Explanation : A Mystery Only Prosecutors Can Unwind

Starting about 10 years ago, the so-called King of Debt tried something new: spending his own money. He spent up to $400 million buying golf courses, hotels, and wineries. He also took on $400 million in personally guaranteed loans, exposing him to personal bankruptcy in the event that he cant pay back the loans in full.

These decisions are unusual for private real-estate companies, which typically take advantage of debt through the tax code and funnel their largest investments through partnerships that protect individual investors from personal bankruptcy. Whats more, its not clear how Trump suddenly came up with all of that cash. Eric Trump toldThe Washington Post that his father had incredible cash flow and built incredible wealth.He didnt need to think about borrowing for every transaction. We invested in ourselves. But The New Yorkers Adam Davidson wrote in 2018 that The portfolio of assets that Trump owns does not suggest that he would have so much money that he can casually spend a few hundred million on a whim.

It gets even weirder. All those golf properties look like horrendous businesses, having declared losses of more than $315 million since 2000, according to Trumps tax records. In short, Trump is pouring a mysteriously large amount of money into opaque businesses suffering mysteriously high losses.

Promise: Business Will Come Back

The law made it cheaper to bring back earnings from abroad, while also keeping companies from perpetually avoiding taxes on those profits by deeming them repatriated. It placed a 15.5% tax on cash and other liquid assets held by multinationals offshore entities, and an 8% rate on other assets held overseas. Normally, those profits would be subject to the corporate tax rate, which at the time was 35%, when brought back to the U.S

The impact on U.S. companies investments abroad is clear: Repatriated dividends spiked starting in 2018.

Tax professionals who study the effects of the laws international tax elements say there havent been many prominent inversionsin which U.S.-based companies restructure so that they are owned by a foreign parentin recent years.

But corporations can still be taxed on international profits below the domestic 21% rate, and the law didnt create the fully territorial tax regime Republicans were aiming for, tax experts said. The law and IRS rules for parts of the international provisions also offer some competing incentives, both encouraging and discouraging a buildup of assets overseas.

The whole thing was badly structured if the incentive here was to move assets back to the U.S. or create jobs, as opposed to just moving cash back, said Reuven Avi-Yonah, a professor at the University of Michigan Law School and director of its international tax LLM program.

But The Presidency Has Not Resolved His Core Financial Problem: Many Of His Businesses Continue To Lose Money

With The Apprentice revenue declining, Mr. Trump has absorbed the losses partly through one-time financial moves that may not be available to him again.

In 2012, he took out a $100 million mortgage on the commercial space in Trump Tower. He has also sold hundreds of millions worth of stock and bonds. But his financial records indicate that he may have as little as $873,000 left to sell.

Don’t Miss: How Much Does It Cost To Stay In Trump Hotel

What Is A Usa

USA stands for Universal Savings Account.

Tax Reform 2.0 includes a new small Universal Savings Account that would allow taxpayers to contribute up to $2,500 a year.

These simplified accounts have proven successful in Canada and the United Kingdom.

Withdrawals would be tax-free and not reserved strictly for retirement or any other prescribed activity.

These simplified accounts have proven successful in Canada and the United Kingdom and would help Americans protect more of their savings from taxation without all the retirement strings attached.

Regrettably, the proposed contribution limit of $2,500 a year is much too low. Even in its limited form, the proposed USA would give families a better option for long-term savings and simplify financial planning.

The proposed USAs do not replace other savings accounts or Social Security.

