Losers: Residents Of High

Theupside of residing in states with high income and property taxes including New Jersey, New York and California was that you could write off tens of thousands of dollars in state and local levies if you itemized your tax return.

For instance, New Yorkers who itemized returns in 2017 claimed an average state and local tax deduction of $23,804, according to the Tax Policy Center.

Under the new law, that write-off has been limited to $10,000.

“You can argue that those who live in Florida or in other low or zero state tax places fared better compared to high-tax states,” said John Voltaggio, CPA and managing director at Northern Trust.

Be aware that if you were hit by the AMT under the old law, you were probably not benefiting from the SALT deduction, either. “They weren’t able to deduct it anyway because of AMT,” Voltaggio said.

Million More Businesses Claimed This Trump Tax Break Last Year

- About 21 million tax returns claimed a 20% pass-through deduction last year, up from 18 million during the 2019 tax season, according to IRS data.

- The tax break on qualified business income, also called the QBI deduction, was created by the 2017 Tax Cuts and Jobs Act signed by President Donald Trump.

- More business owners are likely learning about the deduction and have restructured their businesses to get it, experts said of the increase.

Nearly 3 million more business owners claimed a 20% tax deduction on their income last year relative to the prior filing season, according to IRS data.

Around 21.2 million returns claimed the “qualified business income” deduction during tax season last year, which reflected income for 2019. That’s an increase from 18.4 million tax returns the year prior.

The Tax Cuts and Jobs Act, signed by former President Donald Trump in 2017, created the so-called pass-through deduction.

The tax break allows owners of pass-through businesses, like sole proprietors, partnerships and S corporations, to deduct up to 20% of their business income from taxes.

More from Personal Finance:Senate Dems propose capital gains tax at death

The income from such businesses flows to the individual tax returns of the business owner.

Some complex rules apply to the 20% deduction, however. For example, service businesses like doctors, lawyers and accountants may not be eligible if their taxable income exceeds a certain threshold.

Trump Tax Cuts And The Middle Class: Here Are The Facts

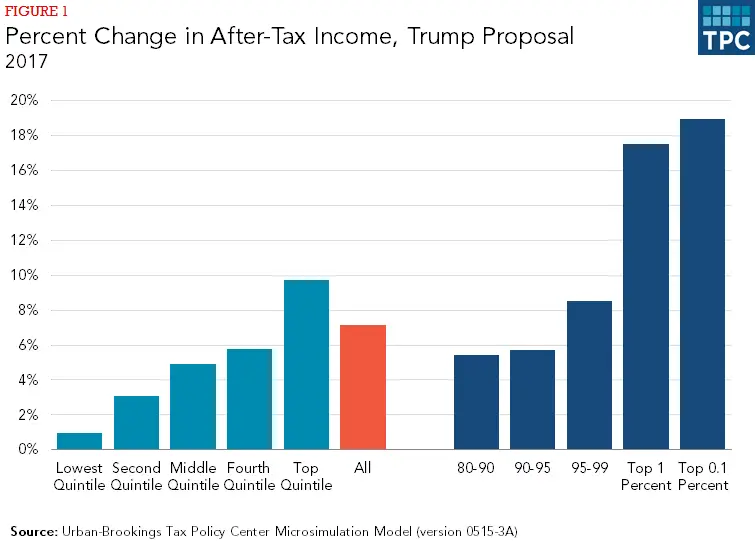

Ever since Congressional Republicans passed the Tax Cuts and Jobs Act in 2017, the left has sought to portray the tax cuts as a bad deal for the middle class.

Now that they have taken back Congress, Democrats on Capitol Hill are holding a hearing on Wednesday to examine how the middle class is faring. While they will undoubtedly use this hearing to score political points, the fact is the tax cuts have created unprecedented prosperity for the middle class in the form of higher wages, more take-home pay, more jobs and new employee benefits.

Don’t Miss: What Is Trump’s Zero Tolerance Policy

Winners: High Earners Who Formerly Paid The Amt

Under the old law, taxpayers with higher incomes were subject to something known as the alternative minimum tax.

These filers would calculate their income tax liability twice: once under the ordinary rules and again with the AMT, which would bar you from claiming certain write-offs and itemized deductions.

You would then look at your liabilities under the ordinary rules and the AMT and pay whichever tax was the highest.

The number of people who think they’re worse off versus those who are actually worse off is driven by this perception of whether the refund went up or down.Ed ZollarsCPA at Thomas Zollars & Lynch

The Tax Cuts and Jobs Act raised the 2018 AMT exemption to $109,400 for married taxpayers, from $84,500. For single filers, the exemption rose to $70,300, from $54,300.

