Related: Mcsally Silent On Trumps Comments About Making Cuts To Medicare

The continued threats from the GOP to these two popular programs also contradict public sentiment. According to Gallup, nearly two decades of polling on Social Security indicates that a majority of adults want Social Security left completely intact. Medicare also generally sees positive poll numbers in Gallup surveys. And while Medicaid and Medicare are not the same, Medicaid is one of the largest public programs run by the federal government. As recently as last week, voters in Republican-led Missouri joined those in Oklahoma and other GOP-helmed states to expand lower-income public insurance options like Medicaid. This would seem to put Trump and other GOP politicians at odds with the general sentiment on tax-funded programs like Social Security and Medicare.

Medicare and Social Security will almost certainly come up on the campaign trail, if public sentiment on the popular programs is to be believed. While Republicans are bent on defunding the programs , Democratic presidential candidate Joe Biden has pledged to keep Medicare as it is, ensuring there is no disruption to the current Medicare system. And on Social Security, Biden wants to increase funding to the program by having Americans with especially high wages to pay the same taxes on those earnings that middle-class families pay.

Correction: A previous version of this story used outdated data to account for the number of Arizonans on Medicare. We regret the error.

Ctc Gains May Have Just Cancelled Out Other Losses

As mentioned earlier, some families may have owed more tax because the expansion of the standard deduction meant the loss of personal exemptions. The TCJA expanded a few tax credits and deductions, including the child tax credit, and families may have needed to claim them just to offset the loss of personal exemptions.

Example: A two-parent family with two children may have actually owed more in taxes in 2018 than in 2017. The following table shows how:

| Tax Break Type | |

|---|---|

| $30,900 | $28,000 |

This family received a standard deduction of $24,000 in 2018. The family would have effectively received a deduction of $28,900 in 2017, because of the combined standard deduction and personal exemptions . In this scenario, the family could need to claim the child tax credit of $2,000 per child in 2018 just to break even. Even then, the total value of the combined standard deduction and CTC in 2018 would be less than the combined value of the standard deduction, personal exemptions, and CTC in 2017 .

So while Trumps tax reform allowed families to claim a higher child tax credit, some families may not have saved very much from it. As the IRS releases more data, it will be possible to look at whether the combined effect of the TCJA changes were enough to help certain working-class families save money.

Law Does Relatively Little For Low

I have just outlined the three fundamental flaws of the 2017 tax law. Let me now examine in more detail how the 2017 tax largely leaves behind low- and moderate-income Americans and indeed hurts many.

The 2017 tax law should have placed top priority on raising the living standards of low- and moderate-income households, given decades of stagnant working-class incomes and growing income inequality. The share of after-tax income flowing to the bottom 60 percent fell by 3.8 percentage points between 1979 and 2015, while the share flowing to the top 1 percent rose by 5.6 percentage points. And looking at the working class a racially and geographically diverse group often defined as families with working-age adults in which no one has a college degree real working-class median income rose by only about 3 percent from 1979 to 2015.