What’s The Background To This

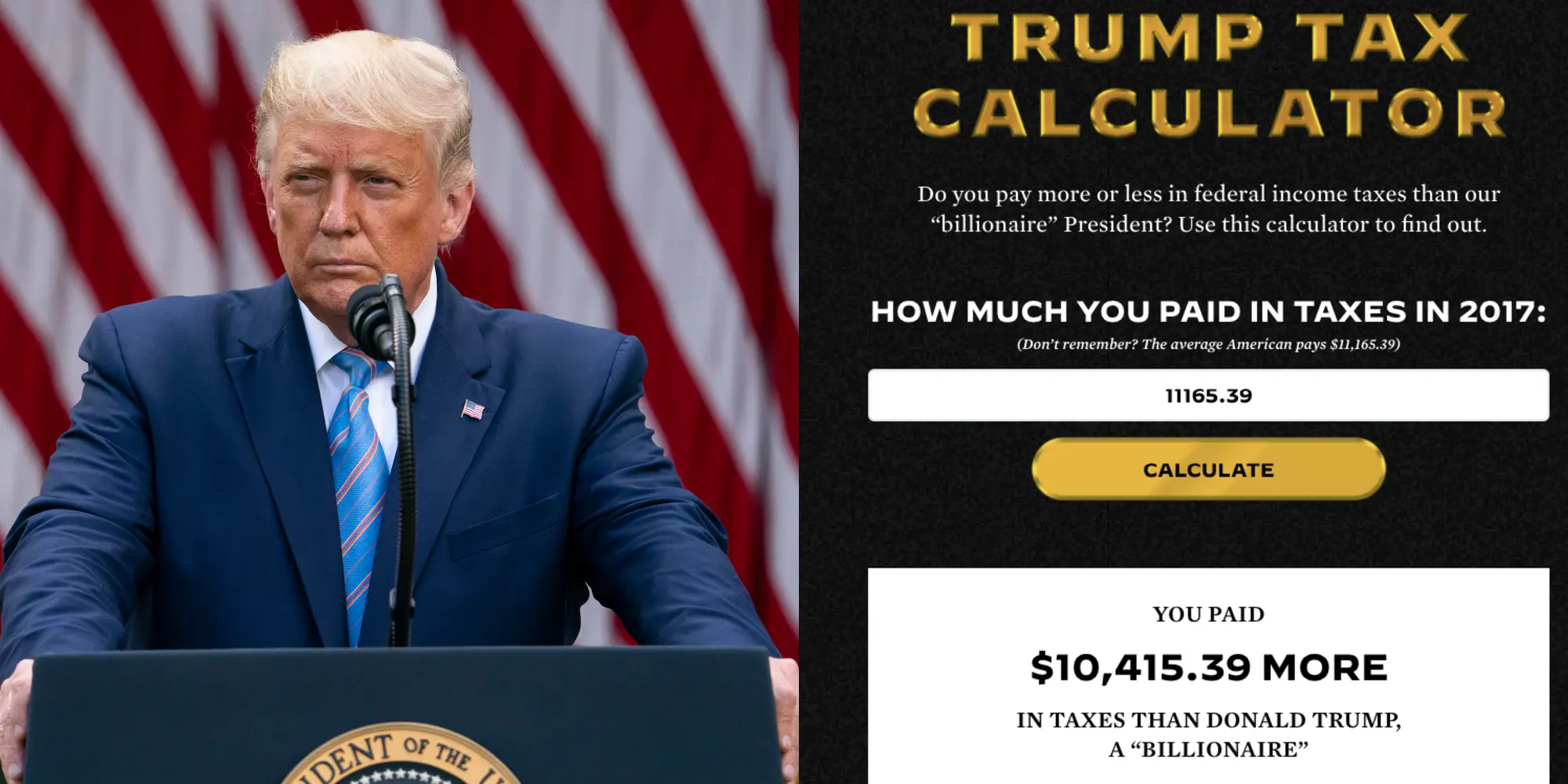

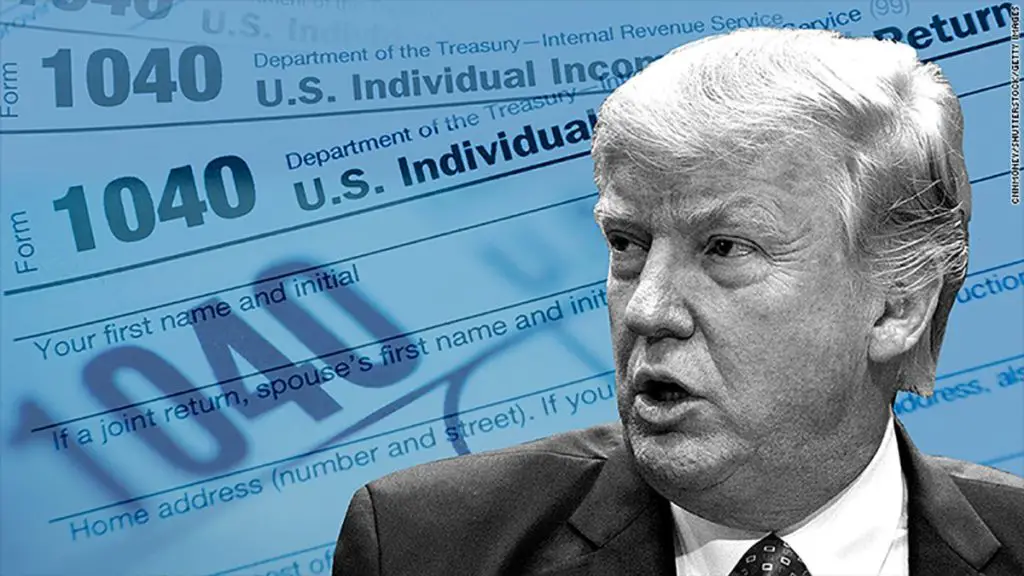

Mr Trump has come under fire from Democrats for years for not making his tax returns public as his predecessors did.

