, SSI payments are limited to low-income Americans — senior citizens, or adults or children who are disabled or blind. The payments are funded through general revenue from the treasury.

“The largest cut would come from an unspecified proposal to test new approaches to increase labor force participation of people with disabilities,” said Benjamin W. Veghte, the vice president for policy at the National Academy of Social Insurance.

As we noted last year when we looked at this promise, White House budget director Mick Mulvaney has argued that putting forth this proposal doesn’t mean that Trump would be breaking his promise, because the budget proposal doesn’t cut from the Social Security retirement program.

Don’t Miss: How Many Jobs Has President Trump Created