You May Like: Trump Lies Fact Check

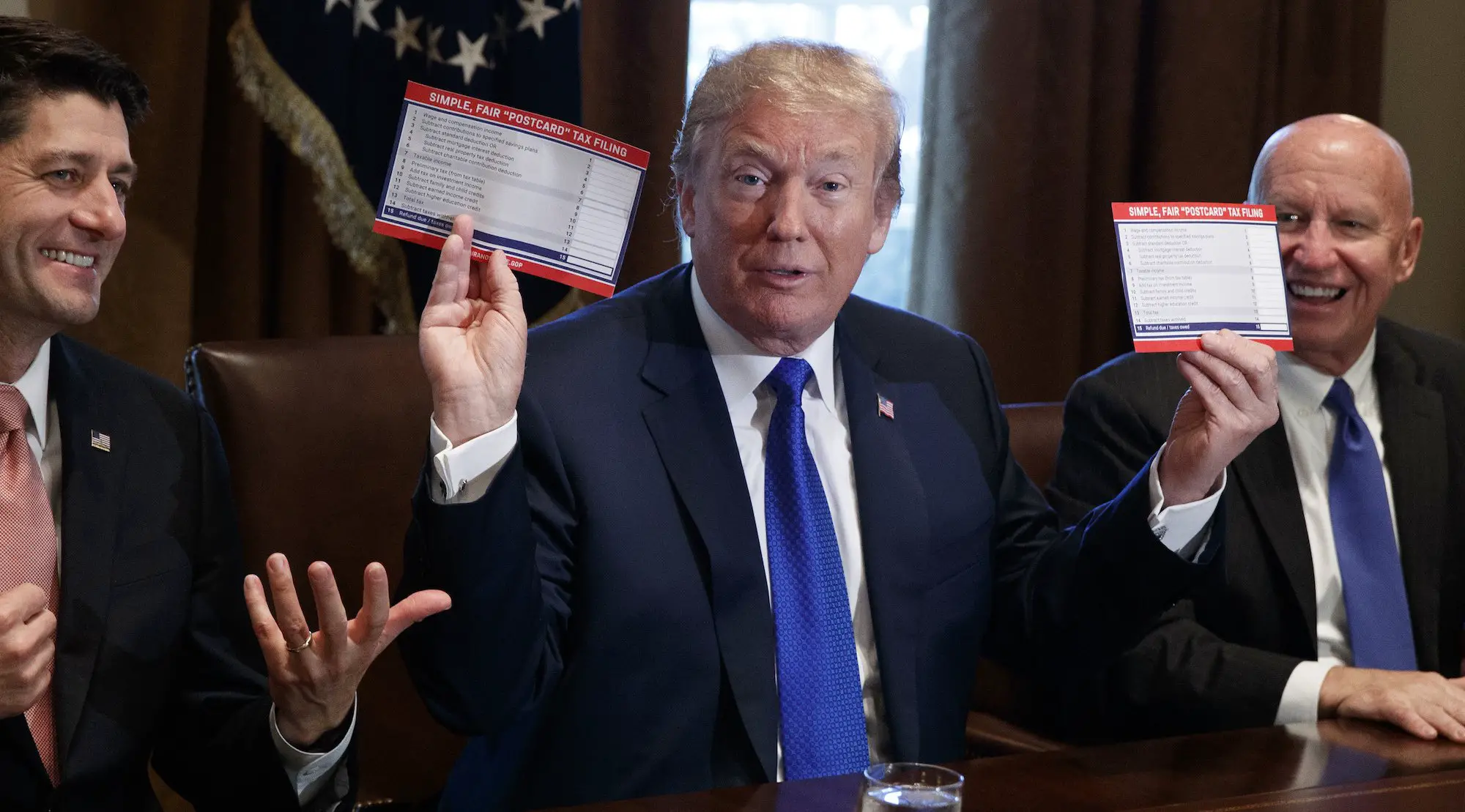

The Trump Tax Bill And The National Debt

One of the things commentators have focused on following the unveiling of the Trump bill is how it will impact the national debt.

The bill will increase the deficit by about $1 trillion over ten years, according to data put out by the Joint Committee on Taxation.

But economic growth is expected to increase regardless. The US Treasury claims that the average per year economic growth will rise to 2.9%. In these lean economic times, this would be significant. But this figure has been assessed based on President Trumps other plans making it through Congress, including deregulation of industry and changes to the welfare system.

The fact is that even some Republicans who traditionally support defaulting on the national debt over increasing it have got behind the tax bill for one reason or another. The belief that additional revenue through economic growth will offset the increase in the national debt harkens back to Reaganomics.

But non-partisan studies reveal that the increase in the current $20 trillion debt will be much greater than the Republicans are anticipating. Theres already a belief that the current tax cuts will be extended to drag out the perceived increase in economic growth.

Are Stock Buybacks Proof That Tax Reform Only Benefits The Wealthy

Publicly traded corporations buy back stock from their shareholders when they have maximized their internal investment opportunities and still have excess cash on hand.