His lawyers have argued that he enjoys total immunity while in office and that Congress has no valid justification to seek the records.

In July, the US Supreme Court ruled that Mr Trump’s financial records could be examined by prosecutors in New York. In a related case, the court ruled that this information did not have to be shared with Congress.

The matter remains under appeal in lower courts so the records have not been handed over in New York.

Mr Trump has denied wrongdoing and called the investigation into his tax affairs a “witch hunt”.

The president also remains engaged in a long-running battle with the Internal Revenue Service over the $72.9m tax refund he received. He could be forced to pay more than $100 million if a ruling were to go against him, the NYT says.

Don’t Miss: Laura Kirilova Chukanov

Trump’s Taxes: What You Need To Know

The New York Times has obtained decades of tax information on US President Donald Trump.

The records reveal “chronic losses and years of tax avoidance”, the newspaper says.

The report, which Mr Trump has called “fake news”, comes a little over a month before the presidential election, when he will take on Democratic nominee Joe Biden.

There is a lot to get through, so here are some of the main points you need to know.

You can read our detailed full story here.

He Is Personally On The Hook For Some Of These Bills

In the 1990s, Mr. Trump nearly ruined himself by personally guaranteeing hundreds of millions of dollars in loans, and he has since said that he regretted doing so. But he has taken the same step again, his tax records show. He appears to be responsible for loans totaling $421 million, most of which is coming due within four years.

Should he win re-election, his lenders could be placed in the unprecedented position of weighing whether to foreclose on a sitting president. Whether he wins or loses, he will probably need to find new ways to use his brand and his popularity among tens of millions of Americans to make money.

Don’t Miss: P0tustrump

Did Repealing Obamacares Individual Mandate Help

From 2014 to 2017, the Affordable Care Act required Americans to pay a penalty on their taxes if they did not have qualifying health insurance coverage during the year. This penalty was officially called the Individual Shared Responsibility Payment but was usually referred to as the individual mandate.

President Trumps tax plan repealed the individual mandate starting in 2018. The repeal of Obamacares individual mandate saved taxpayers $3.7 million in taxes. The penalty affected 4.7 million taxpayers in 2017 primarily for taxpayers with adjusted gross income between $5,000 and $15,000 and it cost an average of $788 per taxpayer. Presumably, repealing the individual mandate saved people hundreds of dollars on their taxes.

However, these tax savings need to be taken in context. Going without health insurance can leave you with big medical bills if you get sick and can end up costing you more overall. This may have happened in 2018. U.S. Census Bureau data shows that fewer Americans had health insurance coverage in 2018 than 2017, while data from the U.S. Bureau of Labor Statistics also shows that health care spending increased for 60% of Americans from 2017 to 2018. Average spending on health care rose by 3.2%, while health insurance spending decreased by 0.3%, on average.

In other words, Americans spent more on health care after the individual mandate was repealed. Whether these expenses exceeded the savings from the repeal remains to be seen in future federal data.

Are Presidents Required To Release Their Tax Returns

Presidents arent required by law to release their tax returns. Nevertheless, between 1974 and 2012, every president but Gerald Ford has made a voluntary release of the tax returns they filed while in office. Ford released no complete returns, but released 10 years of summary data including gross income, taxable income, major deductions, and taxes paid.

This tradition of voluntary tax return disclosure ended in 2017, when President Trump declined to release any personal tax information. Trump has offered various reasons for keeping his returns private, but he has frequently insisted that he wont make a release while his returns are being audited by the IRS.

Read Also: Fact Checker Trump Lies

Trump Has Gone To Great Lengths To Keep His Tax Returns Secret Despite Saying He Wants To Make Them Public

He has also lied about severing ties to his own businesses, raising questions of whether he used his vast powers as president to make money for himself. Trump said in 2019 that the presidency was costing him up to $5 billion, but has steadfastly refused to furnish documents proving that claim.

In January 2017, Trump held a press conference with his three eldest children and pointed to a large pile of papers that he said showed he was withdrawing from the Trump Organization and giving all control over to Eric Trump and Donald Trump, Jr. He has never permitted reporters to look at those purported documents.

A 2020 investigation from The New York Times found and analyzed nearly two decades’ worth of Trump’s returns. It cited major revelations, including:

Tax experts have described all of those findings as highly unusual, even among the hyper-rich who take advantage of obscure tax loopholes. Trump’s attempts to keep them secret have delayed the ability of prosecutors and judges to determine whether they amounted to tax crimes.

Vance has gone further than anyone else to obtain Trump’s returns, twice going to the Supreme Court to obtain them.