The AMT tweak is forecast to reduce the number of people paying the AMT to 200,000 per year through 2025 which is when this change will expire compared to 5 million in 2017, prior to the tax overhaul, the Tax Policy Center found.

“Under today’s laws, it’s highly unlikely you’ll be in the AMT, said Jeffrey Levine, CPA and CEO of BluePrint Wealth Alliance in Garden City, New York.

Workers Barely Benefited From Trumps Sweeping Tax Cut Investigation Shows

Big companies drove the 2017 Tax and Jobs Act, but did not commit to any specific wage hikes, the Center for Public Integrity found

Big companies drove Donald Trumps tax cut law but refused to commit to any specific wage hikes for workers, despite repeated White House promises it would help employees, an investigation shows.

The 2017 Tax and Jobs Act the Trump administrations one major piece of enacted legislation did deliver the biggest corporate tax cut in US history, but ultimately workers benefited almost not at all.

This is one of the conclusions of a six-month investigation into the process that led to the tax cut by the Center for Public Integrity, a not-for-profit news agency based in Washington DC.

The full findings, based on interviews with three dozen key players and independent tax experts, and analysis of hundreds of pages of government documents, are .

Read Also: How To Email Donald Trump

Did The Trump Tax Cuts Work The Answer May Not Be What You Think

A common justification for raising corporate tax rates is that cutting tax rates back in 2017 didnt work so well. So whether for reasons fiscal or egalitarian, its good policy to reverse some or all of President Trumps Tax Cuts and Jobs Act.

Certainly a cursory glance at the statistics which is what the they didnt work claim is based on shows GDP growth, productivity, and business investment about the same heading into the pandemic. Not much sign of the sharp and sustained surge that some proponents promised. President Trump, for instance, said the tax cuts would be rocket fuel for the economy. But as The Wall Street Journal concluded in early 2020: Early growth in business investment seems to have faded overall economic growth rose before pulling back again. Cross-border investment patterns have changed only modestly.

A couple things to keep in mind, however: For starters, many GOP politicians and pundits argued for the tax cuts in a way most economists didnt. While the former said the tax cuts would radically alter investment incentives and unleash a flood of corporate cash into the domestic economy from overseas holdings, the latter made arguments more like this one from AEI economist Alan Viard :

One reason the trade wars may have undercut the tax cuts was because of the massive business uncertainty they created. In a new analysis by Hites Ahir, Nicholas Bloom, and Davide Furceri, the researchers note the following:

Cutting The 22 Percent Income Tax Rate Wouldnt Benefit Most Middle

One idea floated by both Rep. Kevin Brady ranking member of the House Ways and Means Committeeand National Economic Council Director Larry Kudlow would lower the 22 percent marginal income tax rate to 15 percent. Some commentators and media outlets dubbed this provision a middle class tax cut. Upon closer examination, this is not the case.

To receive any benefit from this rate cut, taxpayers incomes need to be high enough to fall in the 22 percent bracket or above. For married couples, the minimum adjusted gross income to fall into the 22 percent bracket this year is $105,051.* As most couples in the United States will make less than $105,051 in 2020or will have deductions that put them below the 22 percent bracketthey wouldnt benefit at all from the rate reduction. Moreover, because the rate cut would only affect the portion of income that falls within the 22 percent bracket, even those with incomes higher than $105,051 would not see the full benefit unless their incomes place them in higher brackets. For couples, the minimum AGI to be in the next tax bracket is $195,850three times higher than what the median household earned in 2018.

Altogether, according to CAP calculations using the open-source tax calculator Tax-Brain, nearly two-thirds64 percentof the tax cut from this plan would go to taxpayers in the top 10 percent, while the bottom 50 percent wouldnt see any change at all.