Stock buybacks simply return the excess cash to the shareholders for them to invest elsewhere in the economy.

Stock buybacks simply free up capital so that it can be used outside the existing business.

To the extent that stock buybacks increase the wealth of investors, some of the largest recipients of buybacks are public sector pensions funds and private retirement accounts.

Teachers, firefighters, police, and most other current and future retirees benefit from better investment opportunities.

Stock buybacks simply free up capital so that it can be used outside the existing business for more productive investments.

The notion that only the wealthy benefit when businesses return profits to their investors is simply wrong.

Recommended Reading: Cost To Stay In Trump Towers

More Markets & Economy Perspectives

These lackluster results should not, in the end, be very surprising. The claim that a huge tax cut for the wealthy and corporations would trickle down to everyone else was based on an outdated and discredited set of ideas for how the economy works. In that old framework, the way to produce a better economy is to get out of the way of job creators and let the free market do the rest. A tax cut for corporations, then, should have reduced the cost of capital and induced them to invest more, which ultimately is supposed to create jobs and push up wages.

But even that very first step never happened. In the last two years, the growth rate of private direct investment has substantially declined. In the four years before the law passed, private direct investment grew by about 3.3% annually, according to data compiled by the Federal Reserve Bank of St. Louis. In thetwo years since the law was enacted, that rate is down to 2.5%.

The idea that tax cuts aimed at corporations and the rich would bestow economic gifts on all of us is flawed. Because thats not how the economy works in real life. Corporations dont make investment decisions based on tax giveaways. And wages dont automatically increase with tax cuts or with productivity improvements.

Relationship To Title 26 Of The United States Code

The Internal Revenue Code of 1954 was enacted in the form of a separate code by act of August 16, 1954, ch. 736, 68A 1. The changed the name of the 1954 Code to the “Internal Revenue Code of 1986”. In addition to being published in various volumes of the United States Statutes at Large, the Internal Revenue Code is separately published as Title 26 of the United States Code. The text of the Internal Revenue Code as published in title 26 of the U.S. Code is virtually identical to the Internal Revenue Code as published in the various volumes of the . Of the 50 enacted titles, the Internal Revenue Code is the only volume that has been published in the form of a separate code.

Read Also: How Much Does A Night At The Trump Hotel Cost

Promise: Paying For Itself

After the law was enacted, Treasury Secretary Steven Mnuchin began to assert that resulting economic growth would generate enough tax revenue for the overhaul of the tax code to pay for itself.

At the time, economists did not think that was true in any sense, and its definitely not true now, said Eric Ohrn, an assistant professor of economics at Grinnell College.

The claim has since been widely derided, as the law paid for about a fifth of itself, according to an estimate from the Congressional Budget Office.

The tax code overhaul was initially estimated to cost just under $1.5 trillion over a decade. That 10-year window, plus temporary provisions like the lowered individual rates, effectively hid the real cost of the law, some tax experts contend.

Provisions that raise revenue by limiting companies ability to write off things like losses and debt interest expenses effectively shifted those benefits past that 10-year window by allowing companies to push unused deductions to future years indefinitely, noted Steve Rosenthal, a senior fellow at the Tax Policy Center.

Last March, lawmakers rolled back some of those revenue raisers to soften the pandemics economic blow.

The TCJA was actually more costly than it appeared, said Rosenthal. Because the revenue pickups were timing gimmicks. And then those timing gimmicks were reversed as part of the Covid legislation.

How Tax Rates Work

Remember that the tax rates are marginal. The tax rate of your total income applies only to the income earned in that bracket. For instance, if youre single and your taxable income is $300,000 in 2021, only the income you earn past $207,351 will be taxed at the rate of 35% shown on the corresponding federal income tax chart above. The lower rates apply to income in the corresponding brackets.

This is important to consider when thinking about deductions and figuring out your taxable income. Just because your total income reaches a new tax bracket, doesnt mean all your money is taxed at that rate. In fact, it only applies to anything above the threshold for the new bracket.