The subpoenas will also enable Vance to obtain other documents related to Trump’s taxes, including communications between the Trump Organization and its accountants at the accounting firm Mazars USA, as well as questions, complaints, concerns, instructions, and arguments for how to value certain assets.

With The Cash From The Apprentice Mr Trump Went On His Biggest Buying Spree Since The 1980s

The Apprentice, which debuted on NBC in 2004, was a huge hit. Mr. Trump received 50 percent of its profits, and he went on to buy more than 10 golf courses and multiple other properties. The losses at these properties reduced his tax bill.

But the strategy ran into trouble as the money from The Apprentice began to decline. By 2015, his financial condition was worsening.

Recommended Reading: Did Trump Donate His Salary To Military Cemeteries

Will The Tax Cuts Really Add $2 Trillion To The National Debt

No, its spending that adds to the debt.

Tax reforms promise was simple. American families will send an average of $1,400 less to Washington each year. For that promise to be true, however, Congress must also reduce spending.

Deficit spending today means tax increases in the future.

The tax cut was merely a reduction in the growth rate of federal tax collections.

According to the nonpartisanTax Foundation, the tax cuts will only reduce revenue temporarily. By 2024, the tax cuts actually raise more yearly revenue than before the reform and add $448 billion to the debt in the short run.

The most conservative estimates from the Congressional Budget Office show that the federal government will collect about $20 billion more this year than last.

In that sense, the tax cut was merely a reduction in the growth rate of federal tax collections.

In August, revenues were up 1 percent, but spending rose by 7 percent. Congress decision to slow the growth rate of tax collections while simultaneously dramatically increasing spending is a recipe for fiscal disaster.

The imminent return of trillion-dollar deficits will be driven entirely by too much spending.

The imminent return of trillion-dollar deficits will be driven entirely by too much spending. Washington takes more than $3.3 trillion of the American peoples money every year, and that should be more than enough to cover the bills.

The Most Successful Part Of The Trump Business Has Been His Personal Brand

The Times calculates that between 2004 and 2018, Mr. Trump made a combined $427.4 million from selling his image an image of unapologetic wealth through shrewd business management. The marketing of this image has been a huge success, even if the underlying management of many of the operating Trump companies has not been.

You May Like: How Many Lies Has Trump Told As President

Trump May Also Have Held Back The Returns To Avoid Legal And Financial Jeopardy

The other probable reason Trump was reluctant to release the returns is that theres clearly some legally questionable stuff in there.

For instance, the records obtained by Buettner, Craig, and McIntire show that Trump wrote off $26 million in supposed consulting fees as a business expense between 2011 and 2018. But the reporters took the added step of uncovering where some of that money was going and they figured out that some of those write-offs matched payments to Trumps daughter Ivanka, as revealed on her own financial disclosure forms.

Ivanka was an executive vice president of the Trump Organization, not some outside consultant. And sources told the Times that there were no outside consultants involved in certain projects for which Trumps businesses wrote off consulting fees.

The Times story also mentions other questionable practices Trump dubbed a Westchester, New York, mansion an investment property so he could write off property taxes on it, but his son Eric Trump called it our compound. The Trump Organization also wrote off Donald Trump Jr.s legal fees for the lawyer who represented him in the Russia investigation.

This is probably just scratching the surface the Times reporters say they have more stories coming. But the larger point is that Trump has a history of questionable tax practices, is facing an audit where he has a lot on the line, and having reporters closely scrutinize his tax returns is only a problem for him.

Trump Urges Judge To Block Irs From Handing Over His Tax Returns To Congress

WASHINGTON Lawyers for former President Donald Trump urged a federal judge late Tuesday to block the Treasury Department and the IRS from giving his tax returns to the House Ways and Means Committee.

Trump’s taxes have long been the Democrats’ “white whale,” the lawyers said.

The reason given by the committee chairman, Rep. Richard Neal, for seeking the returns, to examine how the IRS audits presidents, is simply a pretext for wanting to search for something embarrassing, they told the federal judge.

The committee sued the Treasury Department when it refused to hand over the returns during the Trump administration. But the Biden administration changed positions and agreed to provide the returns, so the committee sought to dismiss the lawsuit. Trump and his companies then intervened, seeking to block the release.

“No one believes that Chairman Neal requested President Trump’s tax returns so he can study legislation about IRS audits. No one. Chairman Neal admits that this justification was a mere litigation strategy. His fellow Committee-Members don’t buy it either,” the former president’s lawyers said.

“Anyone who’s paid even minimal attention to American politics understands what’s happening here: President Trump did not voluntarily disclose his tax returns during the campaign, his political opponents assume the information would damage him, and so his opponents want to force the disclosure.”

You May Like: How To Contact Donald Trump By Mail