You May Like: Why Are Trumps Ratings Going Up

Law Does Relatively Little For Low

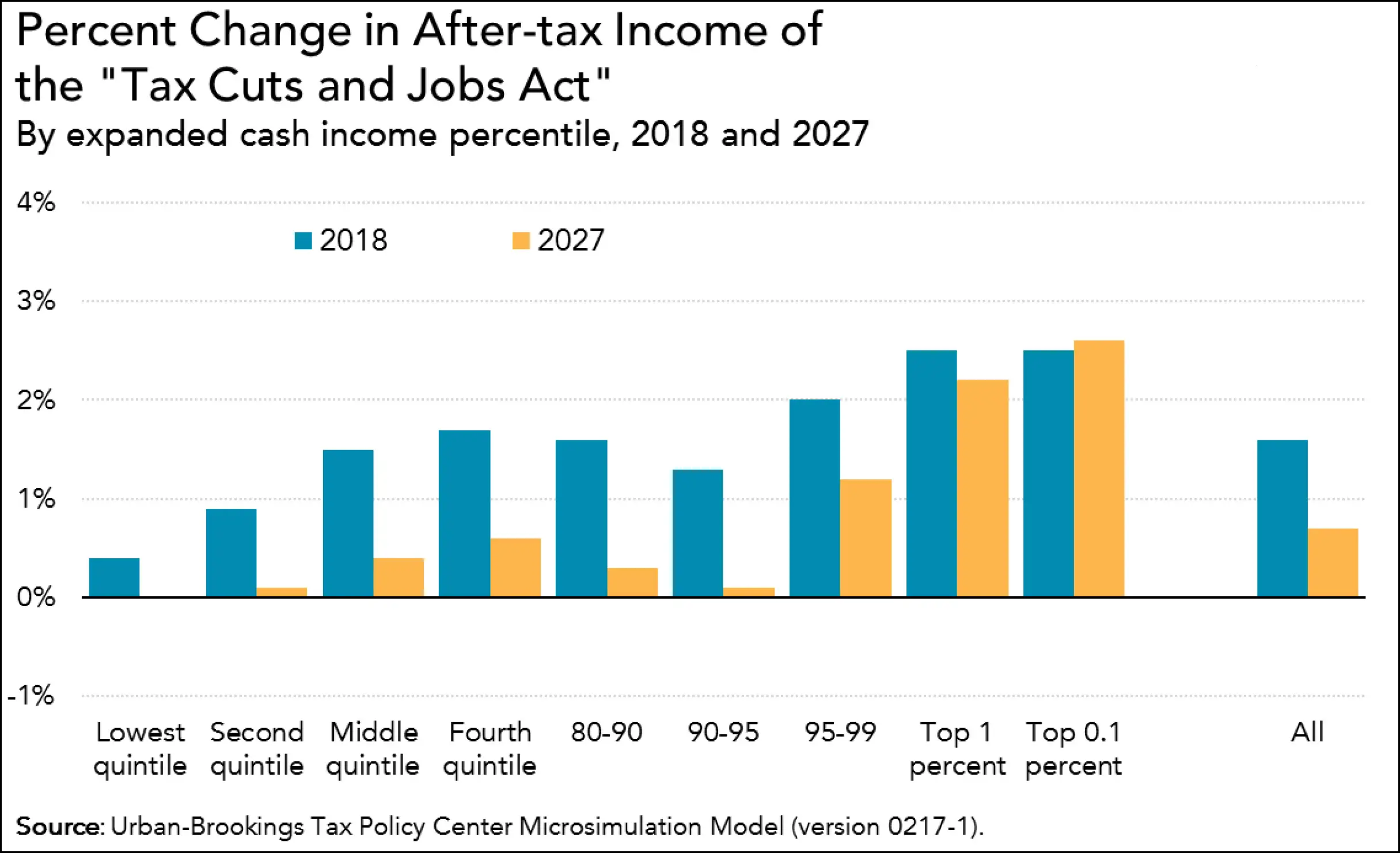

I have just outlined the three fundamental flaws of the 2017 tax law. Let me now examine in more detail how the 2017 tax largely leaves behind low- and moderate-income Americans and indeed hurts many.

The 2017 tax law should have placed top priority on raising the living standards of low- and moderate-income households, given decades of stagnant working-class incomes and growing income inequality. The share of after-tax income flowing to the bottom 60 percent fell by 3.8 percentage points between 1979 and 2015, while the share flowing to the top 1 percent rose by 5.6 percentage points. And looking at the working class a racially and geographically diverse group often defined as families with working-age adults in which no one has a college degree real working-class median income rose by only about 3 percent from 1979 to 2015.

Fox News Host Confronts Gop Sen Rick Scott Over Trump Tax Cuts Adding Trillions To Deficit

Fox News host Chris Wallace on Sunday confronted Republican Senator Rick Scott of Florida over former President Donald Trump‘s tax cuts, which were estimated to increase the U.S. deficit by $1.5 trillion over the course of a decade.

When Wallace asked Scott during an interview on Fox News Sunday if the Trump tax cuts, which were passed in 2017, should be reversed, the Republican senator, who had previously served as Florida governor, dodged the question and said that tax cuts could happen without increasing the deficit.

“I cut taxes and fees 100 times over $10 billion and I actually balanced a budget and paid off a third of the state debt. You can do both. I think there’s about 4,000 lines of the Florida budget. I went through every line and said ‘I am not going to waste anybody’s money,'” Scott said.

Trump signed the Tax Cuts and Jobs Act in 2017 to change corporate tax rates and individual tax rates.