Read Also: When Did Trump Get Impeached

Why Were The Individual Tax Cuts Not Made Permanent To Begin With

Procedural rules in the Senate and an unwillingness to constrain spending forced Congress to make the majority of the Tax Cuts and Jobs Act temporary.

Tax cuts for individuals, which are the largest tax cuts in the package, expire in 2025. Since Congress has already agreed to this package of tax cuts, it should be its first priority in Tax Reform 2.0 to make the entire law permanent.

The $2 Trillion Scenario

The most pessimistic estimate of the legislation’s budget effects came from the Committee for a Responsible Federal Budget , which argued on Dec. 18, 2017, that Congress is using a flawed baseline to measure the law’s budget effects .

These “gimmicks,” the think tank argues, obscure $570 billion to $725 billion in extra costs over 10 years, bringing the price of the law to $2 to $2.2 trillion. Factoring in expected economic growth , the cost falls to $1.5 trillion to $1.7 trilliontriple the Tax Foundation’s dynamic estimate. That does not count additional debt service costs, though. With interest, the law could cost $1.9 trillion to $2 trillion.

Recommended Reading: Tally Of Trump Lies

What Is Expensing And Why Is It Important

Expensing makes it more affordable for people to start a business and for existing businesses to upgrade and expand their operationsthings that create new jobs and enable employers to raise wages.

Expensing allows companies to deduct the cost of investments immediately and mitigates a current tax bias against investment.

The new tax law also expands expensing for small businesses.

The Tax Cuts and Jobs Act expands the old laws 50 percent bonus depreciation for short-lived capital investments to 100 percent or full expensing for five years and then phases it out over the subsequent five years.

The new tax law also expands expensing for small businesses by raising the cap on eligible investment and increasing the phase-out amount.

Making permanent the temporary expensing included in the law and expanding it beyond short-lived investments could double the economic boost projected from the 2017 reform.

Child Tax Credits Saw Big Changes

Under the Trump tax plan, the Child Tax Credit increased to $2,000 per child under 17. The credit used to be $1,000. However, the Biden Administration subsequently expanded the CTC for 2021 to $3,000 per child under age 18 or $3,600 for each child you have under 6 years old. The 2021 CTC is also full refundable, so parents benefited from the credit regardless of whether they owe taxes or not.

The CTC expansion was a provision of Bidens American Rescue Plan, but was only included for tax year 2021. In 2022, the program revert to its former scope under Trump.

Read Also: Superpowerchecks.con

The Lowered Corporate Income Tax Rate Makes The Us More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

Sen Tom Cotton: Joe Biden Would Return Us To A Weak Dangerous Past

Five months later, he told NBC News Meet the Press that hed privately told Obama after that meeting had ended to, Follow your instincts, Mr. President and that Biden had wanted him to take one more day to do one more test to see if he was there.

He further leaned into that version in a 2015 interview, saying that I thought he should go, but follow his own instincts. Biden then contradicted his initial claims, saying, imagine if I had said in front of everyone, Dont go, or Go, and his decision was a different decision. It undercuts that relationship.

Meanwhile, Hillary Clinton, in her 2014 book Hard Choices, wrote that Biden remained skeptical about the raid, while Gates in his 2014 book, wrote that he and Biden were both skeptics.

Sen. Tom Cotton, R-Ark., leveled several accusations against Joe Biden, mostly regarding his views and actions as vice president on foreign policy. This one, about what a former defense secretary had to say about Bidens judgment, is accurate.

Cotton said that Barack Obamas own secretary of defense said Joe Biden has been wrong on nearly every major national security decision over the past four decades.

This is true. Robert Gates, who served as President Obamas secretary of defense for more than two years, wrote in his 2014 memoir, Duty: Memoirs of a Secretary At War, that Biden had been wrong on nearly every major foreign policy and national security issue over the past four decades.

Don’t Miss: Trump Tower Nightly Cost