Wallace asked the senator the same question again: “When Donald Trump was president, you had the tax cut, which added $2 trillion to the deficit, according to the Congressional Budget Office. And you didn’t have the commensurate spending cuts. So, the question is, if you’re not going to have the spending cuts, should you repeal the tax cutsif the debt and deficit are so vital?”

Newsweek contacted Scott for comments but didn’t hear back in time for publishing.

You May Like: Will Trump Win In 2020

The Tcja Opened Up New Loopholes For The Wealthy

Although labeled tax reform, the 2017 tax law actually opened up major new loopholes for the wealthy to exploit. One of the biggest loopholes within the bill is the so-called pass-through loophole, which created a 20 percent deduction of business income for owners of businesses such as S corporations or LLCsopening up a number of new gaming opportunities. The deduction effectively lowered the top tax rate on most business income of high-income individuals by 10 percentfrom the pre-2017 rate of 39.6 percent down to 29.6 percent. The largest beneficiaries of this provision by far are the richest 1 percent of Americans, who will see nearly two-thirds of the windfall. Moreover, in the final hours before the bill was passed, lawmakers added a last-minute provision to expand the pass-through loophole, especially for real estate owners.

Surprise Tax Bills For Some Middle

The lower income tax rates should have helped Americans throughout the year because employers generally withheld less income tax from employee paychecks, increasing their after-tax income. Unfortunately, many workers didnât know they needed to make changes on their W-4 forms to counteract the changes. The result was that some workers had more take-home pay, but then underpaid their income taxes and owed the IRS thousands of dollars on Tax Day.

outbreak, the Trump administration has extended the deadline by 90 days, to July 15, 2020. Policygenius recommends filing your taxes as early as possible to take advantage of any refunds you’re owed, or to give yourself more time to pay any tax bill.)

Make sure to update your W-4 in 2020, especially if you had surprise tax bills in 2018 or 2019. The IRS doesnât require anyone to make changes unless they get a new job, so you need to put in the effort to adjust your W-4 withholding yourself.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

Also Check: What Kind Of Jobs Has Trump Created

How Democrats May Sidestep Sinema And Embrace New Taxes On Wealth

Senate Democrats can’t spare any votes in their endeavor to turn Biden’s economic plans into law over united Republican opposition. The tricky political maneuvering required to get Sinema’s vote is already infuriating the party’s progressive wing who want the package to transform the economy and alleviate inequality.

“It would be outrageous to not include something that so desperately needs to be done, that’s the most popular part of this package, that all of us ran on,” Rep. Pramila Jayapal of Washington, who chairs the Congressional Progressive Caucus, told reporters on Thursday.

But Sinema’s position against tax rate increases is leading Democrats to dust off older ideas in search for back-ups. Chief among them is a “Billionaire’s Income Tax” that’s being authored by Wyden, which targets unrealized gains on assets. Importantly, it means assets that haven’t been sold but whose value still went up would be taxed annually. It’s based on an earlier proposal from 2019 and an updated version still hasn’t been released.

For the wealthy, assets are a much more sizable part of income compared to the typical worker. If you work a salaried job, you probably pay an income tax. Meanwhile, if you’re a billionaire holding profitable stocks, you’re paying a preferential tax rate if you decide to sell and won’t pay a dime until you do.

“You would have to create a completely new structure to do this,” he said. “It’s time-consuming, and it’s complicated.”

Trumps New Capital Gains Tax Proposal Would Give 99 Percent Of Its Benefits To The Top 1 Percent

President Trump has recently floated a proposal to cut the top capital gains ratea tax paid on the profit received from selling a capital asset such as stocks, bonds, or propertiesfrom 20 percent to 15 percent. Capital gains taxes already receive preferential tax treatment compared with ordinary income from wages or salaries. According to IRS data from 2018, only the wealthiest 0.8 percent of Americans had any capital gains or dividends in the current 20 percent tax bracket. As such, cutting the top rate on these assets would almost exclusively benefit the wealthy. The Institute on Taxation and Economic Policy estimates that a full 99 percent of the tax cut would go to the richest 1 percent.

The uber-wealthy within the top 1 percent would see the largest benefits from each of these two policies. According to a Center for American Progress analysis based on 2017 tax data, if the top capital gains rate were reduced to 15 percent and the net investment income tax were repealed as part of the Trump administrations efforts to repeal the ACA, the highest-income 0.001 percent of Americansthose with incomes exceeding $63.4 million per yearwould receive a windfall of nearly $14 billion: an average tax cut of more than $9.6 million per person.

Also Check: Did Trump Raise Taxes On The Middle Class